Real estate investors face mounting tax complexity as their portfolios grow. Traditional LLC structures often create administrative burdens and missed optimization opportunities.

Series LLC offers a game-changing solution that transforms how investors manage multiple properties. We at Bette Hochberger, CPA, CGMA see this structure delivering substantial tax savings while simplifying compliance across diverse real estate holdings.

How Series LLC Actually Works for Real Estate

Series LLC breaks away from traditional LLC structures in fundamental ways. A standard LLC houses all properties under one entity and makes every asset vulnerable to liabilities from any single property. Series LLC creates individual compartments within a master entity instead. Each series operates as an independent legal entity with its own assets, liabilities, and operations.

When a tenant sues over an incident at one property, the other properties in separate series remain completely protected. Delaware pioneered this structure in 1996. Today 15 states plus Puerto Rico recognize Series LLCs, with Texas, Nevada, and Illinois leading adoption rates among real estate investors.

Legal Framework Across Key States

The legal landscape varies dramatically by state. Delaware offers the most robust framework with established case law and strong liability protection. Texas follows closely, with over 60% of new real estate Series LLCs formed there due to favorable regulations and no franchise tax on individual series.

Nevada provides excellent privacy protections, while Illinois offers streamlined formation processes. California presents a unique situation – it prohibits domestic Series LLC formation but allows foreign Series LLCs to register as foreign entities (creating planning opportunities for multi-state investors).

Operational Mechanics and Asset Segregation

Each series within the structure must maintain completely separate finances, records, and operations to preserve liability protection. The master LLC typically serves as the management entity, while individual series hold specific properties. Series can have different ownership percentages, management structures, and profit distributions.

This flexibility allows investors to bring in partners for specific properties while they maintain sole ownership of others. The IRS requires separate EINs for each series and treats them as distinct entities for tax purposes while allowing consolidated reporting under specific circumstances.

Tax Treatment and Compliance Requirements

The IRS treats each series as a separate entity for federal tax purposes (enabling tailored tax strategies for each property investment). Investors can elect different tax treatments for individual series based on their specific financial situations and investment goals. Some series might benefit from cash accounting while others use accrual methods.

State tax treatment varies significantly across jurisdictions. Texas imposes no franchise tax on individual series, while other states may require separate filings. This variation creates opportunities for strategic tax planning when investors structure their portfolios across multiple states and optimize their overall tax burden through careful series placement.

Why Series LLC Delivers Superior Tax Benefits

Series LLC structure provides substantial tax advantages that traditional LLCs cannot match. The liability segregation creates protection where lawsuits against one property cannot touch assets in other series. Each series maintains separate liability exposure, which means a slip-and-fall lawsuit at one rental property leaves your other investments completely untouchable.

Pass-Through Taxation Maximizes Property-Level Benefits

The IRS treats each series as a distinct entity for federal tax purposes while it allows consolidated reports under the master LLC. This dual treatment enables investors to optimize depreciation schedules differently across properties – luxury condos might benefit from accelerated depreciation while commercial properties use straight-line methods. Nevada investors particularly benefit since the state does not impose state income tax on LLC owners’ share of company profits. Each series can elect different methods, with some that use cash basis for smaller properties and accrual for commercial holdings that exceed $27 million in gross receipts.

