Consultants face unique tax challenges that traditional employees never encounter. The IRS requires most independent contractors to make quarterly estimated taxes throughout the year rather than waiting until April.

We at Bette Hochberger, CPA, CGMA see consultants struggle with these payments regularly. Missing deadlines or underpaying can result in penalties that eat into your profits significantly.

Understanding Quarterly Estimated Tax Requirements for Consultants

Who Must Pay Quarterly Estimated Taxes

The IRS requires consultants to pay quarterly estimated taxes when they have net earnings from self-employment of $400 or more from gig work, even if it’s a side job, part-time or temporary. This threshold catches most independent contractors since traditional employee withholding doesn’t apply to consulting income. Self-employed individuals who earn over $400 annually must also pay self-employment tax at 15.3% on net earnings up to $168,600 for 2024 (this covers Social Security and Medicare contributions that employers typically handle).

Safe Harbor Protection Against Penalties

Safe harbor rules protect consultants from underpayment penalties if they pay either 90% of the current year’s tax liability or 100% of the previous year’s tax liability, whichever is smaller. High earners with adjusted gross income that exceeds $150,000 must pay 110% of the prior year’s liability to qualify for safe harbor protection. These rules provide flexibility when income fluctuates unpredictably throughout the year.

Payment Schedule and Critical Deadlines

Quarterly estimated tax payments follow specific deadlines: April 15, June 15, September 15, and January 15 of the following year. The IRS charges quarterly interest rates on tax underpayments and overpayments for individuals and businesses, which it calculates from each missed deadline. Late payments trigger penalties even when consultants receive refunds at year-end.

Payment Methods and Calculation Tools

The Electronic Federal Tax Payment System allows automated payments to prevent missed deadlines, while Form 1040-ES provides worksheets for payment amount calculations. Consultants who earn income unevenly can use the annualized income installment method to adjust payments based on when income actually arrives rather than spread it equally across four quarters. This method proves particularly valuable for seasonal consultants or those with project-based income patterns.

Once you understand these requirements and deadlines, the next step involves accurate calculation of your quarterly payment amounts.

