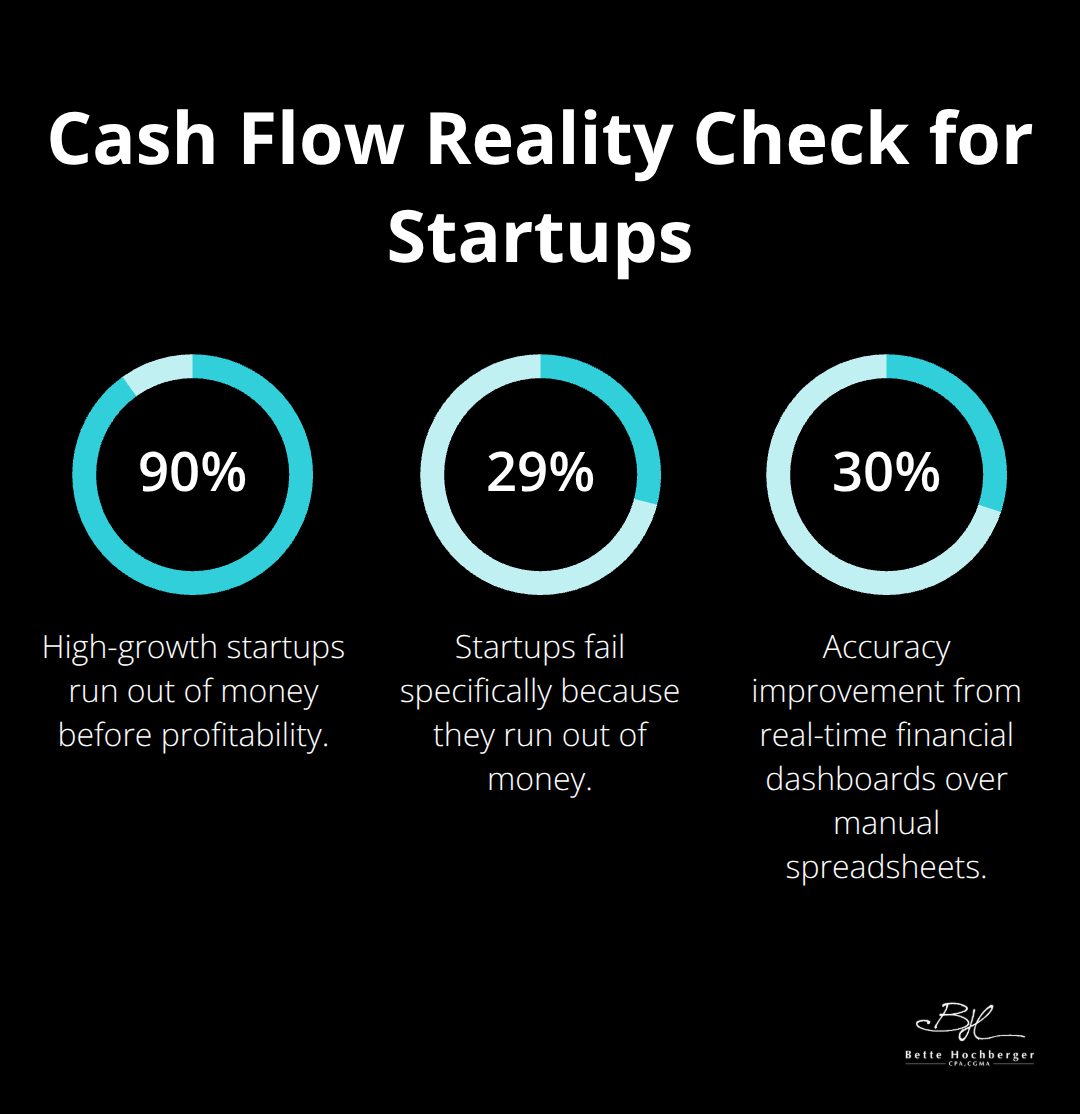

High-growth startups face a dangerous reality: 90% run out of money before achieving profitability. Your cash burn rate determines whether you’ll join the successful 10% or become another cautionary tale.

We at Bette Hochberger, CPA, CGMA see promising companies fail daily because they mismanage their cash flow. The difference between thriving and dying often comes down to smart financial planning and disciplined spending controls.

What Is Cash Burn Rate and Why Does It Matter

Cash burn rate measures how fast your startup spends money each month before it generates positive cash flow. Gross burn rate tracks total monthly expenses including salaries, rent, and marketing costs. Net burn rate subtracts monthly revenue from gross burn, which shows your actual cash depletion.

CB Insights research reveals 29% of startups fail because they run out of money. This statistic makes burn rate tracking essential for survival.

