Growing companies face a tough choice when they need financial leadership: hire a full-time CFO or explore CFO outsourcing.

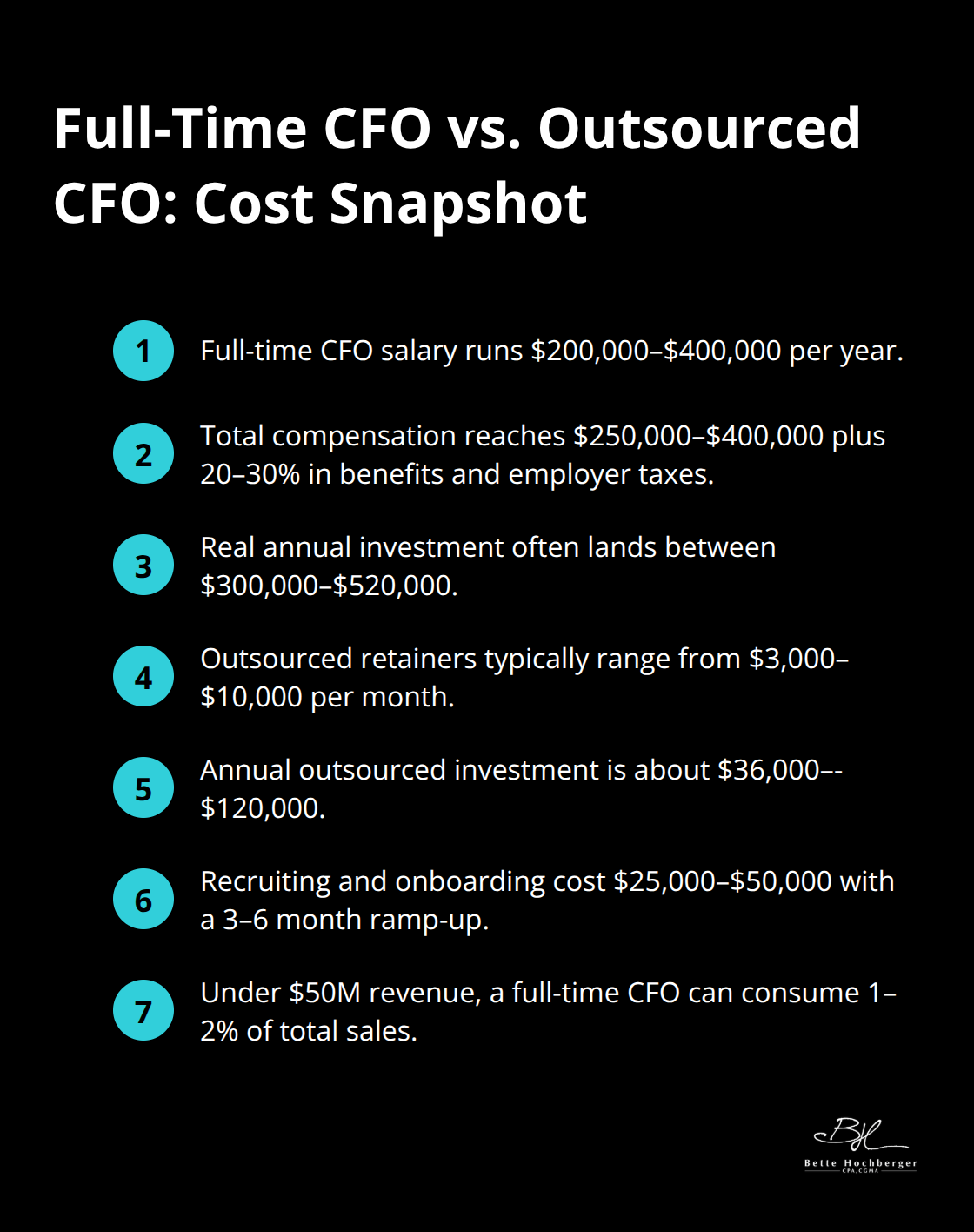

The numbers tell a clear story. A full-time CFO costs $200,000-$400,000 annually, while outsourced services start at $3,000-$10,000 monthly.

We at Bette Hochberger, CPA, CGMA see companies make this decision daily, and the math favors outsourcing for most growing businesses.

What Does CFO Outsourcing Really Cost

The True Price of Full-Time Financial Leadership

A full-time CFO salary represents just the start of your financial commitment. Total compensation reaches $250,000-$400,000 annually in the U.S., with an additional 20-30% for benefits, bonuses, and employer taxes. This pushes your real investment to $300,000-$520,000 yearly.

