The October 15th deadline approaches fast for taxpayers who filed extensions earlier this year. Missing this final date means facing penalties and interest charges that can add up quickly.

We at Bette Hochberger, CPA, CGMA see many taxpayers scramble during these final weeks. Smart planning now can save you money and stress before the 10/15 extended due date arrives.

What the October 15 Extended Deadline Really Means

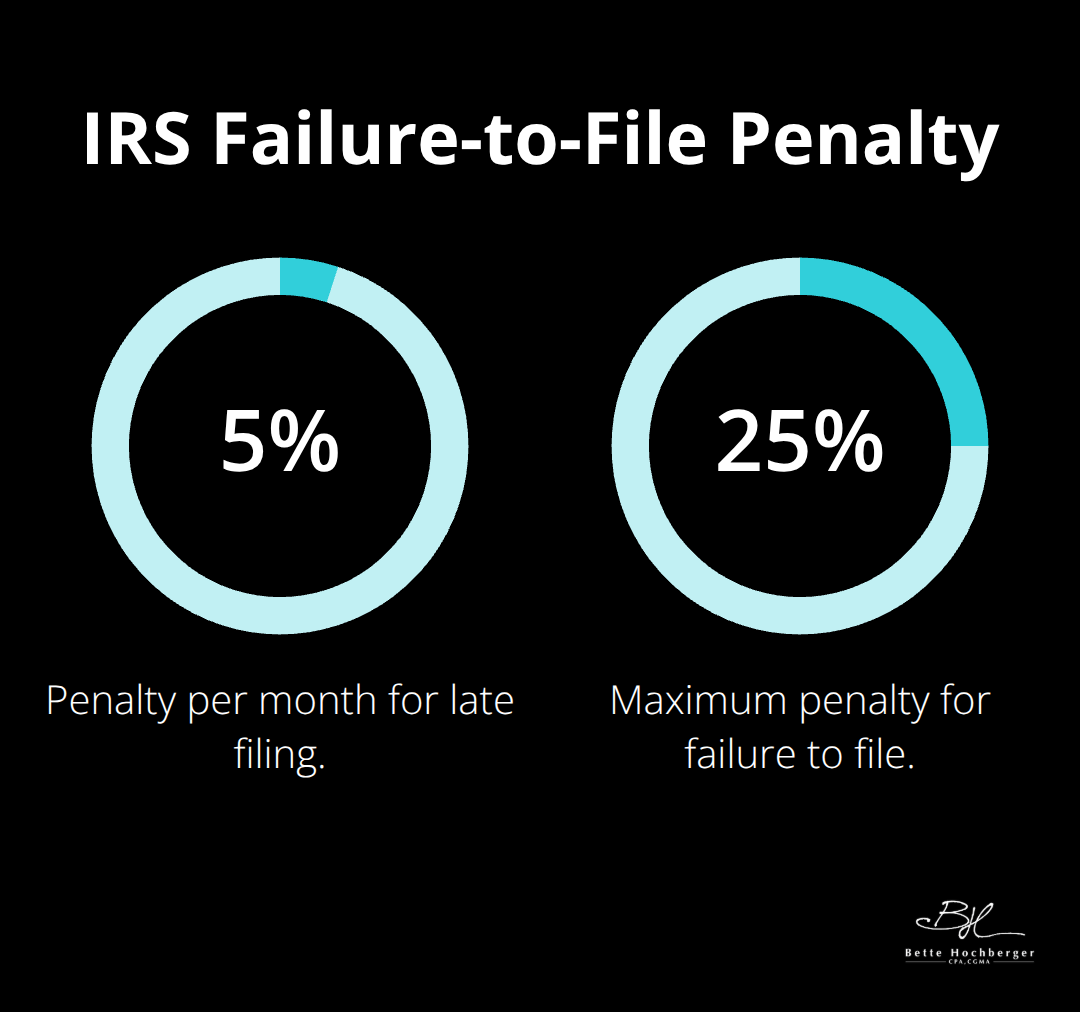

The October 15 deadline represents your final opportunity to file your 2024 tax return without harsh penalties. This date applies specifically to taxpayers who submitted Form 4868 before the original April 15 deadline. The IRS imposes a failure-to-file penalty of 5% of the tax due for each month or partial month your return remains late, with a maximum penalty of 25%. The agency sets the minimum penalty at $510 for returns filed more than 60 days late (or 100% of the amount owed if less than $510).

Filing Extension vs Payment Extension

Most taxpayers confuse this distinction, and it costs them money. An extension grants additional time to submit your paperwork only, not to pay taxes owed. You must pay at least 90% of your tax liability by the original April deadline to avoid failure-to-pay penalties of 0.5% per month. Interest accrues daily on unpaid balances at 8% for 2024. The IRS does not grant second extensions after October 15, which makes this your absolute final chance.

