Hi everyone! I’m Bette Hochberger, CPA, CGMA. At my firm, we know that managing small business taxes can be overwhelming for many entrepreneurs.

Setting aside the right amount for taxes is crucial to avoid financial surprises and maintain compliance with tax laws.

This guide will help you understand your tax obligations, calculate your tax liability, and implement effective strategies for setting aside funds for small business taxes.

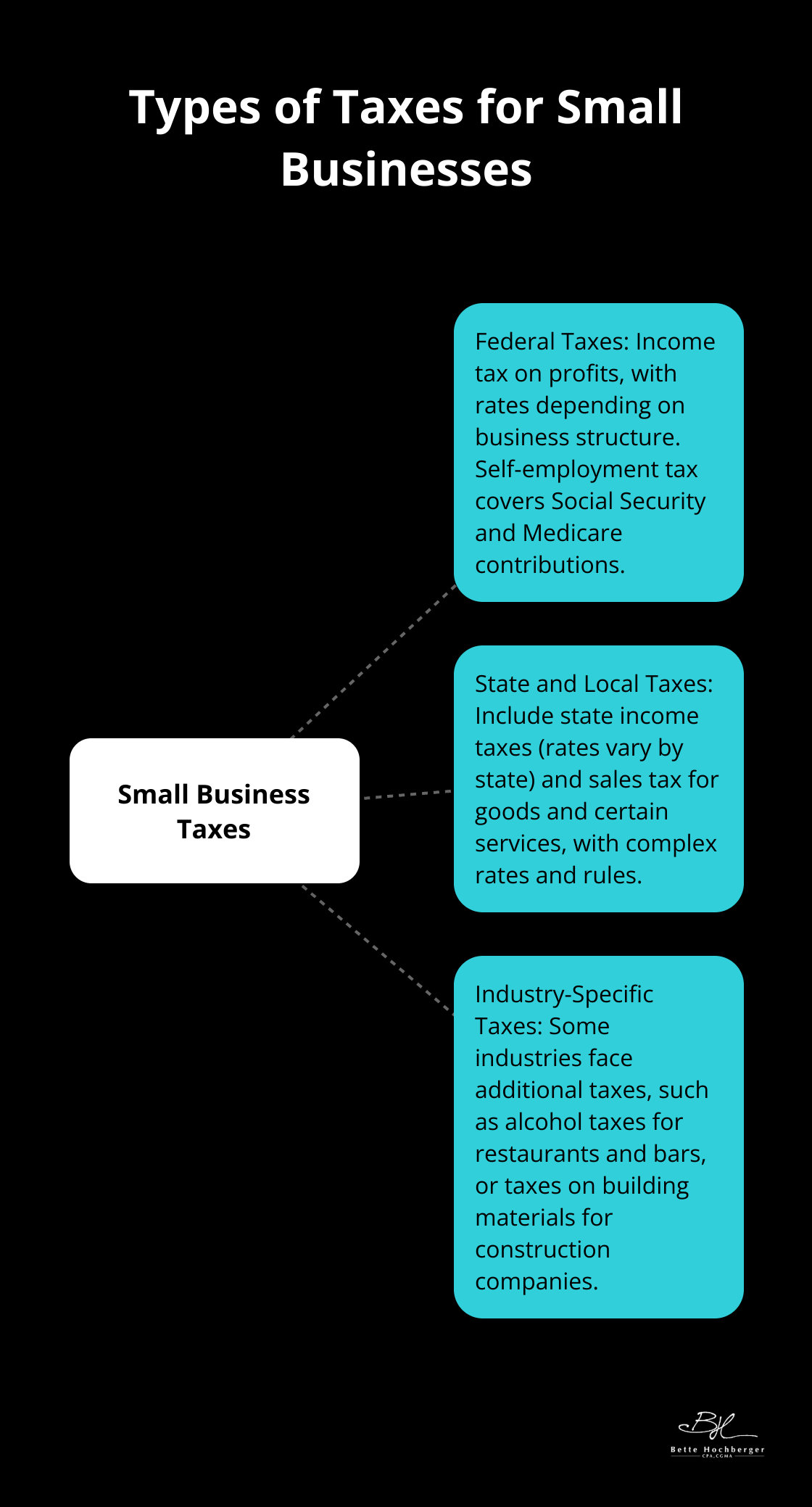

What Taxes Do Small Businesses Pay?

Small businesses face a complex web of tax obligations that significantly impact their bottom line. Understanding these requirements is essential for financial success and legal compliance.

Federal Tax Obligations

At the federal level, small businesses typically pay income tax on their profits. The exact rate depends on the business structure. Sole proprietors and single-member LLCs report business income on their personal tax returns, while corporations pay a flat 21% tax rate on their profits.

Self-employment tax is another important federal obligation for many small business owners. This tax covers Social Security and Medicare contributions for individuals filing schedules for sole proprietor businesses, rental/flow-through income, farm income, and/or employee business expenses.

State and Local Tax Requirements

State and local taxes vary widely depending on location. Most states impose their own income taxes, with rates ranging from 0% to over 13% in some cases. For instance, California has a top rate of 13.3% for high earners, while Florida has no state income tax at all.

