The IRS has expanded its ability to see crypto activity. Starting with 2025 transactions, custodial brokers must file the new Form 1099-DA to report customers’ gross proceeds; basis/gain-loss reporting begins with 2026 transactions. This is a phased rollout set by final regulations issued in 2024.

We at Bette Hochberger, CPA, CGMA see many taxpayers caught off guard by the agency’s sophisticated blockchain monitoring tools. Understanding these tracking methods is essential for proper tax compliance.

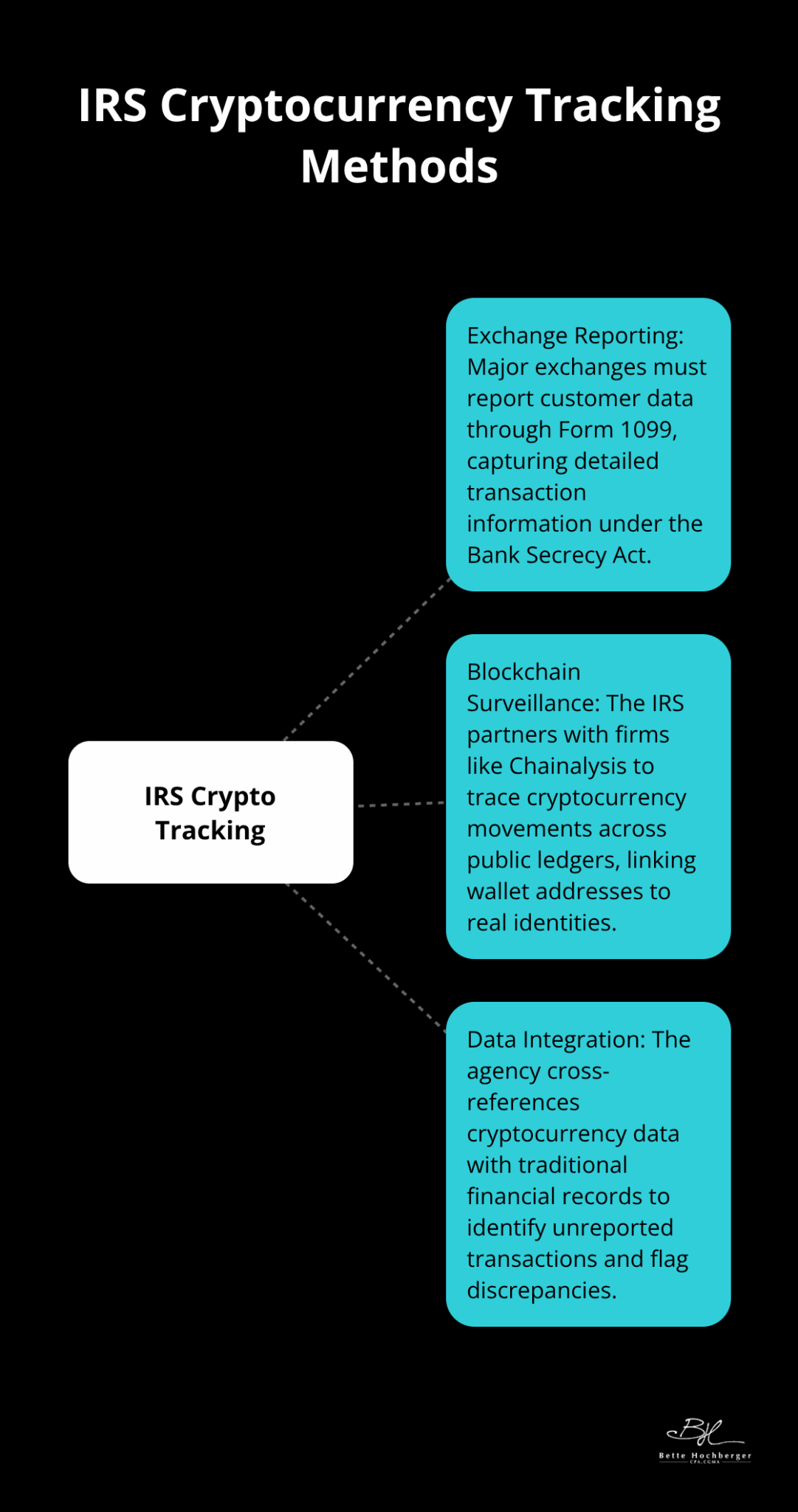

How the IRS Tracks Your Crypto Activity

Major U.S. custodial platforms (e.g., Coinbase, Kraken, Binance.US) will report via Form 1099-DA under the Internal Revenue Code. Separately, many platforms are MSBs under the Bank Secrecy Act, which imposes AML/SAR duties—but BSA obligations are distinct from 1099 tax reporting.

