Real estate syndication offers investors powerful tax advantages that can significantly boost returns when properly structured. The average syndication deal generates 15-20% more after-tax income compared to traditional real estate investments.

We at Bette Hochberger, CPA, CGMA see many investors miss out on substantial tax savings due to poor planning and strategy implementation.

How Do Syndication Tax Benefits Really Work

Real estate syndication tax benefits operate through three primary mechanisms that can dramatically reduce your tax liability. Depreciation deductions alone can shelter 80-90% of your cash flow from taxes in the first few years of ownership. The IRS allows residential properties to depreciate over 27.5 years and commercial properties over 39 years, but cost segregation studies accelerate this timeline significantly.

Maximizing Depreciation Through Cost Segregation

Cost segregation studies identify property components that can have tax lives of 5, 7, or 15 years instead of the standard timeline. A typical $10 million apartment complex generates substantial first-year depreciation deductions through cost segregation. This strategy works particularly well when combined with bonus depreciation, which allows 100% expensing of qualifying assets (though this benefit phases out starting in 2023 at 80%).

The number 100% seems to be not appropriate for this chart. Please use a different chart type.

Pass-Through Benefits for Limited Partners

Syndication losses flow directly to your personal tax return through K-1 forms, which reduces your overall tax burden. These passive losses offset passive income from other real estate investments or syndications. High earners benefit most since passive losses can shelter income that would otherwise face 37% federal tax rates plus state taxes.

Strategic 1031 Exchange Implementation

Syndications structured as Tenancy-in-Common arrangements allow 1031 exchange participation with minimum investments that may require a $500,000 investment stake. This structure defers capital gains taxes indefinitely when you reinvest proceeds into new syndication deals. The key requirement involves identification of replacement properties within 45 days and completion of the exchange within 180 days of your original property sale.

Passive Activity Loss Rules and Income Limits

The IRS limits passive losses to $25,000 annually against ordinary income for investors with modified adjusted gross income under $100,000 (this benefit phases out completely at $150,000). Investors who exceed these thresholds must carry forward unused losses until they generate passive income or sell their syndication interest. These advanced tax strategies require careful planning to maximize their effectiveness in your overall investment portfolio.

