VC-backed companies routinely miss significant tax savings that could add millions to their bottom line. A 2023 study by PwC found that 73% of startups fail to optimize their tax strategies during startup funding rounds.

We at Bette Hochberger, CPA, CGMA see founders focus entirely on raising capital while ignoring tax planning that could save 15-30% on their tax burden.

The cost of these oversights compounds with each funding round, creating unnecessary tax liabilities that drain resources from growth initiatives.

What Tax Traps Are Draining Your Startup’s Cash

VC-funded startups face three devastating tax mistakes that collectively drain billions from the startup ecosystem annually. These errors compound with each funding round and create unnecessary liabilities that steal resources from growth initiatives.

Employee Misclassification Penalties Hit Hard

Startups misclassify employees as contractors and face brutal financial consequences. If the determination was that the employee was misclassified, the employer is subject to back taxes, interest, and penalties. Companies must pay both employer and employee portions of Social Security and Medicare taxes (totaling 15.3%) plus unemployment taxes and workers’ compensation premiums. The IRS actively audits startups with high contractor ratios, particularly those in software development where worker classification lines blur frequently.

Stock Option Exercises Trigger Massive Tax Bills

Stock option exercises without proper planning destroy founder wealth systematically. Founders who miss Section 83(b) elections face ordinary income tax rates up to 37% on paper gains instead of capital gains rates of 20%. A typical Series A founder who exercises $1 million in options late pays $370,000 in taxes versus $200,000 with proper timing. The Alternative Minimum Tax adds another 28% burden on the spread between exercise price and fair market value. Companies that grow from $10 million to $100 million valuations between funding rounds create $90 million in additional AMT exposure for employees who exercise options during this growth phase.

R&D Credits Sit Unclaimed on Balance Sheets

Software startups systematically ignore R&D tax credits that offset 10% of qualified development expenses. Approximately 33% of U.S. businesses qualify for the Research & Development (R&D) tax credit under current law. Companies that spend $2 million annually on engineering salaries, contractor fees, and cloud computing costs qualify for $200,000 in federal credits plus state credits that average another $100,000. Qualified Small Businesses founded after 2012 apply these credits directly against payroll taxes and generate immediate cash flow relief.

California offers an additional 15% credit on the first $1 million of qualified expenses, while states like New York provide 9% credits with no cap. Startups can amend returns for three prior years to claim missed credits and potentially recover $900,000 in overlooked benefits.

These tax traps represent just the surface of optimization opportunities that most VC-backed companies overlook. Strategic tax planning requires sophisticated approaches that go far beyond basic compliance.

