At Bette Hochberger, CPA, CGMA, we often get asked: “What does fractional CFO mean?” It’s a term that’s gaining traction in the business world, especially among small and medium-sized enterprises.

A fractional CFO is a financial expert who provides high-level strategic guidance on a part-time or contract basis. This blog post will explore the role of a fractional CFO, its benefits, and when your business might need one.

What Does a Fractional CFO Do?

Key Responsibilities

A fractional CFO provides high-level financial strategy and management on a part-time or contract basis. This financial expert takes on critical tasks such as:

- Developing and implementing financial strategies

- Managing cash flow

- Creating budgets and forecasts

- Analyzing financial data to guide decision-making

A recent Deloitte survey revealed that over 52% of executives outsource at least one finance function. This practice improves forecasting accuracy and allows in-house teams to focus on growth initiatives.

Fractional vs. Traditional CFOs

Unlike traditional CFOs who work full-time for a single company, fractional CFOs serve multiple clients simultaneously. This arrangement allows businesses to access top-tier financial expertise without committing to a full-time salary and benefits package. The flexibility of fractional CFO services has sparked a 103% year-over-year increase in demand for these professionals in the U.S.

Qualifications and Experience

Fractional CFOs typically bring a wealth of experience to the table. Most have held senior financial positions in various industries, giving them a broad perspective on business challenges. They often hold advanced degrees in finance or accounting and professional certifications (such as CPA or CGMA).

Impact on Business Performance

The impact of a fractional CFO can be substantial. 37% of small businesses outsource at least one business process. This trend signifies a move towards improving efficiency and profitability through outsourced financial leadership. Fractional CFOs implement robust forecasting models, which lead to significant improvements in cash-flow visibility and overall financial management.

Technology and Innovation

Modern fractional CFOs leverage cutting-edge financial technology to deliver tailored solutions. This blend of expertise and innovation allows them to provide strategic insights that drive business growth and profitability. As businesses continue to seek cost-effective financial leadership, the role of fractional CFOs becomes increasingly vital in navigating complex financial landscapes and driving sustainable growth.