Calculating Your Quarterly Estimated Tax Payments

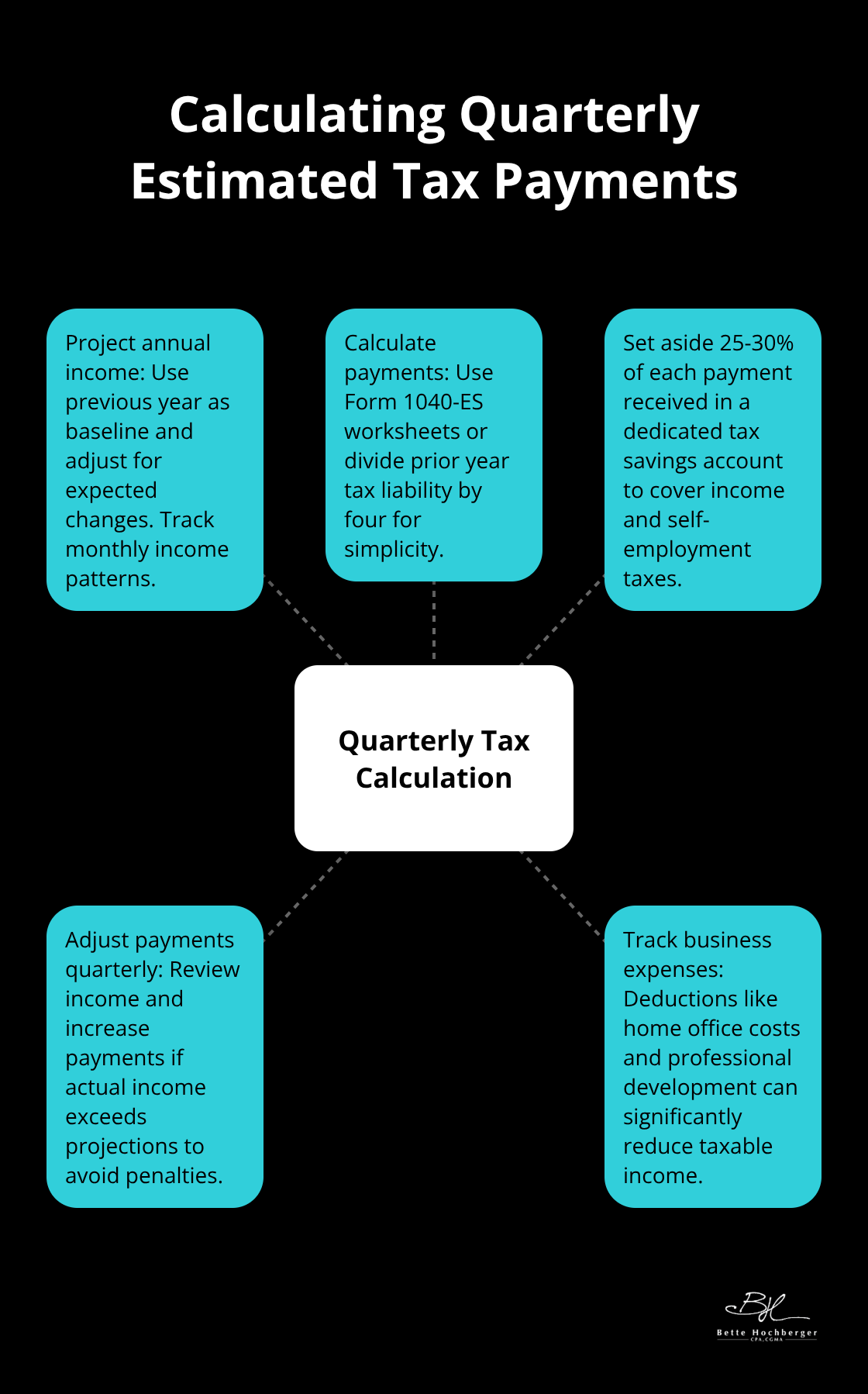

Project Your Annual Income with Monthly Tracking

Use your gross income from the previous year as your baseline, then adjust for expected changes in your consulting business. Track monthly income patterns to identify seasonal fluctuations or project-based spikes that affect annual totals. Most consultants underestimate their income by 15-20% according to IRS data, which leads to underpayment penalties. Set aside 25-30% of each payment you receive in a dedicated tax savings account to cover both income tax and the 15.3% self-employment tax rate. High-income consultants who earn over $200,000 face an additional 0.9% Medicare tax, which makes accurate projections even more important.

Calculate Payments with the Previous Year Method

Form 1040-ES provides worksheets, but the simplest approach uses your prior year tax liability divided by four. If you paid $20,000 in total taxes last year, each quarterly payment should be $5,000 to meet safe harbor requirements. Consultants who earn over $150,000 must pay 100% of prior year tax (making each payment $5,000 in this example). The annualized income installment method works better for irregular income patterns and allows smaller payments during slow months and larger payments when major projects complete. Track business expenses throughout the year since deductions like home office costs, professional development, and equipment purchases reduce your taxable income significantly.

Adjust Payments When Income Changes

Review your income quarterly and adjust your payments when actual income exceeds projections. If first-quarter income runs 30% higher than expected, increase subsequent payments to avoid year-end penalties. The IRS Electronic Federal Tax Payment System allows payment modifications up to 8 PM Eastern on due dates. Set quarterly calendar reminders to prevent missed deadlines that trigger penalty calculations based on the federal short-term rate plus 3 percentage points (currently around 7% annually).

Even with accurate calculations, consultants frequently make costly mistakes that can derail their tax strategy and create unnecessary financial stress.

