Choosing the right tax filing status can significantly impact your tax liability and potential refund. At Bette Hochberger, CPA, CGMA, we understand the importance of making this decision wisely.

Your tax filing status affects everything from your tax bracket to the deductions and credits you’re eligible for. This guide will help you navigate the different options and select the most advantageous status for your situation.

Who Qualifies for Single Filing Status?

Definition and Eligibility

The single filing status applies to individuals who are unmarried, divorced, or legally separated as of December 31 of the tax year. This status also includes those who have never married or whose spouse died in a previous year and have not remarried.

Advantages of Single Filing

Filing as single offers several benefits:

- Simplicity: It requires less paperwork than other statuses.

- Flexibility: Single filers can claim certain deductions and credits without considering a spouse’s income or deductions.

- Standard Deduction: For the 2025 tax year, single filers will have a standard deduction of $15,000. This amount can significantly reduce taxable income for many individuals.

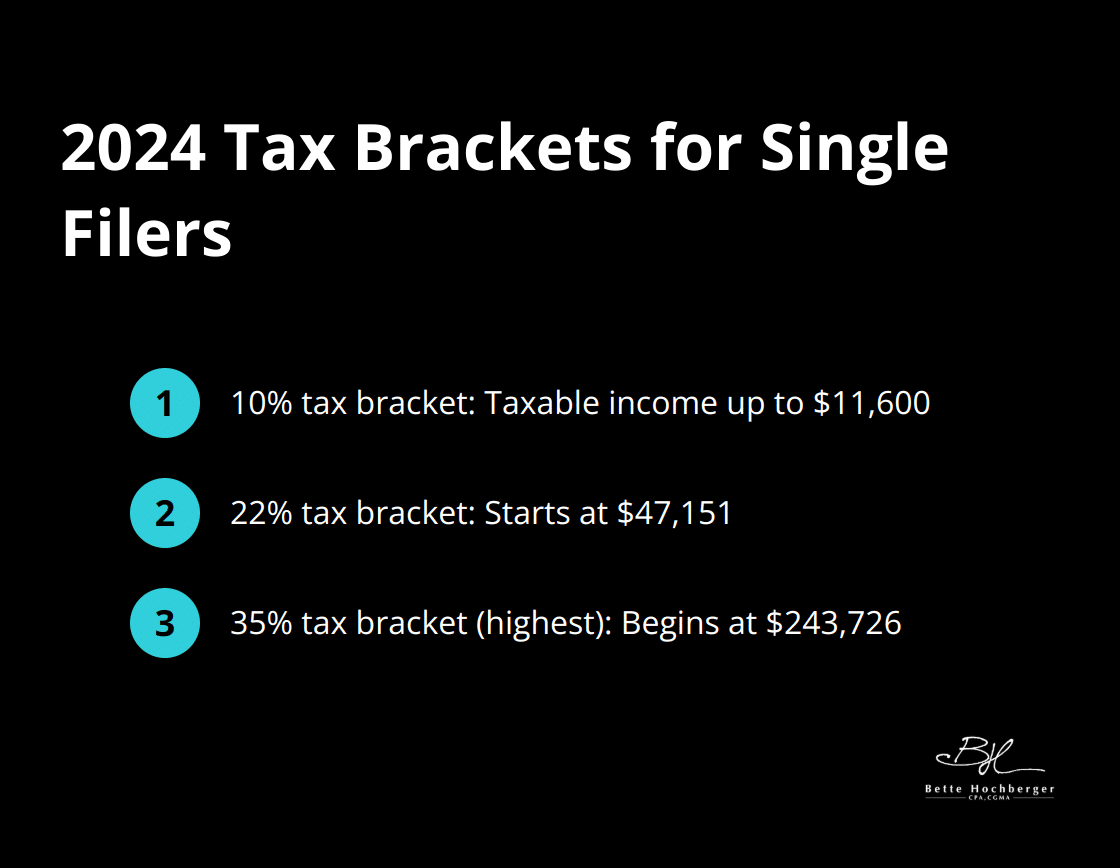

Tax Brackets for Single Filers

Single filers face their own set of tax brackets. For 2024, the IRS has provided the following brackets:

These brackets are generally lower than those for married couples filing jointly, which can result in a higher tax bill for single filers with substantial income.

Potential Drawbacks

While the single filing status is straightforward, it’s not always the most advantageous. Single filers miss out on certain tax benefits available to married couples or heads of household. For example, the income thresholds for various tax credits and deductions are often lower for single filers, potentially limiting their ability to claim these benefits.