The Math That Determines Your Runway

Your runway equals current cash divided by monthly net burn rate. A startup with $500,000 in the bank and a $50,000 monthly net burn has 10 months to reach profitability or secure new funding.

Most successful startups maintain 12-18 months of runway to provide flexibility during fundraising cycles. Traditional tech companies struggle with $300,000 engineering salaries, making talent costs the biggest burn rate driver.

Fatal Mistakes That Kill Cash Flow

Founders consistently underestimate employee costs and hiring timelines when they project growth. Variable expenses like marketing often spiral out of control without proper tracking systems.

Companies overestimate revenue projections while they underestimate operational costs, which creates a deadly combination. Businesses that fail to monitor your cash flow cannot adapt quickly when market conditions change.

The Hidden Costs That Destroy Budgets

Fixed expenses like rent and salaries remain constant, but variable costs fluctuate dramatically based on growth initiatives. Marketing spend can increase by 300% during customer acquisition campaigns without proper controls in place.

Employee-related expenses extend beyond base salaries to include benefits, equipment, and office space (often totaling 30-40% more than anticipated). These hidden costs accelerate cash depletion faster than most founders expect, but it’s essential to distinguish between “good burn” where you’re strategically building value.

Now that you understand what drives cash burn, the next step involves implementing specific strategies to optimize your cash flow management and extend your runway.

How Do You Maximize Cash While Minimizing Waste

Smart cash management demands ruthless prioritization of activities that generate immediate revenue. Companies that focus 70% of their resources on customer acquisition and retention extend their runway significantly compared to those that spread resources across multiple initiatives.

Focus Marketing Spend on Proven Channels

Direct your marketing budget toward channels with proven ROI above 3:1 rather than experimental campaigns that drain cash without measurable returns. Track conversion rates weekly and eliminate underperforming campaigns within 30 days. Test new channels with maximum 10% of your marketing budget to avoid major cash drains.

Cut Operating Expenses Without Harming Growth

Renegotiate office leases to reduce square footage by 30-40% as remote work becomes standard practice. Software subscriptions often represent 15-20% of monthly expenses for tech startups, yet most companies use only 60% of their licensed features.

Audit these tools monthly and eliminate redundant services immediately. Replace expensive enterprise software with cost-effective alternatives that provide 80% of functionality at 20% of the cost. Consolidate vendors to negotiate better rates through volume discounts (often 15-25% savings).

Transform Payment Terms Into Cash Flow Advantages

Switch from monthly to annual payment cycles to improve cash flow through upfront revenue collection. Offer 5-10% discounts for early payments to accelerate receivables collection and reduce administrative costs.

Negotiate 60-90 day payment terms with suppliers while you collect from customers within 30 days. This creates a positive cash conversion cycle that funds operations through customer payments rather than reserves.