Why Fractional CFOs Are Game-Changers

Cost-Effective Financial Leadership

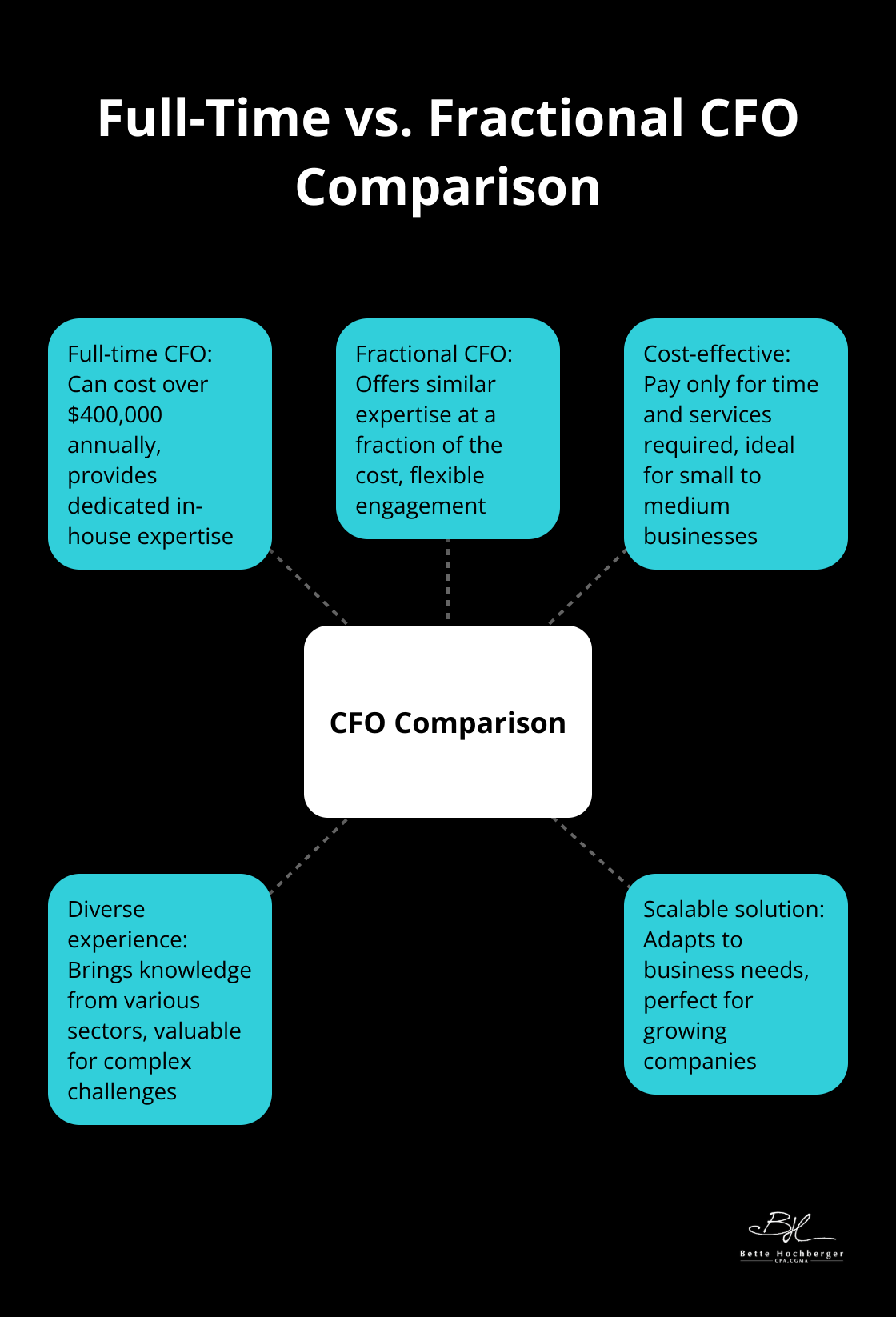

Fractional CFOs revolutionize financial management by offering top-tier expertise without the hefty price tag. Companies can reduce CFO costs significantly through fractional services. A full-time CFO might demand over $400,000 annually, but a fractional CFO provides similar expertise for a fraction of the cost. This arrangement allows businesses to access high-level financial acumen on an as-needed basis, paying only for the time and services required.

Flexible Services Tailored to Your Needs

The adaptability of fractional CFO services sets them apart. As your business evolves or faces challenges, you can adjust the level of involvement. This flexibility proves particularly valuable for startups and small businesses experiencing rapid growth or seasonal fluctuations. The trend towards flexible financial leadership is evident in the growing outsourcing market, which was worth $302.62 billion in 2024 and is expected to reach $525.23 billion by 2030.

Diverse Industry Experience

Fractional CFOs bring a wealth of knowledge from various sectors to your business. Their broad perspective on financial strategies and best practices becomes invaluable when you navigate complex financial landscapes or explore new market opportunities. This diverse experience often translates into innovative solutions tailored to your specific industry challenges.

Data-Driven Decision Making

With a fractional CFO, you gain a strategic partner who translates complex financial data into actionable insights. They implement robust forecasting models and performance tracking systems, which lead to more informed decision-making.

Strategic Financial Guidance

Fractional CFOs provide strategic financial guidance that aligns with your specific goals and challenges. Whether you’re a startup looking to scale or an established business seeking to optimize financial operations, a fractional CFO can serve as the catalyst for your next phase of growth. Their expertise helps you navigate financial complexities, identify growth opportunities, and make sound financial decisions that propel your business forward.

As businesses continue to recognize the value of expert financial management without the commitment of a full-time executive, the demand for fractional CFOs continues to rise. This trend underscores the importance of considering when your business might benefit from engaging a fractional CFO.

When Do You Need a Fractional CFO

Recognizing the right time to bring in a fractional CFO can transform your business. These financial experts offer strategic guidance during critical phases of your company’s growth and development. Let’s explore some key scenarios where a fractional CFO can provide significant value.

Rapid Growth and Scaling

If your business experiences rapid growth, a fractional CFO becomes invaluable. A typical company grew at only 2.8 percent per year during the ten years preceding COVID-19, and only one in eight recorded higher growth rates. A fractional CFO can implement scalable financial systems, manage cash flow during expansion, and ensure your growth remains sustainable. They’ll help you avoid common pitfalls (like overextension of resources or inadequate financial planning) that can derail even the most promising ventures.

Financial Challenges and Restructuring

When you face financial difficulties, a fractional CFO can serve as your lifeline. They bring fresh perspectives and specialized knowledge to turn around struggling businesses. Fractional CFOs can identify cost-saving opportunities, negotiate with creditors, and develop strategies to improve profitability. Their objective viewpoint often uncovers solutions that internal teams might overlook.

Preparing for Funding or Acquisition

If you plan to gear up for a funding round or consider an acquisition, a fractional CFO becomes indispensable. They can prepare your financial statements, create compelling financial projections, and help you understand your company’s true value. Research shows that startups with more than 30% of their revenue coming from a single client are particularly vulnerable to cash flow issues. Fractional CFOs also play a key role in due diligence processes, ensuring you’re well-prepared for scrutiny from potential investors or buyers.

Strategic Financial Planning

A fractional CFO excels at strategic financial planning. They analyze your current financial position, identify areas for improvement, and create a roadmap for future growth. This includes setting realistic financial goals, developing budgets, and creating forecasts that align with your business objectives. Their expertise allows you to make informed decisions about investments, expansions, and resource allocation.

Navigating Complex Financial Landscapes

As your business grows, you may encounter complex financial situations (such as mergers, international expansions, or regulatory changes). A fractional CFO brings specialized knowledge to navigate these challenges. They stay updated on industry trends and regulations, ensuring your business remains compliant and competitive. Their experience across various sectors allows them to provide insights and strategies tailored to your specific industry needs.

Final Thoughts

Fractional CFOs offer a powerful solution for businesses seeking top-tier financial expertise without full-time commitments. These professionals provide strategic insight, industry experience, and cost-effective services that transform financial landscapes. Organizations of all sizes benefit from the flexible approach of a fractional CFO, which adapts to their unique needs and challenges.

Strategic financial management plays a vital role in today’s competitive business environment. A fractional CFO brings a fresh perspective to financial operations, helps navigate complex challenges, and enables data-driven decisions. Their expertise proves invaluable during rapid growth, funding preparations, or when companies need to optimize financial processes.

At Bette Hochberger, CPA, CGMA, we offer comprehensive fractional CFO services tailored to your specific requirements. Our team leverages advanced cloud technology and industry knowledge to deliver personalized financial strategies. We strive to answer the question “What does fractional CFO mean?” through our commitment to helping you achieve your financial goals and unlock your company’s full potential.