Recruitment and onboarding add another $25,000-$50,000, while the 3-6 month ramp-up period delays strategic impact when you need it most. These numbers become particularly painful for companies that generate under $50 million in revenue, where a full-time CFO can consume 1-2% of total sales.

How Outsourced CFO Services Transform Your Budget

Fractional CFO services operate on flexible models that match your actual needs. Hourly rates range from $150-$500, while monthly retainers span $3,000-$10,000. Your annual investment stays between $36,000-$120,000 (less than 25% of full-time costs).

Most companies find sweet spots around $6,000-$8,000 monthly for comprehensive strategic support. The elimination of benefits, payroll taxes, and recruitment expenses creates immediate savings. Companies can scale services up during fundraising or acquisition periods, then reduce engagement afterward.

Speed Advantage Creates Market Opportunities

Outsourced CFOs deploy within two weeks compared to months for permanent hires. This speed advantage becomes critical during growth phases, funding rounds, or acquisition opportunities. Companies avoid the risk of recruitment while they access diverse expertise across multiple sectors.

The ability to adjust service levels based on business needs eliminates the fixed cost burden that can strain cash flow during challenging periods. This flexibility proves invaluable for businesses that experience rapid growth phases or seasonal fluctuations in their financial complexity needs.

These cost advantages become even more compelling when you consider the level of expertise and strategic capabilities that outsourced CFO services provide.

