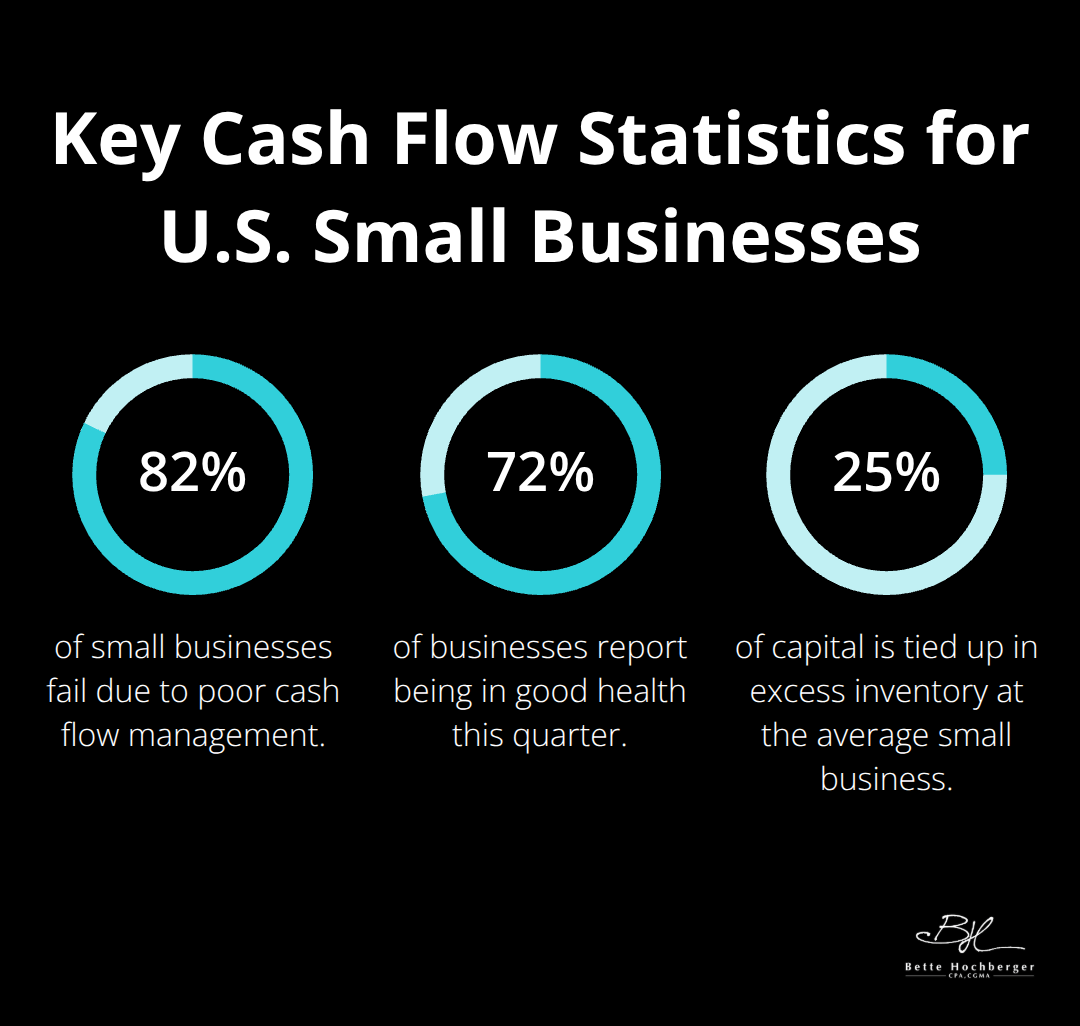

Cash flow optimization can make or break your business success. While 82% of small businesses fail due to poor cash flow management, the right strategies can transform your financial position within months.

We at Bette Hochberger, CPA, CGMA see businesses struggle with timing mismatches between income and expenses daily. The good news is that proven techniques and modern tools can solve these challenges faster than most owners expect.

Understanding Cash Flow Optimization Fundamentals

What Makes Cash Flow Different from Profit

Most business owners confuse cash flow with profit, but this misunderstanding costs companies millions annually. According to the U.S. Chamber of Commerce, 72% of businesses report being in good health this quarter, indicating that while many businesses maintain stability, cash flow management remains critical for sustained success.

