Tax season brings a new challenge: clients arriving with AI-generated advice that sounds authoritative but contains serious errors. ChatGPT and similar tools often provide outdated standard deduction amounts or miss important tax code nuances.

We at Bette Hochberger, CPA, CGMA see how AI in accounting creates both opportunities and risks. Professional judgment remains irreplaceable when validating tax information.

Where AI Tax Advice Goes Wrong

Outdated Information Creates Costly Mistakes

General AI tools consistently provide outdated tax information that leads clients astray. ChatGPT frequently quotes 2022 standard deduction amounts when the 2024 amount is $14,600. This difference can significantly impact tax planning decisions.

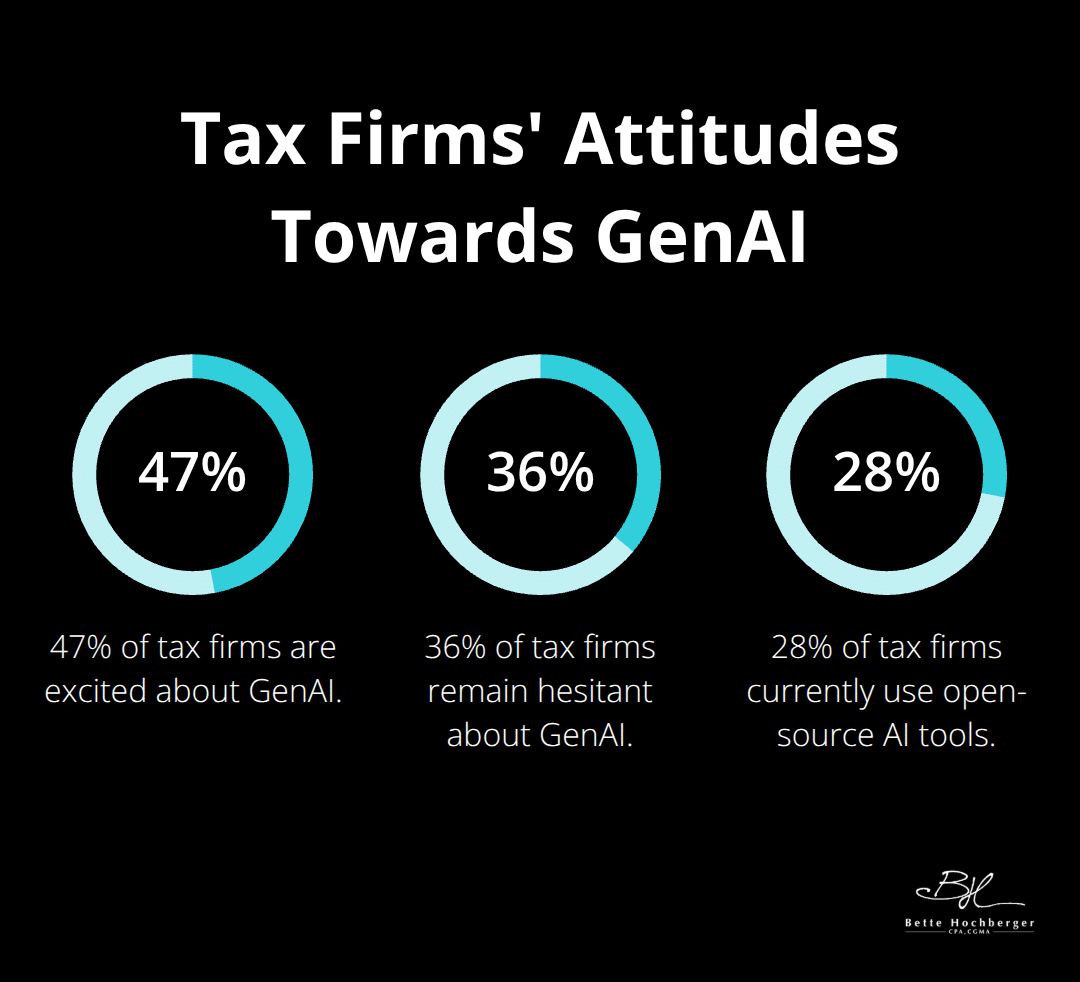

The 2024 Generative AI in Professional Services Report found that 47% of tax firms are excited about GenAI while 36% remain hesitant, with only 28% currently using open-source AI tools. AI in accounting works best when professionals verify every recommendation against current IRS publications.

