Health Savings Accounts (HSAs) offer a powerful way to save for medical expenses while potentially reducing your tax burden. Many people wonder, “Are HSA deductions pre-tax?”

At Bette Hochberger, CPA, CGMA, we often field questions about the tax implications of HSA contributions. In this post, we’ll break down how HSA contributions are treated for tax purposes and explore the benefits of these accounts.

Understanding Health Savings Accounts (HSAs)

What Are HSAs?

Health Savings Accounts (HSAs) are tax-advantaged savings accounts that let you set aside money on a pre-tax basis to pay for qualified medical expenses. These accounts offer a unique combination of tax benefits and flexibility, making them an attractive option for many people.

How HSAs Function

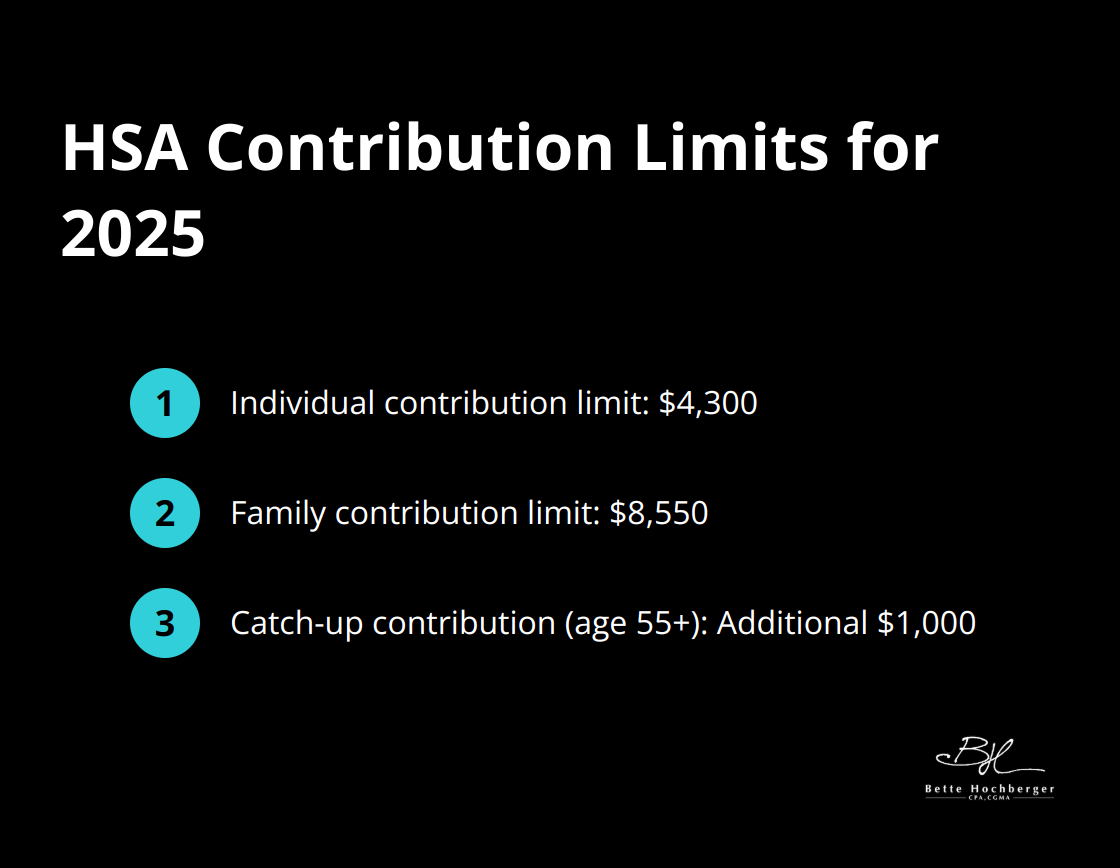

When you open an HSA, you can contribute money to the account on a pre-tax basis. This means your contributions reduce your taxable income for the year. For 2025, individuals can contribute up to $4,300, while families can contribute up to $8,550 if you have coverage for your family. If you’re 55 or older, you can add an extra $1,000 as a catch-up contribution.

Eligibility Requirements

Not everyone can open an HSA. To qualify, you must meet these criteria:

- Enrollment in a high-deductible health plan (HDHP)

- No other health coverage (with some exceptions)

- Not enrolled in Medicare

- Not claimed as a dependent on someone else’s tax return

For 2025, an HDHP must have a minimum deductible of $1,650 for individual coverage or $3,300 for family coverage. The maximum out-of-pocket expenses for these plans are capped at $8,300 for individuals and $16,600 for families.

