At Bette Hochberger, CPA, CGMA, we’ve seen how Fractional CFO services can transform businesses.

These services offer a powerful way to access top-tier financial expertise without the hefty price tag of a full-time executive.

For companies looking to supercharge their growth, Fractional CFO services provide strategic insights, improved financial management, and a clear path to scalability.

What Is a Fractional CFO?

Definition and Role

A Fractional CFO is an experienced CFO consultant who provides services for organizations in a part-time, retainer, or contract arrangement. These professionals bring extensive experience, often from multiple companies across various industries, to focus on critical financial areas such as cash flow management, financial forecasting, and strategic planning.

Fractional vs. Full-Time CFO

The primary distinction between a Fractional and full-time CFO lies in commitment and cost. A full-time CFO is a permanent employee with a substantial salary and benefits package. In contrast, a Fractional CFO offers top-tier expertise at a reduced cost, typically working on a flexible schedule tailored to the company’s needs. This cost-effective model allows smaller businesses and startups to access CFO-level insights without incurring excessive expenses.

Ideal Candidates for Fractional CFO Services

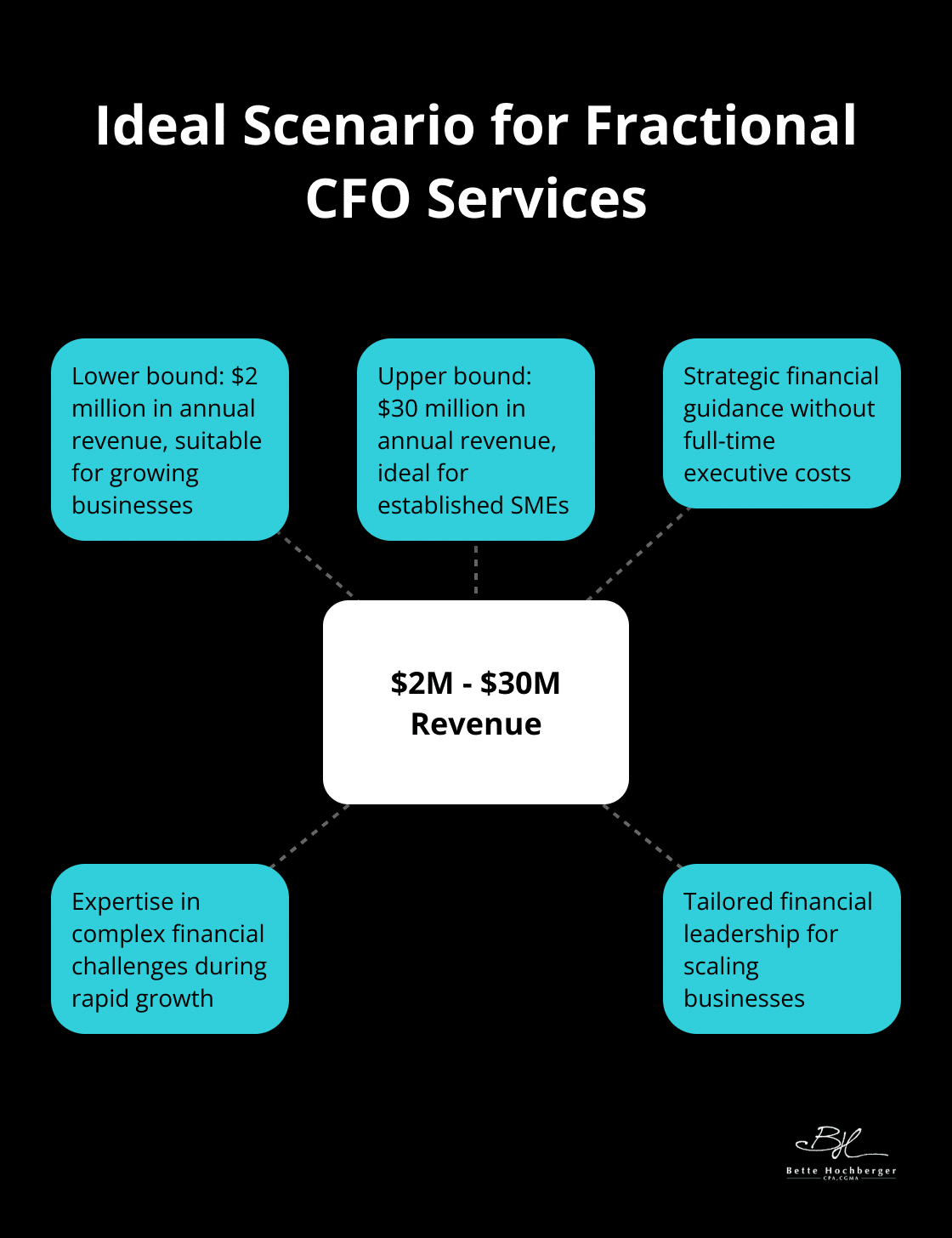

While businesses of all sizes can benefit from Fractional CFO services, certain types of companies find them particularly valuable:

- Startups and high-growth companies: These businesses often face complex financial challenges as they scale rapidly. A Fractional CFO can help navigate these challenges, ensuring sustainable growth.