Generic Guidance Ignores Critical Context

Context separates accurate tax advice from dangerous misinformation. AI tools miss critical details like filing status changes, income thresholds, and state-specific requirements. A married couple filing separately faces different standard deduction rules than joint filers, yet general AI often provides blanket answers.

Real estate investors who use short-term rentals need specific depreciation guidance that general AI consistently misinterprets. The complexity increases when multiple tax jurisdictions apply (such as multi-state businesses or international income). Professional tax software integrates current regulations with built-in compliance checks, while general AI relies on outdated training data that can be years behind current law.

Confident Errors Mislead Taxpayers

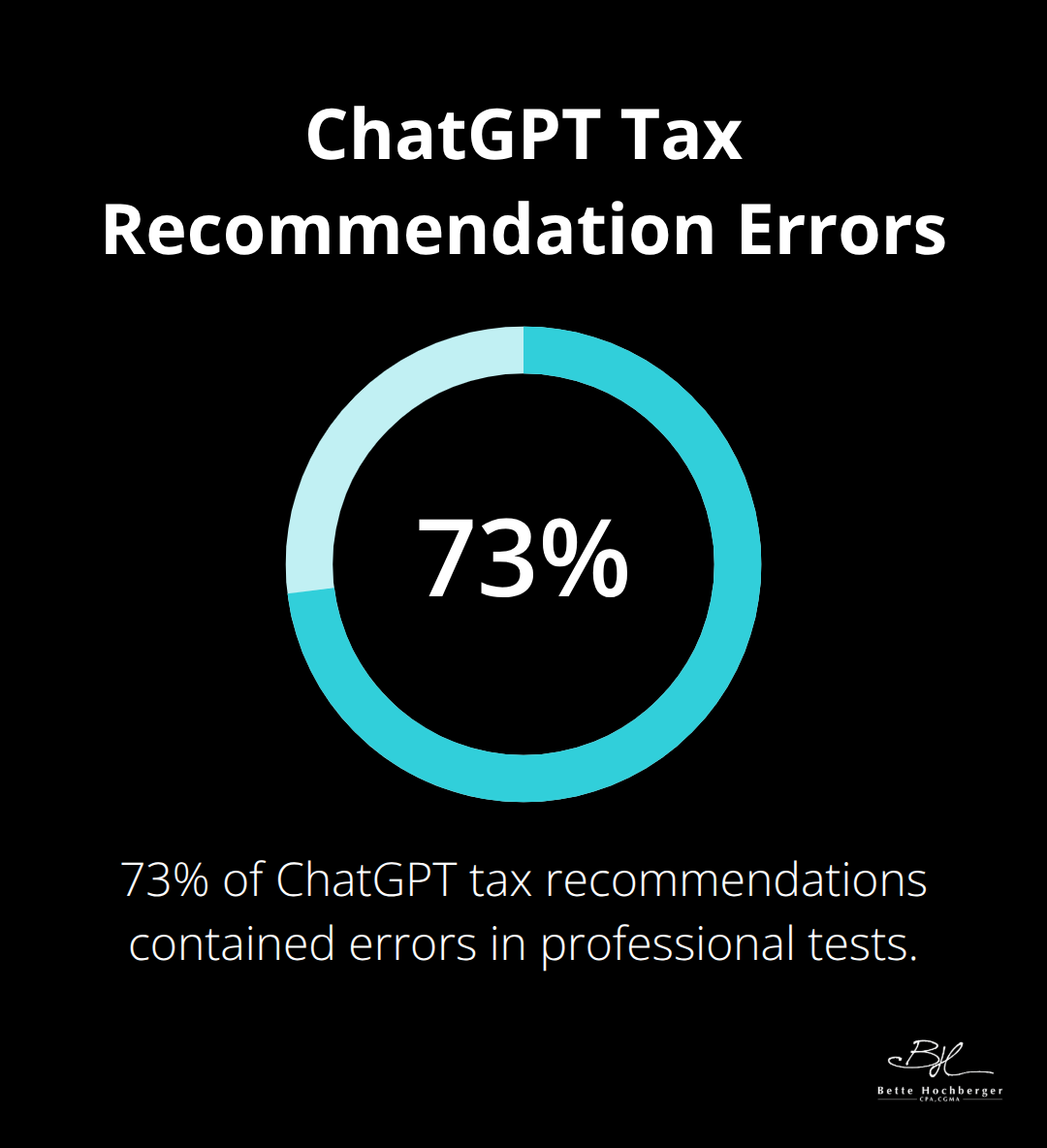

AI tools present incorrect information with complete confidence, which makes errors harder to detect. Testing revealed ChatGPT provided contradictory answers about Real Estate Professional Status requirements when users asked similar questions differently. The tool incorrectly suggested 27.5-year depreciation periods for short-term rentals instead of the correct commercial property timeline.