Who Qualifies for Extended Deadlines

Taxpayers who filed Form 4868 before April 15 automatically receive the October 15 extension. Military personnel who serve in combat zones get at least 180 days after they leave the combat zone to file. Taxpayers in federally declared disaster areas may receive additional extensions beyond October 15. U.S. citizens who live abroad qualify for an automatic two-month extension without Form 4868, but must still request additional time if needed.

Penalties That Accumulate Fast

The combined failure-to-file and failure-to-pay penalties cannot exceed 5% per month for an overdue return. However, interest continues to accrue on the unpaid balance even after penalties max out. The IRS calculates these charges from the original due date, not from when you miss the extended deadline. This means penalties and interest can accumulate for months before you even realize the full impact.

Now that you understand the stakes of the October 15 deadline, let’s examine the most common mistakes taxpayers make in these final weeks that can cost them thousands in penalties and missed opportunities.

Common Mistakes to Avoid Before the October 15th Deadline

The three weeks before October 15th expose the most expensive mistakes taxpayers make all year. Taxpayers who file without complete records trigger IRS audits at triple the normal rate according to Treasury Inspector General data. Returns that lack W-2s, 1099s, or business receipts face automatic correspondence audits that delay refunds by 6-12 months. The IRS matches your reported income against third-party documents, and discrepancies generate notices with penalties that start at $25 per form.

