Cash flow is the lifeblood of any business, determining its ability to thrive and grow. Effective cash flow management can mean the difference between success and failure, especially in today’s fast-paced business environment.

At Bette Hochberger, CPA, CGMA, we understand the critical role that cash flow plays in your company’s financial health. This guide will provide you with practical strategies and tools to improve your cash flow management, helping you navigate financial challenges and seize growth opportunities.

What Is Cash Flow Management?

The Essence of Cash Flow

Cash flow management involves tracking, analyzing, and optimizing the movement of money in and out of your business. It’s not just about having money in the bank; it’s about understanding and controlling the timing of your income and expenses.

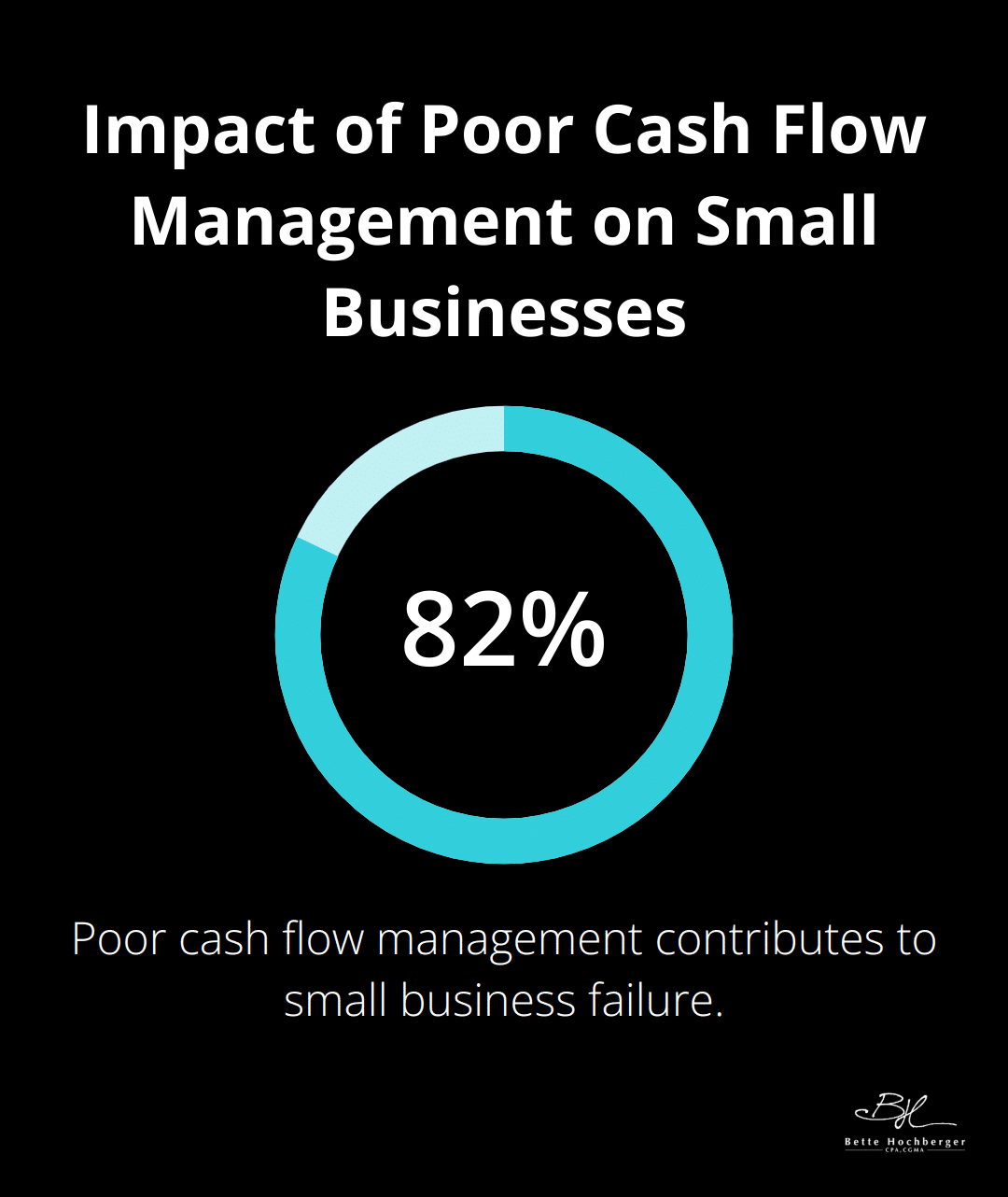

A study found that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of small businesses. This statistic highlights the critical nature of maintaining a healthy cash flow.