Advanced Blockchain Surveillance Technology

The agency partners with blockchain analysis firms like Chainalysis to trace cryptocurrency movements across public ledgers. These tools can link seemingly anonymous wallet addresses to real identities through transaction patterns and exchange deposits. Even non-custodial wallets become traceable when users move funds to regulated exchanges that require Know Your Customer verification. The IRS received new funding under the Inflation Reduction Act to add staff across functions over the next decade. While crypto is one focus area, the ‘87,000 agents’ figure often cited refers to total projected hires across all IRS operations, not specifically crypto enforcement.

Cross-Platform Data Integration

The agency cross-references cryptocurrency data with traditional financial records from banks and payment processors to identify unreported transactions. This system flags discrepancies between reported income and actual cryptocurrency holdings or spending patterns. NFT transactions are also monitored through blockchain data, allowing the IRS to track high-value digital asset sales that taxpayers might assume are private.

Audit Risk Assessment

The combination of exchange reports, blockchain analysis, and financial data matching creates multiple verification points that make cryptocurrency tax evasion extremely risky. The IRS can audit taxpayers up to six years for major discrepancies in crypto reporting (compared to the standard three-year window). This extensive tracking capability means that common mistakes in crypto tax reporting can quickly escalate into serious compliance issues.

Common Crypto Tax Mistakes That Trigger IRS Attention

Three specific reporting errors consistently trigger IRS investigations and penalties that can reach $100,000 plus five years in prison. The first major mistake involves treating cryptocurrency trades as non-taxable when every single trade between different cryptocurrencies creates a taxable event. Many taxpayers incorrectly assume that swaps between Bitcoin and Ethereum or altcoin trades don’t require reporting, but the IRS considers each exchange a sale followed by a purchase.