What Expertise Do You Actually Get

Depth of Experience Across Industries

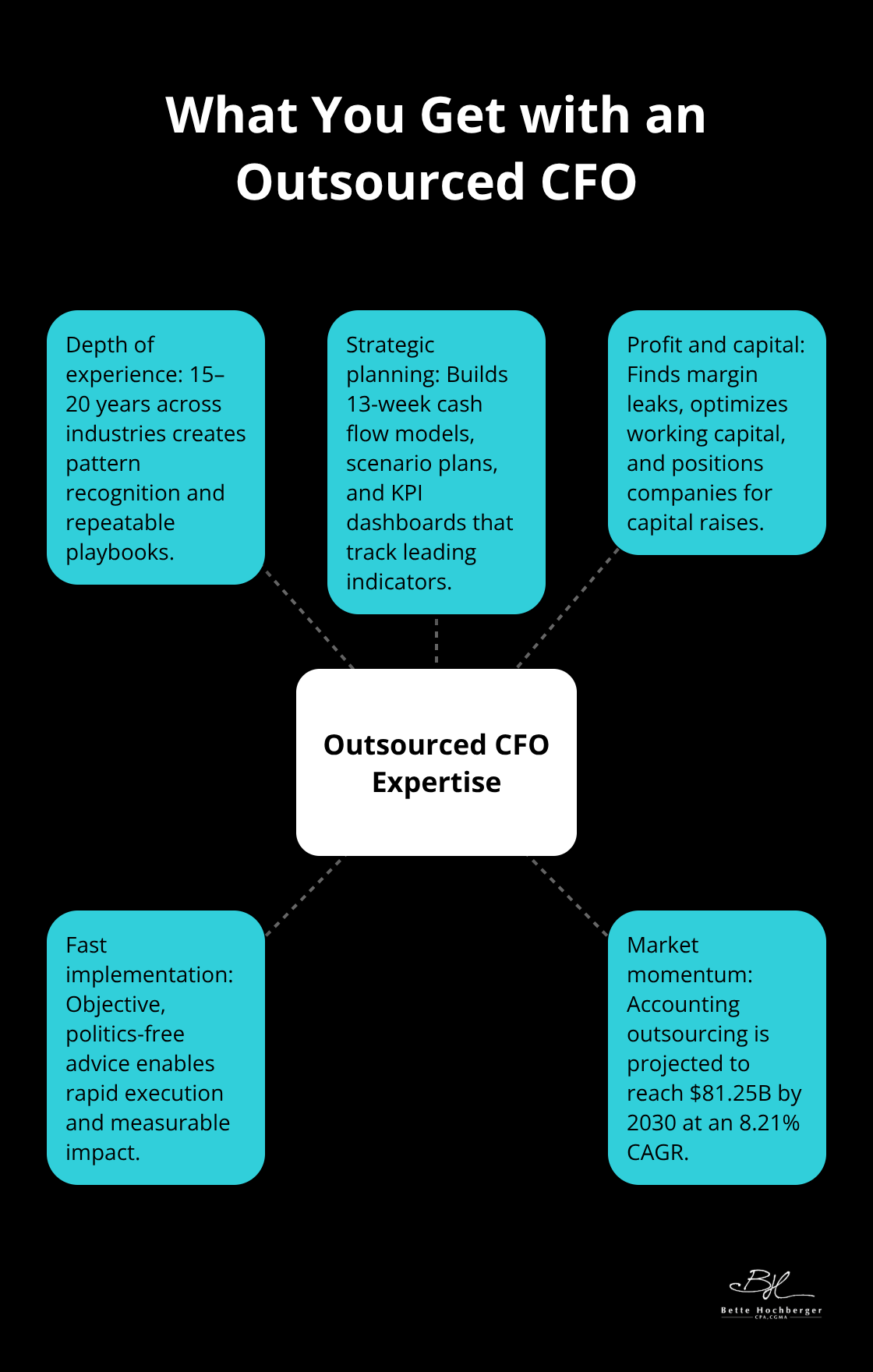

Outsourced CFOs possess 15-20 years of financial leadership across multiple companies and sectors. This exposure creates pattern recognition that single-company CFOs cannot match. A seasoned outsourced CFO has navigated economic downturns, scaled operations, and executed exit strategies dozens of times.

These professionals apply lessons from technology companies to manufacturing firms. They adapt proven frameworks to your specific situation. This cross-pollination of ideas accelerates problem-solving and strategic planning in ways that internal hires struggle to replicate.

Strategic Financial Planning That Drives Growth

Outsourced CFOs focus on forward-looking financial strategy rather than historical reports. They build 13-week cash flow models, create scenario plans for different growth trajectories, and establish KPI dashboards that track leading indicators.

The global accounting outsourcing market is projected to hit $81.25 billion by 2030, growing at an 8.21% CAGR. These professionals transform raw financial data into actionable growth strategies.

Profit Optimization and Capital Management

Outsourced CFOs identify profit leaks through margin analysis and optimize working capital management. They create roadmaps for capital raising that position companies for investor readiness. Their strategic planning capabilities turn financial management from a reactive function into a proactive growth engine.

These experts conduct comprehensive reviews of cost structures and uncover hidden opportunities for profit improvement. They implement systems that provide real-time insights into financial health (enabling informed decision-making at critical moments).

Immediate Implementation Without Politics

The objective perspective that outsourced CFOs provide comes free from internal politics and organizational bias. They deliver candid advice and innovative financial strategies without concern for office dynamics or job security fears.

This objectivity proves particularly valuable during periods of rapid growth or complex financial landscapes. Small and medium businesses can implement strategic changes quickly without the resistance that often accompanies internal recommendations.

The flexibility and scalability of these services become even more apparent when you examine how outsourced CFOs adapt to your company’s changing needs.