Maximizing HSA Benefits

Many financial advisors recommend maximizing HSA contributions for eligible individuals. Unlike Flexible Spending Accounts (FSAs), HSA funds roll over from year to year, allowing you to accumulate savings for future medical expenses.

Moreover, once you turn 65, you can withdraw funds for non-medical expenses without penalty (though you’ll pay income tax on these withdrawals). This feature essentially transforms your HSA into an additional retirement account, offering even more financial flexibility in your later years.

As we move forward, we’ll explore the tax treatment of HSA contributions and how they can impact your overall financial strategy.

How Are HSA Contributions Taxed?

Pre-Tax Contributions Through Employer-Sponsored Plans

Health Savings Accounts offer a triple-tax advantage – deposits are tax-deductible, growth is tax-deferred, and spending is tax-free. When you contribute to an HSA through your employer’s plan, the contributions are typically made with pre-tax dollars. This reduces your taxable income for the year. For example, if your annual salary is $50,000 and you contribute $3,000 to your HSA, your taxable income drops to $47,000.

The percentage of workers with an HRA or HSA-eligible health plan whose employers contributed to the account had steadily increased since 2009. This widespread availability makes it easier for many employees to take advantage of these tax savings.

Tax-Deductible Contributions for Individual Accounts

If you’re self-employed or your employer doesn’t offer an HSA, you can still open an individual HSA and enjoy tax benefits. Contributions to individual HSAs are tax-deductible, even if you don’t itemize deductions on your tax return. This above-the-line deduction directly reduces your adjusted gross income (AGI).

