At Bette Hochberger, CPA, CGMA, we understand that preserving wealth is a top priority for our clients.

Ultra high net worth tax planning is a critical component of wealth management, helping individuals safeguard their assets and minimize tax liabilities.

This blog post will explore effective strategies and advanced techniques for optimizing your tax position and protecting your wealth for generations to come.

What Is Wealth Management Tax Planning?

The Strategic Approach to Asset Preservation

Wealth management tax planning is a strategic approach to preserve and grow assets while minimizing tax liabilities. This process forms a critical component of financial success for high-net-worth individuals and businesses.

The Impact of Proactive Tax Planning

Proactive tax planning can significantly affect your bottom line. A study by KPMG found that automated tax preparation solutions can reduce errors by up to 70%, but human review is still necessary to ensure accuracy. This reduction in errors can lead to more efficient tax planning and potentially lower tax liabilities.

Essential Elements of an Effective Tax Strategy

An effective tax strategy must be multifaceted and tailored to your unique financial situation. Here are some key components:

- Income Timing: Strategic timing of income receipt can make a substantial difference. For instance, deferring income to a future tax year (when you might be in a lower tax bracket) can result in significant savings.

- Deduction Maximization: The identification and leverage of all available deductions is essential.

- Investment Structure: The structure of your investments can dramatically affect your tax liability. For example, the use of tax-efficient investment vehicles (such as municipal bonds or index funds) can reduce your taxable income.

The Ongoing Nature of Tax Planning

Tax planning isn’t a one-time event; it’s an ongoing process that evolves with your financial situation and changes in tax laws. Recent tax provisions in the newly finalized reconciliation bill will shape how financial professionals advise clients, highlighting the importance of staying updated with tax law changes.

Integration with Overall Financial Strategy

The integration of tax planning into your overall financial strategy is paramount. This integration doesn’t just save money on taxes; it creates a foundation for long-term wealth preservation and growth.

As we move forward, we’ll explore specific strategies for minimizing tax liability, which form the next crucial step in effective wealth management tax planning.

How to Minimize Your Tax Liability

Smart Asset Allocation

At Bette Hochberger, CPA, CGMA, we believe that strategic asset allocation forms the foundation of effective wealth management. We recommend placing high-yield investments in tax-advantaged accounts while keeping tax-efficient investments in taxable accounts. For example, you should hold dividend-paying stocks in your IRA to defer taxes on those dividends.

A Vanguard study found that proper asset location can add up to 0.75% in annual returns. This percentage may seem small, but over time, it can lead to substantial wealth preservation.

