At Bette Hochberger, CPA, CGMA, we often field questions about fractional CFO pricing. Many businesses are curious about the costs associated with this flexible financial leadership option.

In this post, we’ll break down the factors that influence fractional CFO costs and explore various pricing models. We’ll also compare the expenses of hiring a fractional CFO versus a full-time CFO to help you make an informed decision for your company’s financial strategy.

What Drives Fractional CFO Costs?

The cost of a fractional CFO can vary widely based on several key factors. Understanding these elements will help you make an informed decision when considering fractional CFO services for your company’s financial strategy.

Expertise and Track Record

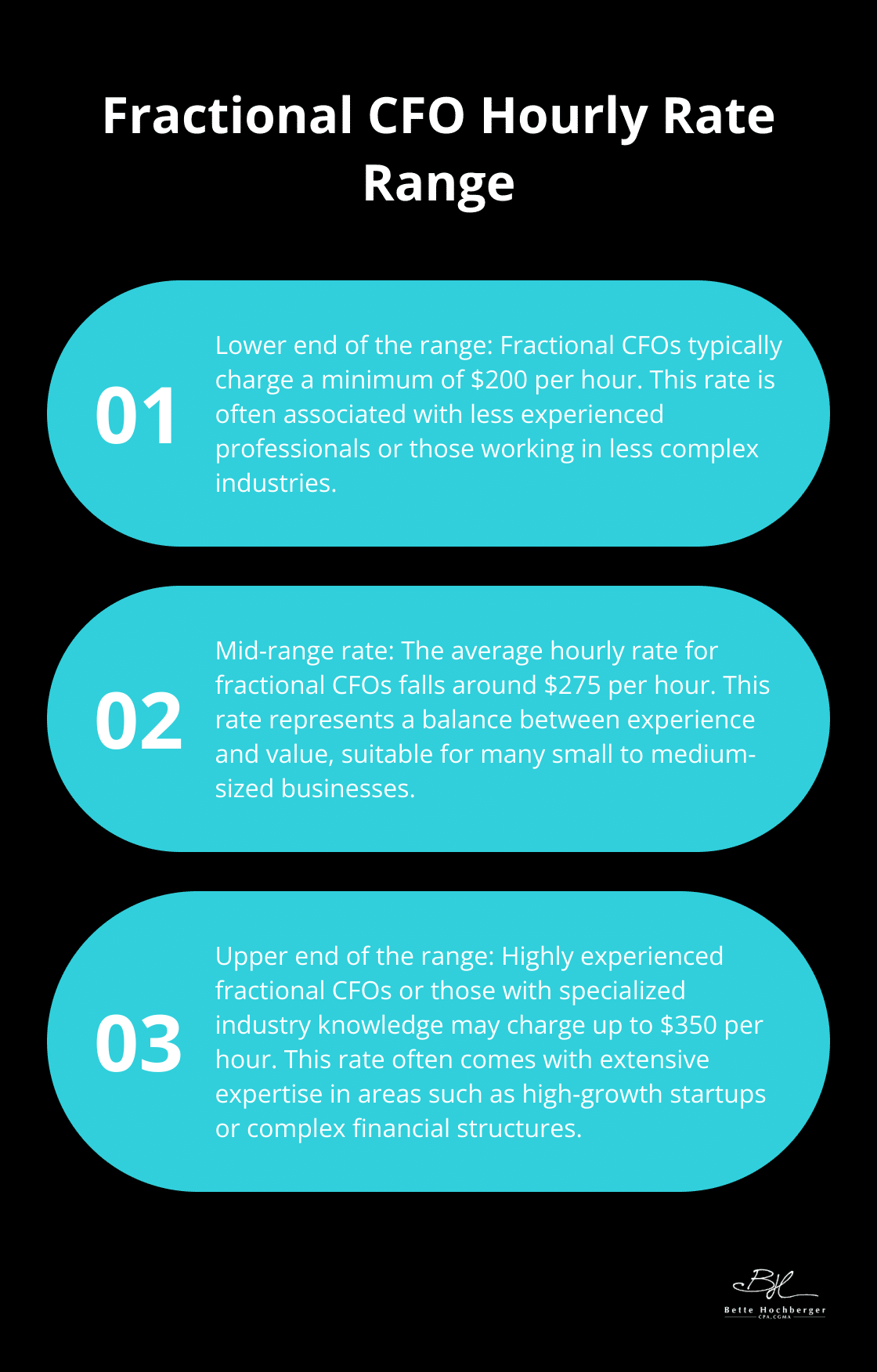

A fractional CFO’s experience level significantly impacts their rates. Those with extensive backgrounds in high-growth startups or specific industries often command higher fees. For example:

- Fractional CFOs generally charge between $200 and $350 per hour

- Less experienced professionals might start at the lower end of this range

Service Scope and Time Commitment

The range of services required directly affects costs. A company needing only basic financial oversight will pay less than one seeking comprehensive strategic planning and fundraising support. Time commitment also plays a role:

- A fractional CFO working 10 hours per month will cost less than one engaged for 30 hours

- Hourly rates might be higher for shorter engagements

Industry Specifics

Certain industries require specialized knowledge, which can increase costs. Healthcare or fintech companies often face complex regulations, necessitating a CFO with specific expertise. This specialized knowledge can add a premium to standard rates.

Company Financials

A company’s size and financial complexity influence pricing. Larger companies with more intricate financial structures typically require more time and expertise, leading to higher costs. However, the exact costs can vary based on specific needs and circumstances.

These factors provide a foundation for understanding fractional CFO costs. However, pricing models can vary significantly, which leads us to our next topic: the typical pricing structures used by fractional CFOs.

How Do Fractional CFOs Structure Their Pricing?

Fractional CFOs use various pricing models to accommodate different business needs and budgets. Understanding these models will help you choose the most cost-effective option for your company.

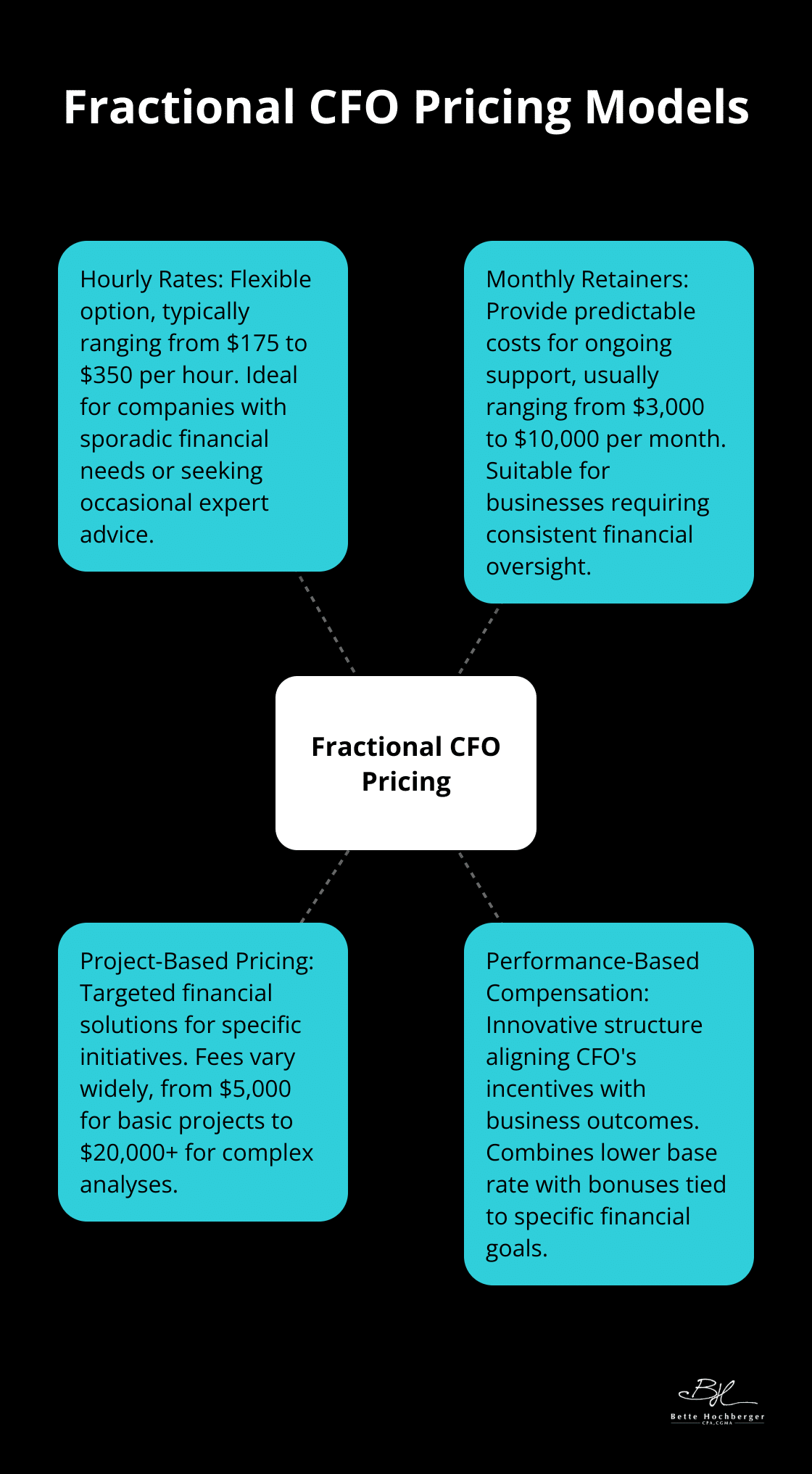

Hourly Rates: Flexibility for Short-Term Needs

Many fractional CFOs charge by the hour, with rates typically ranging from $175 to $350. This model works well for companies with sporadic financial needs or those seeking occasional expert advice. A startup might engage a fractional CFO for 10 hours a month during its initial growth phase, paying around $1,750 to $3,500 monthly.

Monthly Retainers: Predictable Costs for Ongoing Support