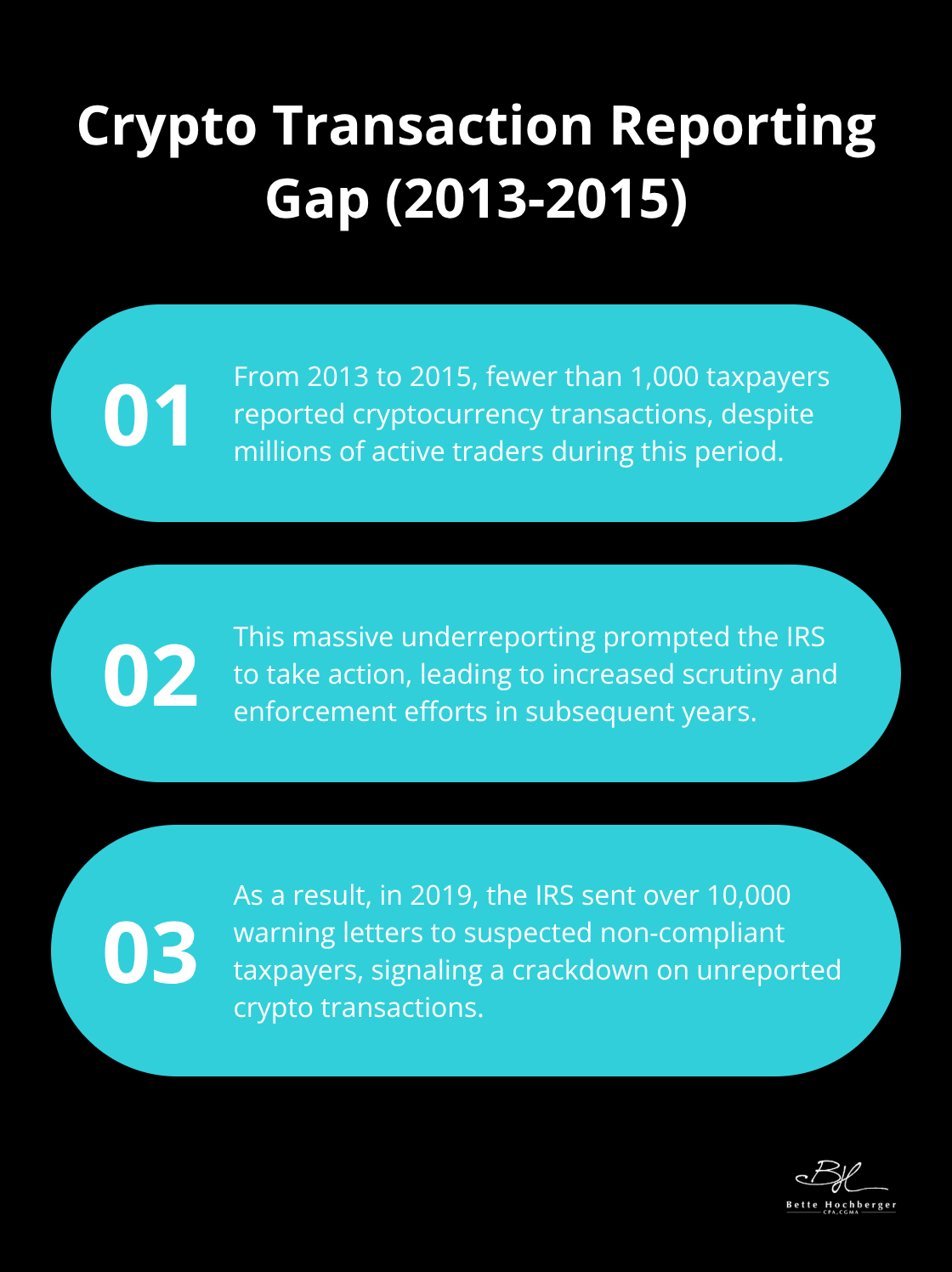

From 2013 to 2015, fewer than 1,000 taxpayers reported cryptocurrency transactions despite millions of active traders. This massive underreporting prompted the agency to send over 10,000 warning letters to suspected non-compliant taxpayers in 2019.

Cost Basis Calculation Errors That Trigger Audits

The second major error involves artificial cost basis manipulation to reduce taxable gains. Taxpayers often use incorrect methods like cherry-picking favorable purchase prices instead of proper FIFO or specific identification methods required by tax law. The IRS cross-references exchange data with reported cost basis figures, which makes discrepancies immediately visible to automated fraud detection systems.

Incorrect cost basis reporting can result in criminal penalties and extended audit periods of up to six years (instead of the standard three-year limitation). These calculation errors represent one of the fastest ways to attract unwanted IRS attention.

DeFi and Staking Income Underreporting

The third mistake involves failure to report income from decentralized finance activities and cryptocurrency staking rewards. Staking rewards, liquidity mining, and yield farming generate taxable income at fair market value when received, not when sold. Many taxpayers incorrectly treat these activities as non-taxable events, but the IRS requires reporting all digital asset income regardless of amount.

DeFi transactions often lack traditional Form 1099 reporting, which leads taxpayers to assume they’re invisible to tax authorities. However, blockchain analysis tools can trace all on-chain activities back to exchange accounts with full KYC verification. These sophisticated tracking methods make proper record-keeping and compliance strategies essential for avoiding penalties.