Incomplete Documentation Creates Audit Red Flags

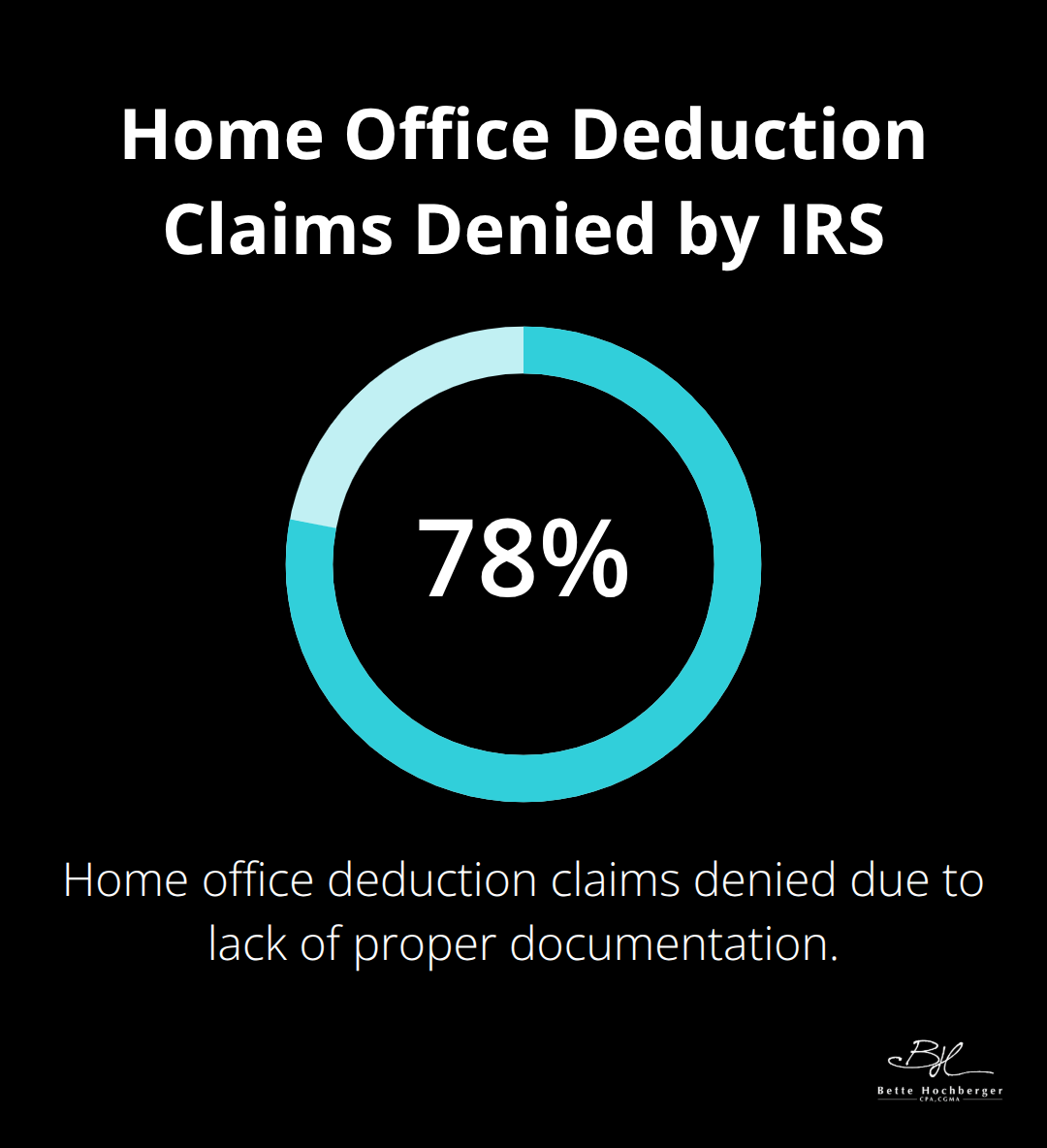

Business expenses above $75 require receipts to qualify for deductions during IRS examinations. The Cohan rule allows estimated expenses only when taxpayers demonstrate attempts to maintain records, but this protection disappears without any documentation. Professional service providers like attorneys and consultants lose an average of $8,400 in disallowed deductions when they cannot substantiate client entertainment or travel expenses. Home office deductions require detailed records that show exclusive business use, and the IRS denies 78% of these claims that lack proper documentation.

Estimated Tax Payment Gaps Generate Compound Penalties

Taxpayers who miss quarterly estimated payments face underpayment penalties of 8% annually on the shortage amount. The safe harbor rule requires payments equal to 100% of last year’s tax liability (or 110% if your adjusted gross income exceeded $150,000). Self-employed individuals and business owners who skip September 15th payments accumulate penalties from that date through October 15th. State tax agencies impose separate estimated payment penalties that average 12% annually, and these charges continue to accrue until you file both federal and state returns with full payment.

State Tax Requirements Often Get Overlooked

Many taxpayers focus solely on federal deadlines and forget state tax obligations that carry separate penalties. States like California impose failure-to-file penalties of 5% per month (up to 25% maximum) plus failure-to-pay penalties of 0.5% monthly. New York charges interest at 7.5% annually on unpaid balances, while Texas business franchise tax returns face penalties of $50 per month for late filings. These state-level mistakes can double your total penalty exposure and create additional compliance headaches that extend well beyond October 15th.

Tax Strategies to Implement Before October 15th

The final weeks before October 15th present your last chance to implement powerful tax reduction strategies that many taxpayers overlook. Maximum IRA contributions for 2024 stand at $7,000 for taxpayers under 50 and $8,000 for those 50 and older, and you can make these contributions right up to the filing deadline. Traditional IRA contributions reduce your taxable income dollar-for-dollar, potentially dropping you into a lower tax bracket. Health Savings Account contributions offer triple tax benefits with a 2024 limit of $4,300 for individual coverage and $8,550 for family coverage (plus an additional $1,000 catch-up contribution for taxpayers 55 and older). Self-employed individuals can establish and fund SEP-IRAs up to 25% of their net self-employment earnings or $69,000, whichever is less.