- Small to medium-sized enterprises (SMEs): Many SMEs lack the resources for a full-time CFO but still need expert financial guidance. Fractional CFOs fill this gap effectively.

- Companies undergoing transitions: During mergers, acquisitions, or major restructuring, a Fractional CFO can provide essential financial leadership.

- Businesses seeking financial optimization: Companies looking to improve cash flow, reduce costs, or prepare for fundraising can greatly benefit from the strategic insights of a Fractional CFO.

The Impact of Fractional CFOs

Fractional CFOs take a broader view than bookkeepers or accountants who primarily deal with day-to-day transactions. They align financial strategies with overall business objectives, making them particularly beneficial for companies with revenues between $2 million and $30 million. These businesses often need strategic financial guidance but may not require or be able to afford a full-time executive.

The flexibility and expertise offered by Fractional CFOs bring experience in analyzing historical data and market trends to predict future financial performance accurately. As we move into the next section, we’ll explore the key benefits of leveraging Fractional CFO services and how they can drive significant growth for your business.

Why Fractional CFOs Transform Businesses

Cost-Effective Financial Expertise

Fractional CFOs offer top-tier financial leadership without the full-time price tag. This arrangement allows small and medium-sized businesses to access CFO-level insights at a fraction of the cost. A full-time CFO can cost upwards of six figures annually, not including benefits and bonuses. A fractional CFO provides lower cost, high-value expertise, enabling businesses to allocate resources more efficiently and invest in growth opportunities.