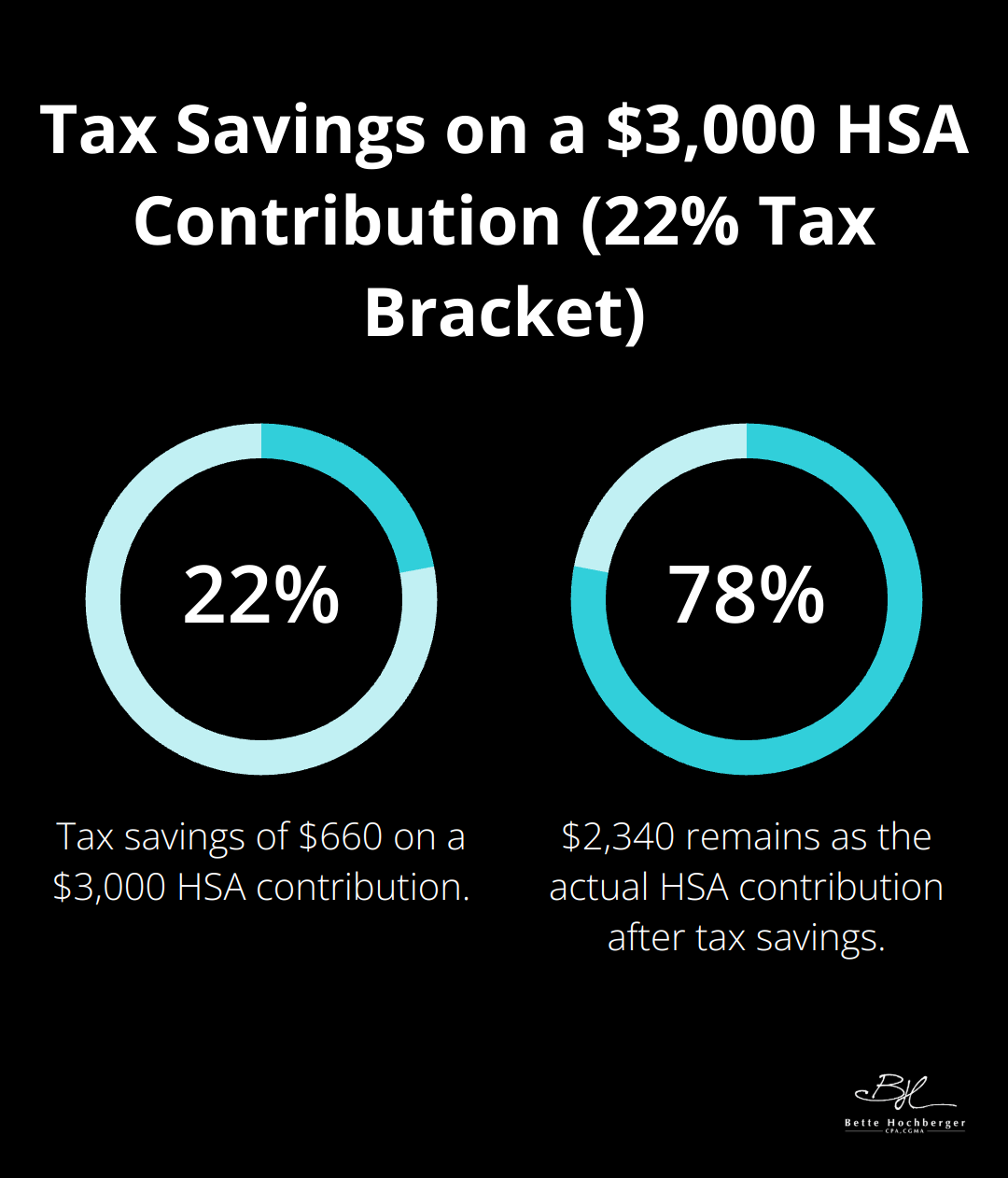

For instance, if you’re in the 22% tax bracket and contribute $3,000 to your HSA, you could save $660 on your federal taxes. You must report these contributions on Form 8889 when filing your taxes.

State Tax Implications for HSA Contributions

While HSA contributions are tax-advantaged at the federal level, state tax treatment can vary. Most states follow federal tax treatment, allowing HSA contributions to be deducted from state taxes. However, there are exceptions.

California and New Jersey, for example, do not offer state tax deductions for HSA contributions. In these states, you’ll still benefit from federal tax advantages, but your state taxable income won’t be reduced by your HSA contributions.

Maximizing Your HSA Tax Benefits

To make the most of your HSA’s tax advantages:

- Contribute the maximum amount allowed (if financially feasible)

- Use HSA funds for qualified medical expenses to maintain tax-free status

- Keep accurate records of your contributions and withdrawals

Seeking Professional Advice

Tax laws can be complex and change frequently. A qualified tax professional (such as those at Bette Hochberger, CPA, CGMA) can help you navigate the nuances of HSA tax benefits and develop a strategy that aligns with your financial goals. They can also ensure you’re taking full advantage of all available tax deductions and credits related to your healthcare expenses.

As we move forward, let’s explore the broader benefits of HSA pre-tax contributions and how they can impact your overall financial strategy.