Profit appears when you complete a sale, but cash flow only improves when payment actually hits your bank account. A company can report $100,000 in monthly profits while experiencing negative cash flow if customers pay 60 days late and suppliers demand immediate payment.

The Three Cash Flow Components That Matter

Operating cash flow tracks money from daily business activities, while investing cash flow covers equipment and asset purchases. Financing cash flow includes loans and equity transactions (such as investor funding or business loans).

Operating cash flow deserves your primary attention because it reflects your business’s ability to generate cash from core operations. Research shows that adaptive resilience strategies help businesses survive economic challenges, while those dependent on financing cash flow face constant pressure. Smart business owners focus 80% of their attention on operating cash flow optimization.

The Real Cash Flow Problems That Kill Businesses

Poor management skills top the list of cash flow destroyers, followed by insufficient startup capital and weak business plans. Entrepreneurs consistently underestimate growth costs, which creates cash constraints during expansion phases.

Timing mismatches between customer payments and supplier demands create the most common cash crises. Small businesses often price products without including all costs (like overhead and labor), leading to profitable sales that actually drain cash reserves.

The solution requires micromanagement of every expense and detailed forecasts that account for payment timing differences. These proven strategies can transform your cash position, which we’ll explore in the next section.

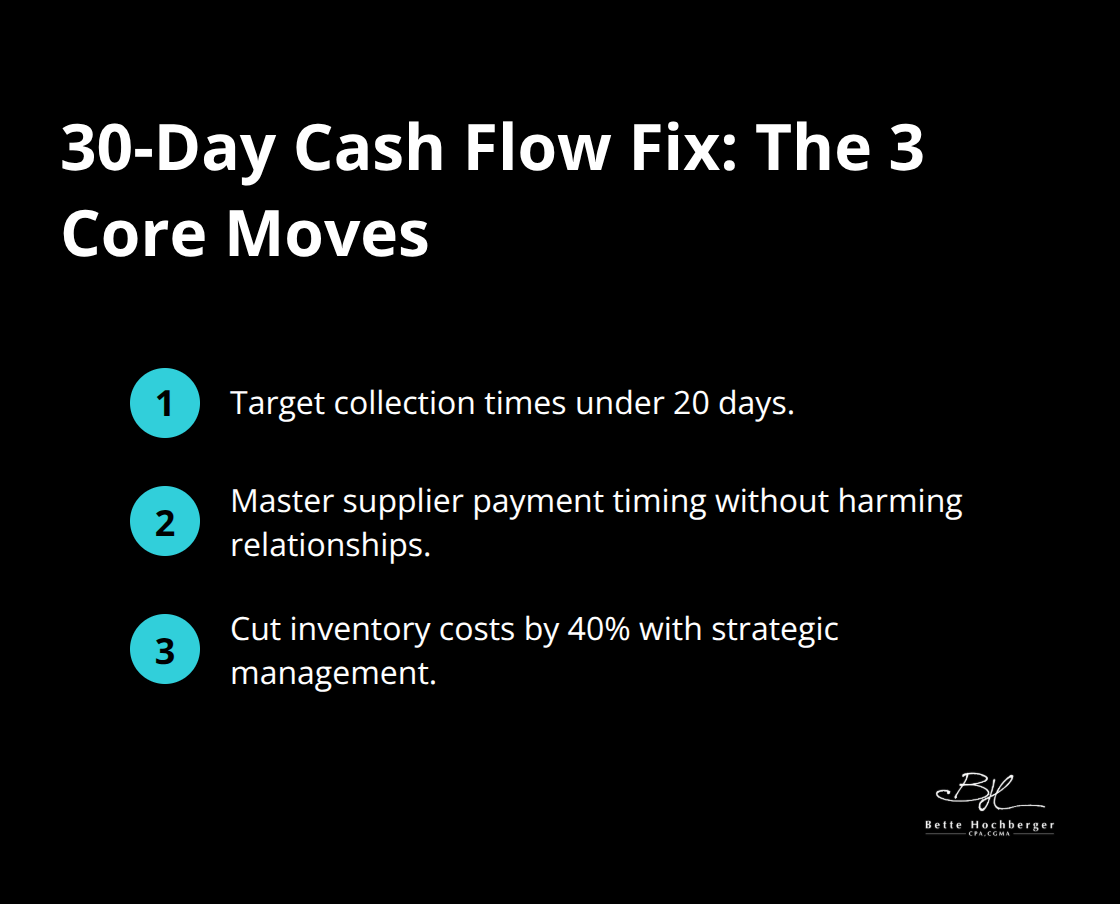

How Can You Fix Your Cash Flow Within 30 Days

Transform your cash position through three aggressive strategies that address the root causes of cash flow problems. Companies that implement these tactics typically see improvements within 30 days, with some that experience positive changes in just two weeks.

