Legal fees can be a significant expense for many individuals and businesses. At Bette Hochberger, CPA, CGMA, we often get questions about tax deductions for legal fees.

The rules surrounding these deductions can be complex, varying based on the nature of the legal expenses and the context in which they were incurred. Understanding which legal fees are deductible and which are not can potentially save you money on your taxes.

Are Legal Fees Tax Deductible?

The tax deductibility of legal fees depends on several factors, primarily the nature of the expense and its relation to income-generating activities. The proper categorization of legal expenses can significantly impact tax situations.

Business vs. Personal Legal Expenses

The IRS distinguishes between business and personal legal expenses. Business-related legal fees are generally deductible, while personal legal expenses typically are not. For example, legal fees to draft contracts for your business qualify for deduction, but fees for a personal injury lawsuit do not.

Qualifying Criteria for Deductions

To qualify for a deduction, legal fees must meet two criteria:

- Ordinary: The IRS defines this as common and accepted in your field.

- Necessary: The expense must be helpful and appropriate for your business.

A restaurant owner’s legal fees for health code compliance would likely meet these criteria (as it’s both common in the industry and essential for operation).

Documentation: The Foundation of Successful Deductions

Proper documentation forms the cornerstone when claiming legal fee deductions. We recommend maintaining detailed records, including:

- Itemized invoices from attorneys

- Proof of payment

- Clear descriptions of services rendered

These records should explicitly connect the legal fees to your business activities. For instance, if you’re a landlord, keep separate records for legal fees related to property management (deductible) versus personal matters (non-deductible).

The Prevalence of Legal Issues in Business

Small business owners were over 20 percentage points more likely to have experienced a drop in income compared to other groups. This statistic underscores the importance of understanding which legal fees are deductible.

Maximizing Your Deductions

To maximize your legal fee deductions:

- Separate personal and business legal expenses meticulously

- Maintain comprehensive records (including detailed invoices and payment proofs)

- Understand the specific deduction rules for your industry or profession

The proper categorization and documentation of your legal expenses can potentially reduce your tax burden. This saved money can then be reinvested back into your business, fueling growth and success.

As we move forward, let’s explore the specific types of legal fees that qualify for tax deductions, providing you with a clearer picture of how to optimize your tax strategy.

Which Legal Fees Can You Deduct?

At Bette Hochberger, CPA, CGMA, we often advise clients on the intricacies of deducting legal fees. While not all legal expenses are tax-deductible, many business-related fees can significantly reduce your tax burden. Let’s explore the types of legal fees you can potentially deduct.

