Hiring a Contract CFO can be a game-changer for businesses looking to elevate their financial strategy without the commitment of a full-time executive.

At Bette Hochberger, CPA, CGMA, we’ve seen firsthand how the right financial expertise can transform a company’s trajectory. This guide will walk you through the process of finding and hiring the perfect Contract CFO for your unique business needs.

What Does a Contract CFO Do?

Definition and Core Responsibilities

A Contract CFO (also known as a fractional CFO) provides high-level financial strategy and management on a part-time or project basis. This role has gained popularity among small to medium-sized businesses that need advanced financial guidance without the expense of a full-time executive.

Contract CFOs assess potential investment opportunities and make recommendations based on the company’s financial health and strategic direction. They analyze financial data to provide insights that drive business growth and profitability. Their responsibilities often include developing cash flow projections, creating budgets, and establishing financial controls.

Full-Time vs. Contract CFO: Key Differences

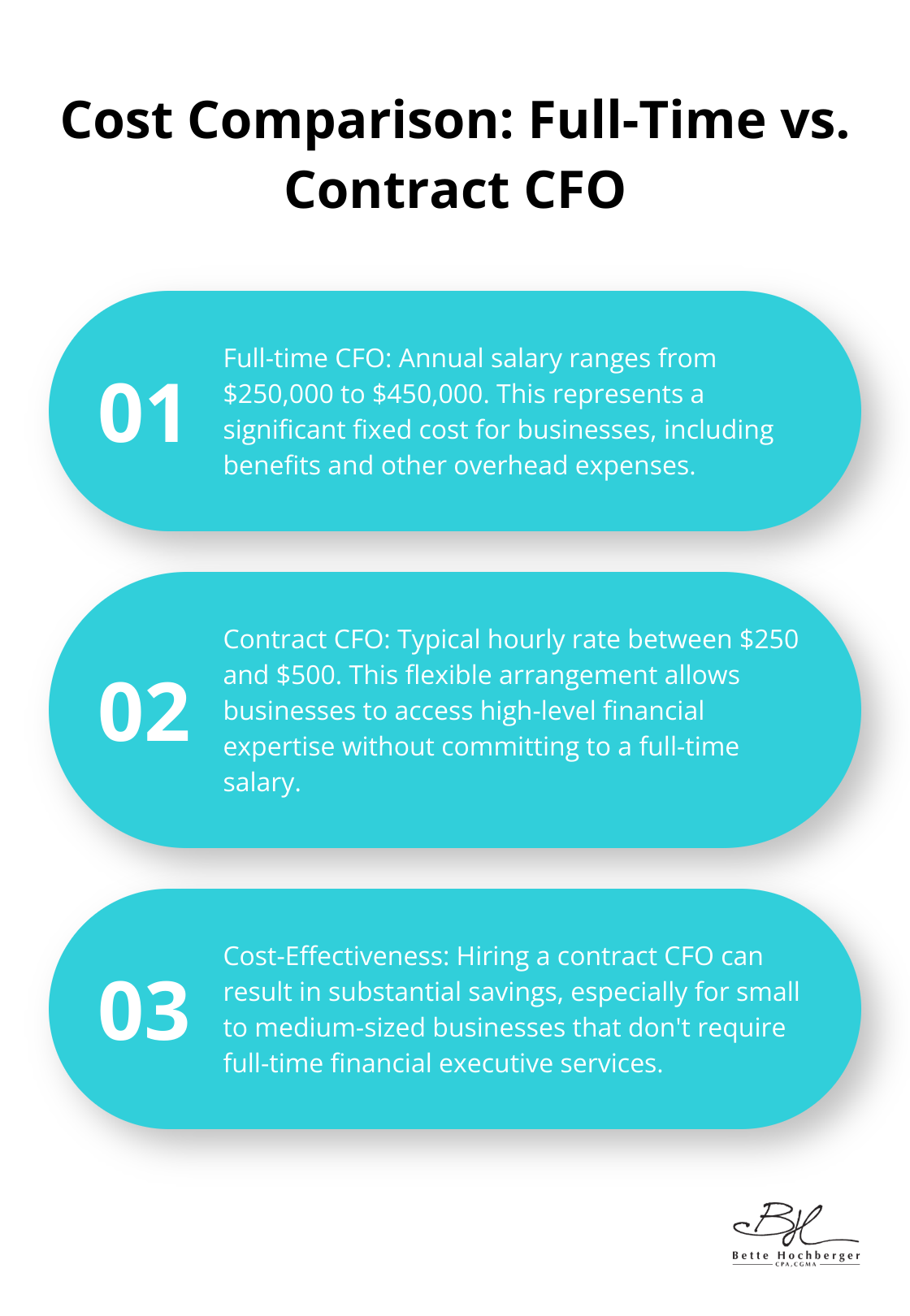

The main distinction between a full-time and contract CFO lies in their engagement model. Full-time CFOs work as permanent employees, while contract CFOs operate on a flexible, as-needed basis. This flexibility allows businesses to access top-tier financial expertise without committing to a full-time salary and benefits package.