Considerations for Choosing Single Status

When deciding whether to file as single, consider the following:

- Your marital status as of December 31 of the tax year

- Your income level and potential deductions

- Eligibility for other filing statuses (e.g., Head of Household)

- Long-term tax planning goals

A thorough review of your personal situation is essential before deciding on a filing status. Professional tax advisors can help navigate these complexities and choose the most beneficial status for your unique circumstances.

As we move forward, let’s explore the differences between married filing jointly and separately, which offer their own sets of advantages and considerations.

Married Filing Jointly or Separately: Which Is Right for You?

The Advantages of Joint Filing

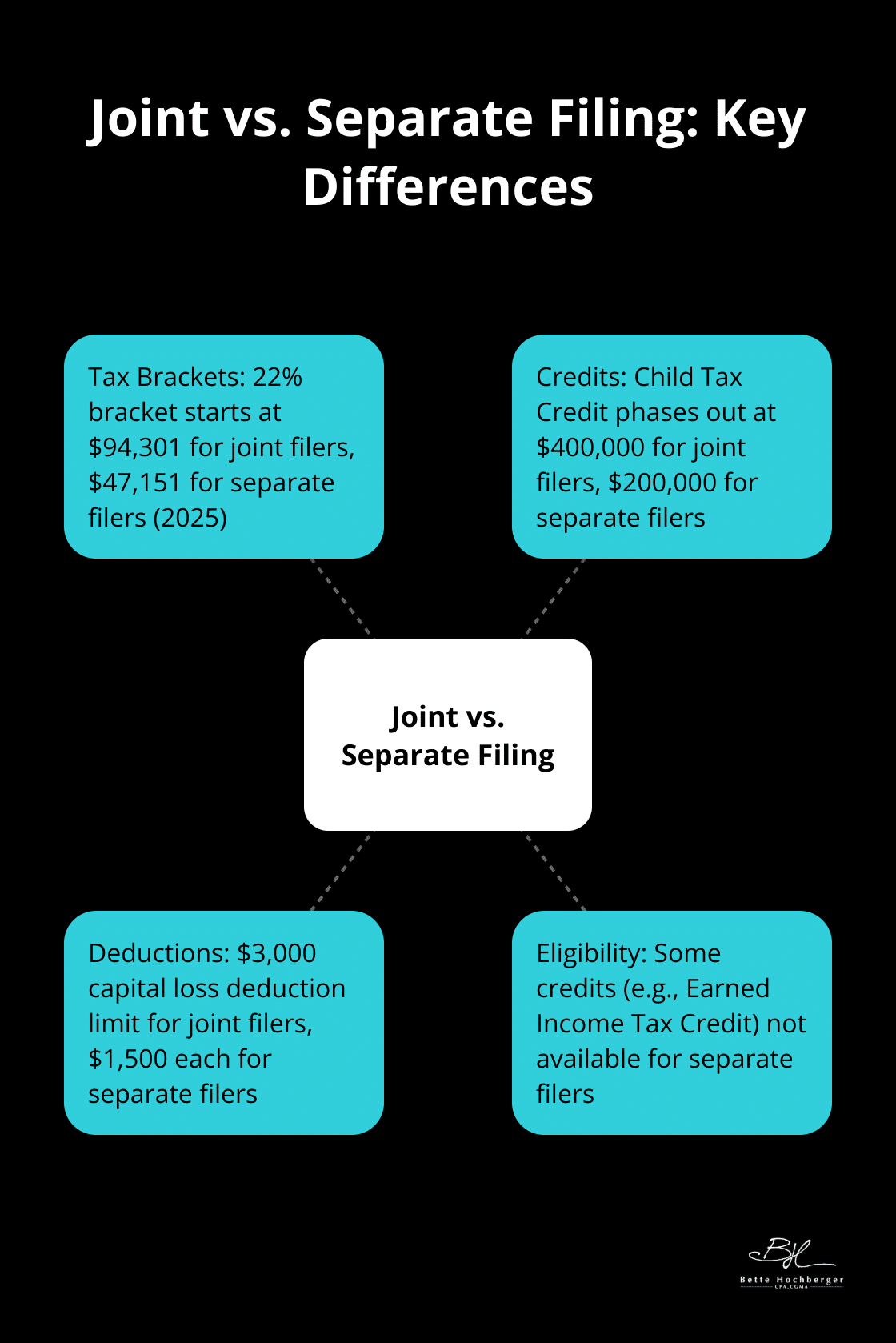

Most married couples benefit from filing jointly. The IRS offers more favorable tax brackets for joint filers, which often results in a lower overall tax bill. For example, in 2025, the 22% tax bracket for joint filers will start at $94,301, while it begins at $47,151 for those filing separately.