Target Collection Times Under 20 Days

Send invoices immediately after delivery and include payment terms of net 15 instead of net 30. Businesses need improved payment options for accelerating receipts and optimizing cash flow. Offer 2% discounts for payments within 10 days, which costs less than alternative finance options and accelerates cash inflow.

Follow up on overdue accounts within 48 hours of the due date, not after 30 days. Implement automated reminder systems that send payment notices at 7, 14, and 21 days after invoice date. Accept multiple payment methods that include ACH transfers, which process faster than checks and reduce costs by up to 50%.

Master Payment Timing Without Damage to Relationships

Pay suppliers on day 29 of net 30 terms, not day 15. This simple change can free up significant capital without violation of agreements. Negotiate extended payment terms with your top three suppliers and try for net 45 or net 60 terms. Many vendors prefer predictable payments over early payments.

Schedule all monthly bills for the same date to improve cash flow forecast accuracy. Request payment terms that align with your customer payment cycles. If customers pay you in 45 days, negotiate 60-day terms with suppliers to create a 15-day cash buffer.

Cut Inventory Costs by 40% Through Strategic Management

Implement just-in-time inventory management to reduce costs and free up cash. The average small business ties up 25% of capital in excess inventory (often without realizing the impact on cash flow). Analyze sales data from the past 12 months to identify slow items and liquidate them at cost rather than hold them.

Focus inventory purchases on items with turnover rates above 6 times per year. Negotiate consignment arrangements with key suppliers for expensive or slow products. Use inventory management software that tracks turnover rates and automatically reorders based on actual demand patterns rather than assumptions.

These three strategies form the foundation of rapid cash flow improvement, but technology solutions can amplify your results even further.