For businesses that require consistent financial oversight, monthly retainer agreements offer stability and predictability. These arrangements often include a set number of hours or specific deliverables. A typical monthly retainer might range from $3,000 to $10,000 (depending on the scope of work), with many falling between $5,000 to $7,500. This model allows for deeper engagement and strategic planning over time.

Project-Based Pricing: Targeted Financial Solutions

Some fractional CFOs offer project-based pricing for specific financial initiatives. This could include preparing for a funding round, implementing a new financial system, or conducting a comprehensive financial analysis. Project fees vary widely based on complexity and duration but might range from $5,000 for a basic financial model to $20,000 or more for a complex M&A analysis.

Performance-Based Compensation: Aligning Interests

Innovative fractional CFO firms sometimes offer performance-based compensation structures. This might involve a lower base rate combined with bonuses tied to specific financial goals, such as improving profit margins or securing funding. While less common, this model can be particularly attractive for growth-focused companies looking to closely align their CFO’s incentives with business outcomes.

When selecting a pricing model, consider your company’s financial needs, growth stage, and budget constraints. The right pricing structure will ensure you get the financial expertise you need without unnecessary costs.

Now that we’ve explored the various pricing models, let’s compare the costs of fractional CFOs to those of full-time CFOs to give you a clearer picture of the potential savings and benefits.

Full-Time vs Fractional CFO Costs: A Comprehensive Comparison

When evaluating financial leadership options, a comparison of full-time and fractional CFO costs proves essential. This analysis will help businesses make informed decisions about their financial management strategies.