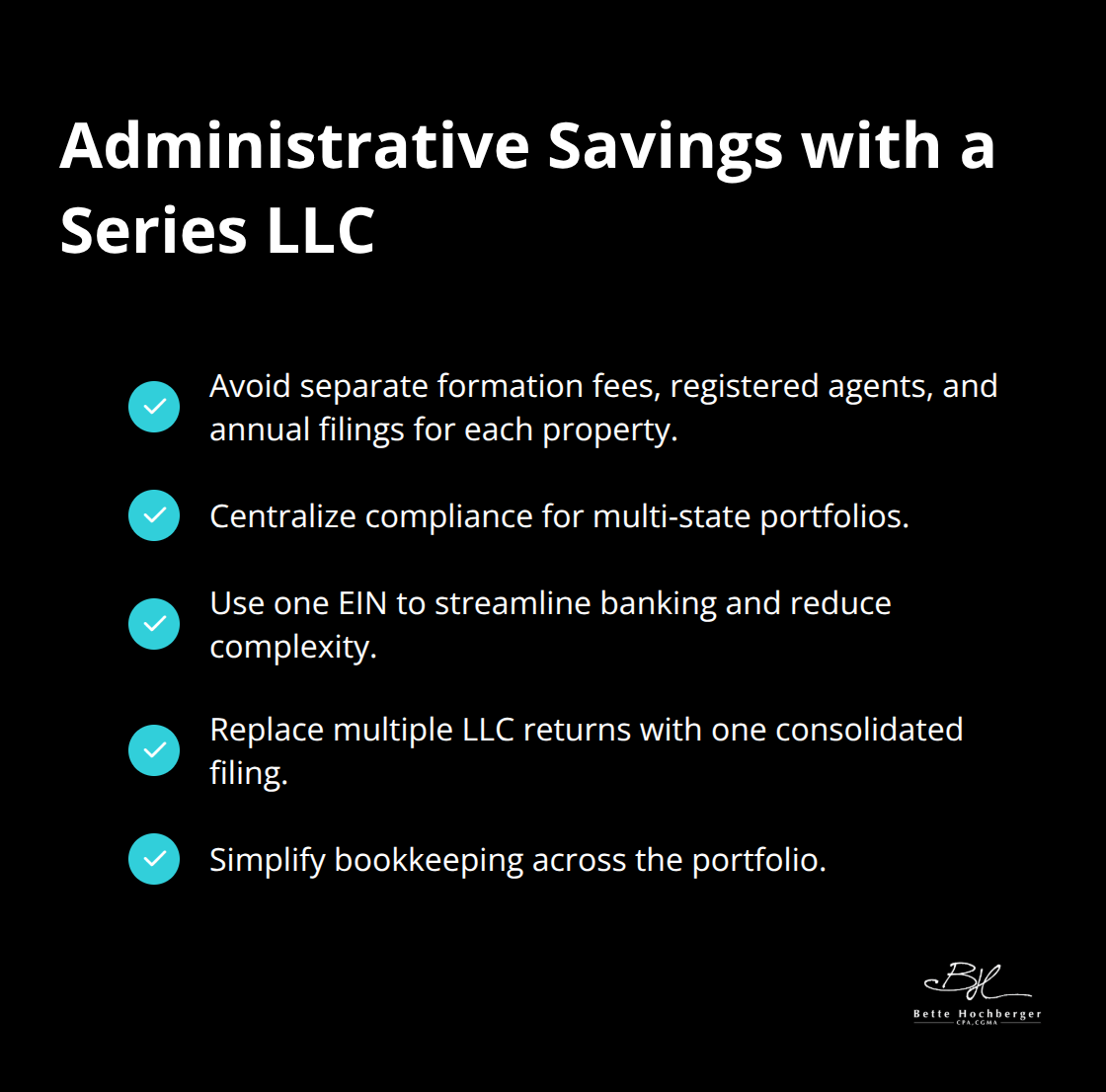

Administrative Cost Reduction Compounds Over Time

Series LLC eliminates the need for separate formation fees, registered agents, and annual filings for each property. Multi-state portfolios see greater savings through centralized compliance. One EIN covers the entire structure despite separate series operations, which streamlines bank relationships and reduces complexity.

Professional tax preparation costs drop significantly since one consolidated return replaces multiple LLC filings, with additional savings from simplified bookkeeping across the portfolio.

Strategic Tax Elections Across Different Property Types

Each series can make independent tax elections that align with specific property characteristics and investment goals. Residential rental series might elect Section 199A deductions while commercial series optimize cost segregation studies. This flexibility allows investors to maximize tax benefits at the property level rather than apply blanket strategies across diverse holdings.

Strategic implementation of these tax benefits requires careful consideration of your specific portfolio composition and investment timeline.

