Small businesses that implement a strategic tax approach save an average of $7,200 annually compared to those using reactive methods. The IRS reports that 40% of small business owners overpay taxes due to missed deductions and poor planning.

We at Bette Hochberger, CPA, CGMA see this pattern repeatedly. A well-designed small business tax strategy transforms your financial outlook and keeps more money in your business account.

What Tax Fundamentals Drive Small Business Success

Small business owners who master tax fundamentals position themselves for substantial savings and sustainable growth. The Section 179 Deduction allows businesses to deduct up to $2,500,000 of qualifying equipment costs in 2025, with a phase-out at $3,130,000 according to IRS guidelines. This represents a massive opportunity that most small businesses leave untouched. Smart business owners accelerate equipment purchases before year-end to maximize these deductions.

Business Structure Tax Impact

Your business structure determines your entire tax approach. S corporations save owners the 15.3% self-employment tax compared to sole proprietorships, but require strict payroll compliance. LLCs provide operational flexibility while they allow pass-through taxation, which makes them ideal for businesses with fluctuating income. The IRS reports that the wrong structure costs small businesses an average of $3,400 annually in unnecessary taxes. C corporations face double taxation but offer superior fringe benefit deductions and retirement plan contributions.

Documentation Standards That Work

Accurate record maintenance separates successful tax strategies from costly mistakes. The IRS requires businesses to maintain receipts for all deductions, and digital storage systems reduce audit risk by 60% compared to paper methods. Separate business and personal bank accounts immediately, as mixed funds trigger IRS scrutiny and disallow legitimate deductions. Track vehicle mileage with apps or logbooks since the 2024 standard rate of 67 cents per mile adds up quickly. Businesses that use automated expense software report 23% more deductions than those that rely on manual methods.

Quarterly Payment Strategy

Estimated tax payments prevent penalties and cash flow disruptions. Small businesses must pay 90% of current year taxes or 100% of prior year taxes to avoid IRS penalties. Companies that experience growth years should base payments on prior year obligations to preserve capital (this strategy protects cash flow during expansion). Set aside 25-30% of net income for taxes immediately upon receipt to avoid year-end surprises.

The foundation you build with these fundamentals directly impacts how effectively you can time income and expenses throughout the year.

How Do You Time Tax Moves for Maximum Savings

Strategic income and expense management creates the biggest tax savings opportunities for small businesses. Cash-basis businesses gain maximum control when they accelerate deductible expenses into the current year while they defer income recognition until January. This approach works particularly well when you expect higher tax rates next year or when current year income pushes you into a higher bracket.

The IRS allows businesses to prepay expenses like insurance, rent, and professional services up to 12 months in advance (this creates immediate deductions). Smart business owners purchase office supplies, equipment repairs, and marketing services before December 31st to reduce current year taxable income.