Without proper management, even profitable businesses can struggle to pay bills, invest in growth, or weather unexpected financial storms.

Inflows and Outflows: Your Business’s Pulse

Cash inflows represent the money entering your company. These include payments from customers, loans, investments, and asset sales. Outflows, on the other hand, represent all the ways money leaves your business (such as payroll, rent, supplies, and loan repayments).

Cash flow problems can stem from various factors including poor management, incomplete accounting, and too much debt. This struggle often stems from a mismatch between the timing of inflows and outflows. For example, you might have to pay suppliers before receiving payment from customers, creating a cash crunch.

Common Cash Flow Hurdles

Late Payments

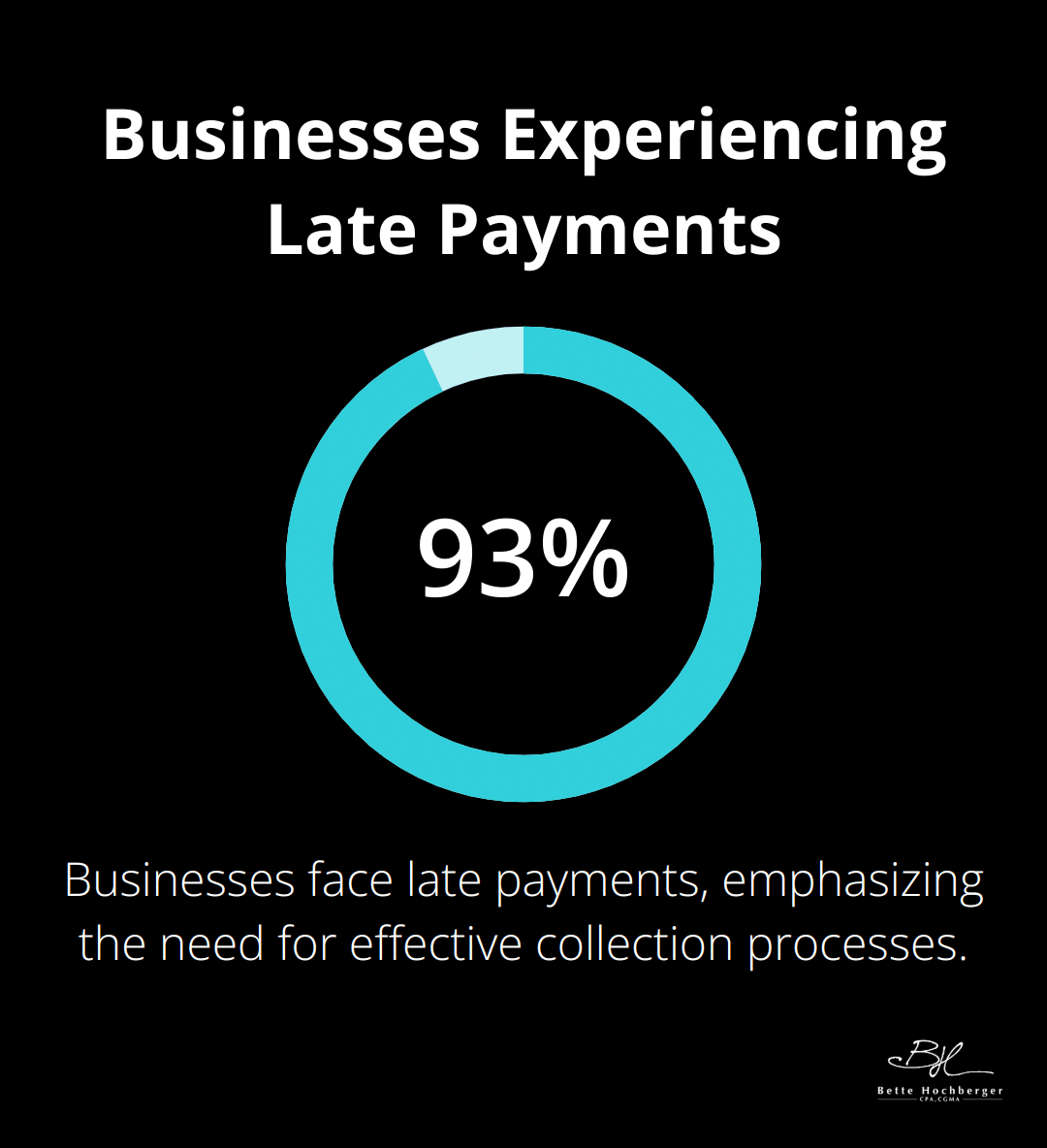

One of the biggest obstacles businesses face is late payments. This delay can disrupt your cash flow, making it difficult to meet your own financial obligations.