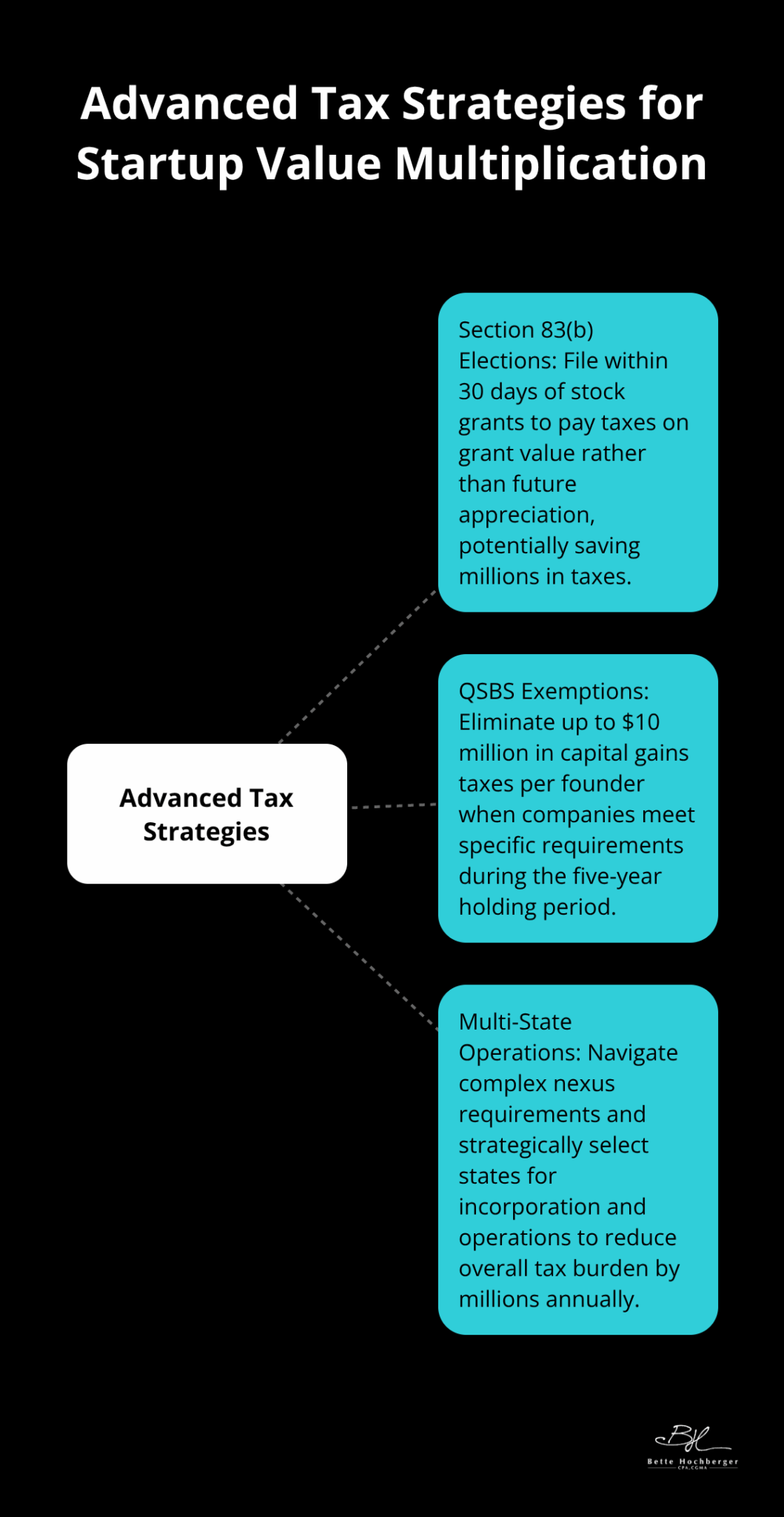

How Can Advanced Tax Strategies Multiply Your Startup Value

Section 83(b) Elections Demand Perfect Timing

VC-backed companies that master advanced tax strategies generate substantially more value for founders and investors than those that stick to basic compliance. Section 83(b) elections must be filed within 30 days of stock grants, yet many founders miss this deadline and pay ordinary income rates up to 37% instead of capital gains rates of 20% on future appreciation.

The election applies to restricted stock grants where vesting occurs over time. Founders who file early pay taxes on the grant value rather than the potentially massive appreciation at vesting. A founder who receives $500,000 in restricted stock that grows to $5 million over four years saves $1.35 million in taxes through proper 83(b) timing.

The IRS provides no extensions or second chances on this election, which makes it the most time-sensitive tax decision startup founders face.

QSBS Exemptions Eliminate Capital Gains Taxes

Qualified Small Business Stock exemptions eliminate up to $10 million in capital gains taxes per founder when companies meet specific requirements during the five-year holding period. The stock must be acquired directly from a C Corporation with gross assets under $50 million, and the company must conduct active business operations rather than passive investments.

Companies that structure QSBS properly from incorporation maximize this benefit for all stakeholders. The exemption applies to both founders and early employees who receive stock grants, creating substantial wealth preservation opportunities across the entire cap table.