What Tax Mistakes Cost Consultants the Most Money

Income Projection Errors Drive Up Penalties

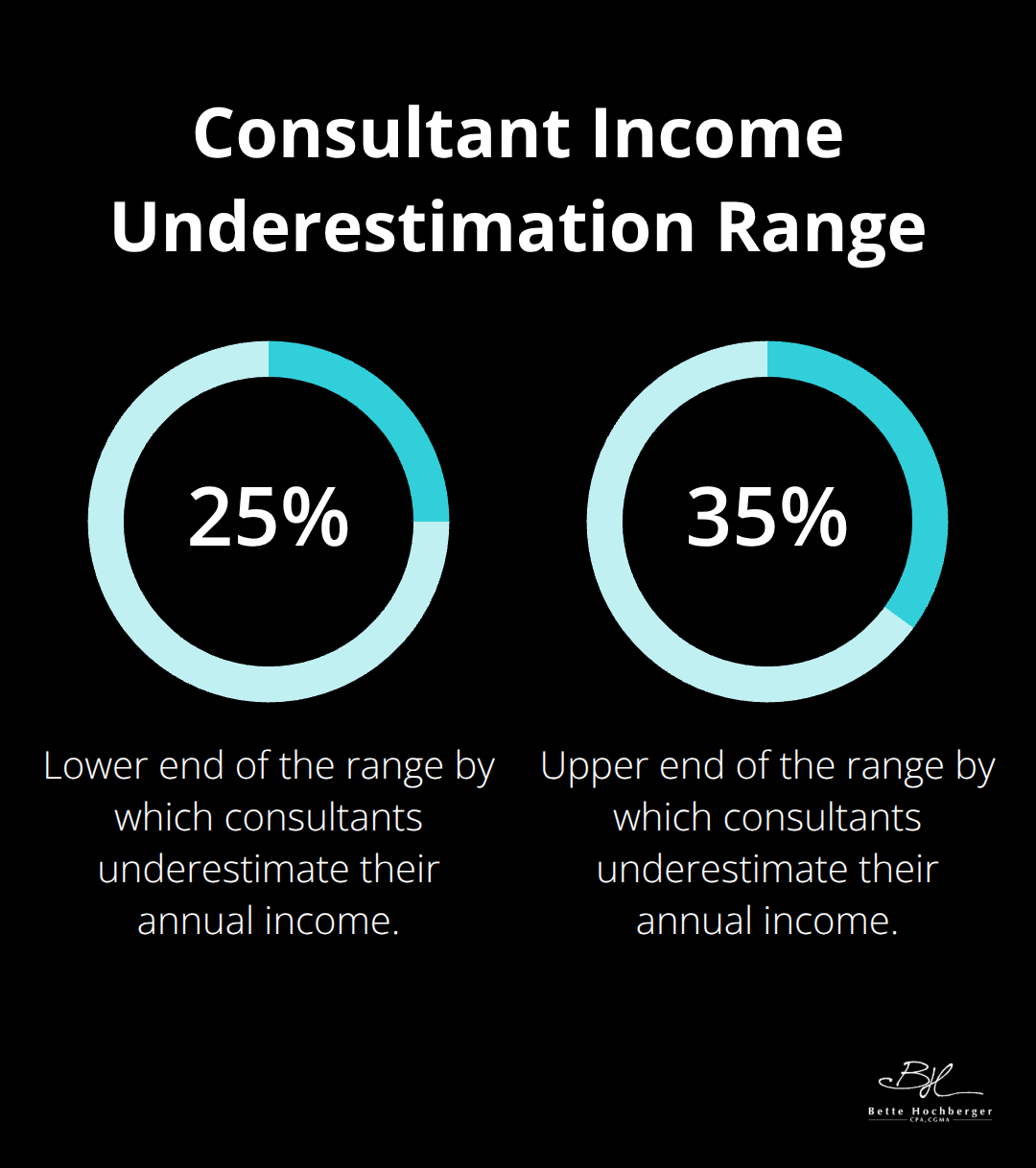

Consultants consistently underestimate their annual income by 25-35%, which creates substantial underpayment penalties at year-end. The IRS charges 7% annual interest on underpaid amounts, calculated from each quarterly deadline. A consultant who underestimates income by $30,000 faces roughly $2,100 in additional interest charges if the shortfall persists through all four quarters.

Income spikes from large projects or new clients catch most consultants off guard. Track your pipeline value monthly and increase quarterly payments immediately when contracts exceed projections. The annualized income installment method allows you to calculate estimated tax payments based on your actual income for specific periods, preventing penalties when income arrives unevenly throughout the year.

Self-Employment Tax Catches Consultants Unprepared

The 15.3% self-employment tax shocks consultants who transition from employee status and forget that employers previously covered half of Social Security and Medicare contributions. A consultant who earns $100,000 owes $15,300 in self-employment tax plus regular income tax rates.

High earners face an additional 0.9% Medicare tax on income that exceeds $200,000 (bringing the total self-employment tax to 16.2% on higher income levels). This additional tax applies to single filers with income above $200,000 and married couples filing jointly with income above $250,000.

Missed Deadlines Trigger Compound Penalties

The IRS penalty rate currently sits at 7% annually, but late payments also generate failure-to-pay penalties of 0.5% monthly. These penalties accumulate daily until payment arrives, which creates expensive compound interest scenarios for consultants who miss multiple deadlines.

Set automatic payments through the Electronic Federal Tax Payment System to prevent missed deadlines that cost consultants thousands in avoidable penalties each year. The system processes payments up to 8 PM Eastern on due dates, which provides same-day flexibility for last-minute adjustments.

Final Thoughts

Successful quarterly estimated taxes require three fundamental strategies that separate profitable consultants from those who struggle with tax compliance. Automate your payment system through the Electronic Federal Tax Payment System to eliminate missed deadlines that cost consultants an average of $2,100 annually in penalties. Maintain a dedicated tax savings account with 30% of each payment to cover both income tax and the 15.3% self-employment tax rate (which includes Social Security and Medicare contributions).

Professional tax guidance provides substantial advantages that far exceed the fees involved. We at Bette Hochberger, CPA, CGMA help consultants navigate complex tax situations and minimize liabilities while maintaining healthy cash flow. Expert advice prevents costly mistakes like underestimating self-employment tax or missing safe harbor thresholds that protect against penalties.

Your next step involves implementing a systematic approach to quarterly estimated taxes before the next deadline arrives. Set up automated payments, establish your tax savings account, and schedule quarterly income reviews to stay ahead of your obligations. Review and adjust your payments quarterly when income fluctuates to prevent year-end surprises that derail your financial plans.