Overestimating Future Sales

Another common challenge is overestimating future sales. It’s easy to be optimistic, but unrealistic projections can lead to overspending and cash shortages. The key is to base your projections on historical data and market trends, not wishful thinking.

Seasonal Fluctuations

Seasonal fluctuations also pose a significant challenge. Businesses in industries like retail or tourism often experience cash flow peaks and valleys throughout the year. Planning for these fluctuations is essential to maintain financial stability year-round.

Proper cash flow management can transform a business. Implementing robust tracking systems, creating accurate forecasts, and developing strategies to smooth out cash flow bumps can turn financial challenges into opportunities for growth and stability.

As we move forward, we’ll explore specific strategies to improve your cash flow and overcome these common challenges. These tactics your business from merely surviving to thriving in today’s competitive marketplace.

Boosting Your Cash Flow

Speed Up Your Receivables

One of the most effective ways to improve cash flow is to accelerate your accounts receivable. Automate and consolidate receivables to get paid faster. Implement processes that automatically send invoice reminders and follow up on overdue payments. This can significantly speed up your cash inflow.

Implement a clear follow-up process for overdue payments. Send reminders at 30, 60, and 90 days past due. A study by Atradius found that 93% of businesses experience late payments, highlighting the importance of a robust collection process.

Optimize Your Inventory

Excess inventory ties up cash that could be used elsewhere in your business. Conduct regular inventory audits to identify slow-moving items. Consider selling these at a discount to free up cash and storage space. Implement a just-in-time inventory system to minimize costs. The JIT system was designed to reduce inventory costs, improve cash flow, and increase efficiency by producing goods only as needed.

Negotiate with Suppliers

Your suppliers can be valuable partners in improving cash flow. Negotiate longer payment terms when possible. For instance, extending terms from 30 to 60 days can provide a significant cash flow boost. However, maintain good relationships – prompt payment when due can solidify long-term partnerships.

Consider volume discounts for bulk purchases, but be cautious not to overstock. The key is to find the balance between favorable terms and maintaining optimal inventory levels.

Leverage Technology

Modern technology offers powerful tools for managing cash flow. Cloud-based accounting software can automate invoicing, send payment reminders, and provide real-time visibility into your financial position.

Electronic payment systems can also speed up transactions. Offer multiple payment options, including credit cards and ACH transfers, to make it easier for customers to pay promptly. The easier you make it for customers to pay, the faster you’ll receive your money.

These strategies can significantly improve your cash flow management. However, every business is unique, and what works for one may not work for another. To truly optimize your cash flow, you’ll need to analyze your specific business needs and industry challenges. This leads us to our next topic: tools and techniques for accurate cash flow forecasting.

