At Bette Hochberger, CPA, CGMA, we know that navigating the complex world of taxes can be overwhelming. Many taxpayers are unaware of the legal ways to reduce their tax burden.

IRS tax loopholes, when used correctly, can help individuals and businesses save money while staying compliant with the law. In this post, we’ll explore some of the most effective tax strategies that can potentially lower your tax bill.

What Are Legal Tax Loopholes?

Legal tax loopholes provide opportunities for individuals and businesses to reduce their tax liability within the bounds of the law. These are not underhanded tactics but rather provisions in the tax code that allow taxpayers to lower their tax burden legitimately.

Avoidance vs. Evasion: A Critical Distinction

Understanding the difference between tax avoidance and tax evasion is essential. Tax avoidance involves the use of legal methods to minimize tax liability. Tax evasion, however, is illegal and includes deliberate misrepresentation of financial information to reduce taxes.

For instance, claiming a home office deduction when you meet all IRS requirements exemplifies tax avoidance. Failure to report cash income constitutes tax evasion.

Dispelling Common Myths

Many people incorrectly believe that using tax loopholes is unethical or exclusive to the wealthy. The tax code’s complexity often includes incentives for certain behaviors, and taking advantage of these incentives simply means following the rules as written.

Another misconception suggests that using tax loopholes will trigger an audit. While aggressive tax strategies might increase audit chances, the correct use of common and well-established loopholes is unlikely to raise red flags.

Real-World Applications

The IRS allows deduction of up to $3,000 in capital losses against ordinary income each year. This provision enables a strategy known as tax-loss harvesting. Investors can sell investments that have decreased in value to realize the loss and reduce their taxable income (a perfectly legal way to lower one’s tax bill).

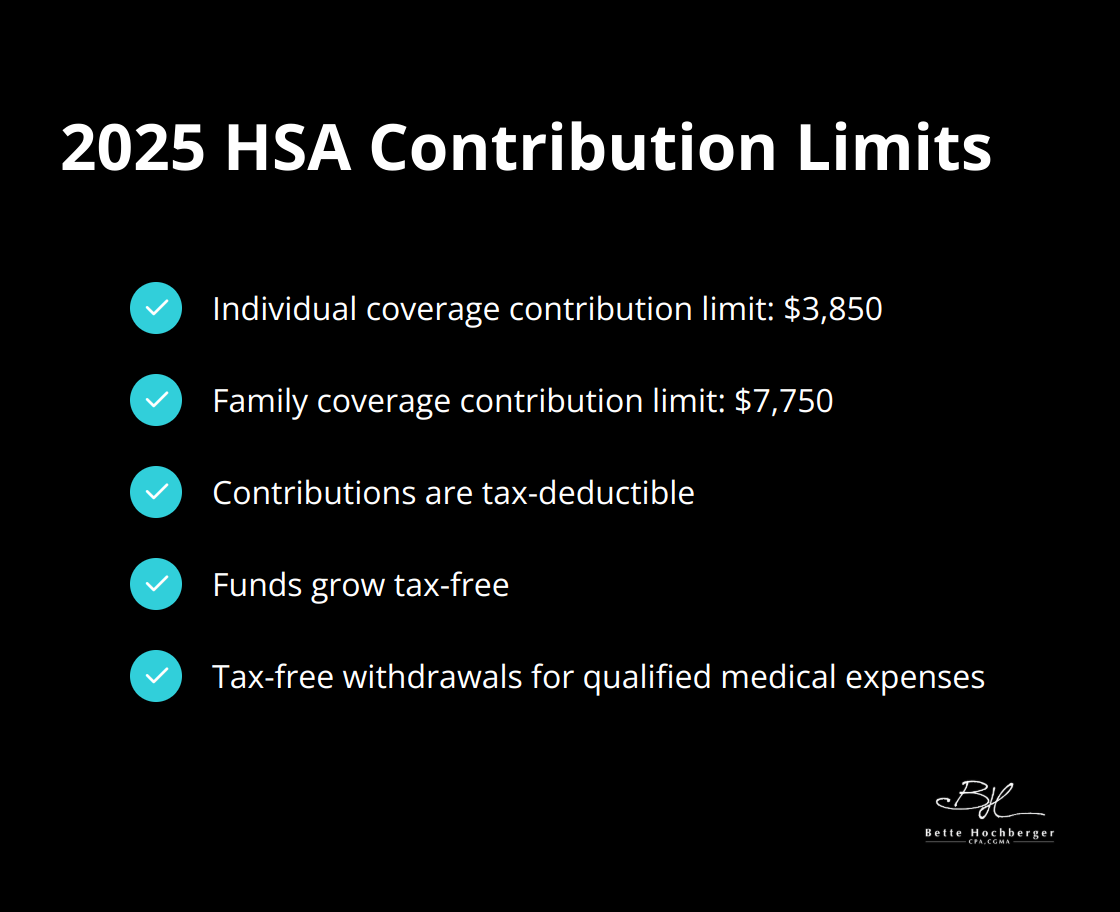

Health Savings Accounts (HSAs) offer another practical application. In 2025, individuals can contribute up to $3,850 for individual coverage or $7,750 for family coverage. These contributions are tax-deductible, grow tax-free, and allow tax-free withdrawals for qualified medical expenses (a triple tax advantage that many overlook).