Multi-State Operations Create Complex Tax Webs

Multi-state operations create complex nexus requirements that trigger tax obligations in states where companies have economic presence, employees, or sales above statutory thresholds. States like California impose franchise taxes of $800 minimum regardless of income, while Delaware charges based on authorized shares and assets.

Companies with remote employees in states like New York face additional payroll tax withholding requirements. Sales tax nexus rules vary dramatically between states with thresholds ranging from $100,000 in Connecticut to $500,000 in California (economic nexus thresholds that trigger compliance obligations).

Strategic state selection for incorporation and operations can reduce overall tax burden by millions annually. Many startups benefit from working with a fractional CFO to navigate these complex decisions. The next phase of tax optimization focuses on timing these strategies around specific funding events.

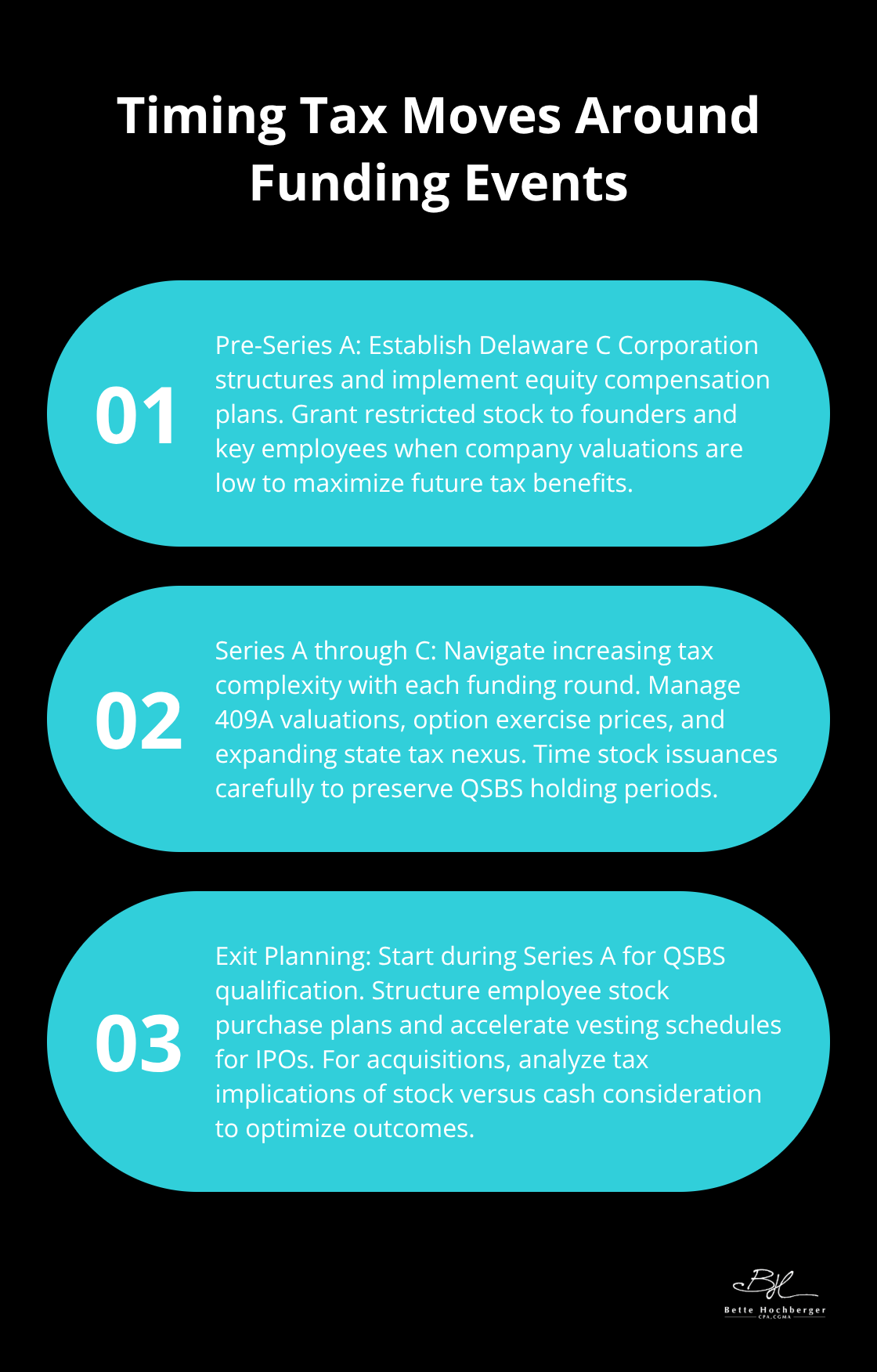

How Should You Time Tax Moves Around Funding Events

Tax strategy execution around funding rounds separates sophisticated startups from those that hemorrhage money to the IRS. Pre-Series A companies must establish Delaware C Corporation structures and implement equity compensation plans before valuations spike and create massive tax exposure. Companies that wait until after their first institutional round face 409A valuations that transform exercise prices significantly overnight, which creates substantial immediate tax liability for employees. The 30-day window for Section 83(b) elections closes permanently after stock grants, which makes pre-funding preparation non-negotiable for wealth preservation.

Lock in Low Valuations Before Institutional Money Arrives

Pre-funding optimization requires companies to establish equity structures when company valuations remain artificially low and 409A appraisals reflect minimal enterprise value. Founders should grant restricted stock to themselves and key employees during this narrow window when fair market value sits at low per-share amounts. Series A rounds typically increase valuations significantly, which transforms these same shares into higher-value obligations that trigger massive ordinary income recognition. Companies that complete equity grants six months before fundraising capture the maximum spread between grant value and eventual liquidity value.

Series Growth Phases Multiply Tax Complexity