Advanced Tax Strategies for Syndication Investors

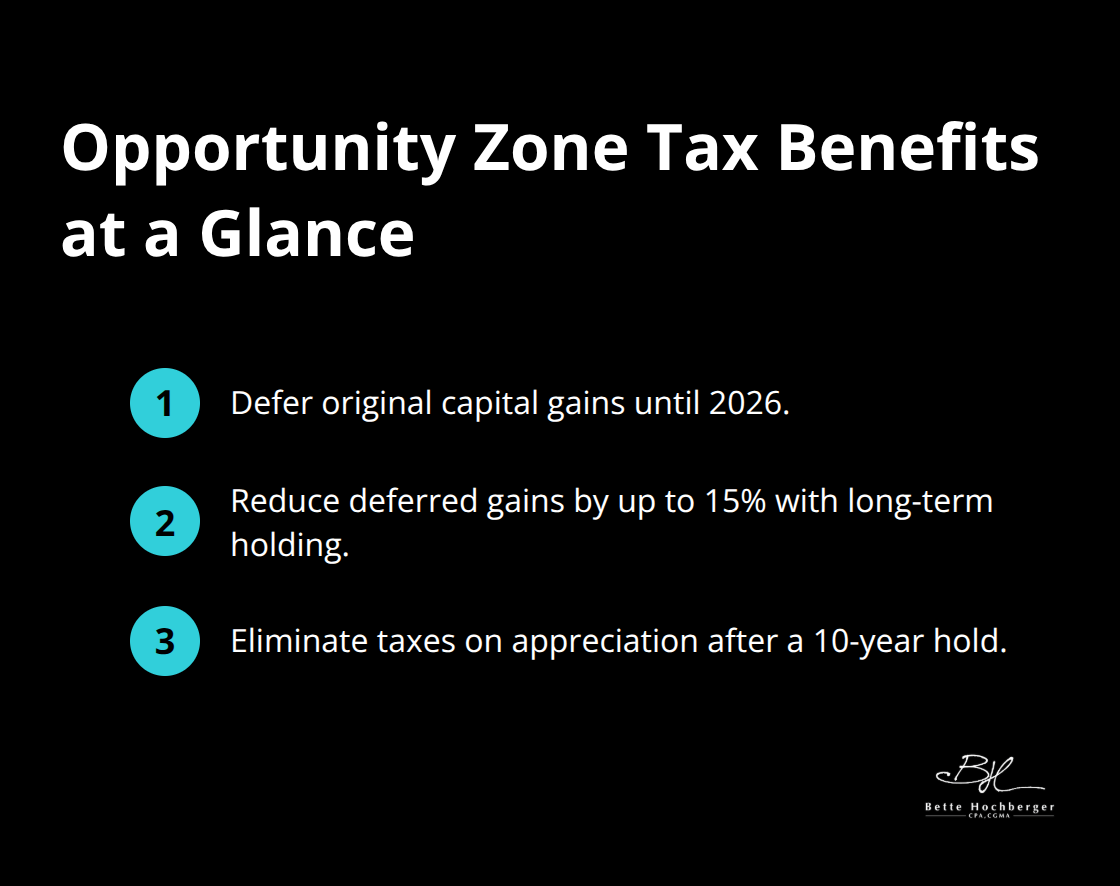

Smart investors leverage opportunity zone investments to eliminate capital gains taxes entirely when they hold investments for 10 years. The IRS created 8,764 designated opportunity zones across all 50 states, which offer three distinct tax benefits: deferral of original gains until 2026, reduction of deferred gains up to 15% for long-term holdings, and complete elimination of taxes on appreciation within the opportunity zone investment. Investors who moved $100 million into opportunity zone funds in 2018 now face zero taxes on any gains generated within these investments through 2028.

Opportunity Zones and Tax Credits

Historic tax credits generate 20% federal credits plus state credits that often reach 25% of qualified rehabilitation expenses. Low-income housing tax credits provide dollar-for-dollar tax reductions worth approximately $0.90 per dollar invested over 10 years. These credits stack with other tax benefits to create powerful wealth-building opportunities for sophisticated investors.

New Markets Tax Credits offer 39% credits over seven years for investments in low-income communities. Solar tax credits provide 30% federal credits for renewable energy installations (dropping to 26% in 2033). These credits work best when investors have substantial tax liability to offset.

Structuring Investments for Maximum Tax Efficiency

Investors should structure syndications as partnerships rather than LLCs taxed as corporations to maintain pass-through treatment and avoid double taxation. The 20% pass-through deduction under Section 199A reduces taxable income for investors with total income below $182,050 for single filers and $364,100 for married couples filing jointly.

Self-directed IRAs allow tax-deferred real estate investments, though UBIT (Unrelated Business Income Tax) applies to leveraged properties. Roth IRAs provide tax-free growth for younger investors who can wait decades before distributions. Solo 401(k) plans offer higher contribution limits and loan options for self-employed investors.

Capital Gains vs Ordinary Income Planning

Long-term capital gains rates of 0%, 15%, or 20% beat ordinary income rates that reach 37% for high earners. Investors should time syndication exits to occur in years with lower ordinary income to maximize the benefit of preferential capital gains treatment. Installment sales spread gain recognition over multiple years, which prevents investors from jumping into higher tax brackets.

Net investment income tax adds 3.8% to capital gains for investors with modified adjusted gross income exceeding $200,000 for singles and $250,000 for married couples. This additional tax makes timing decisions worth tens of thousands in tax savings for high-net-worth investors.

These advanced strategies require careful coordination with your overall tax situation, which makes professional guidance essential for avoiding costly mistakes that could trigger IRS scrutiny.