Joint filers also enjoy higher income thresholds for certain tax benefits. The Child Tax Credit (which phases out at $400,000 for joint filers but only $200,000 for separate filers) can lead to thousands of dollars in tax savings for families.

Filing jointly simplifies the tax preparation process. Couples submit one tax return, which reduces paperwork and can lower tax preparation costs.

Scenarios for Separate Filing

Despite the advantages of joint filing, separate filing can be beneficial in specific situations. One common scenario occurs when one spouse has significant medical expenses. The IRS allows deduction of medical expenses that exceed 7.5% of adjusted gross income (AGI). By filing separately, the spouse with high medical costs might more easily exceed this threshold and claim a larger deduction.

Separate filing can also benefit couples where one spouse has substantial student loan debt and participates in an income-driven repayment plan. This approach can sometimes result in lower monthly payments, as the plan would only consider the income of the spouse with the debt.

High-Income Couple Considerations

High-income couples face unique tax challenges. The marriage penalty (where two high earners pay more in taxes filing jointly than they would as single filers) can become a factor. Couples approaching higher tax brackets should analyze both filing options carefully.

Impact on Tax Credits and Deductions

The choice between joint and separate filing affects eligibility for various tax credits and deductions. For instance, separate filers cannot claim the Earned Income Tax Credit or the American Opportunity Tax Credit for education expenses. However, they might qualify for a larger deduction for casualty losses or miscellaneous itemized deductions. It’s worth noting that the capital loss deduction limit is $1,500 each when filing separately, compared to $3,000 on a joint return.

The Role of State Taxes

While federal tax considerations often dominate the decision-making process, state taxes can also play a significant role. Some states require couples to file the same status on their state return as they do on their federal return. Others allow for different filing statuses. Understanding these state-specific rules is essential for making an informed decision.

As we move forward, let’s explore another important filing status: Head of Household. This status offers unique benefits for single parents and individuals supporting dependents.

Who Qualifies for Head of Household Status?

Understanding Head of Household Eligibility

The Head of Household filing status offers significant tax advantages for eligible taxpayers. This status applies to unmarried individuals who provide a home for certain dependents.

To qualify as Head of Household, you must meet specific criteria. You need to be unmarried or considered unmarried on the last day of the tax year. You must also pay more than half the cost of keeping up a home for the year. This home must serve as the main residence for you and a qualifying person for more than half the year.

A qualifying person can be your child, parent, or certain other relatives. For children, they must be under 19 (or under 24 if they’re full-time students) and live with you for more than half the year. For parents, they don’t need to live with you if you pay more than half their support.

Tax Benefits of Head of Household Status

Filing as Head of Household comes with substantial tax benefits. For the 2025 tax year, the standard deduction for Head of Household filers is $23,625, significantly higher than for single filers. This increased deduction can lead to considerable tax savings.

Head of Household filers also benefit from more favorable tax brackets. The 12% tax bracket for Head of Household filers in 2025 extends to $48,475 of taxable income. This means more of your income is taxed at lower rates.

Common Misconceptions

Many taxpayers misunderstand the requirements for Head of Household status. A frequent error is the assumption that simply having a dependent qualifies you for this status. However, you must also maintain the household and meet specific relationship tests.

Another misconception involves divorced parents. The child must live with you for more than half the year for you to claim Head of Household status. The non-custodial parent typically cannot claim this status based on child support payments alone.

It’s important to note that your marital status on December 31 determines your filing status for the entire year. If you’re married on this date, you generally cannot file as Head of Household, even if you lived apart from your spouse for most of the year.

Seeking Professional Guidance

The rules surrounding Head of Household status can be complex. Many individuals who could benefit from this status are unaware of their eligibility. A qualified tax professional can help you navigate these rules and ensure you claim the most advantageous filing status for your situation.

Final Thoughts

Your tax filing status plays a pivotal role in determining your tax liability and potential refunds. Each status, from Single to Married Filing Jointly, offers unique advantages and considerations. The right choice depends on your individual circumstances, including marital status, dependents, and financial situation.

Professional guidance can help you navigate the complexities of tax filing statuses. At Bette Hochberger, CPA, CGMA, we offer personalized financial services, including strategic tax planning and preparation. Our team can assist you in selecting the most beneficial tax filing status for your specific needs.

Life events such as marriage, divorce, or having children can change your optimal filing status. Regular reviews with a qualified tax professional will help you maximize your tax benefits and minimize your liability. This proactive approach to your tax filing status will contribute to your overall financial health and future security.