Strategic Implementation of Series LLC for Real Estate Portfolios

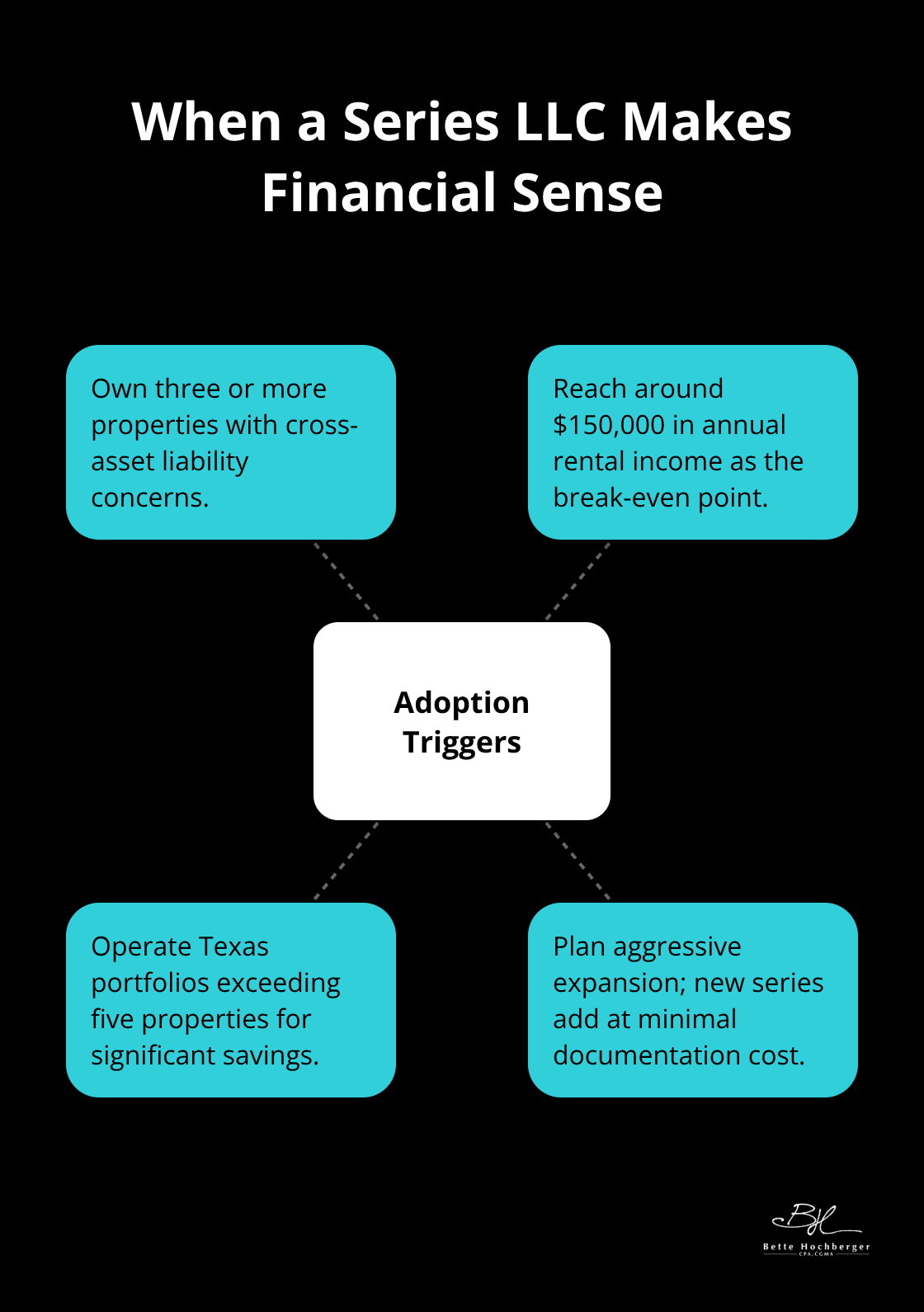

Series LLC makes financial sense when you own three or more investment properties and face liability concerns across different asset classes. The break-even point typically occurs around $150,000 in annual rental income, where administrative savings offset the increased complexity. Texas real estate investors with portfolios that exceed five properties can achieve significant cost savings through proper LLC structuring.

The structure works best for investors who plan aggressive expansion – new properties become seamless additions since additional series cost nothing beyond documentation.

Property Type Segregation Maximizes Protection

Smart investors separate high-risk properties from stable income producers through strategic series allocation. Student rentals and short-term vacation properties occupy separate series due to higher liability exposure, while established residential rentals fill different series. Commercial properties demand their own series because of complex lease structures and higher lawsuit potential. Each property type requires different insurance coverage, lease terms, and management approaches that Series LLC accommodates naturally. Delaware-based Series LLCs offer the strongest legal framework for this segregation, with established case law that supports liability barriers between series.

Cash Flow Management Across Multiple Series

Each series maintains separate bank accounts and financial records, but the master LLC can coordinate cash flow between series through intercompany transactions. Profitable series can loan money to series that need capital improvements, which creates tax-efficient internal financing. Series with positive cash flow can distribute profits to owners while loss-generating series offset gains at the master LLC level. This flexibility allows investors to optimize tax timing – they can accelerate depreciation in some series while they defer gains in others.

Operational Efficiency Through Centralized Management

Professional management becomes streamlined since one entity oversees all operations while it maintains legal separation between properties. The master LLC handles vendor relationships, insurance policies, and administrative functions across all series (reducing overhead costs significantly). Property managers can work under unified contracts while they maintain separate accounting for each series. This centralized approach eliminates duplicate administrative tasks and creates economies of scale that traditional multiple-LLC structures cannot achieve. Working with a real estate CPA ensures proper implementation of these complex structures and ongoing compliance requirements.

Final Thoughts

Series LLC structure transforms real estate tax planning through liability segregation, administrative cost reduction, and flexible tax elections across multiple properties. The structure delivers measurable savings when investors own three or more properties, with break-even points around $150,000 in annual rental income. Pass-through taxation benefits maximize property-level deductions while consolidated reports simplify compliance requirements.

Investors must evaluate state-specific regulations before they implement a Series LLC since only 15 states recognize this structure. Delaware and Texas offer the strongest legal frameworks, while California prohibits domestic formation but allows foreign registration. Proper implementation requires separate bank accounts, detailed record-keeping, and distinct operations for each series to maintain liability protection (which prevents asset commingling that could compromise the entire structure).

Real estate investors who consider this structure should assess their portfolio size, liability exposure, and expansion plans. The complexity increases with multiple series, which makes professional guidance essential for proper setup and ongoing compliance. Bette Hochberger, CPA, CGMA can help investors evaluate whether Series LLC aligns with their investment goals while they maximize tax benefits across diverse real estate holdings.