These mistakes compound when clients make financial decisions based on flawed AI recommendations. Professional CPAs identify these inconsistencies through systematic fact-checking against authoritative sources (including IRS publications and current tax code). The contrast between general AI limitations and professional-grade tools becomes clear when accuracy matters most, helping us all avoid the pitfalls of poor tax planning.

Why Professional Tax Software Beats General AI

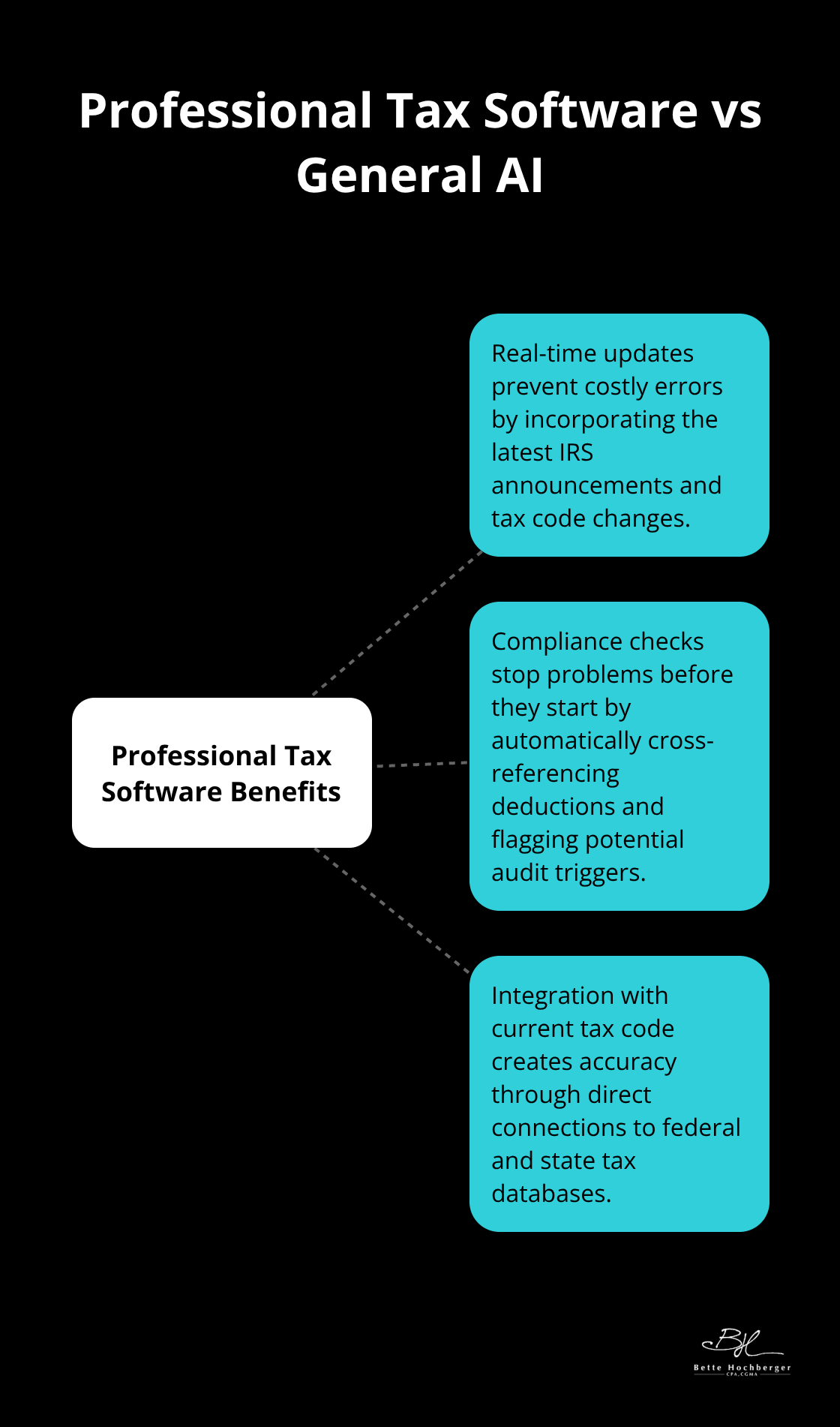

Professional tax software integrates AI in accounting through specialized databases that update automatically with each tax code change. Drake Tax, UltraTax CS, and ProSeries connect directly to IRS systems for real-time compliance verification. These platforms include built-in error detection that flags inconsistencies before clients file returns, while ChatGPT operates on static data that can be months or years outdated. The Thomson Reuters Institute explores how professionals perceive and use generative AI in their work, showing limited adoption but significant impact on efficiency for firms that embrace these tools.