Strategic Financial Planning

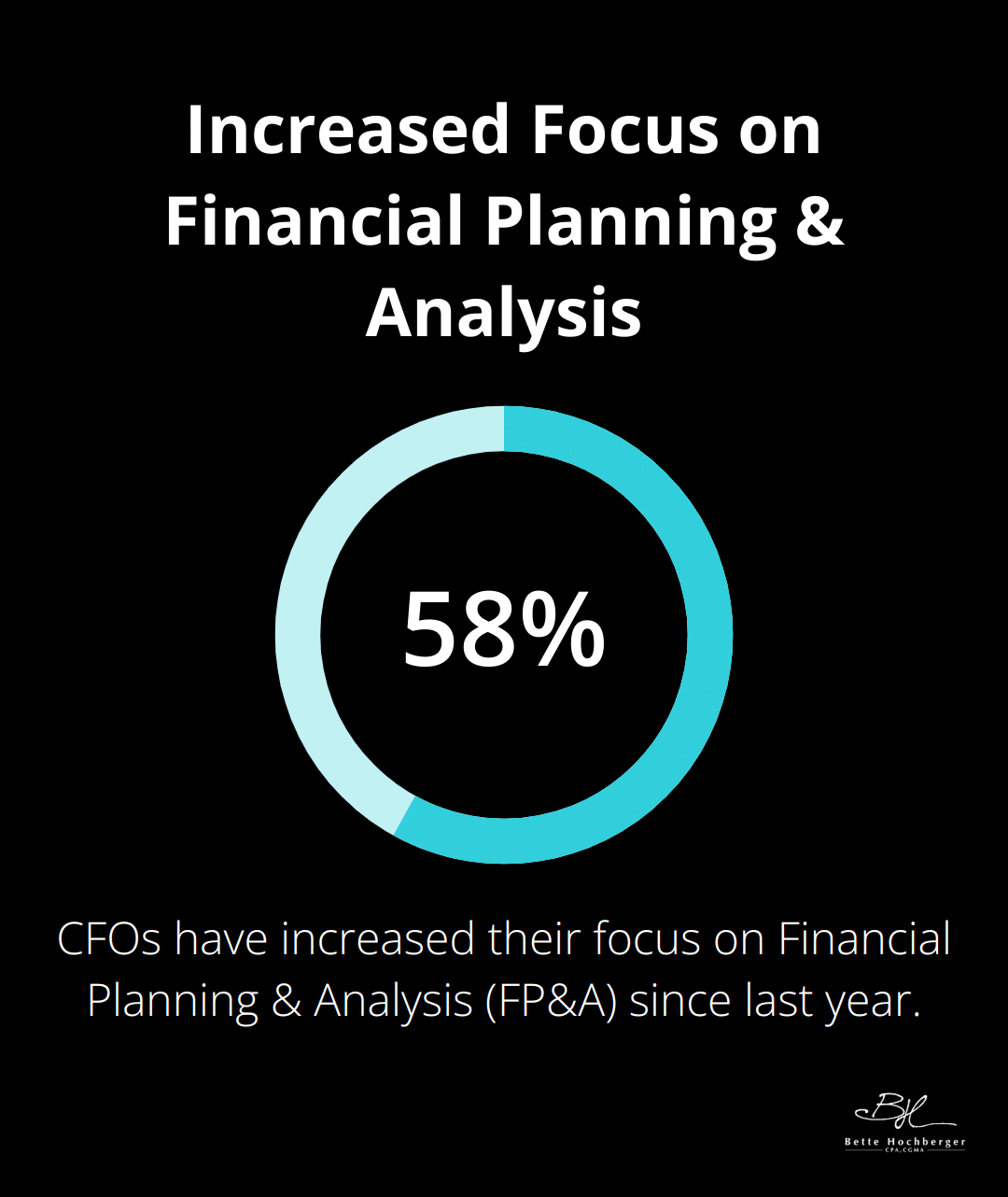

Fractional CFOs don’t just analyze numbers; they create actionable strategies that drive growth. These professionals examine market trends and company financial data to craft robust financial plans. 58% of CFOs have increased FP&A focus since last year, according to a PwC report. This strategic approach helps businesses make informed decisions and stay ahead of the competition.

Cash Flow Mastery

Cash flow management is a critical skill that Fractional CFOs bring to the table. They implement sophisticated cash management techniques, optimize working capital, and identify potential cash traps before they become problems. Fractional CFOs serve as safeguards against common pitfalls, ensuring businesses maintain healthy cash flows for sustained operations and growth.

Enhanced Financial Reporting

With a Fractional CFO, businesses receive more than just reports; they gain actionable insights. These professionals use advanced analytical tools and methodologies to transform raw data into strategic assets. This level of analysis empowers businesses to make data-driven decisions quickly and confidently.

Expanded Financial Network

Hiring a Fractional CFO provides access to their extensive professional network. This network proves invaluable when businesses need to raise capital, negotiate with vendors, or explore new opportunities. The connections a Fractional CFO brings can open doors to new partnerships, funding sources, and strategic alliances.

Fractional CFOs offer more than financial expertise; they provide a pathway to business transformation. Their ability to blend strategic thinking with practical financial management makes them invaluable assets for companies aiming to scale and succeed in competitive markets. As we explore how to implement Fractional CFO services effectively, it’s clear that their impact extends far beyond the balance sheet.