Sales tax is another significant consideration for many small businesses. If you sell goods or certain services, you’ll likely need to collect and remit sales tax to your state and local government. The rates and rules can be complex, varying not just by state but often by county or even city.

Industry-Specific Taxes

Some industries face additional tax obligations. For example, restaurants and bars may need to pay alcohol taxes, while construction companies might owe specific taxes on building materials. It’s important to research any industry-specific taxes that may apply to your business.

Staying Compliant

Compliance with tax laws is non-negotiable for small businesses. Failing to meet your tax obligations can result in hefty penalties, interest charges, and even legal consequences.

To stay compliant, set up a robust bookkeeping system to track all income and expenses accurately. This not only helps ensure you’re paying the correct amount of taxes but also makes it easier to identify potential deductions that can lower your tax bill.

Regular check-ins with a tax professional can also prove invaluable. Tax laws change frequently, and a skilled accountant can help you navigate these changes and optimize your tax strategy. They can also ensure you meet all filing deadlines, which is crucial for avoiding penalties.

Understanding your tax obligations is just the first step. The next crucial aspect is calculating your tax liability accurately. Let’s explore the factors that affect how much tax your small business will owe.

What Impacts Your Small Business Tax Bill?

Business Structure Influence

Your choice of business structure significantly impacts your tax obligations. Sole proprietorships and partnerships report business income on personal tax returns, which subjects all profits to self-employment tax. S corporations can reduce self-employment tax liability by allowing owners to pay themselves a reasonable salary and take the rest as distributions.

C corporations face a flat 21% federal tax rate on profits, but they’re subject to double taxation when distributing dividends to shareholders. Limited Liability Companies (LLCs) offer flexibility, providing an array of taxation alternatives while shielding individual members.

Revenue and Profit Margins Matter

It’s not just about how much you earn, but how much you keep. High revenue doesn’t necessarily mean high taxes if your profit margins are slim. Businesses with lower revenue but higher profit margins might face a larger tax bill. This underscores the importance of tracking both your top-line revenue and bottom-line profits carefully.

A consulting firm with $500,000 in revenue and $400,000 in profit will likely pay more in taxes than a retail store with $1 million in revenue but only $100,000 in profit. This highlights the importance of effective cost management and pricing strategies to maintain healthy profit margins.

Maximizing Deductions and Credits

One of the most powerful ways to reduce your tax liability is through strategic use of deductions and credits. Common deductions for small businesses include office rent, employee salaries, marketing expenses, and travel costs. However, many business owners overlook less obvious deductions like home office expenses, professional development costs, or even certain insurance premiums.

Tax credits can be even more valuable as they directly reduce your tax bill dollar-for-dollar. The Research and Development (R&D) tax credit can provide significant savings for businesses investing in innovation. Companies can generally claim for the current tax year, plus 3 previous tax years. The Work Opportunity Tax Credit offers incentives for hiring individuals from certain target groups.

Industry-Specific Considerations

Different industries face unique tax challenges and opportunities. For example, restaurants and bars may need to pay alcohol taxes, while construction companies might owe specific taxes on building materials. Real estate investors often benefit from depreciation deductions, while tech startups might qualify for R&D credits.

Understanding these industry-specific nuances can help you plan more effectively and potentially reduce your tax burden. It’s always advisable to consult with a tax professional (like those at Bette Hochberger, CPA, CGMA) who specializes in your industry to ensure you’re taking advantage of all available tax benefits.

Now that we’ve explored the factors that impact your small business tax bill, let’s move on to the practical steps of calculating and setting aside funds for your tax obligations.

How Much Should You Set Aside for Taxes?

Estimating Your Quarterly Tax Payments

The IRS requires most small business owners to pay estimated taxes quarterly. These payments should cover income tax and self-employment tax obligations. To estimate these payments accurately, you must project your annual income and expenses.

Start by reviewing your profit and loss statements from the previous year. If your business is growing, adjust these figures upward. Use the IRS Form 1040-ES worksheet to calculate your estimated tax. This form helps you account for your expected income, deductions, and credits.

It’s important to note that you have to file an income tax return if your net earnings from self-employment were $400 or more. The percentage you need to set aside can vary based on your tax bracket and business structure.