How CFO Flexibility Transforms Business Operations

Service Scaling Matches Growth Phases

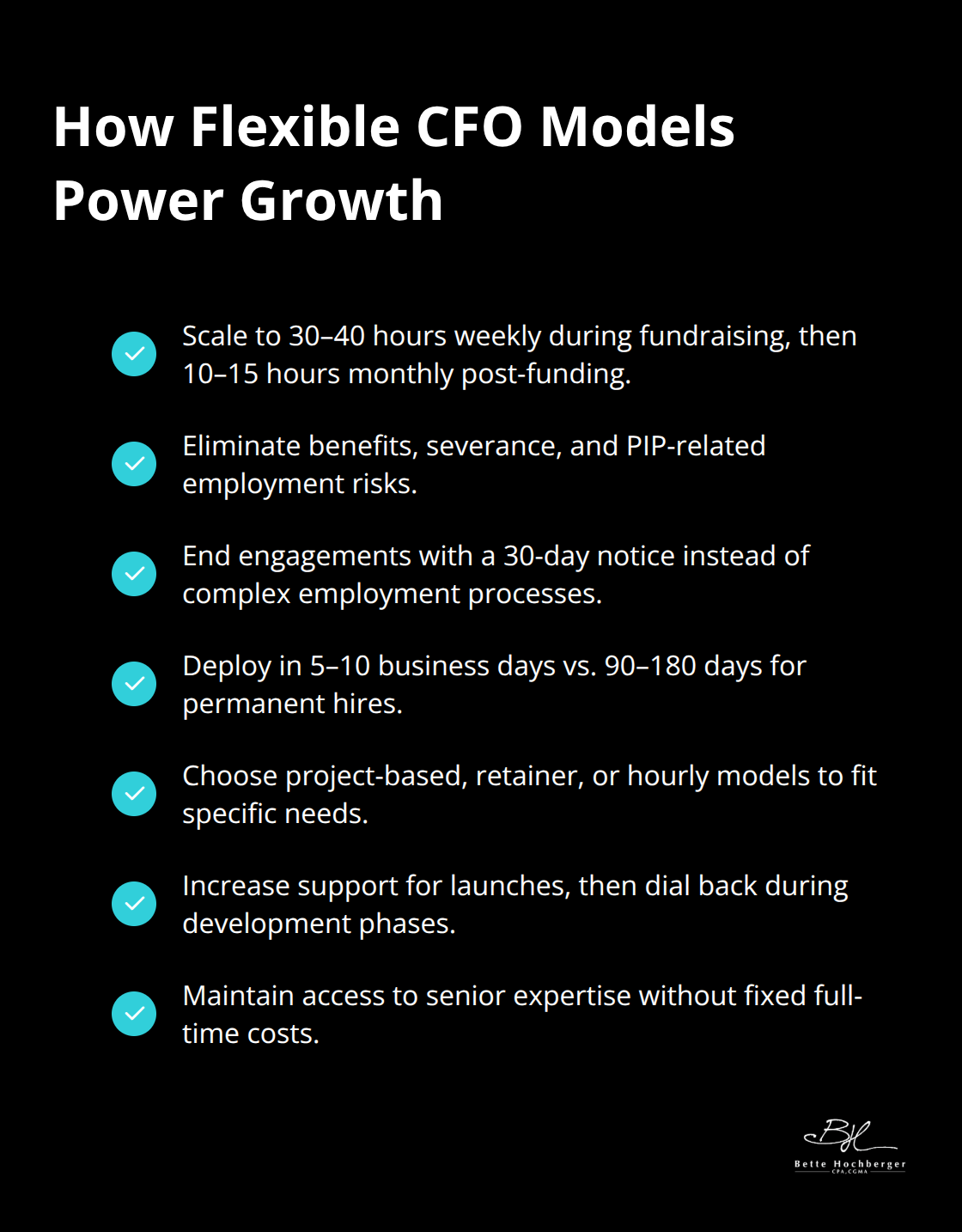

Outsourced CFO services expand and contract with your business cycles without employment complications. Companies increase CFO engagement to 30-40 hours weekly during fundraising periods for investor presentations and due diligence. Post-funding, services drop to 10-15 hours monthly for ongoing strategic guidance. This elasticity prevents overpayment for unused capacity while it provides surge support when needed.

Technology companies use intensive CFO support during product launches, then scale back during development phases. Manufacturing firms increase CFO hours during seasonal peaks and reduce engagement during slower quarters.

This dynamic approach saves costs significantly compared to fixed full-time costs while it maintains access to senior expertise.

Zero Employment Risk Creates Strategic Freedom

Outsourced arrangements eliminate wrongful termination risks, severance obligations, and performance improvement plan complications. Companies can end engagements with 30-day notice periods instead of navigation through complex employment law requirements. This freedom allows businesses to experiment with different strategic approaches without long-term personnel commitments.

The flexibility proves particularly valuable for companies that face market uncertainty or operational pivots. Private equity-backed firms benefit from this agility during portfolio optimization phases while startups avoid equity dilution that often accompanies senior executive hires.

Rapid Deployment Captures Time-Sensitive Opportunities

Outsourced CFOs begin strategic work within 5-10 business days compared to 90-180 days for permanent hires. This speed advantage captures market opportunities that disappear during lengthy recruitment processes. Companies that prepare for acquisition offers or respond to competitive threats cannot afford months-long delays in financial leadership.

The immediate availability extends to specialized expertise during crisis management or rapid expansion phases. Businesses access seasoned professionals who have navigated similar challenges dozens of times and apply proven frameworks to urgent situations without learning curves that plague new hires.

Flexible Engagement Models Optimize Resource Allocation

Project-based arrangements allow companies to access CFO expertise for specific initiatives like system implementations or merger preparations. Retainer models provide consistent monthly support with defined scope boundaries. Hourly engagements work best for companies that need periodic strategic consultation without ongoing commitments.

This variety of engagement options means businesses can match their financial leadership investment to actual needs rather than fixed overhead structures that drain resources during slower periods.

Final Thoughts

CFO outsourcing delivers compelling financial advantages for companies that need strategic leadership without permanent overhead. The cost savings reach 70-80% compared to full-time hires, while businesses access senior-level expertise across multiple industries. Companies between $5-50 million in revenue benefit most from these services (particularly technology firms, manufacturing companies, and private equity-backed businesses).

The decision becomes clear when companies face growth phases, acquisition opportunities, or investor readiness requirements. The ability to access proven financial strategies without long-term employment commitments provides strategic freedom that permanent hires cannot match. Technology companies use intensive CFO support during product launches, then scale back during development phases.

We at Bette Hochberger, CPA, CGMA help businesses evaluate their financial leadership needs through our Fractional CFO services. Our team provides strategic tax planning and cash flow management that positions companies for sustainable growth. The flexibility to scale services up during critical periods and down during steady operations creates optimal resource allocation for your business.