The Importance of Professional Guidance

Tax laws change frequently and can be complex. Working with a qualified tax professional helps navigate these waters safely and effectively. A tax expert can identify applicable loopholes and ensure their proper use to maximize tax savings while maintaining compliance with current regulations.

As we move forward, let’s explore some popular legal tax loopholes that individuals can leverage to optimize their tax situation.

Smart Tax Strategies for Individuals

Maximize Retirement Account Contributions

One of the most effective ways to reduce your tax burden involves maximizing contributions to retirement accounts. In 2025, you can contribute up to $23,000 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older. These contributions use pre-tax dollars, which lowers your taxable income for the year.

For those with a Traditional IRA, the contribution limit for 2025 is $7,000 if you’re under 50, and $8,000 if you’re 50 or older. Depending on your income and workplace retirement plan coverage, these contributions may offer tax deductions.

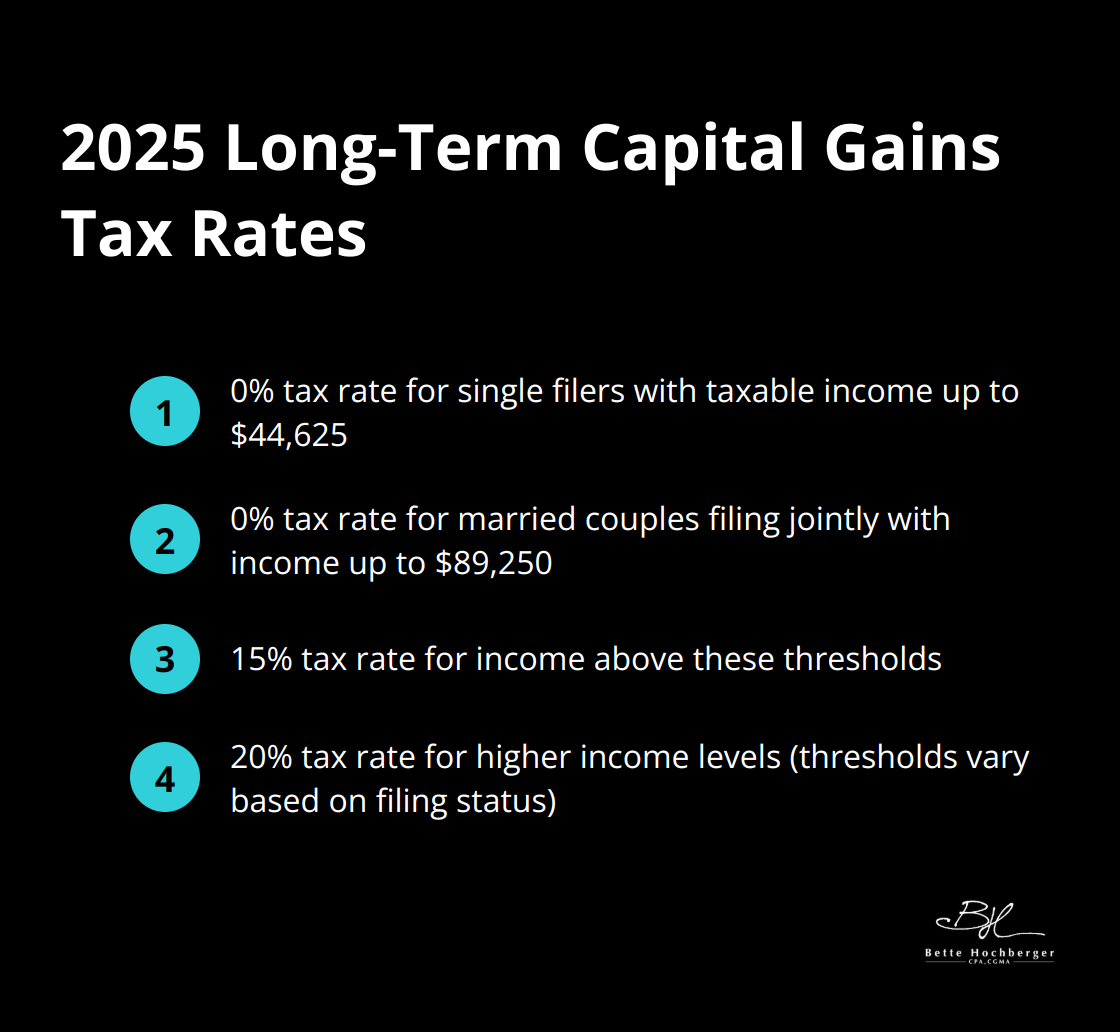

Optimize Capital Gains Tax

Understanding capital gains taxation can lead to substantial tax savings. Long-term capital gains (assets held for more than a year) receive preferential tax rates: 0%, 15%, or 20%, based on your income. For 2025, single filers with taxable income up to $44,625 and married couples filing jointly with income up to $89,250 can benefit from the 0% rate on long-term capital gains.

Strategic timing of asset sales can help you stay within these lower tax brackets. For example, if you plan to sell a highly appreciated asset, consider spreading the sale over multiple tax years to keep your annual income within the lower capital gains tax brackets.

Utilize Health Savings Accounts