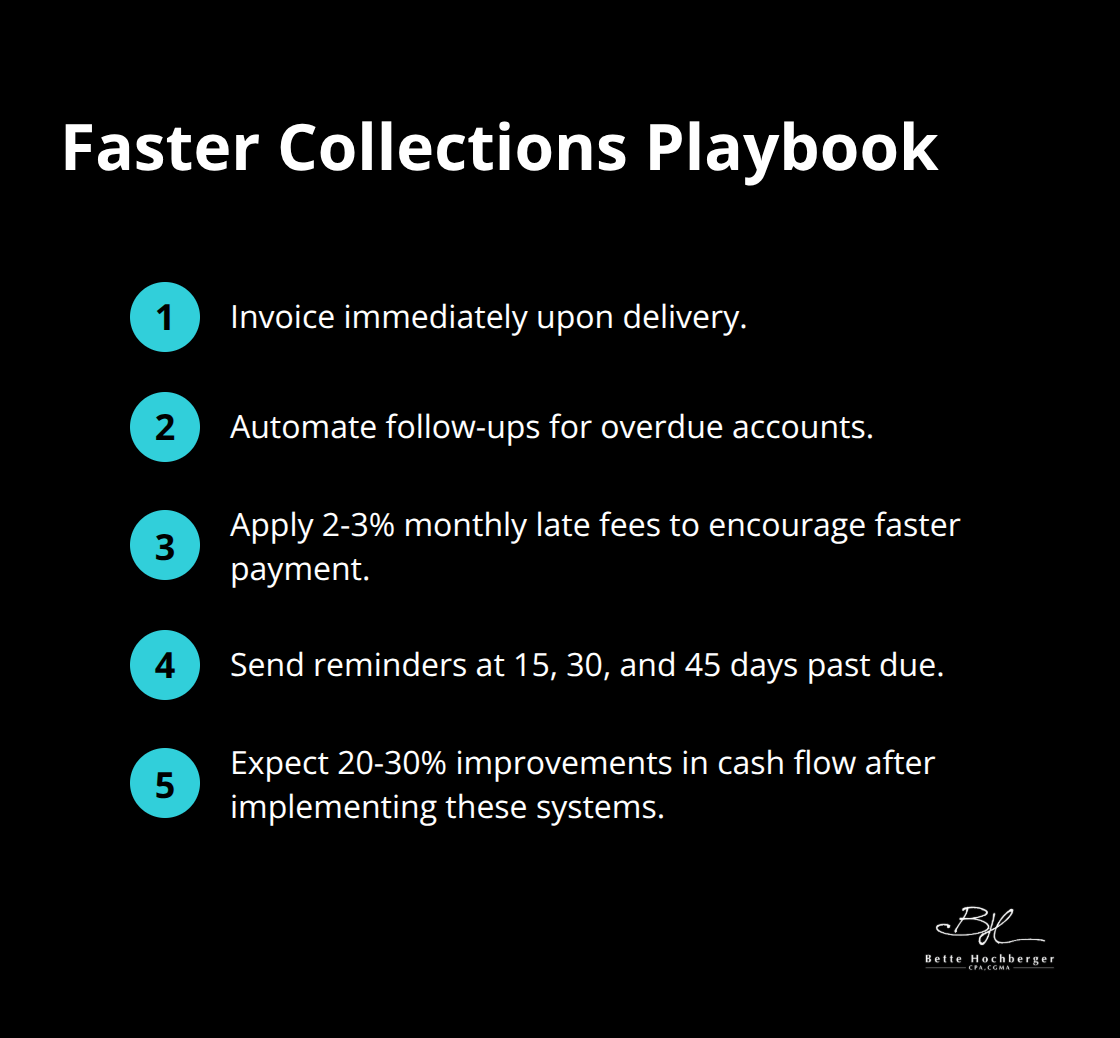

Accelerate Revenue Collection Systems

Invoice immediately upon delivery and implement automated follow-up systems for overdue accounts. Late payment fees of 2-3% monthly encourage faster customer payments while they generate additional revenue streams.

Set up automated reminders at 15, 30, and 45 days past due to maintain consistent collection pressure. Companies that implement these systems typically see 20-30% improvements in cash flow.

Effective cash management requires constant monitoring and accurate forecasting to maintain optimal runway length.