Mastering Cash Flow Forecasting

Building Your Cash Flow Forecast

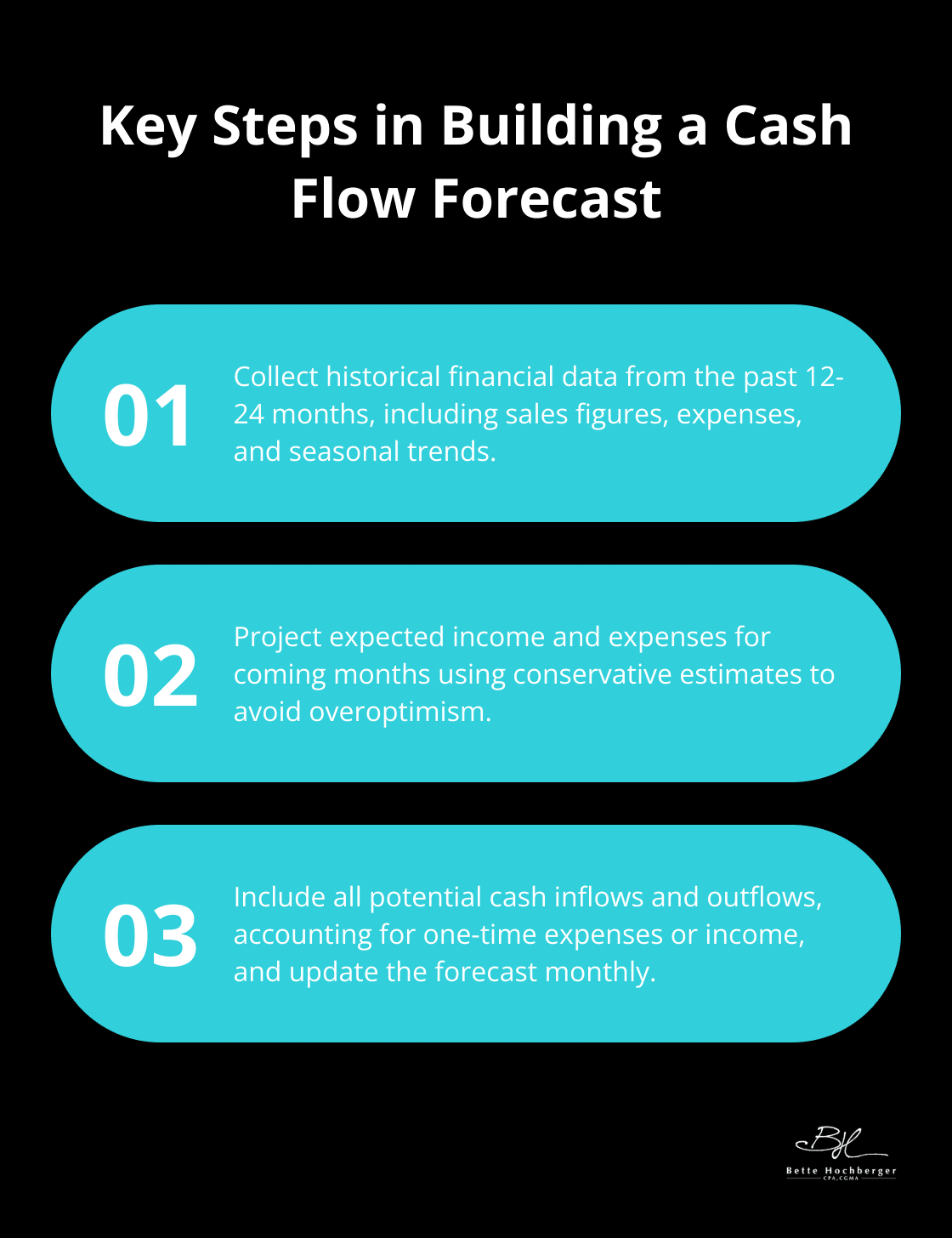

Cash flow forecasting forms a critical tool for business success. It helps you anticipate financial needs, plan for growth, and avoid cash crunches. Start by collecting historical financial data from the past 12-24 months. This includes sales figures, expenses, and seasonal trends. Next, project your expected income and expenses for the coming months. Use conservative estimates to avoid overoptimism.

Include all potential cash inflows and outflows in your forecast. Don’t forget to account for one-time expenses or income (such as equipment purchases or tax refunds). Update your forecast regularly, at least monthly, to maintain accuracy.

Cash flow, debts, customer flow and supply chains will be impacted and finance teams will face increased pressure from internal and external stakeholders. This underscores the importance of precise forecasting.

Harnessing Technology for Precision

Modern financial software can significantly improve the accuracy of your cash flow projections. Tools like QuickBooks, Xero, or Float offer real-time data synchronization and automated forecasting features.

These platforms can integrate with your bank accounts and accounting systems, providing up-to-date information on your financial position. They can also generate visual reports, making it easier to spot trends and potential issues.

A survey by Sage found that businesses using cloud accounting software were 15% more likely to report revenue growth. This suggests that leveraging technology can have a tangible impact on your financial performance.

Planning for Multiple Scenarios

Don’t rely on a single forecast. Prepare for various scenarios to ensure you’re ready for whatever comes your way. Create at least three forecasts: best-case, worst-case, and most likely scenarios.

In your best-case scenario, assume everything goes perfectly. In the worst-case, plan for significant challenges like losing a major client or an economic downturn. The most likely scenario should fall somewhere in between.

Stress test your forecasts by asking “what if” questions. What if sales drop by 20%? What if a key supplier raises prices? This exercise helps you identify potential risks and develop contingency plans.

Cash flow forecasting requires regular attention and adjustment. These techniques will equip you to navigate financial challenges and seize growth opportunities.

Final Thoughts

Effective cash flow management forms the foundation of business success. Companies must accelerate receivables, optimize inventory, negotiate favorable supplier terms, and use technology to improve financial health. Regular forecasting and scenario planning allow businesses to anticipate challenges and seize opportunities in today’s dynamic market.

Cash flow management requires constant monitoring and adjustment to stay ahead of market changes. Bette Hochberger, CPA, CGMA specializes in providing personalized financial services tailored to specific business needs. Our team offers strategic tax planning and Fractional CFO services to help minimize tax liabilities and boost profitability.

We partner with businesses to develop comprehensive strategies that drive growth and success. Our advanced cloud technology and industry expertise enable us to serve diverse sectors effectively. Contact us today to transform your cash flow management into a powerful tool for business success.