Which Technology Tools Actually Fix Cash Flow Problems

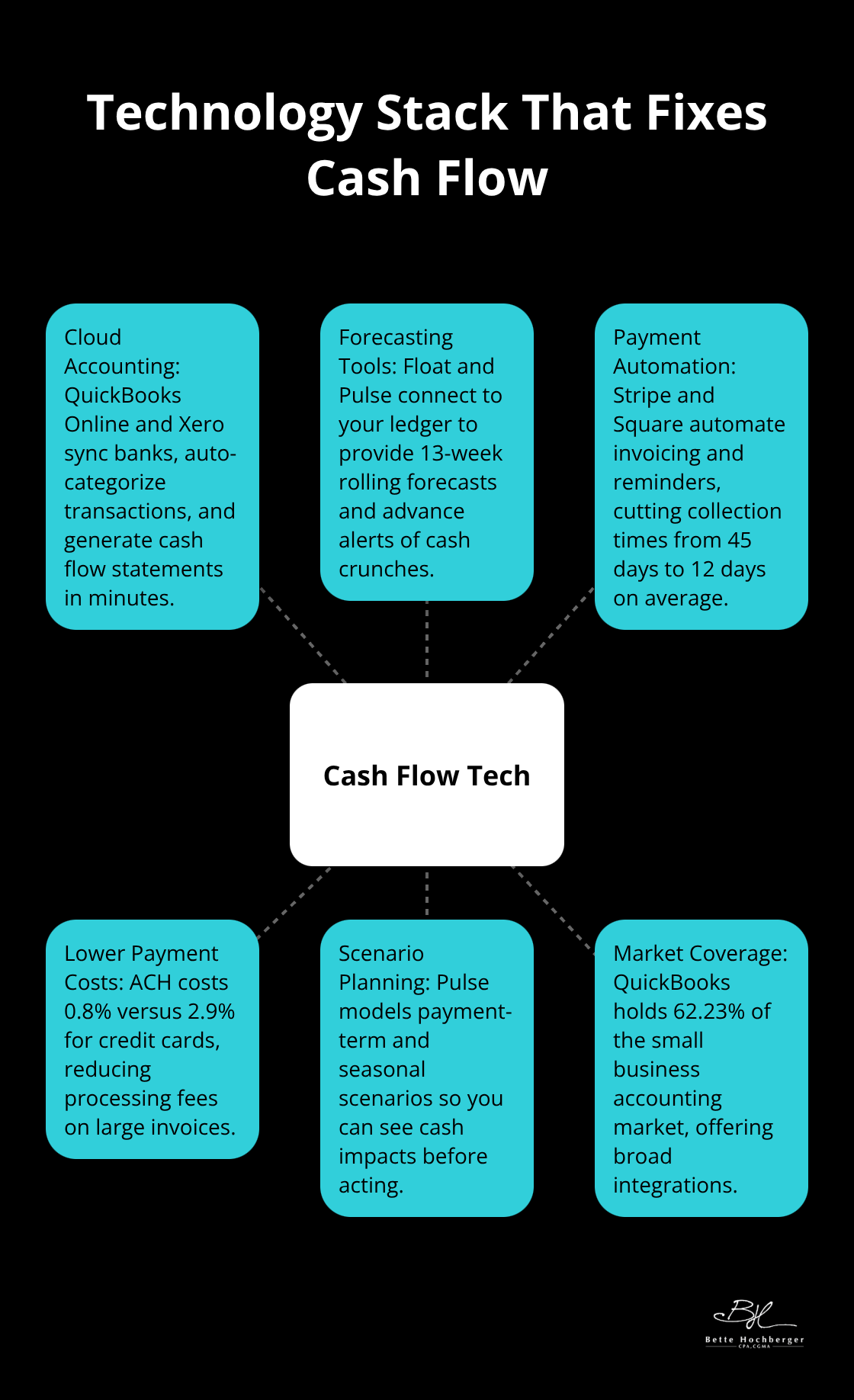

Modern software solutions automate your cash flow management and eliminate the manual tracking that consumes hours each week. QuickBooks Online and Xero lead the cloud accounting space, with QuickBooks capturing 62.23% of the small business market according to recent market analysis.

These platforms sync bank accounts in real-time, categorize transactions automatically, and generate cash flow statements within minutes instead of days. Xero excels at multi-currency management for international businesses, while QuickBooks offers superior integration with payment processors like Stripe and PayPal. Both platforms cost under $50 monthly but save businesses 10-15 hours per week on financial administration.

Cash Flow Forecasting Software That Predicts Problems Before They Hit

Float and Pulse dominate the cash flow forecasting market because they connect directly to accounting software and provide 13-week rolling forecasts. Float processes data from over 100,000 businesses and shows that companies using forecasting reduce cash shortfalls by 70-80% compared to spreadsheet users.

The software alerts you 30 days before potential cash crunches, which allows time for corrective action. Pulse offers scenario planning that shows cash impact of different payment terms or seasonal variations. Both tools cost $50-200 monthly but prevent cash crises that could cost thousands in emergency financing fees. Regular financial forecasting helps anticipate these issues before they become critical.

Payment Automation Systems That Accelerate Collections

Stripe and Square now offer automated invoicing and payment processing that cuts collection times from 45 days to 12 days on average. Stripe’s payment links allow customers to pay invoices with one click, while Square’s automatic payment reminders increase collection rates by 40% according to their 2024 user data.

ACH payments through these systems cost 0.8% versus 2.9% for credit cards (saving significant processing fees on large transactions). Set up recurring billing for subscription services and retainer clients to guarantee predictable monthly cash inflows. These automated systems eliminate the manual follow-up that drains staff time and creates inconsistent collection results.

Final Thoughts

Cash flow optimization delivers measurable results that compound over time. Businesses that implement these strategies report 40% fewer cash shortages within six months and maintain healthier working capital ratios throughout economic downturns. The automated systems and forecasting tools create sustainable improvements that reduce financial stress and enable strategic growth investments.

Start with the 30-day collection acceleration tactics while you simultaneously implement cloud accounting software. Focus on one payment automation system before you expand to additional tools. This phased approach prevents overwhelm and allows you to measure results at each stage.

Complex situations require professional expertise to navigate tax implications and regulatory requirements (especially for growing businesses). We at Bette Hochberger, CPA, CGMA provide strategic tax planning and Fractional CFO services that address cash flow challenges while we minimize tax liabilities. Our team uses advanced cloud technology to provide personalized financial services that support sustainable business growth and wealth creation through proven cash flow optimization strategies.