How Do You Track Cash Flow Like a Pro

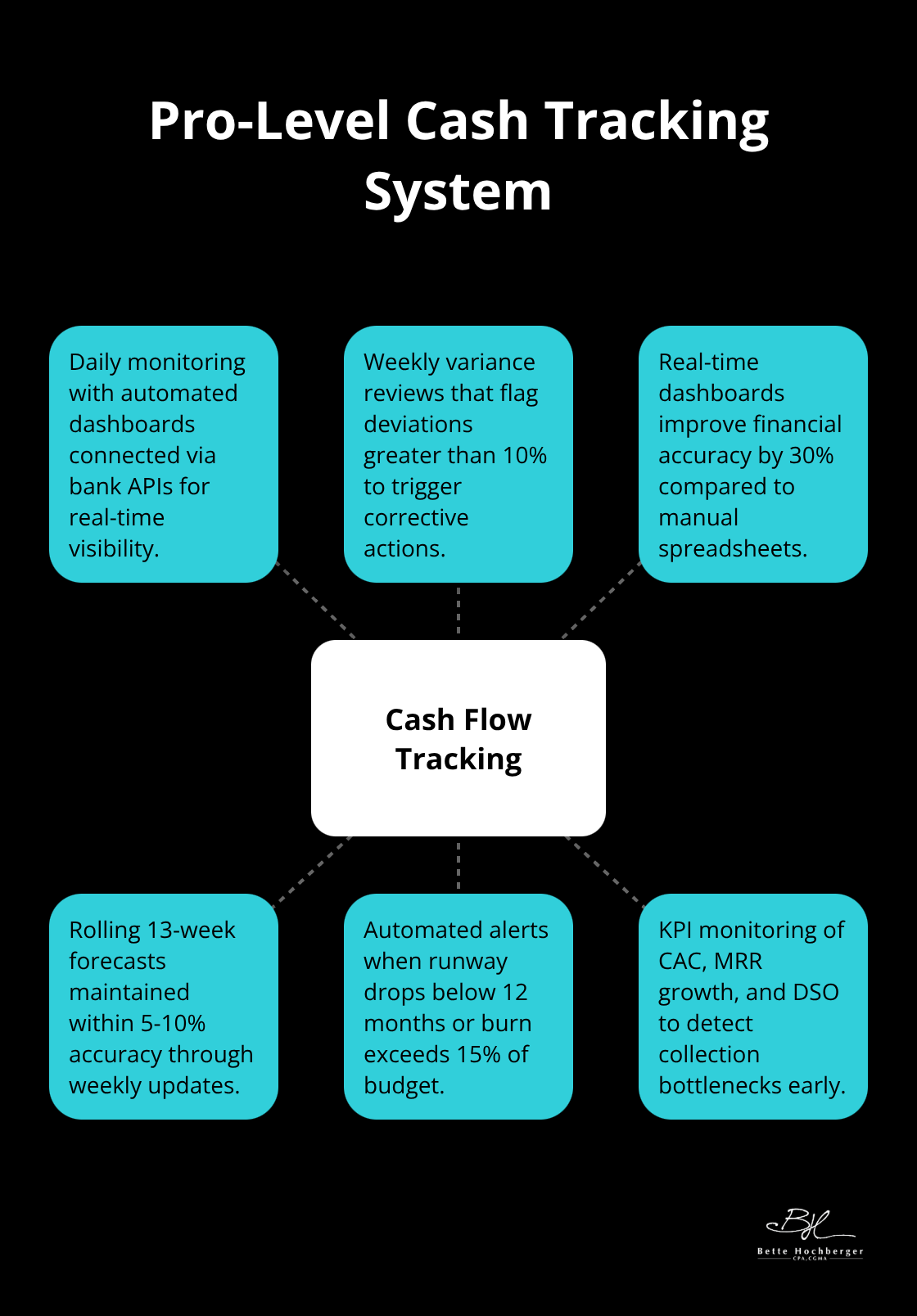

Effective cash flow tracking requires daily monitoring systems rather than monthly reviews that arrive too late to prevent disasters. You must implement automated dashboards that update cash positions in real-time through bank API integrations. These systems give you immediate visibility into spending patterns and revenue collection.

Weekly cash flow reports should compare actual performance against projections with variance analysis that highlights deviations exceeding 10%. Companies using real-time financial dashboards improve their financial accuracy by 30% compared to those that rely on manual spreadsheet updates.

Build Predictive Financial Models That Actually Work

Create rolling 13-week cash flow forecasts that update weekly with actual performance data to maintain accuracy within 5-10% of reality. Include conservative revenue assumptions with 20% downward adjustments for projected sales to account for pipeline delays and customer payment issues.

Model three scenarios: best case with 120% of projected revenue, realistic case with 80% achievement, and worst case with 50% revenue realization. Track key leading indicators like customer acquisition costs and monthly recurring revenue growth rates to predict cash needs 90 days ahead.

Startups that use predictive analytics optimize their expenditure patterns and achieve 25% lower operational costs through data-driven decisions.

Set Up Cash Flow Warning Systems

Configure automated alerts when cash runway drops below 12 months to trigger immediate cost reduction reviews and fundraising preparations. Set weekly burn rate thresholds that trigger notifications when spending exceeds budgeted amounts by 15% or more.

Monthly cash balance alerts at 75%, 50%, and 25% of total reserves provide escalating urgency levels for financial decision-making. Companies that maintain cash reserves of six months can weather market fluctuations and unexpected challenges without emergency fundraising at unfavorable valuations.

Monitor Key Performance Indicators Daily

Track your cash conversion cycle (the time between cash outflow for expenses and cash inflow from customers) to identify bottlenecks in your revenue collection process. Monitor accounts receivable aging reports weekly to spot customers who consistently pay late.

Calculate your days sales outstanding monthly to measure how efficiently you collect revenue. Companies with DSO below 30 days maintain healthier cash positions than those with extended collection periods (often 45-60 days for B2B startups).

Final Thoughts

Effective cash burn rate management separates successful startups from the 90% that fail. Daily monitoring systems, 12-18 months of runway, and ruthless focus on revenue-generating activities over experimental spending create the foundation for survival. Companies that master these fundamentals extend their runway significantly and avoid becoming another startup failure statistic.

Professional financial guidance becomes essential when your runway drops below 12 months or when monthly burn exceeds 15% of budget projections. Complex fundraising scenarios and rapid scaling decisions require expertise that most founders lack internally. We at Bette Hochberger, CPA, CGMA specialize in helping high-growth startups optimize their cash flow management through strategic financial planning.

Sustainable growth requires balance between aggressive expansion and financial discipline. Focus 70% of resources on proven customer acquisition channels while you negotiate favorable payment terms and maintain automated cash flow tracking systems. Smart cash burn rate control positions your startup for long-term profitability rather than emergency fundraising at unfavorable valuations (which destroys founder equity and company control).