How to Implement Fractional CFO Services

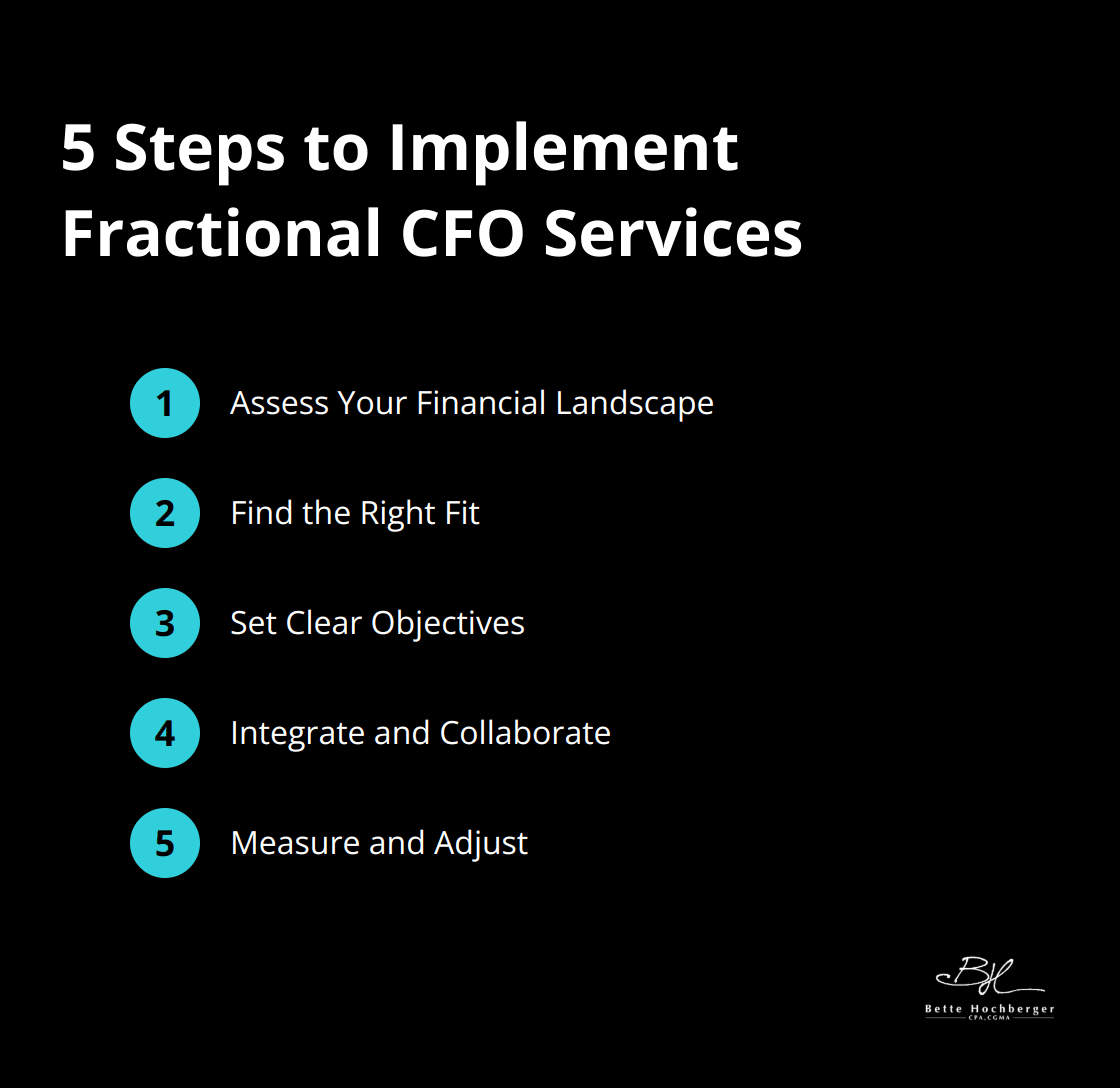

Assess Your Financial Landscape

Start with a thorough assessment of your current financial situation. Analyze your cash flow, review financial statements, and identify areas that need the most attention. Do you struggle with profitability? Need help with financial forecasting? Or perhaps you’re looking to raise capital? Pinpoint your specific needs to find the right Fractional CFO who understands your industry.

Find the Right Fit

When selecting a Fractional CFO, look beyond financial expertise. Seek someone who understands your industry and has experience with companies at your stage of growth.

Consider their communication style and cultural fit with your team. A Fractional CFO should translate complex financial concepts into actionable insights for non-financial team members. They should also align with your company’s values and long-term vision.

Set Clear Objectives

After you choose your Fractional CFO, establish clear, measurable objectives. These might include improving profit margins by a certain percentage, reducing operational costs, or preparing financial documentation for a funding round. Be specific and set timelines for these goals. This clarity will help both you and your Fractional CFO stay focused and accountable.

Integrate and Collaborate

Effective integration of your Fractional CFO is key for success. Introduce them to key team members and ensure they have access to necessary financial data and systems. Schedule weekly or bi-weekly meetings to review progress and address any challenges.

Encourage collaboration between your Fractional CFO and other departments. Their insights can prove valuable across the organization, from marketing to operations. This cross-functional approach can lead to more holistic financial strategies and better overall business performance.

Measure and Adjust

Regularly assess the impact of your Fractional CFO on your business. Look at key financial metrics like revenue growth, profit margins, and cash flow improvements. Consider qualitative factors too, such as improved financial decision-making processes or better financial literacy across your team.

Be prepared to adjust your approach based on these assessments. The needs of your business may evolve, and your engagement with your Fractional CFO should evolve too. This flexibility is one of the key advantages of the Fractional CFO model.

Final Thoughts

Fractional CFO services provide a powerful solution for businesses to access top-tier financial expertise without excessive costs. These professionals offer strategic insights, improved financial management, and a clear path to scalability. Companies can transform their financial decision-making processes and enhance reporting accuracy with the help of a fractional CFO.

The long-term benefits of engaging fractional CFO services extend beyond immediate financial gains. These experts lay the foundation for sustainable growth, helping businesses scale efficiently and profitably. Their strategic input can open doors to new opportunities through extensive professional networks.

For businesses facing complex financial challenges, now is the time to consider fractional CFO services. At Bette Hochberger, CPA, CGMA, we specialize in providing personalized financial services tailored to meet the unique needs of businesses and professionals. Our team’s expertise can help your business thrive in today’s competitive landscape.