Startups face unique financial challenges that can make or break their success. A Fractional CFO for startups can provide expert financial guidance without the hefty price tag of a full-time executive.

At my firm, we understand the critical role a Fractional CFO plays in steering young companies toward financial stability and growth. This guide will help you navigate the process of selecting the right Fractional CFO for your startup’s specific needs.

What Does a Fractional CFO Do?

Strategic Financial Planning

A Fractional CFO provides high-level strategic guidance and financial management on a part-time or project basis. This role proves particularly valuable for startups and small businesses that need sophisticated financial guidance but can’t justify the expense of a full-time CFO.

Fractional CFOs develop comprehensive financial strategies tailored to a startup’s specific needs and growth stage. They create financial models, forecast cash flow, and set budgets that align with the company’s goals. A study by Deloitte reveals that 83% of surveyed executives are leveraging AI as part of their outsourced services (AI-powered outsourcing).

Fundraising and Investor Relations

One of the most critical functions of a Fractional CFO involves assistance with fundraising efforts. They prepare financial documents, create pitch decks, and help negotiate terms with potential investors. The American Institute of CPAs reports that businesses engaging CFO services see improved compliance with financial regulations and oversight (which is essential for attracting investors).

Cost Management and Profitability Analysis

Fractional CFOs identify areas where costs can decrease and profitability can improve. They analyze financial data to uncover inefficiencies and implement strategies to optimize operations. Some companies that utilize fractional CFO services report improved net margins from 14% to 28% within 6 months.

Flexibility and Cost-Effectiveness

Unlike full-time CFOs, fractional CFOs offer flexible engagement terms. Startups can access top-tier financial expertise without the commitment of a full-time salary and benefits package. Typical costs for fractional CFO services range from $3,000 to $10,000 per month (depending on the scope of work and company size).

Technology Integration and Process Improvement

A skilled Fractional CFO stays up-to-date with the latest financial technologies and best practices. They can recommend and implement advanced financial software, streamline processes, and improve overall operational efficiency. This technological expertise often results in more accurate financial reporting and faster decision-making capabilities for startups.

As we move forward, it’s important to understand the essential qualities that make a Fractional CFO truly effective for your startup. Let’s explore the key attributes you should look for when selecting the right financial partner for your business.