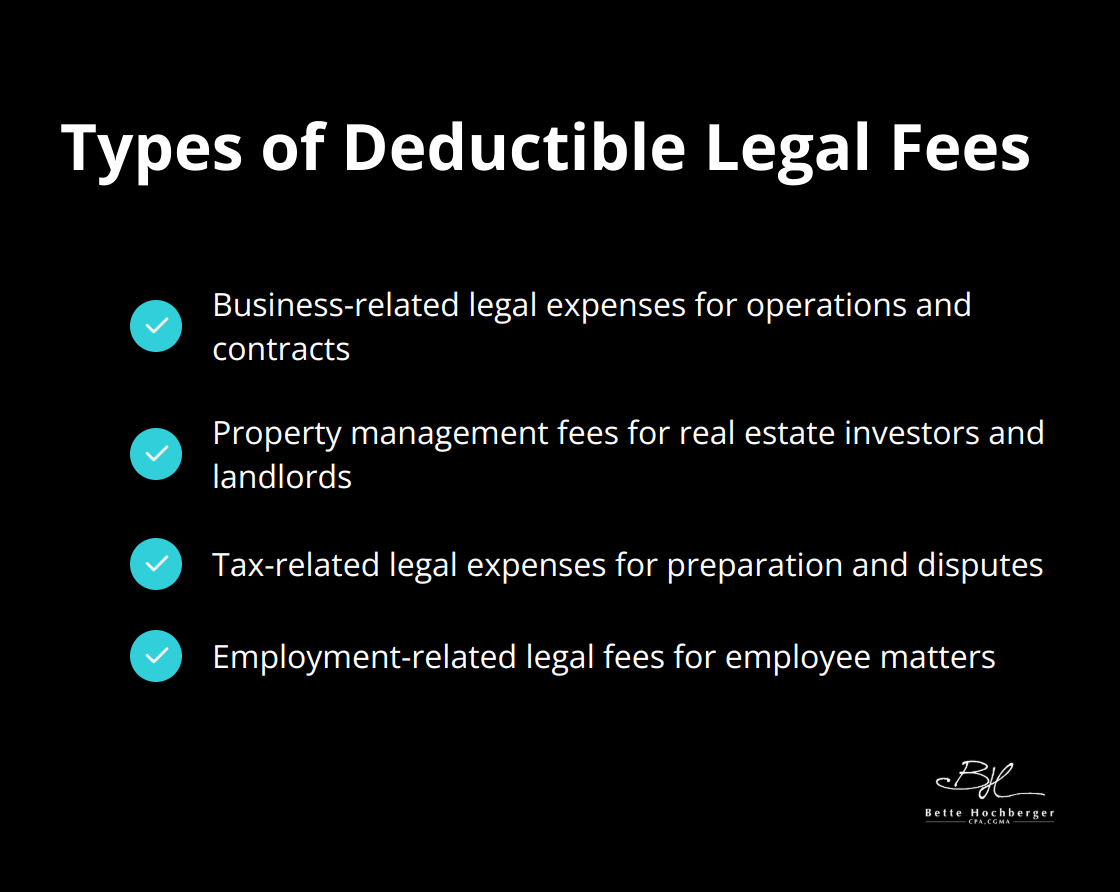

Business-Related Legal Expenses

Business owners can deduct a wide range of legal fees directly tied to their operations. These include costs for contract negotiations, intellectual property protection, and business formation. If you paid an attorney to draft vendor agreements or review lease terms, these expenses are typically deductible.

Property Management Legal Fees

For real estate investors and landlords, legal expenses related to property management often qualify for deductions. This includes fees for eviction proceedings, lease agreement drafting, and addressing tenant disputes.

Tax-Related Legal Expenses

Legal fees associated with tax preparation, planning, and disputes with the IRS may qualify for deductions if they are considered “ordinary and necessary” expenses under §162 (business expenses) or §212 (expenses for the production of income).

Employment-Related Legal Fees

Business-related legal fees are generally deductible, while personal legal fees usually aren’t. Employers can deduct legal expenses related to employee matters, such as drafting employment contracts, handling discrimination claims, or navigating labor disputes.

Documentation Requirements

Proper documentation is essential when claiming these deductions. You must keep detailed records of all legal expenses, including invoices and proof of payment. If you’re unsure about the deductibility of specific legal fees, consult with a tax professional.

While many legal fees can be deducted, it’s important to understand that not all legal expenses qualify for tax deductions. In the next section, we’ll examine which types of legal fees are typically non-deductible, helping you distinguish between expenses that can and cannot reduce your tax liability.

Which Legal Fees Are Not Tax Deductible?

At Bette Hochberger, CPA, CGMA, we often encounter clients who express surprise when they learn that not all legal fees qualify for tax deductions. While business-related legal expenses generally qualify, personal legal fees typically do not. This distinction plays a key role in effective tax planning and helps avoid potential issues with the IRS.