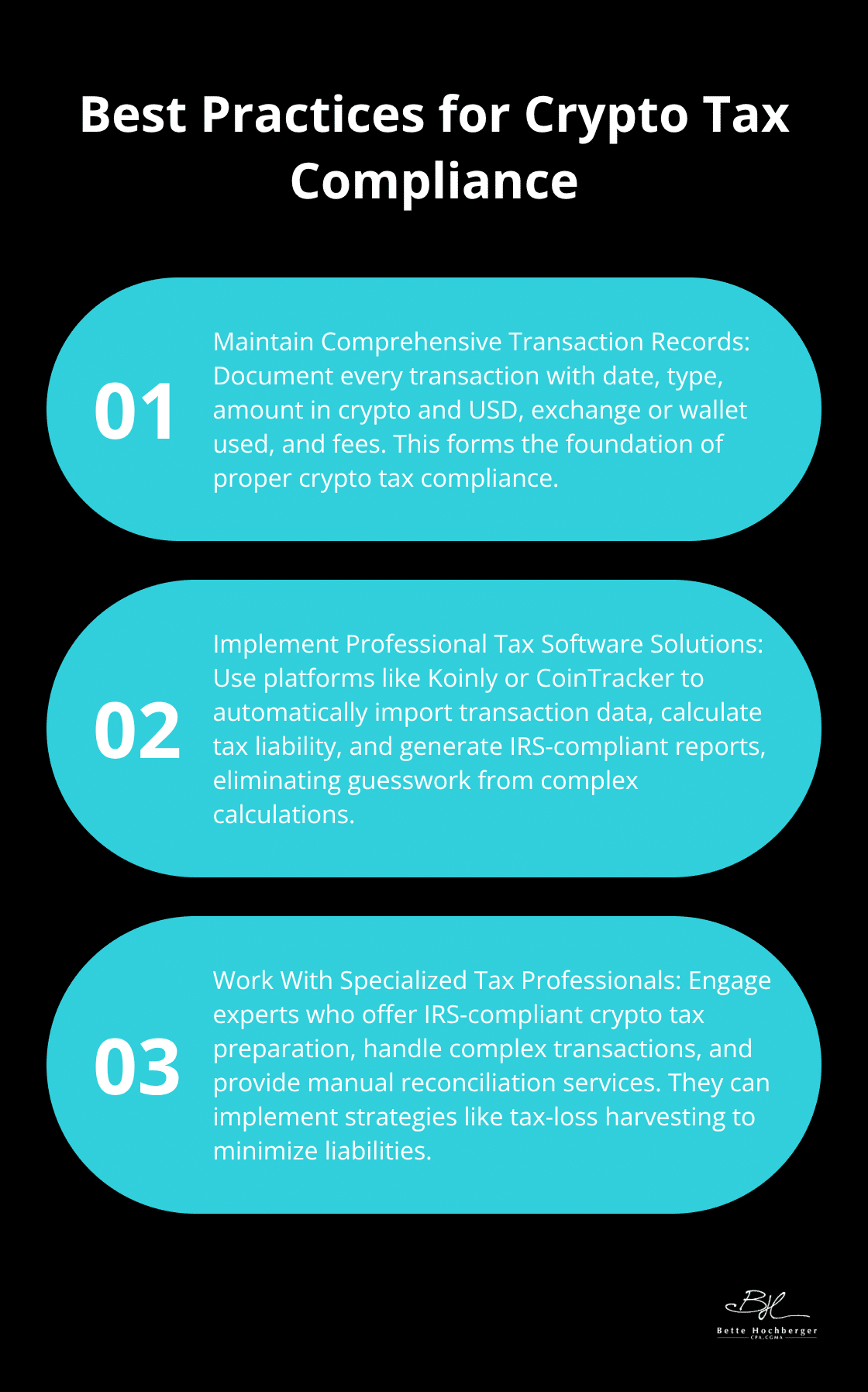

Best Practices for Crypto Tax Compliance

Maintain Comprehensive Transaction Records

Accurate record maintenance forms the foundation of proper crypto tax compliance, yet most taxpayers fail at this basic requirement. You must document every transaction with the date, type of transaction, amount in both crypto and USD, exchange or wallet used, and transaction fees. The IRS requires these records for all transactions regardless of amount – there is no minimum threshold for crypto income reports.

Manual transaction records become impossible for active traders, which makes automated solutions necessary rather than optional. The complexity of multiple exchanges, wallets, and transaction types overwhelms traditional spreadsheet methods within weeks of active use.

Implement Professional Tax Software Solutions

Professional crypto tax software like Koinly, CoinTracker, or Blockpit automatically imports transaction data from over 300 exchanges and calculates your tax liability with proper cost basis methods. These platforms generate IRS-compliant reports (Form 8949 and Schedule D), which eliminates the guesswork from complex calculations.

The software costs typically range from $50 to $400 annually but can save thousands in penalties and audit fees. Most platforms connect directly to exchange APIs, which reduces manual data entry errors that frequently trigger IRS audits.

Work With Specialized Tax Professionals

Standard tax preparers often lack the specialized knowledge needed for cryptocurrency taxation, which leads to costly errors and missed deductions. You need a tax professional who offers IRS-compliant crypto tax preparation, handles complex transactions like DeFi and NFTs, and provides manual reconciliation services for investors.

These specialists stay current with rapidly changing regulations and can implement strategies like tax-loss harvesting to sell investments that are down, replace them with similar investments, and offset realized investment gains. The investment in professional guidance typically pays for itself through proper planning and error prevention.

Professional guidance becomes essential when you deal with mining income, staking rewards, NFT transactions, or international crypto activities where compliance requirements multiply significantly.

Final Thoughts

The IRS has built an extensive surveillance network that makes crypto transactions nearly impossible to hide. Over 87,000 new agents focus on digital asset enforcement while blockchain analysis partnerships and mandatory exchange reporting through Form 1099-K allow the agency to track virtually every cryptocurrency movement. Automated fraud detection systems and cross-platform data matching create multiple verification points that catch underreporting within months.

Proactive compliance represents your best defense against penalties that can reach $100,000 and five years in prison (plus criminal charges for serious violations). Professional tax software automates transaction tracking and cost basis calculations while detailed records for every crypto transaction help maintain compliance regardless of amount. Tax professionals who understand cryptocurrency taxation complexities can navigate the evolving regulatory landscape effectively.

We at Bette Hochberger, CPA, CGMA help digital asset holders with strategic tax planning and preparation. Our approach focuses on compliance with current regulations while minimizing tax liabilities through proper planning strategies. Professional guidance prevents costly mistakes and audit complications that affect unprepared taxpayers in this rapidly changing field.