Retirement Contributions That Cut Taxes

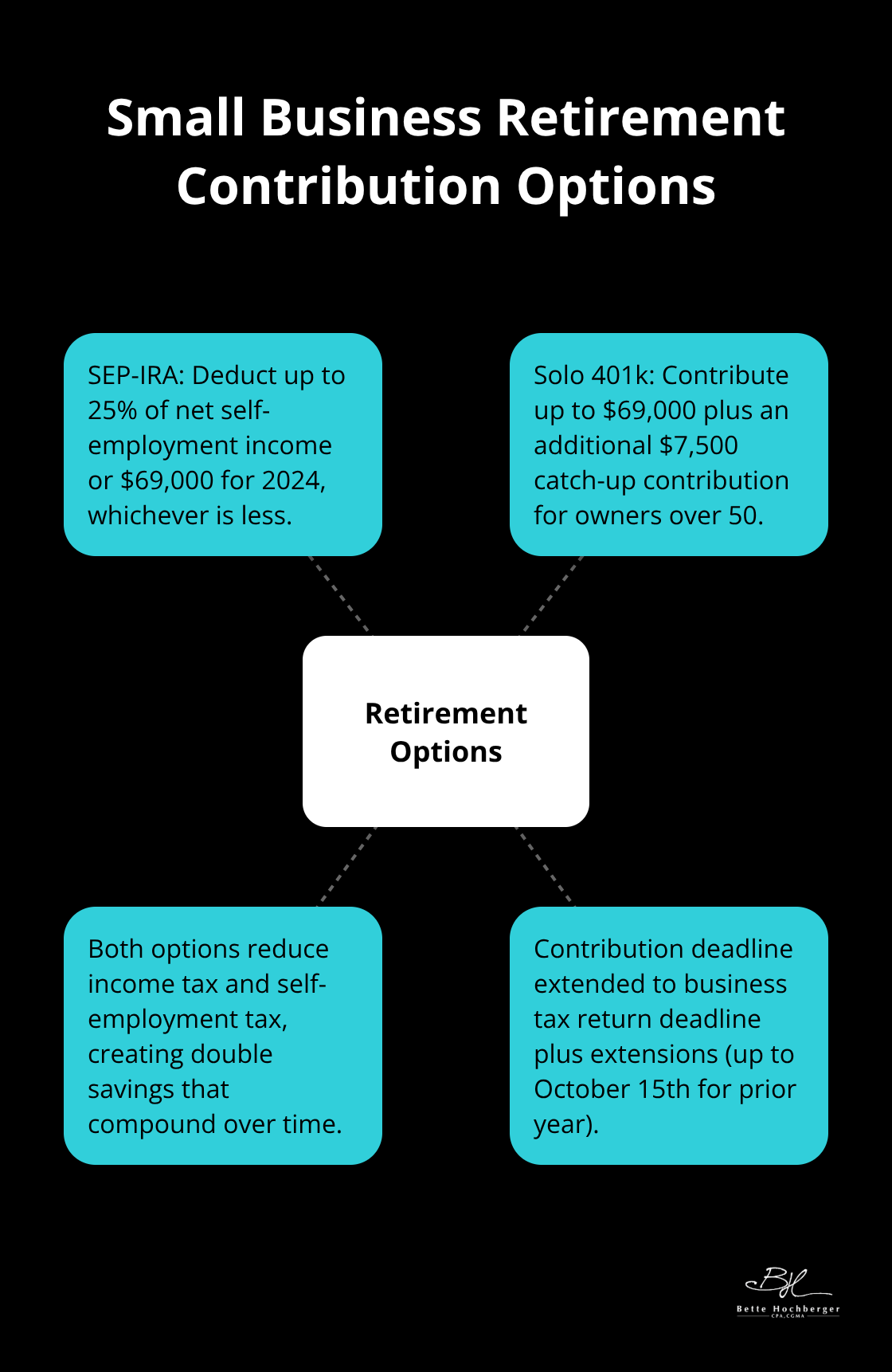

SEP-IRA contributions allow business owners to deduct up to 25% of net self-employment income or $69,000 for 2024, whichever is less. These contributions reduce both income tax and self-employment tax, which creates double savings that compound over time.

Solo 401k plans offer even greater flexibility and allow contributions up to $69,000 plus an additional $7,500 catch-up contribution for owners over 50. The IRS extends the contribution deadline to the business tax return deadline plus extensions (this gives you until October 15th to make prior year contributions). Small businesses that establish retirement plans also qualify for tax credits up to $5,000 to offset setup costs.

Equipment Purchase Acceleration

Section 179 deductions provide immediate write-offs for equipment purchases rather than depreciation over multiple years. The 2025 limit reaches $2,500,000 with qualified equipment purchases. Bonus depreciation adds another layer and allows 40% immediate deduction on qualified property in 2025.

Businesses must place equipment in service before December 31st to claim current year deductions, which makes fourth-quarter purchases particularly valuable. Equipment purchase financing still qualifies for these deductions and allows businesses to preserve cash while they capture tax benefits immediately.

These strategic moves require careful execution to avoid common pitfalls that can trigger IRS scrutiny and penalties. Working with a tax professional ensures proper implementation and helps maximize your tax planning benefits.

What Tax Mistakes Cost Small Businesses the Most Money

Small businesses face significant penalties for missed quarterly estimated tax payments, with average penalties that reach $2,847 per business according to Treasury Department data. Small businesses must pay either 90% of current year tax liability or 100% of prior year liability through quarterly installments to avoid these penalties. The safe harbor rule protects businesses that pay 100% of last year’s taxes, even if current year income increases dramatically. Companies that wait until year-end face cash flow crises and penalty accumulation that compounds quarterly.

Quarterly Payment Calculation Errors

Business owners often miscalculate their quarterly obligations and trigger unnecessary penalties. The IRS requires payments on the 15th of January, April, June, and September (with December 31st as the final deadline). Businesses that experience down years can reduce payments based on current year projections, but this strategy requires accurate profit forecasting. Companies that overestimate expenses or underestimate income face substantial catch-up payments plus interest charges.

Documentation Failures That Trigger Audits

Poor receipt management disqualifies business deductions during IRS audits and costs small businesses significant amounts in lost tax benefits annually. The IRS requires contemporaneous records for all business expenses, which means receipts must show date, amount, business purpose, and parties involved. Digital receipt apps reduce audit risk compared to shoebox storage methods, while cloud-based systems prevent loss from disasters or theft. Proper record keeping streamlines tax preparation and maximizes deductions.

Personal and Business Expense Confusion

Businesses that mix personal and business expenses face automatic disallowance of deductions plus potential fraud penalties that reach 75% of unpaid taxes. Separate bank accounts and credit cards eliminate this risk immediately and create clear audit trails that satisfy IRS requirements. The IRS scrutinizes businesses with commingled funds and often disallows legitimate deductions when personal expenses appear on business accounts. Small business owners who use business credit cards for personal purchases create red flags that increase audit probability significantly.

Final Thoughts

Proactive small business tax strategy implementation delivers measurable financial benefits that compound annually. Businesses that plan strategically save $7,200 per year compared to reactive approaches, while poor planning costs companies an average of $3,400 in unnecessary taxes. The Section 179 deduction alone provides up to $2,500,000 in immediate equipment write-offs, yet most small businesses fail to capitalize on this opportunity.

Professional tax guidance becomes necessary when your business reaches $100,000 in annual revenue, experiences rapid growth, or operates across multiple states. Complex situations like entity restructuring, retirement plan establishment, or equipment purchase timing require specialized expertise to avoid costly mistakes. The IRS penalty structure punishes errors severely (making professional support a smart investment rather than an expense).

Start your tax strategy immediately when you separate business and personal accounts, establish quarterly payment schedules, and document all business expenses with digital systems. Review your business structure annually to optimize tax efficiency as your company grows. We at Bette Hochberger, CPA, CGMA help businesses develop comprehensive tax strategies that minimize liabilities while they maximize profitability.

![Are VC-Funded Startups Leaving Money on the Table? [Tax Guide]](https://bettehochberger.com/wp-content/uploads/emplibot/Are-VC-Funded-Startups-Leaving-Money-on-the-Table_-_Tax-Guide__1759839079-500x383.jpeg)