Maximizing Tax-Advantaged Accounts

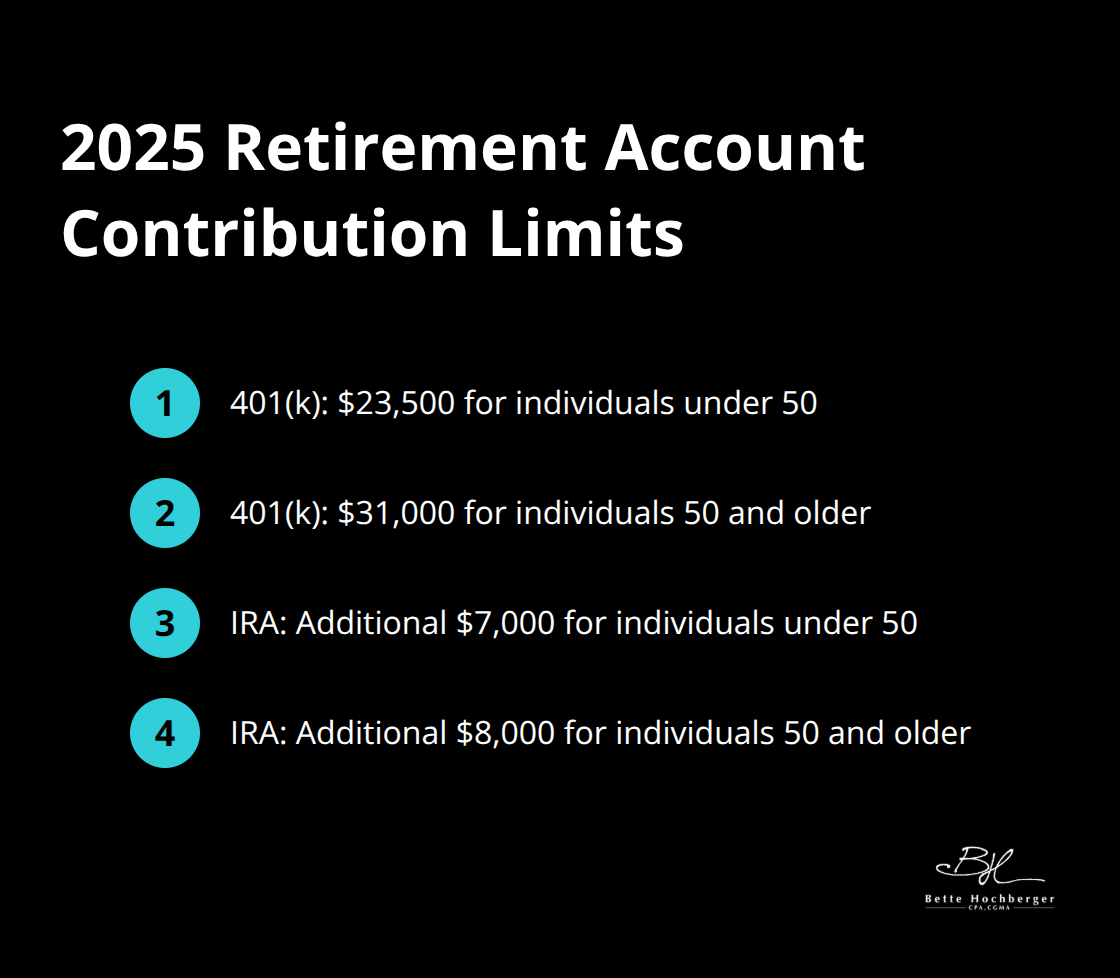

We strongly advocate for maximizing contributions to retirement accounts. For 2025, you can contribute up to $23,500 to your 401(k), or $31,000 if you’re 50 or older. IRAs allow an additional $7,000, or $8,000 for those 50 and above.

Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,150 for individual coverage or $8,300 for family coverage (these amounts include catch-up contributions for those 55 and older).

Strategic Charitable Giving

Charitable giving doesn’t just benefit your favorite causes; it can also reduce your tax bill. We often recommend setting up a Donor-Advised Fund (DAF) for our clients. A DAF allows you to make a large charitable contribution in a high-income year, receive an immediate tax deduction, and then distribute the funds to charities over time.

The National Philanthropic Trust reported that DAFs grew by 27.3% in 2021, highlighting their increasing popularity as a tax-smart giving strategy.

Proactive Tax-Loss Harvesting

Tax-loss harvesting should be a year-round strategy, not just an end-of-year consideration. You can offset capital gains and potentially reduce your tax bill by selling investments at a loss. The IRS allows you to deduct up to $3,000 in net capital losses against your ordinary income each year.

Tax loss harvesting, or TLH for short, is selling an asset at a loss (which can happen especially during market downturns) primarily to offset taxes owed on gains. This strategy requires careful monitoring and execution to maximize its benefits.

These strategies provide a solid foundation for minimizing your tax liability, but they represent just the tip of the iceberg. In the next section, we’ll explore advanced tax planning techniques that can further enhance your wealth preservation efforts.

Advanced Tax Strategies for Wealth Preservation

At Bette Hochberger, CPA, CGMA, we understand the power of advanced tax planning techniques in wealth preservation. Let’s explore some potent strategies that extend beyond basic tax planning.