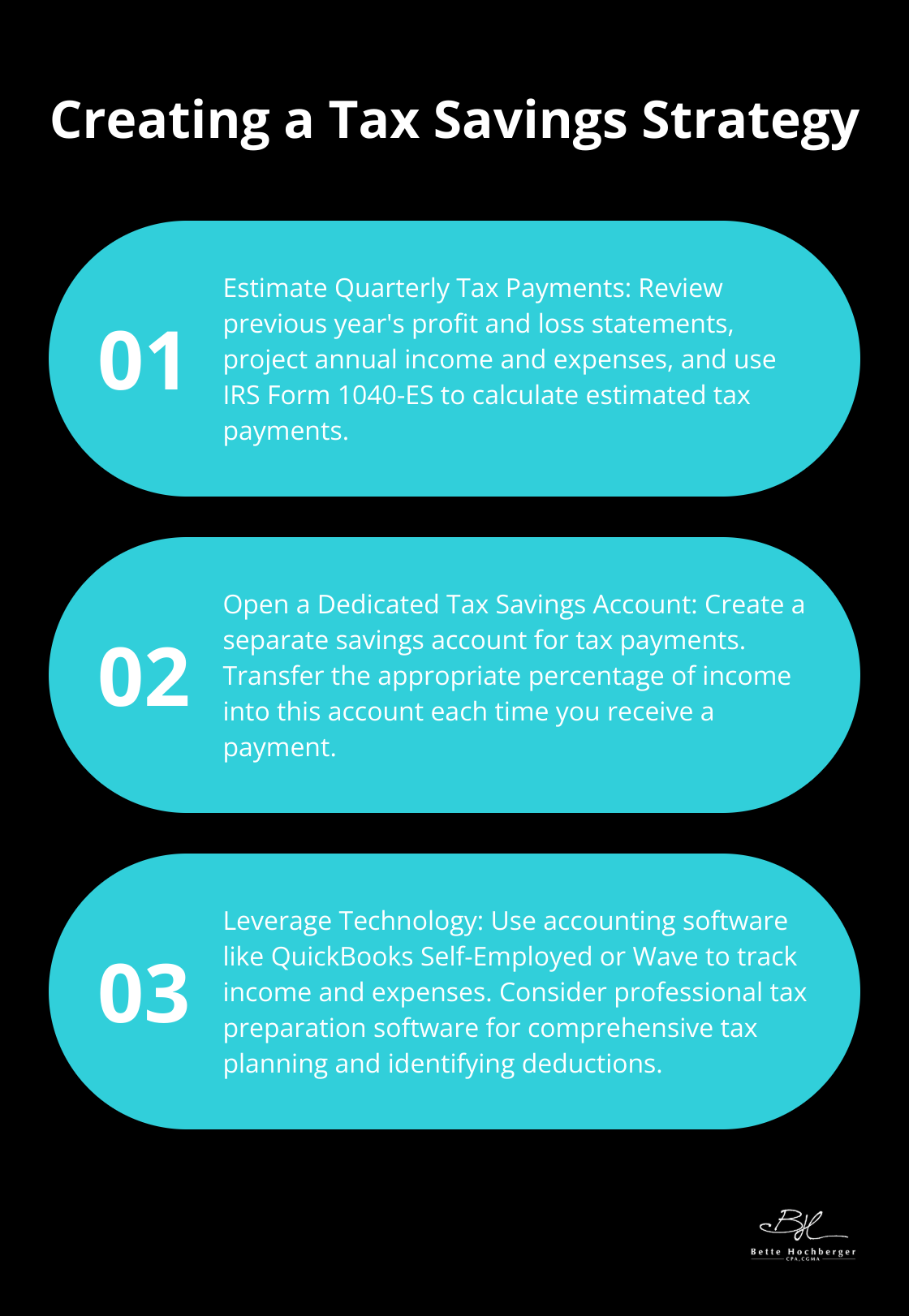

Creating a Tax Savings Strategy

An effective strategy is to open a separate savings account dedicated to tax payments. Each time you receive income, transfer the appropriate percentage into this account. This approach helps ensure you’re not caught short when tax time arrives.

For instance, if you need to set aside a certain percentage for taxes, and you receive a payment, transfer that amount to your tax savings account immediately. This disciplined approach can help you avoid the stress of scrambling for funds when it’s time to pay your taxes.

Leveraging Technology for Tax Planning

Several tools and software options can streamline your tax planning process. QuickBooks Self-Employed allows you to track and organize your business income and expenses, maximize your business deductions, and track your business mileage.

Wave (a free accounting software) can help you track your income and expenses. While it doesn’t calculate your estimated taxes directly, it provides clear financial reports that can inform your tax planning.

For more comprehensive tax planning, consider using professional tax preparation software like TurboTax or H&R Block. These tools can help you identify deductions and credits you might otherwise miss.

While these tools are helpful, they’re not a substitute for professional advice. Complex tax situations often require the expertise of a qualified tax professional. Bette Hochberger, CPA, CGMA specializes in helping small business owners navigate their tax obligations and implement effective tax planning strategies.

Final Thoughts

Small business taxes require careful planning and management. Entrepreneurs must understand their tax obligations, calculate liabilities accurately, and implement effective saving strategies. Your business structure, revenue, profit margins, and industry all influence your tax liability, so you should take advantage of available deductions and credits while maintaining meticulous records.

Estimating quarterly tax payments and creating a dedicated savings account will help you stay on top of your obligations throughout the year. Technology and software tools can streamline this process, making it easier to track income, expenses, and potential deductions. However, navigating the complex world of small business taxes often requires professional assistance.

At Bette Hochberger, CPA, CGMA, we specialize in helping small business owners minimize tax liabilities and ensure profitability. Our team uses advanced cloud technology to provide personalized financial services across diverse industries. Proactive tax planning is a strategic approach to financial success, allowing you to make informed decisions about your business operations, investments, and growth strategies.