Series A through C funding rounds create cascading tax obligations that compound without proper planning. Each round triggers new 409A valuations that reset option exercise prices higher and create additional AMT exposure for employees. Companies that raise significant Series B rounds see their common stock valuations jump substantially, which creates considerable taxable income for anyone who exercises options during this period. QSBS holding periods restart with each new stock issuance, which requires careful timing to preserve the five-year requirement for capital gains exemptions. State tax nexus expands aggressively as companies hire across multiple jurisdictions, with states like California and New York imposing immediate payroll tax obligations on remote employees.

Exit Strategies Demand Years of Advance Planning

Exit planning starts during Series A rounds, not months before acquisition or IPO events. QSBS qualification requires five-year holding periods from stock acquisition, which makes early planning mandatory for founders who want to eliminate significant capital gains taxes per person. Companies that plan IPOs must structure employee stock purchase plans and accelerate vesting schedules to minimize post-public tax burdens on rank-and-file employees. Acquisition scenarios require careful analysis of stock versus cash consideration, as all-stock deals preserve tax deferral while cash transactions trigger immediate recognition of all accumulated gains.

Final Thoughts

VC-funded startups systematically abandon millions in tax savings through poor planning and missed opportunities. The R&D Tax Credit alone recovers 10% of development expenses, yet 67% of eligible companies never file claims. Section 83(b) elections save founders up to $1.35 million per person, but only when filed within 30 days of stock grants.

The window for tax optimization closes rapidly as startup funding rounds progress and valuations spike. Companies that wait until Series B or C rounds face substantially higher tax burdens and fewer strategic options. Employee stock option exercises without proper AMT planning destroy founder wealth systematically (particularly during high-growth phases between funding rounds).

Professional tax advisory becomes mandatory when companies raise institutional capital, hire across multiple states, or approach exit scenarios. We at Bette Hochberger, CPA, CGMA help minimize tax liabilities while managing cash flow effectively for growing businesses. Start immediately by reviewing your current equity structure, filing any missed Section 83(b) elections, and calculating potential R&D credits from prior years.