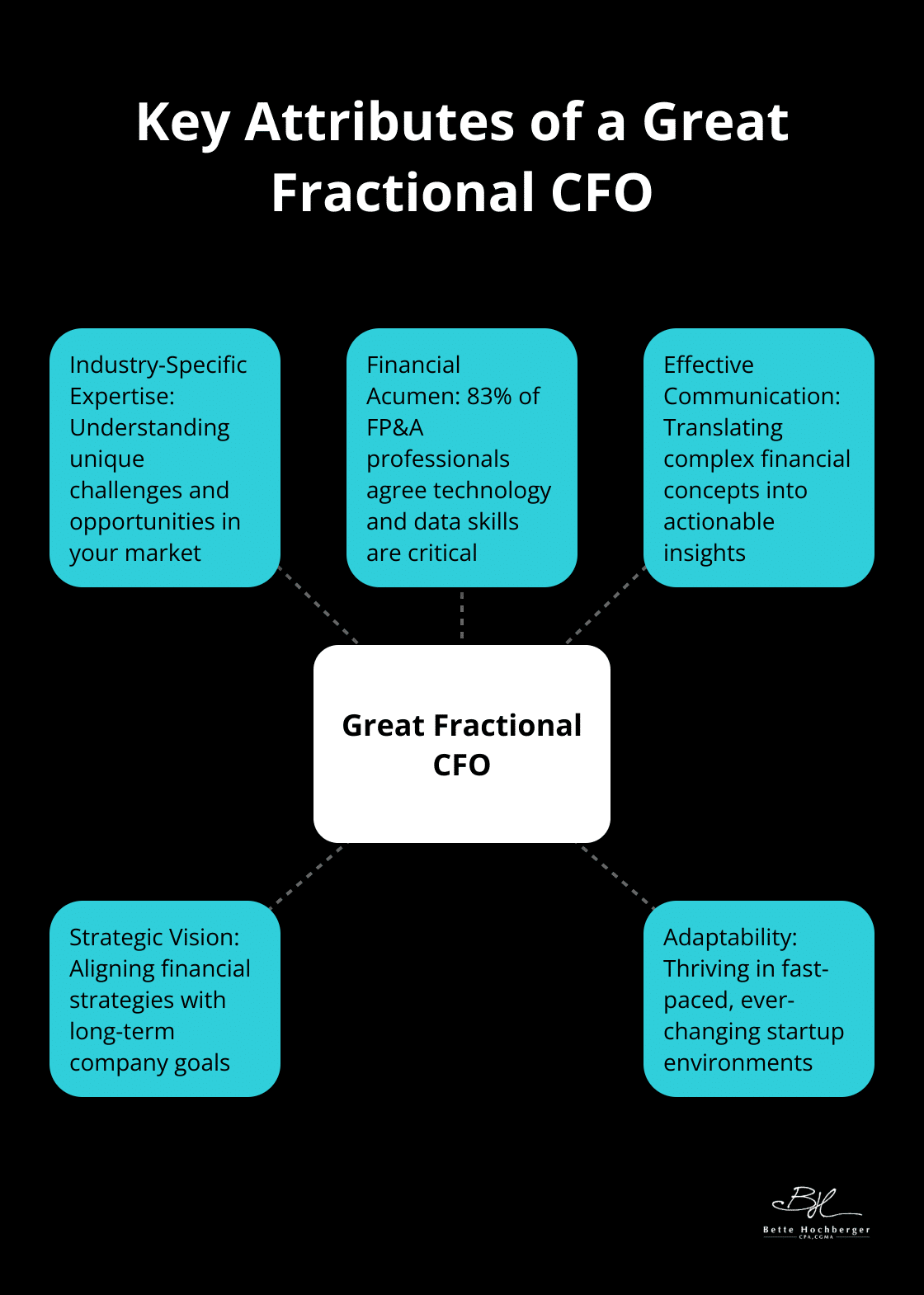

What Makes a Great Fractional CFO?

Industry-Specific Expertise

A Fractional CFO with experience in your industry will provide immediate value. They understand the unique challenges and opportunities in your market. For example, a CFO experienced in SaaS startups will know the importance of metrics like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC). This knowledge allows them to make informed decisions tailored to your business model.

Financial Acumen and Forecasting Skills

The best Fractional CFOs excel at financial analysis and forecasting. They create detailed financial models that account for various scenarios your startup might face. 83% of FP&A professionals agree that technology and data skills are critical in today’s business environment. Look for a CFO who can translate complex data into actionable insights for your team.

Effective Communication

A top-tier Fractional CFO translates financial jargon into clear, actionable language. This skill proves invaluable when presenting to investors or board members who may not have a finance background. Your Fractional CFO should explain complex financial concepts in a way that empowers decision-making across your organization.

Strategic Vision

The best Fractional CFOs think beyond numbers. They connect financial data to your startup’s overall strategy and growth objectives. This strategic thinking allows them to provide valuable input on business decisions, not just financial ones. Look for a CFO who can align financial strategies with your company’s long-term vision.

Adaptability in a Startup Environment

Startups operate in fast-paced, ever-changing environments. Your Fractional CFO must thrive in ambiguity and pivot strategies quickly. They should have experience working with limited resources and prioritize financial initiatives that will have the most significant impact on your startup’s growth. Ask potential candidates for specific examples of how they’ve helped other companies overcome financial challenges or achieve growth milestones in similar high-pressure situations.

As you evaluate potential Fractional CFOs, consider their track record with startups similar to yours. The right Fractional CFO can transform your startup’s financial trajectory, providing the leadership needed to navigate the complex journey from early-stage to established business. Now, let’s explore the practical steps you can take to hire the ideal Fractional CFO for your startup.

How to Hire Your Ideal Fractional CFO

Define Your Financial Priorities

Start by outlining your startup’s specific financial needs. Do you need to raise capital, improve cash flow management, or prepare for rapid scaling? A survey by CFO.com found that 72% of companies who clearly defined their financial priorities before hiring a Fractional CFO reported higher satisfaction with their choice. This clarity will guide your search and help potential candidates understand your expectations.

Conduct a Thorough Search

Expand your search when looking for candidates. Use professional networks, industry associations, and specialized recruiting firms. The CFO Leadership Council reports that 65% of successful Fractional CFO placements come through professional referrals. Don’t limit your your search to local candidates; many Fractional CFOs work remotely, providing strategic oversight, managing cash flow, and supporting investor relations, which expands your pool of potential talent.

Scrutinize Experience and Qualifications

When you evaluate candidates, prioritize those with a track record in your industry and growth stage. Look for certifications like CPA or MBA (which indicate a strong foundation in financial management).

Assess Cultural Fit and Communication Style

The best Fractional CFO for your startup will integrate with your team and effectively communicate complex financial concepts. During interviews, present real scenarios your company has faced and ask how they would approach them. This gives insight into their problem-solving skills and how well they align with your company’s decision-making style.

Negotiate Terms and Set Clear Expectations

After you identify your top candidate, negotiate terms. Be transparent about your budget and expected time commitment. Define deliverables, reporting structures, and key performance indicators (KPIs) to measure success.

Final Thoughts

Selecting the right Fractional CFO for startups will significantly impact your company’s financial trajectory and overall success. A Fractional CFO brings more than just financial expertise; they offer strategic insights, industry knowledge, and the ability to navigate complex financial landscapes. Their adaptability and cost-effectiveness make them an invaluable asset for young companies looking to scale efficiently.

Focus on candidates who possess strong financial acumen and demonstrate a deep understanding of your industry and startup environment. Look for professionals who communicate complex financial concepts clearly and align their strategies with your company’s vision. The right financial leadership can give your startup a competitive edge, inform financial decisions, and pave the way for sustainable growth.

At Bette Hochberger, CPA, CGMA, we provide personalized financial services, including Fractional CFO solutions tailored to the unique needs of startups and growing businesses. Our team uses advanced cloud technology and industry expertise to help clients minimize tax liabilities, manage cash flow, and ensure profitability. Take the time to find a Fractional CFO who not only understands the numbers but also shares your passion for innovation and success.