Common Tax Mistakes in Real Estate Syndications

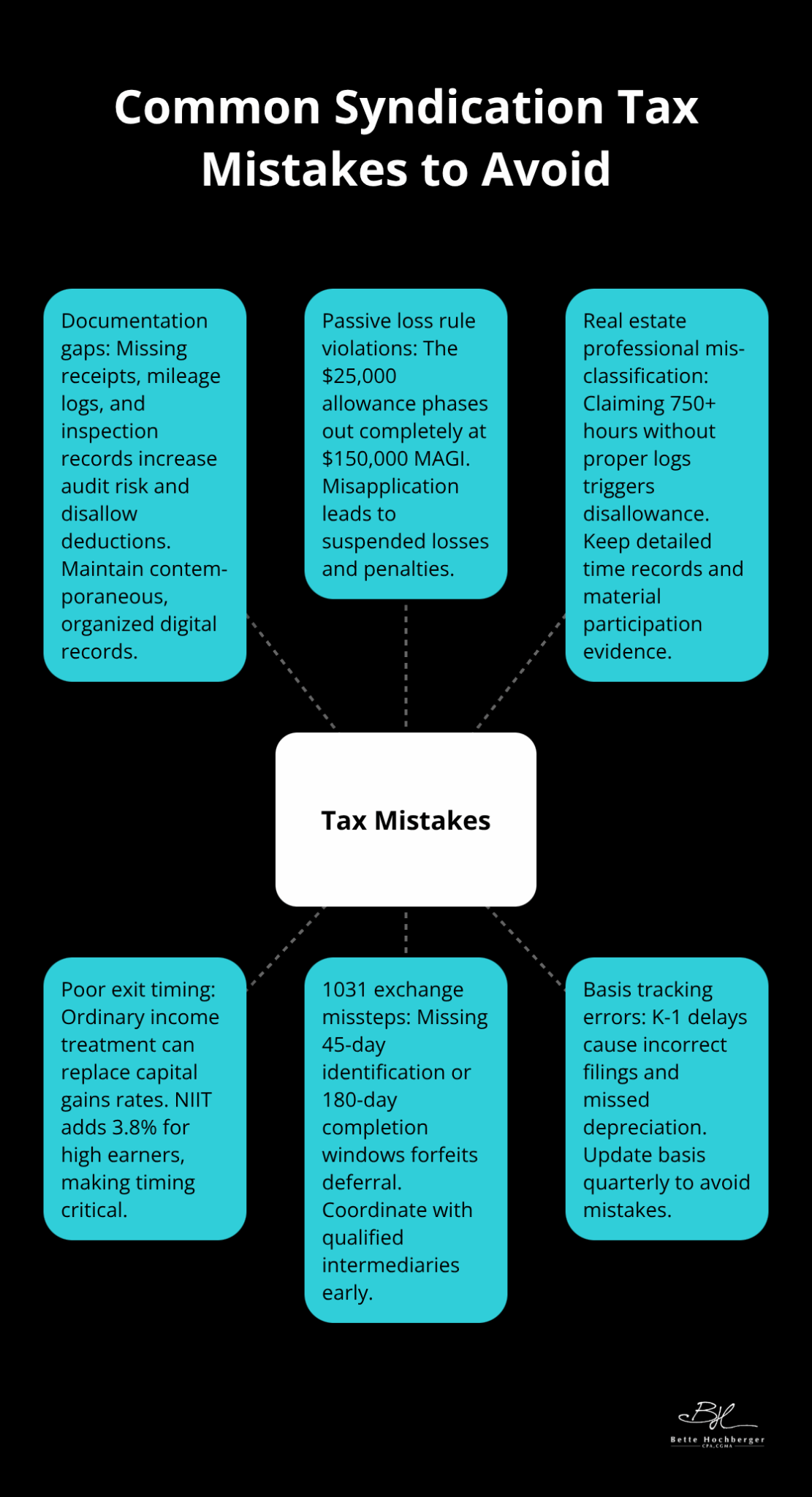

Most syndication investors lose 25-40% of their potential tax savings through preventable mistakes that compound year after year. The IRS examines syndication returns at higher rates than individual returns when documentation gaps exist, which makes proper record maintenance non-negotiable for serious investors.

Inadequate Documentation Triggers IRS Audits

Investors who fail to maintain detailed records face higher audit rates compared to those with complete documentation. The IRS requires substantiation for every deduction claimed, which includes receipts for travel expenses, professional fees, and property inspections.

Syndication investors must track their basis adjustments quarterly since K-1 forms arrive months after year-end. This creates gaps that lead to incorrect tax filings. Missing depreciation schedules cost investors significant amounts annually in lost deductions according to tax court records.

Digital record systems prevent most documentation problems, yet many investors still rely on paper files that get lost or damaged. Investors who maintain organized digital files reduce their audit risk substantially while maximizing available deductions.

Passive Activity Loss Rule Violations

The $25,000 passive loss allowance phases out completely at $150,000 modified adjusted gross income, but many high-income investors incorrectly claim these deductions anyway. Suspended passive losses must carry forward until you generate passive income or dispose of your entire syndication interest (partial sales don’t trigger loss recognition).

Real estate professional status requires 750 hours annually of material participation, yet investors routinely claim this status without proper time documentation. The IRS disallows billions in passive loss deductions annually due to improper classifications.

Investors who mix active and passive income sources without understanding the interaction rules face significant penalties per violation. These mistakes create long-term tax problems that reduce overall investment returns significantly.

Poor Exit Strategy Tax Planning

Syndication exits with poor timing result in ordinary income treatment instead of capital gains rates, which costs investors significantly more in taxes. Installment sales reduce tax burdens substantially for large gains, yet most investors take lump sum distributions that push them into maximum tax brackets.

The net investment income tax adds 3.8% to gains for high earners, which makes December sales particularly costly when combined with other annual income. Investors who fail to coordinate 1031 exchanges properly lose substantial amounts in deferred taxes per investment.

Exit strategies planned during acquisition prevent these costly mistakes that destroy wealth accumulation over time. Professional tax guidance becomes essential for investors who want to maximize their after-tax returns from syndication investments.

Final Thoughts

Real estate syndication tax optimization demands multiple strategies that work together to maximize your after-tax returns. Cost segregation studies paired with bonus depreciation create immediate tax savings that compound over time. Strategic use of 1031 exchanges defers capital gains indefinitely while opportunity zone investments eliminate taxes entirely on long-term holdings.

The 20% pass-through deduction reduces taxable income for investors who qualify, while proper exit timing prevents unnecessary tax burdens. Professional tax guidance becomes essential given the complexity of syndication tax rules and frequent regulatory changes (especially with evolving IRS interpretations). We at Bette Hochberger, CPA, CGMA help real estate investors navigate these complexities through strategic tax planning services.

Smart tax planning transforms syndication investments from good returns into exceptional wealth-building vehicles. Investors who implement these strategies consistently see 15-25% higher after-tax returns compared to those who ignore tax optimization. The key lies in proactive planning rather than reactive tax preparation, which allows you to structure investments for maximum benefit from day one.