The cost difference is significant. The average full-time CFO salary ranges from $250,000 to $450,000 per year, whereas contract CFOs typically charge between $250 and $500 per hour (according to data from Robert Half).

Advantages of Hiring a Contract CFO

- Cost-Effectiveness: Businesses can tap into high-level financial expertise without the overhead of a full-time executive.

- Flexibility: Companies can scale financial oversight as needed, which proves particularly valuable for growing businesses or those facing specific financial challenges.

- Diverse Experience: Contract CFOs often bring experience from various industries, offering fresh perspectives and best practices.

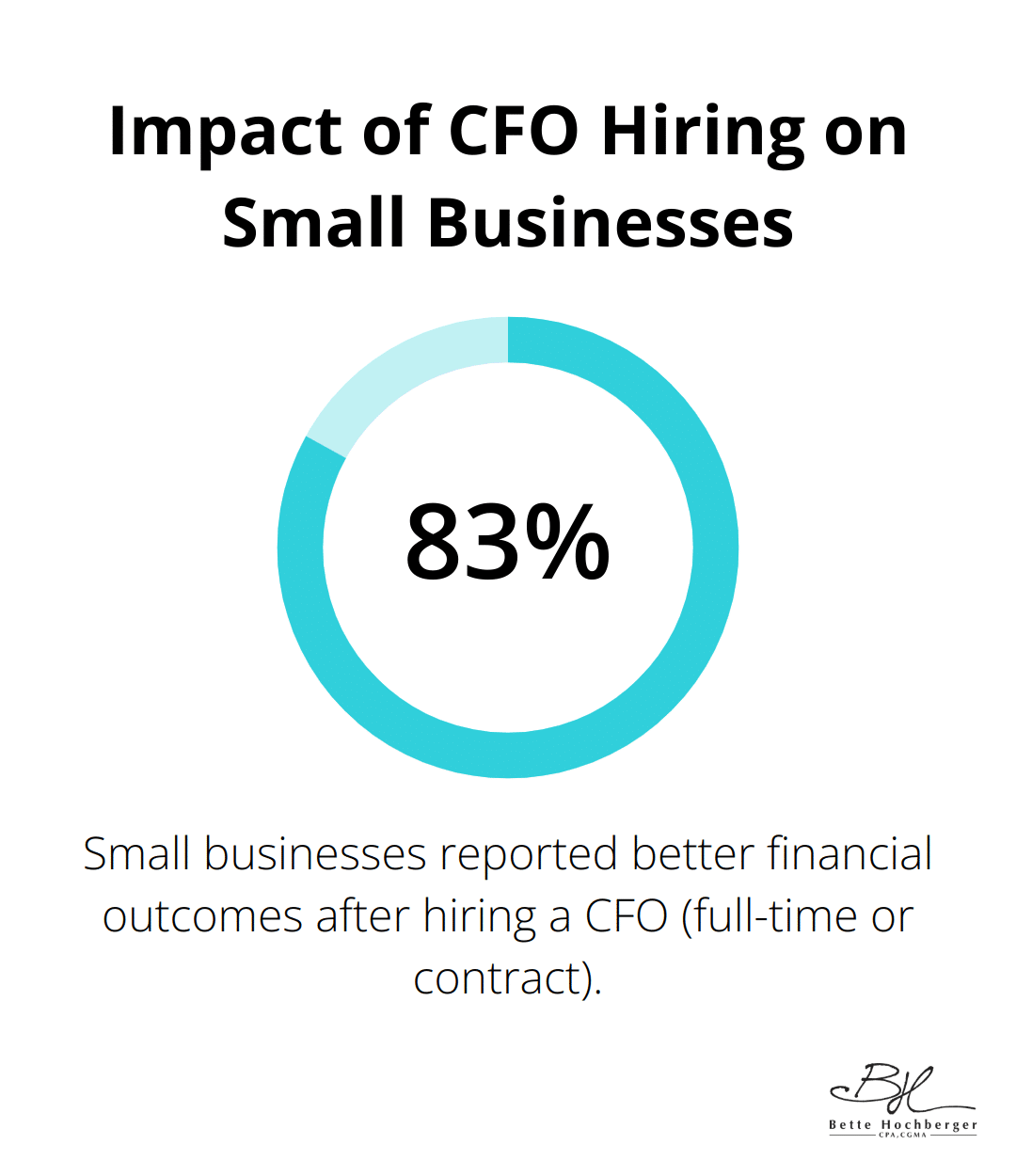

A study by Intuit found that 83% of small businesses reported better financial outcomes after hiring a CFO (whether full-time or on a contract basis).

Strategic Role in Business Growth

Contract CFOs play a crucial role in preparing businesses for growth milestones. They assist with:

- Creating comprehensive business plans

- Developing pitch decks for venture capital

- Preparing for mergers and acquisitions

This strategic input can prove invaluable for businesses aiming to scale or enter new markets.

As businesses evolve, their financial needs change. The next section will explore how to determine if your business is ready for a contract CFO and the specific challenges they can address.

When Does Your Business Need a Contract CFO?

Revenue Thresholds and Business Complexity

Businesses often consider hiring a Contract CFO when they reach certain revenue thresholds. The decision to hire a CFO is often tied to the size of the company, particularly its revenue. While some companies may benefit from these services at lower revenue levels, particularly if they experience rapid expansion or face complex financial situations, it’s important to consider company size and revenue when making this decision.

Indicators for Financial Expertise

Several signs suggest it’s time to bring in a Contract CFO:

- Bookkeeping tasks overwhelm your team

- You struggle to accurately forecast cash flow

- You plan to approach investors for funding

- Your business prepares for a sale or acquisition

- You need help navigating complex financial regulations

If you identify with any of these points, you should consider hiring a Contract CFO.

Addressing Specific Financial Challenges