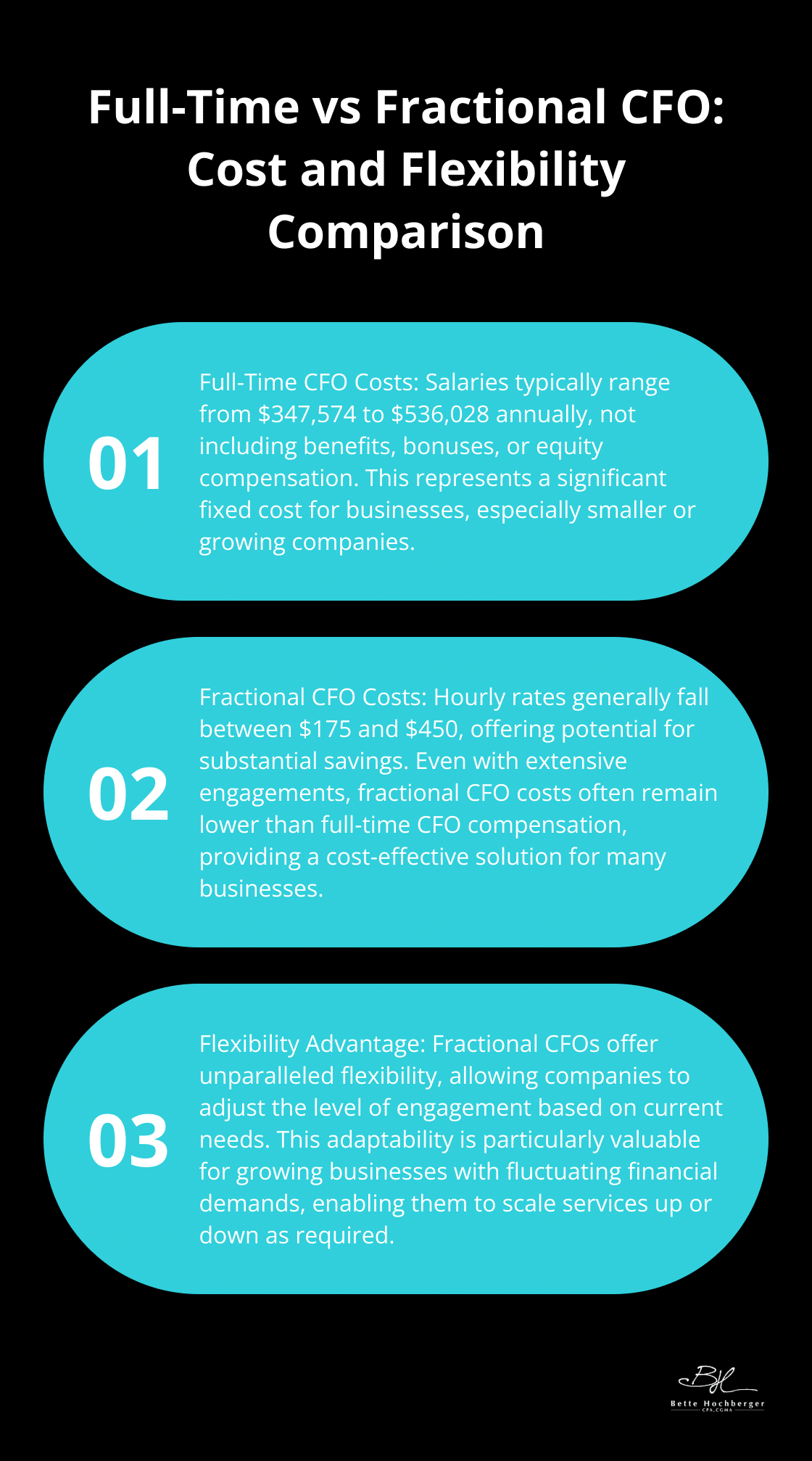

Full-Time CFO Compensation

Full-time CFOs command substantial salaries, with the average salary ranging from $347,574 (10th percentile) to $536,028 (90th percentile), and the majority earning between $390,467 (25th percentile) and higher. This figure excludes benefits, bonuses, or equity compensation, which can push the total package even higher for experienced executives in major markets.

The Cost-Effective Nature of Fractional CFOs

Fractional CFOs offer significant cost savings. They typically charge between $175 and $450 per hour, which can result in substantial savings compared to a full-time CFO’s average salary of $230,000 in the U.S. Even with more extensive engagements, fractional CFO costs often remain lower than full-time CFO compensation.

Flexibility in Financial Leadership

Fractional CFOs provide unparalleled flexibility. Companies can adjust the level of engagement based on their current needs, scaling up during critical periods (like fundraising or M&A activities) and scaling back during quieter times. This adaptability proves particularly valuable for growing businesses with fluctuating financial demands.

Measuring the Impact of Fractional CFO Services

While cost savings are evident, the true value of a fractional CFO lies in their impact on your business. Effective fractional CFOs can significantly improve financial performance through strategic planning, cost reduction initiatives, and improved financial processes. For instance, a fractional CFO might identify tax savings opportunities or negotiate better terms with vendors, directly impacting the bottom line.

Real-World Results

Fractional CFOs have helped clients secure millions in funding, reduce operating costs by 15-20%, and implement financial systems that save hundreds of hours annually in manual work. These tangible outcomes often far outweigh the cost of fractional CFO services, providing a compelling return on investment.

Final Thoughts

Fractional CFO pricing depends on expertise, service scope, industry complexity, and company size. These factors help businesses make informed decisions about their financial leadership needs. Pricing models for fractional CFO services offer flexibility, including hourly rates, monthly retainers, and project-based structures.

Small to medium-sized businesses benefit from fractional CFOs as a cost-effective alternative to full-time financial executives. They provide high-level financial expertise without substantial overhead, allowing companies to access strategic guidance and make data-driven decisions. The right fractional CFO can significantly impact a company’s financial health, from optimizing cash flow to securing funding.

At Bette Hochberger, CPA, CGMA, we specialize in personalized financial services, including strategic tax planning and fractional CFO solutions. Our team aims to help businesses minimize tax liabilities, manage cash flow, and ensure profitability. Visit our website to learn how we can support your business’s financial success with our fractional CFO services.