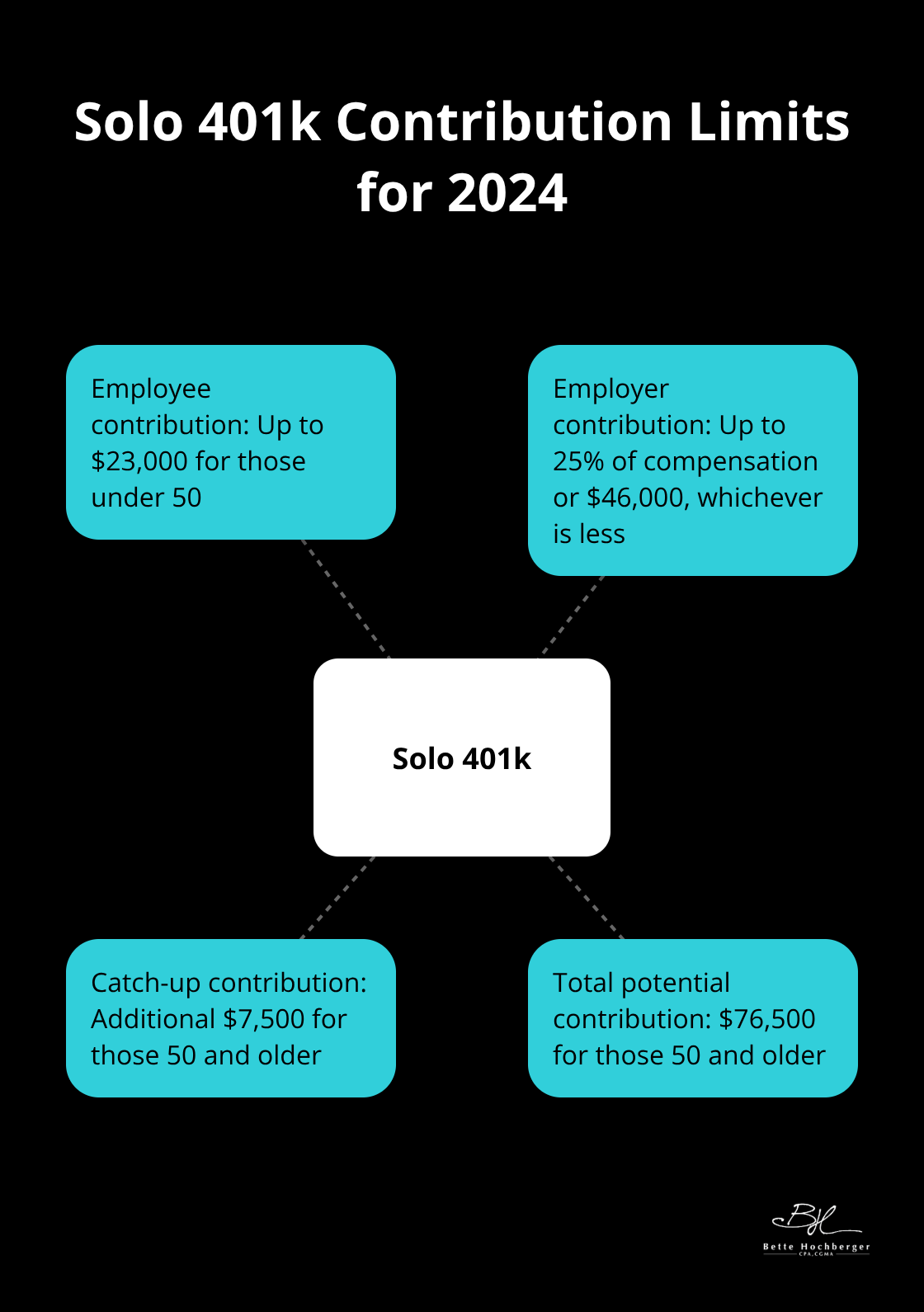

Retirement Account Contribution Limits

Solo 401k plans allow self-employed taxpayers to contribute up to $69,000 in 2024 as both employee and employer, with an additional $7,500 catch-up contribution for those 50 and older. This creates a potential total contribution of $76,500 that directly reduces taxable income. Defined benefit plans can accommodate even larger contributions for high-income professionals, with some plans that allow contributions exceeding $200,000 annually based on actuarial calculations. The key advantage lies in timing: these contributions can be made after year-end but before your filing deadline, which gives you months to evaluate your tax situation and optimize contributions accordingly.

Business Equipment Purchase Deductions

Equipment purchases under Section 179 allow immediate deduction of up to $1,220,000 for 2024, but the deduction phases out when total equipment purchases exceed $2,890,000. Bonus depreciation permits 80% first-year deduction on qualified business property placed in service during 2024. This strategy works particularly well for businesses that need computers, machinery, or vehicles before year-end. The IRS requires that you place equipment in service by December 31st to qualify for current-year deductions, making October the ideal time to finalize these purchases.

Professional Development and Business Meal Deductions

Business meals qualify for 100% deduction through 2024 if they meet specific requirements, while entertainment expenses remain non-deductible. Professional development expenses, including conferences, training, and certification programs, provide full deductions when directly related to your current business or profession. October presents a strategic opportunity to prepay 2025 training expenses that qualify for current-year deductions. Software subscriptions, professional memberships, and industry publications can also be prepaid to maximize current-year deductions while maintaining business operations.

Final Thoughts

The October 15 extended due for tax returns marks your absolute final chance to file without severe penalties that accumulate from the original April deadline. Act now to gather all required documents, calculate outstanding tax liabilities, and submit your return before this deadline expires. Professional assistance from Bette Hochberger, CPA, CGMA helps you navigate complex requirements while identifying tax-saving opportunities you might miss on your own.

Experienced tax professionals prevent costly mistakes that trigger IRS audits and additional penalties. We help businesses and individuals meet their obligations while maximizing available deductions and credits. Our expertise saves you time and money during this critical period when every day counts toward penalty calculations.

Start next year’s preparation immediately after you file your current return to avoid future deadline stress. Establish quarterly payment schedules and maintain organized expense records throughout the year rather than reconstruct everything next October. This proactive approach transforms tax season from a stressful scramble into a manageable process (and often results in better outcomes for your financial situation).

![Are VC-Funded Startups Leaving Money on the Table? [Tax Guide]](https://bettehochberger.com/wp-content/uploads/emplibot/Are-VC-Funded-Startups-Leaving-Money-on-the-Table_-_Tax-Guide__1759839079-500x383.jpeg)