Contract CFOs excel at tackling various financial hurdles. They streamline cash flow management, ensuring you have the capital needed for growth while avoiding cash crunches. They also create robust financial reporting systems (essential for informed business decisions and attracting investors).

For businesses grappling with regulatory compliance, a Contract CFO proves invaluable. They ensure your financial practices align with industry standards and government regulations, helping you avoid costly penalties.

If you plan strategic initiatives like expanding into new markets or launching new products, a Contract CFO provides the financial analysis and projections needed to make these decisions with confidence.

Fueling Business Growth

A Contract CFO doesn’t just manage existing finances; they catalyze growth. They help you identify inefficiencies in your business model, optimize your pricing strategy, and find new opportunities for profit.

They assist in developing a strategic business model that maximizes profits in complex financial environments. They transform financial reports into actionable insights, directly informing business decisions that drive growth.

If you consider raising capital, a Contract CFO proves instrumental. They prepare comprehensive financial projections, create compelling pitch decks, and provide the financial credibility that investors seek.

The decision to hire one should stem from your unique business needs and growth aspirations. While the right time varies for each company, the benefits of having high-level financial expertise on your side remain clear. Now that you understand when to hire one, let’s explore the key steps in the hiring process.

How to Find and Hire the Right Contract CFO

Define Your Financial Needs

Start by identifying your specific financial challenges. Do you struggle with cash flow management? Do you need help with financial forecasting? Or are you preparing for a funding round? Clear articulation of your needs will help you find a CFO with the right expertise.

Capital requirements, risk and interest rates implications continue to move higher on the list of CFO challenges. Identify which of these align with your business goals.

Source Qualified Candidates

After defining your needs, find potential candidates. Professional networks like LinkedIn can serve as valuable resources.

Specialized financial recruitment agencies often have access to a pool of pre-vetted candidates with diverse industry experience.

Evaluate Experience and Qualifications

When reviewing candidates, look for a track record of success in roles similar to your needs.