Health Savings Accounts (HSAs) offer a unique triple tax advantage. HSAs provide reduced taxable income, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. For 2025, individuals with high-deductible health plans can contribute up to $3,850, while families can contribute up to $7,750.

HSAs can also serve as a powerful retirement savings tool. After age 65, you can withdraw funds for any purpose without penalty, paying only income tax on non-medical withdrawals – similar to a Traditional IRA.

Explore Real Estate Tax Benefits

Real estate investments offer significant tax advantages. The depreciation deduction allows you to offset rental income with a portion of your property’s value each year, even if the property appreciates. For residential properties, you can depreciate the value over 27.5 years.

Moreover, the 1031 exchange provision allows you to defer capital gains taxes when selling an investment property by reinvesting the proceeds into a like-kind property. This strategy can help you build wealth over time while deferring taxes.

As we move forward, let’s explore how businesses can take advantage of similar strategies to optimize their tax situations and improve their bottom line.

Smart Tax Strategies for Businesses

Businesses have unique opportunities to leverage tax loopholes legally. Let’s explore some powerful strategies that can reduce your company’s tax burden.

Accelerated Depreciation for Equipment Purchases

The Section 179 deduction offers significant benefits for businesses investing in new equipment. In 2025, this deduction may still be available to businesses that spend less than $4.38 million per year for equipment. This allows businesses to write off the full cost of most new and used business equipment in the purchase year, rather than depreciating it over several years.

For instance, a machinery purchase can be deducted entirely from taxable income in the same year. This leads to substantial tax savings and improved cash flow.