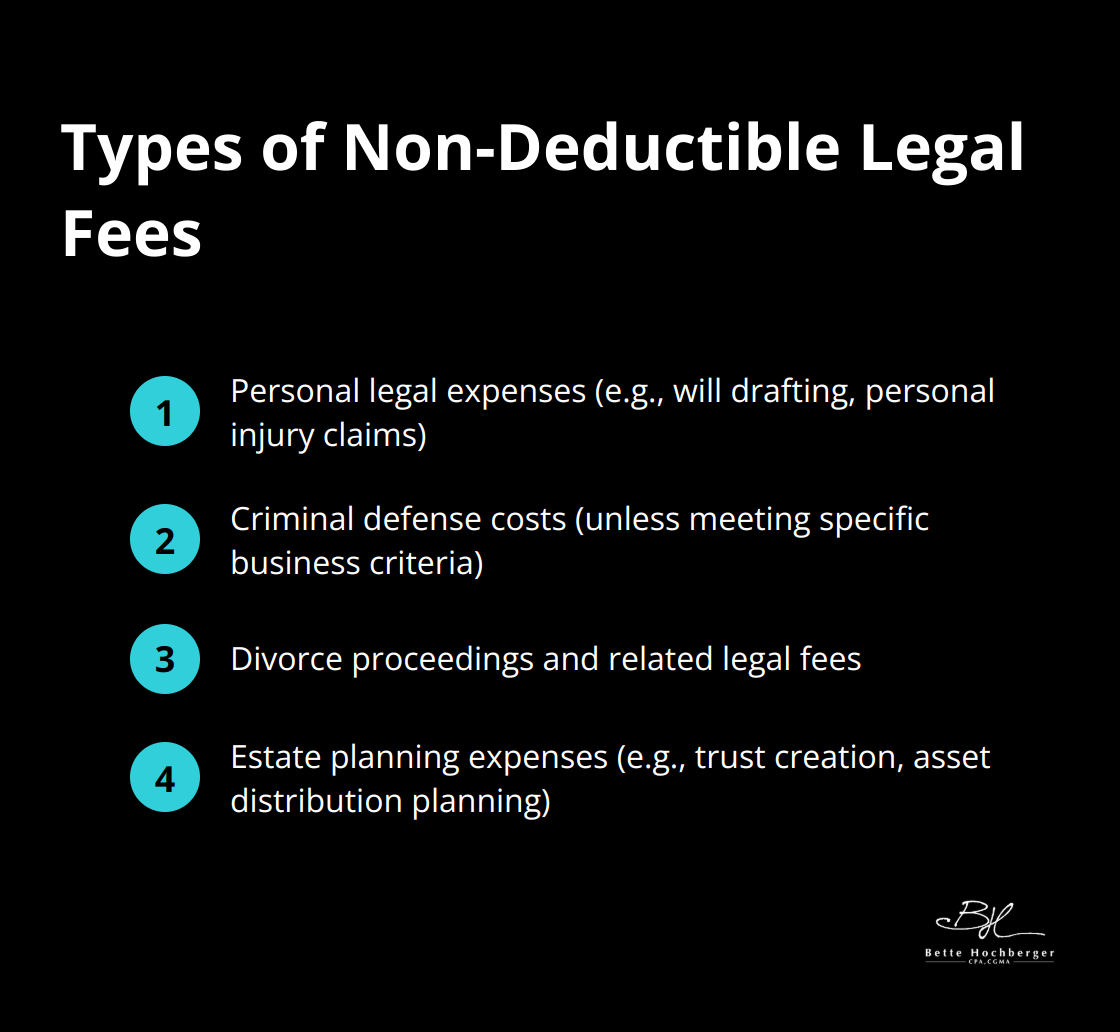

Personal Legal Expenses

The IRS maintains a clear stance: personal legal expenses do not qualify for tax deductions. This category includes fees for will drafting, personal injury claim resolution, or traffic violation handling. For instance, if you hire an attorney to contest a speeding ticket, you cannot deduct those costs from your taxes.

Criminal Defense Costs

Legal fees for criminal defense may be deductible as a business expense, as long as they are ordinary and necessary. This applies to fees related to criminal activity, provided they meet the criteria for business expenses.

Divorce Proceedings

Divorce-related legal fees are considered personal expenses and are not tax-deductible. This includes costs for property division, alimony negotiations, and child custody arrangements.

Estate Planning

While estate planning represents a critical financial step, the associated legal fees do not qualify for tax deductions. This includes costs for trust creation, will drafting, or asset distribution planning. The IRS views these as personal expenses, not business or income-producing activities.

These non-deductible fees can still provide significant financial benefits (despite their tax status). For example, proper estate planning can help reduce estate taxes for your heirs. Similarly, while divorce legal fees don’t qualify for deductions, the right legal strategy can lead to more favorable financial outcomes in the long term.

Final Thoughts

Tax deductions for legal fees require a clear understanding of IRS regulations. Business-related expenses often qualify, while personal legal costs typically do not. Proper documentation (including itemized invoices and payment proofs) is essential to substantiate claims during potential audits.

The complexities of tax law make it advisable to consult with a tax professional. Bette Hochberger, CPA, CGMA specializes in personalized financial services for businesses and professionals. Our expertise in strategic tax planning can help you navigate legal fee deductions and minimize tax liabilities.

Accurate record-keeping and adherence to IRS guidelines are paramount when maximizing deductions. Partnering with experienced professionals allows you to optimize your tax strategy. You can then focus on growing your business with confidence.