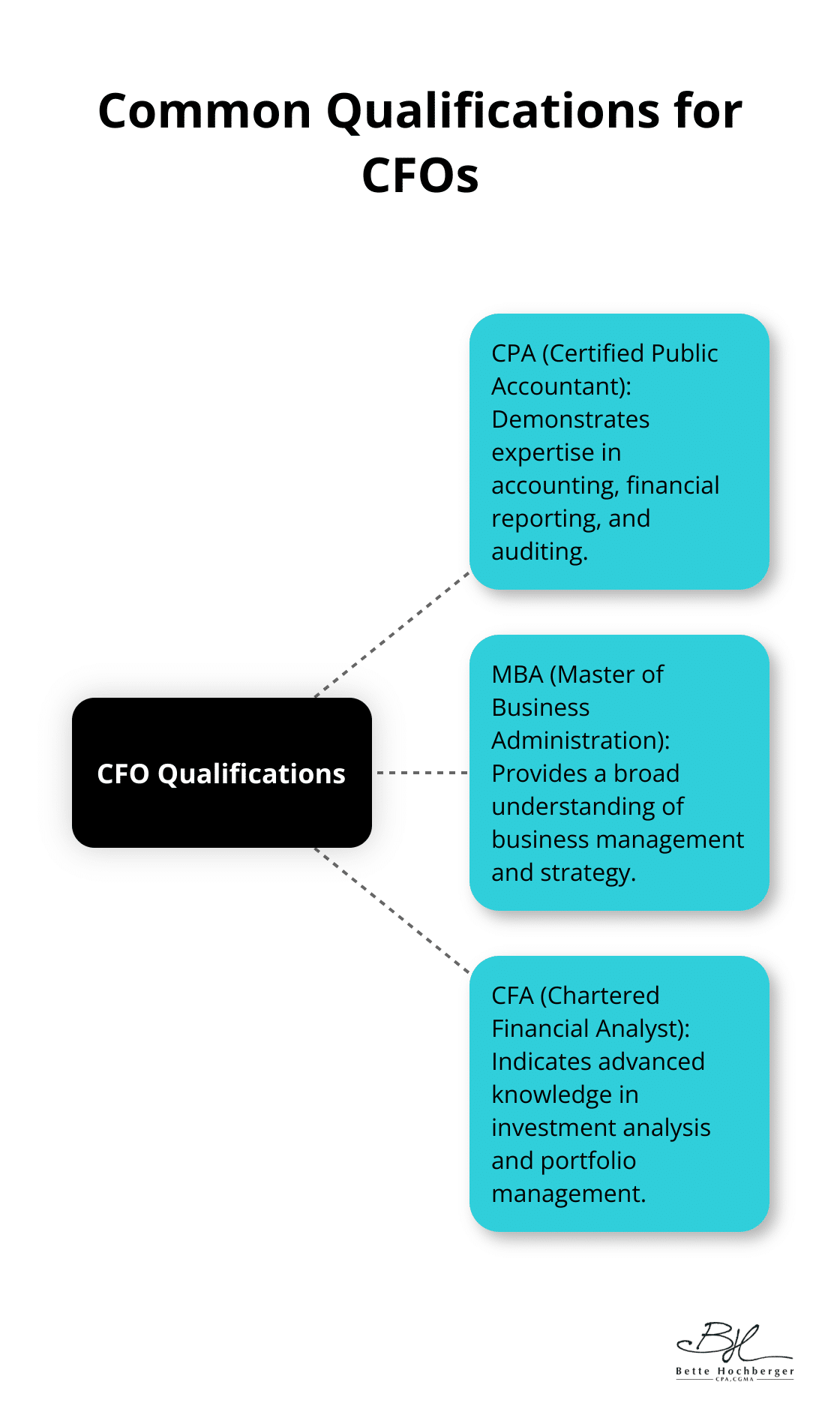

Certifications matter. The most common qualifications for CFOs include CPA (Certified Public Accountant), MBA (Master of Business Administration), and CFA (Chartered Financial Analyst).

Conduct Thorough Interviews

During interviews, ask candidates about specific financial challenges they’ve overcome.

Try presenting a case study based on your company’s financial situation. This approach can provide insights into how the candidate thinks and problem-solves in real-time.

Negotiate Terms and Set Expectations

When you’ve found your ideal candidate, negotiate terms. Robert Half’s 2025 Salary Guide provides data on salary ranges and benchmarks, perks and benefits, and hiring trends for CFOs.

Clearly define the scope of work, expected outcomes, and performance metrics.

A Contract CFO can revolutionize your company’s financial strategy. These professionals offer high-level expertise without the long-term commitment of a full-time executive. When you hire one, focus on candidates with a proven track record in your industry and relevant certifications.

We specialize in personalized financial services, including Contract CFO solutions. Our team helps businesses minimize tax liabilities, manage cash flow, and improve profitability. We have the expertise to guide you through the process of hiring and integrating one into your operations.

Financial complexities should not impede your business growth! Explore how our outsourced accounting services can enhance your financial strategy. With the right financial partner, you can confidently navigate challenges, seize opportunities, and drive your business toward long-term success.