Estate Planning: Beyond the Will

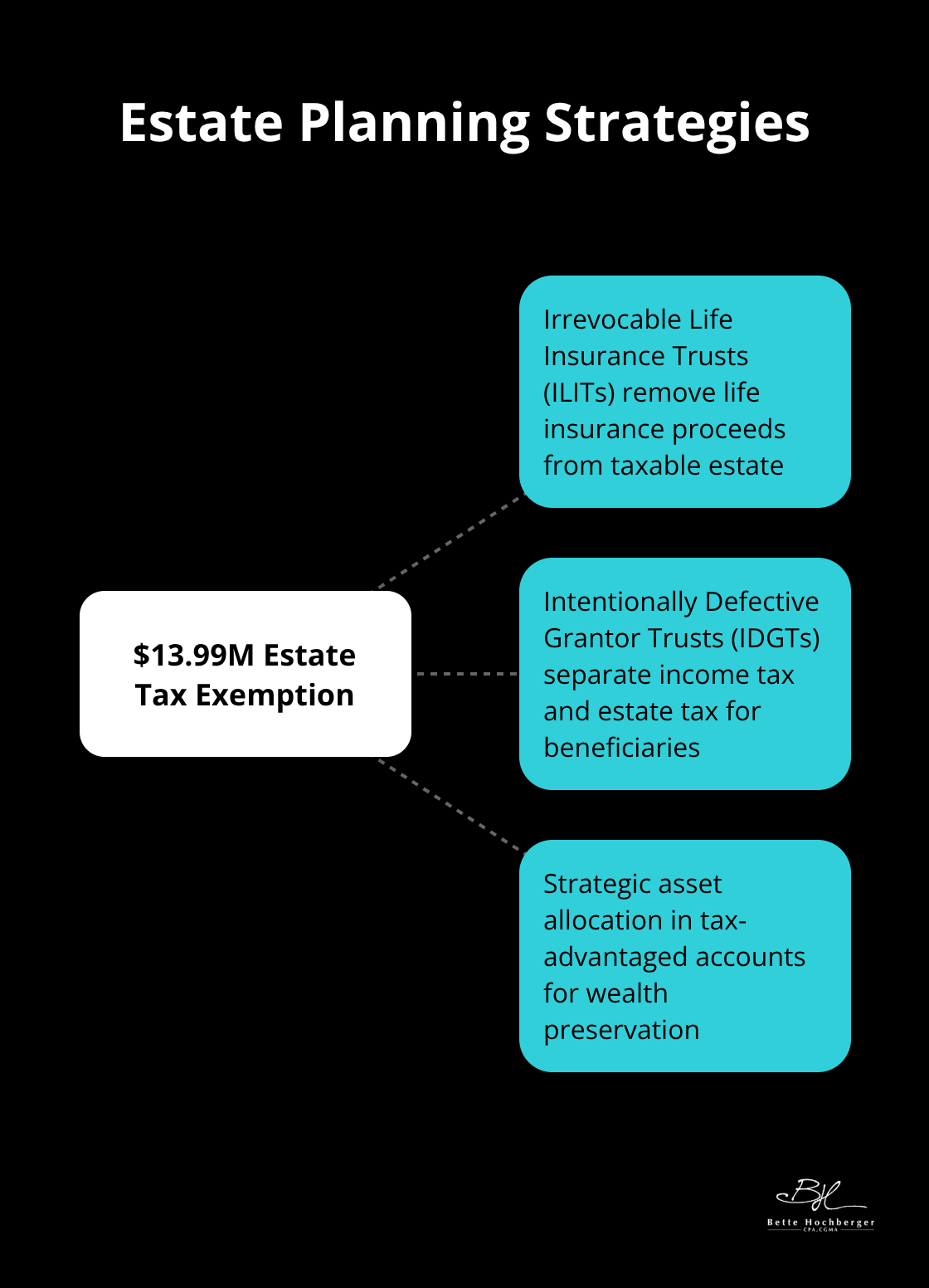

Estate planning protects your wealth for future generations. The federal estate tax exemption for 2025 stands at $13.99 million per individual. Effective estate planning involves more than just staying under these thresholds.

We often recommend the use of irrevocable life insurance trusts (ILITs). An ILIT removes life insurance proceeds from your taxable estate, potentially saving your heirs millions in estate taxes.

Asset Protection Through Trusts

Trusts offer powerful asset protection and tax minimization tools. One particularly effective instrument is the Intentionally Defective Grantor Trust (IDGT).

An IDGT separates income tax and estate tax in a way that benefits you and your heirs. By moving assets into this trust, you can save money on estate taxes while allowing the trust assets to grow tax-free, effectively creating a tax-free gift to your beneficiaries.

Tax Optimization via Business Structures

The right business entity choice significantly impacts your tax liability. S Corporations, for example, help business owners save on self-employment taxes.

The optimal structure depends on various factors, including your income level, growth plans, and exit strategy. Proper guidance through this decision often saves tens of thousands in taxes annually.

Cross-Border Tax Planning

For high-net-worth individuals with international interests, cross-border tax planning becomes essential. The Foreign Account Tax Compliance Act (FATCA) necessitates correct reporting of foreign assets.

One strategy for clients with significant foreign income involves the use of foreign tax credits. This approach helps avoid double taxation on income earned abroad.

These advanced strategies require expert guidance. While they offer significant benefits, they also come with complexities and potential pitfalls. Working with experienced professionals tailors these strategies to your unique financial situation.

Final Thoughts

Effective wealth management tax planning requires expert guidance and a comprehensive approach. We implement powerful strategies to preserve and grow your wealth, from strategic asset allocation to advanced techniques like trusts and cross-border tax planning. Ultra high net worth tax planning demands a deep understanding of complex tax laws and regulations to create long-term strategies aligned with your financial goals.

Proactive tax planning offers benefits beyond immediate tax savings. It can increase after-tax returns, protect assets from unnecessary taxation, and create a lasting financial legacy. Tax laws constantly evolve, so strategies that work today may need future adjustments (which is why regular reviews are essential).

Bette Hochberger, CPA, CGMA specializes in personalized financial services for businesses and professionals. Our team of experts utilizes advanced cloud technology to provide strategic tax planning, Fractional CFO services, and tax preparation tailored to your unique financial situation. We can help you implement the right strategies to minimize tax liabilities, manage cash flow, and ensure long-term profitability.