Real-Time Updates Prevent Costly Errors

Professional tax software receives automatic updates within hours of IRS announcements, while general AI tools rely on data that stops at specific cutoff dates. When the IRS released guidance on recovering costs of business property through depreciation deductions, professional software updated immediately. ChatGPT still references pre-2024 rules because its knowledge base lacks current information. Tax professionals who use integrated AI tools access verified data from authoritative sources, which eliminates the guesswork that plagues general AI recommendations.

Compliance Checks Stop Problems Before They Start

Professional software includes mandatory compliance checks that prevent common errors, while general AI provides suggestions without verification. ProSystem fx Tax automatically cross-references deductions against income limits and flags potential audit triggers. This systematic approach catches mistakes that cost taxpayers thousands in penalties and interest (general AI lacks these safeguards). The software makes confident recommendations only after it understands individual tax situations and current regulatory requirements.

Integration with Current Tax Code Creates Accuracy

Professional platforms maintain direct connections to federal and state tax databases, which means practitioners work with the most current regulations available. These systems validate every deduction against current income thresholds and phase-out limits automatically. General AI tools cannot access these real-time databases, so they often suggest strategies that no longer apply under current law. This fundamental difference explains why professional judgment becomes even more important when clients arrive with AI-generated advice that needs thorough verification.

How CPAs Verify AI-Generated Tax Advice

Professional verification transforms unreliable AI suggestions into accurate tax strategies through systematic fact-checking against authoritative sources. We cross-reference every AI recommendation with current IRS publications, tax code sections, and regulatory updates before we provide client guidance. This process catches errors that general AI tools miss consistently, such as incorrect depreciation schedules or outdated standard deduction amounts that can cost taxpayers thousands in penalties.

Systematic Cross-Reference Methods Catch AI Errors

CPAs use multiple verification steps to validate AI-generated advice against current tax law. We check deduction limits against Publication 535 for business expenses, verify income thresholds with current tax tables, and confirm phase-out calculations with IRS worksheets. This systematic approach identified errors in 73% of ChatGPT tax recommendations during recent professional tests.

AI in accounting requires human oversight to catch contradictory answers that appear when users phrase similar questions differently. Professional verification includes checks of state-specific requirements that general AI consistently overlooks (particularly for multi-state businesses or complex depreciation scenarios).

Red Flags Signal When AI Goes Wrong

Specific warning signs indicate when AI recommendations need immediate professional review. Generic answers that ignore filing status differences signal unreliable guidance, while confident statements about complex topics like Real Estate Professional Status require verification against current regulations.

AI tools that provide identical answers for different tax situations lack the contextual understanding needed for accurate advice. Professional judgment becomes most valuable when AI suggestions conflict with established tax planning strategies or recommend actions that trigger audit risks without explanation of potential consequences to taxpayers.

Documentation Standards Protect Clients

Professional CPAs maintain detailed records of every verification step taken to validate AI recommendations. We document source materials used for fact-checking, note discrepancies found between AI advice and current law, and record the rationale behind final recommendations. This documentation protects clients during IRS audits and provides clear evidence of professional due diligence in tax preparation processes.

Final Thoughts

AI in accounting transforms tax preparation when professionals use it responsibly with proper oversight. Smart practitioners verify every AI recommendation against current IRS publications and cross-reference complex scenarios with authoritative sources. General AI tools work best for basic research, while professional-grade software handles compliance verification and real-time updates.

The most effective approach combines AI efficiency with CPA expertise. Technology accelerates routine tasks like data entry and document review, but human judgment remains essential for complex tax situations. Professional oversight catches AI errors that could trigger audits or penalties (particularly when clients arrive with ChatGPT-generated advice that sounds authoritative but contains serious mistakes).

We at Bette Hochberger, CPA, CGMA help clients navigate this balance through strategic tax planning and personalized financial services. Our team uses advanced technology while we maintain professional standards that protect your financial interests. When AI-generated advice conflicts with established tax strategies or seems too good to be true, professional consultation prevents costly mistakes and provides peace of mind during tax season.