How HSA Pre-Tax Contributions Boost Your Financial Health

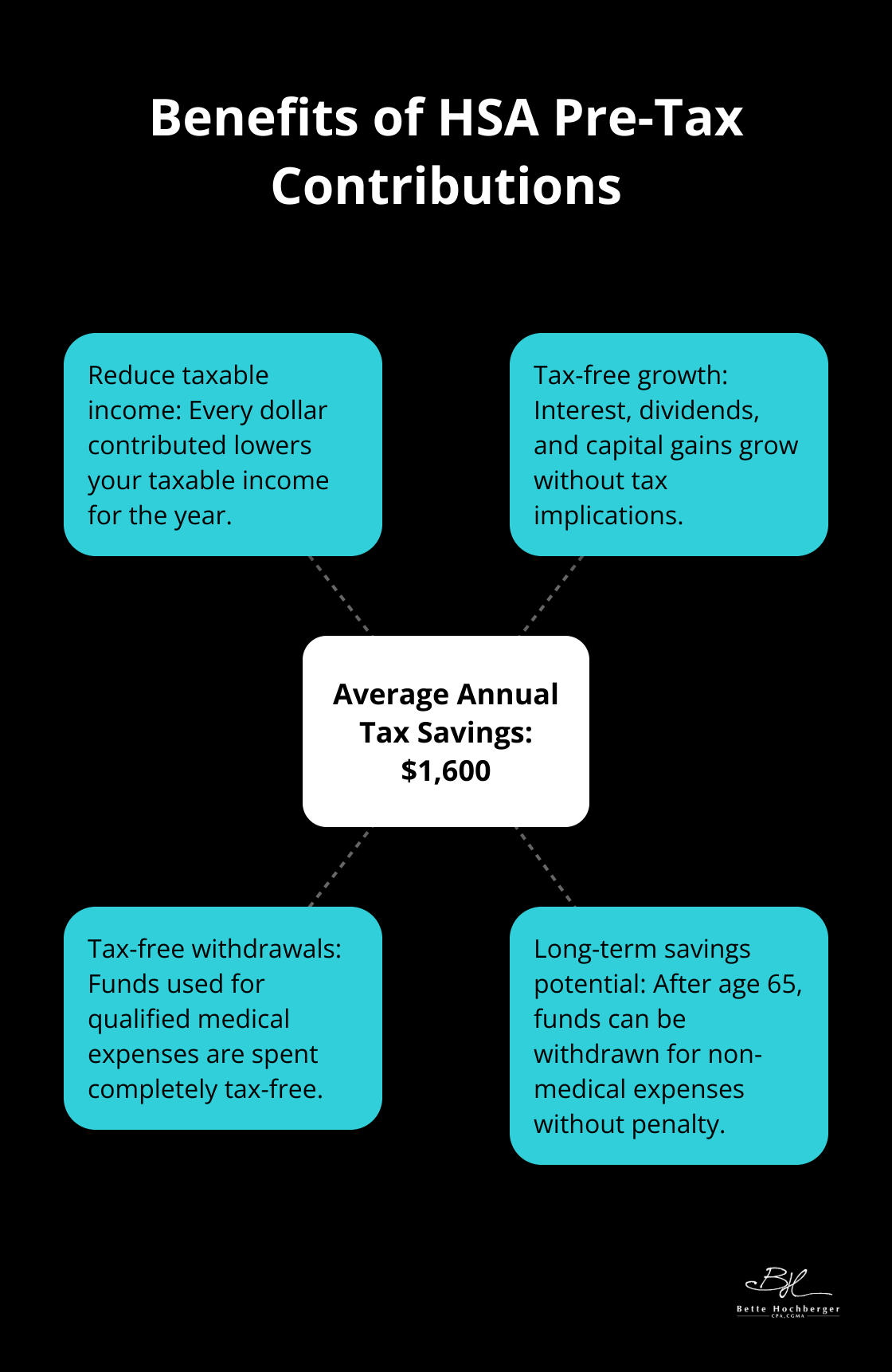

Reduce Your Taxable Income

Health Savings Accounts (HSAs) offer a powerful way to improve your overall financial health. The most immediate benefit of HSA contributions is the reduction in your taxable income. Every dollar you contribute to your HSA is a dollar less that the government can tax. For example, if you’re in the 24% tax bracket and contribute $3,000 to your HSA, you could save $720 on your federal taxes. This tax savings effectively gives you a discount on your healthcare costs.

Grow Your Savings Tax-Free

Unlike traditional savings accounts, the money in your HSA grows without tax implications. This means any interest, dividends, or capital gains your HSA investments earn are not subject to taxes. Over time, this tax-free growth can significantly increase your healthcare savings. Compound interest can help determine how much your money can grow in an HSA over time.

Maximize Your Healthcare Dollars

When you use your HSA funds for qualified medical expenses, you spend completely tax-free dollars. This triple tax advantage (tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified expenses) is unmatched by any other savings vehicle. The average HSA account holder saves $1,600 annually in taxes through their HSA contributions and spending.

Integrate HSA into Your Financial Strategy

HSA pre-tax contributions don’t just save for healthcare – they optimize your overall financial strategy. You can integrate HSA contributions into your comprehensive financial plan to ensure you make the most of this unique tax-advantaged account. A qualified tax professional can help you navigate the nuances of HSA tax benefits and develop a strategy that aligns with your financial goals.

Plan for Long-Term Savings

HSAs offer flexibility for long-term savings. After age 65, you can withdraw funds for non-medical expenses without penalty (though you’ll pay income tax on these withdrawals). This feature transforms your HSA into an additional retirement account, offering more financial flexibility in your later years. Try to maximize contributions to an HSA to take full advantage of this long-term savings potential and effectively reduce your taxable income while preparing for future healthcare costs.

Final Thoughts

Health Savings Accounts provide a powerful combination of tax benefits and financial flexibility. HSA deductions are pre-tax when made through employer-sponsored plans, and they’re tax-deductible for individual accounts. This tax advantage, along with tax-free growth and withdrawals for qualified medical expenses, makes HSAs a valuable tool in your financial arsenal.

HSA contributions can lead to significant tax savings while building a robust healthcare fund for current and future needs. They reduce your taxable income and potentially lower your tax bracket, which can positively impact your overall financial picture. However, HSA rules, contribution limits, and tax implications can be complex to navigate.

Professional guidance becomes invaluable when integrating HSAs into your broader financial strategy. At Bette Hochberger, CPA, CGMA, we offer personalized financial services, including strategic tax planning and preparation (which can help you make the most of these tax-advantaged accounts). Our team can assist you in minimizing tax liabilities and managing cash flow effectively while optimizing your HSA strategy.