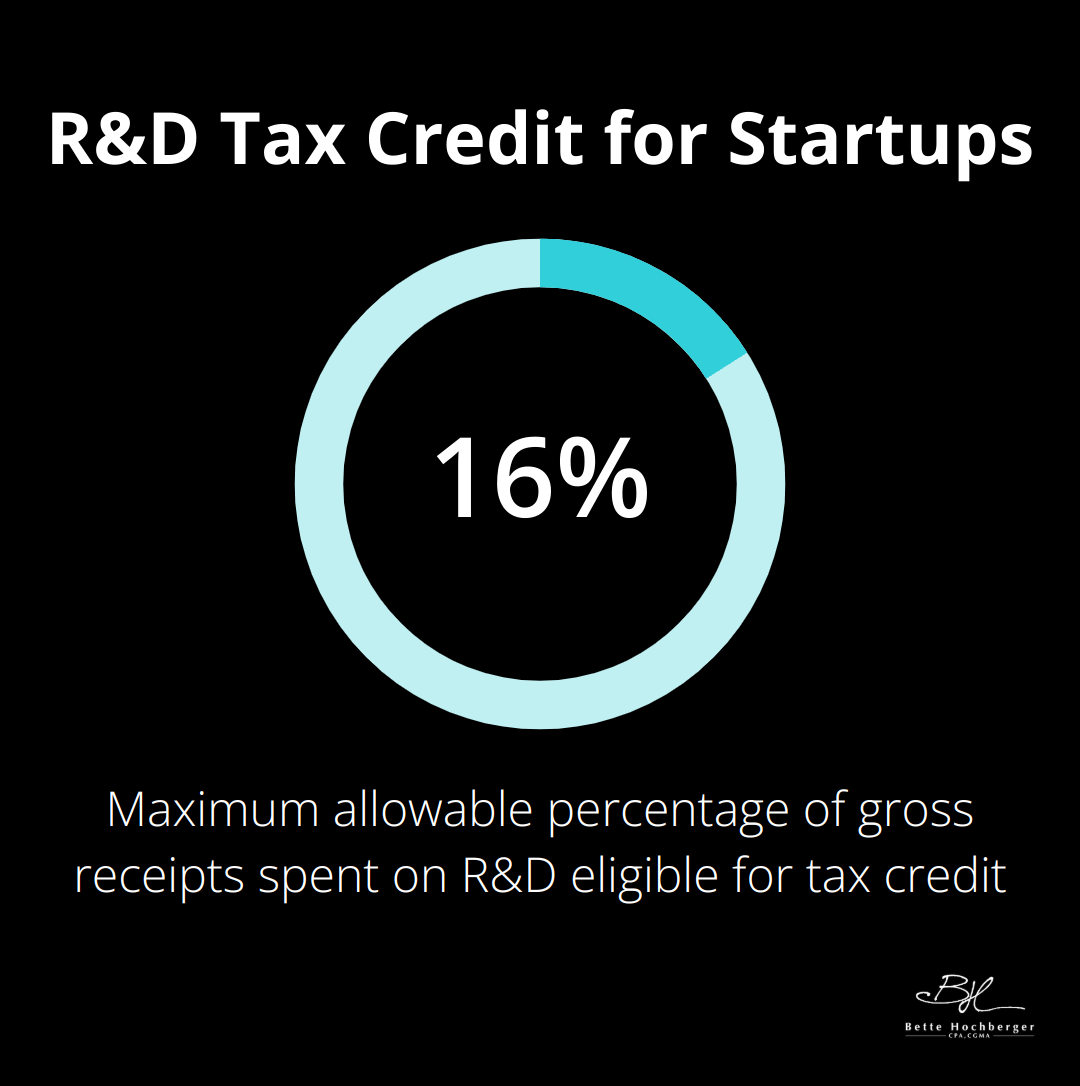

R&D Tax Credits for Innovation

The Research and Development (R&D) tax credit applies to a wide range of industries and activities aimed at developing new products, processes, or software. For startups, the maximum allowable percentage is 16% of gross receipts spent on R&D.

Startups and small businesses can use this credit to offset payroll taxes (even if the company isn’t profitable yet). This makes the R&D credit a valuable tool for innovative businesses across various sectors.

Cost Segregation for Real Estate Investments

Cost segregation provides a powerful tax-saving tool for businesses that own commercial property. This strategy breaks down the components of a building and depreciates them over shorter periods than the standard 39 years for commercial property.

Items like carpet, fixtures, and some electrical systems can be depreciated over 5, 7, or 15 years. This accelerated depreciation results in significant tax deductions in the early years of property ownership. A cost segregation study typically identifies 20% to 40% of a building’s cost that can be reclassified into shorter recovery periods.

Small Business Stock Gains Exclusion

Section 1202 of the Internal Revenue Code allows for the exclusion of capital gains from the sale of qualified small business stock. Investors who hold qualified small business stock for more than five years can exclude up to 100% of the gain from federal income tax (up to $10 million or 10 times the adjusted basis, whichever is greater).

This provision encourages investment in small businesses and can result in substantial tax savings for both the business owners and their investors.

Strategic Entity Structure

The choice of business entity structure can significantly impact tax obligations. S Corporations, for example, allow business income to pass through to the owners’ personal tax returns, potentially reducing self-employment taxes. Limited Liability Companies (LLCs) offer flexibility in taxation, allowing owners to choose how they want to be taxed (as a sole proprietorship, partnership, S Corporation, or C Corporation).

These strategies require careful planning and execution. Professional guidance can help businesses navigate these complex tax strategies to maximize their benefits while ensuring full compliance with IRS regulations.

Final Thoughts

IRS tax loopholes offer significant potential for tax savings, but they require careful consideration and expert guidance. Tax regulations change frequently, so staying informed about updates is essential to maintain effective tax planning strategies. A qualified tax expert can identify appropriate loopholes for your specific financial situation and help you maximize tax benefits while ensuring full compliance with IRS regulations.

Your tax strategy should complement your broader financial objectives, such as retirement planning or business expansion. A holistic approach to finances allows you to make informed decisions that optimize your tax position and advance your overall financial well-being. Professional guidance proves invaluable when implementing tax-saving techniques and developing a comprehensive strategy aligned with your goals.

Bette Hochberger, CPA, CGMA provides personalized financial services tailored to unique needs. Our team of experts can help you navigate tax planning intricacies, leverage available loopholes effectively, and minimize tax liabilities (while managing cash flow and fostering profitability). We offer strategic tax planning and Fractional CFO services to support your financial success.