At Bette Hochberger, CPA, CGMA, we often encounter clients who are unsure about their tax obligations, especially when it comes to estimated taxes.

IRS Form 1040-ES is a critical tool for many taxpayers, particularly self-employed individuals and those with significant non-wage income. This form helps you calculate and pay your estimated taxes throughout the year, avoiding potential penalties and interest.

In this guide, we’ll break down everything you need to know about Form 1040-ES and estimated tax payments.

Understanding IRS Form 1040-ES

What is Form 1040-ES?

Form 1040-ES is an essential document for many taxpayers, particularly those with income not subject to withholding. The Internal Revenue Service (IRS) provides this form to help individuals calculate and pay their estimated taxes throughout the year.

Who Needs to File Form 1040-ES?

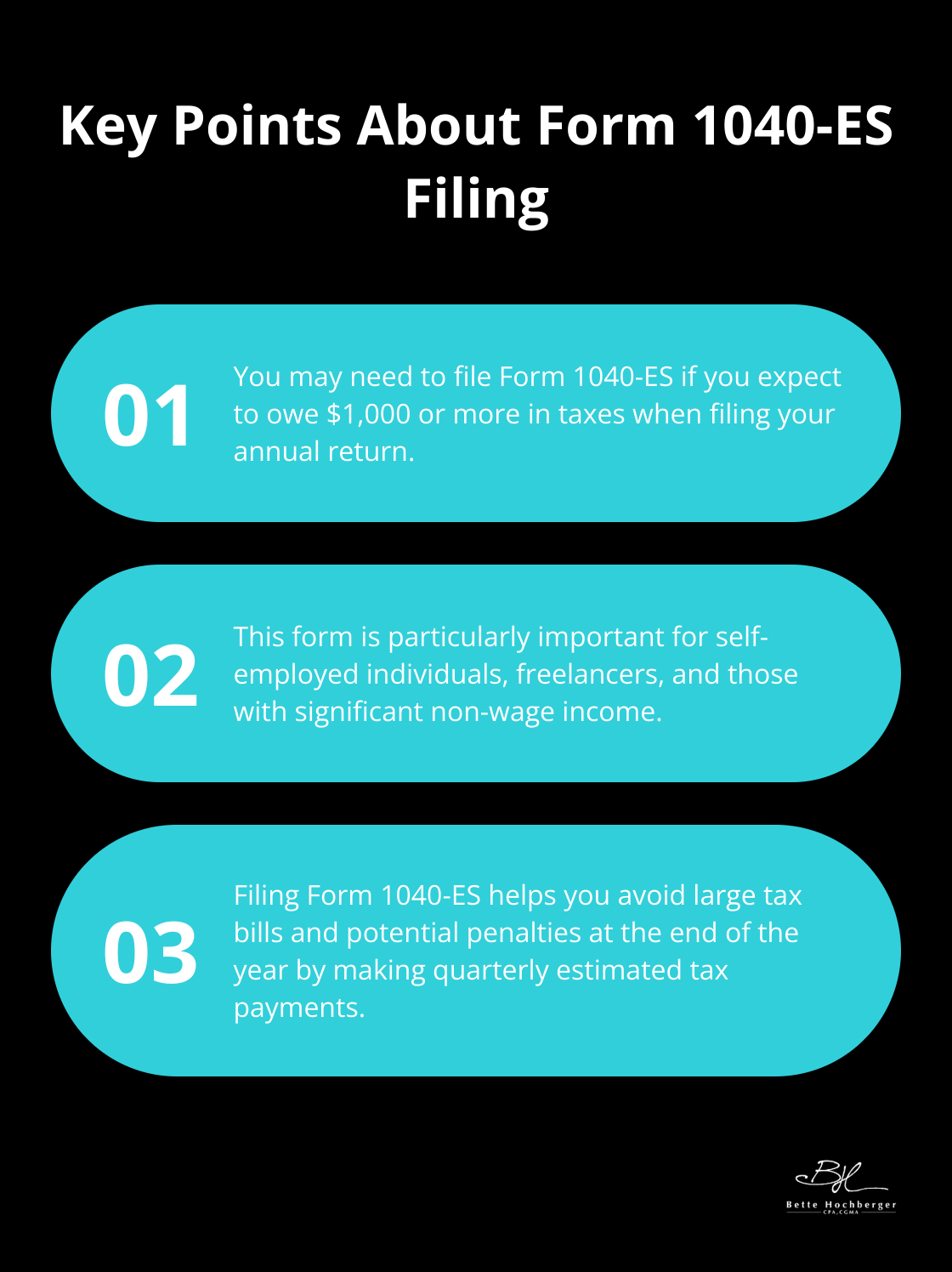

You’ll likely need to file Form 1040-ES if you’re self-employed, a freelancer, or have significant income from investments, rentals, or other sources not subject to withholding. The IRS requires you to file this form if you expect to owe $1,000 or more in taxes when you file your annual return (after subtracting your withholdings and credits).

How Form 1040-ES Works

Form 1040-ES includes a worksheet to help you estimate your tax liability for the year. You’ll use this to calculate your quarterly payments. The form also provides payment vouchers for those who prefer to pay by mail, though electronic payments are increasingly common.

The Importance of Estimated Tax Payments

Paying estimated taxes is not just a legal requirement – it’s a smart financial move. These quarterly payments help you avoid a large tax bill at the end of the year and potential penalties for underpayment.

Benefits of Proper Tax Planning

Proper estimated tax planning can save you money in penalties and interest. It allows you to manage your cash flow more effectively and reduces the stress of a large lump sum payment at tax time. Many taxpayers find that working with a qualified tax professional (such as Bette Hochberger, CPA, CGMA) helps them navigate the complexities of Form 1040-ES and ensures they stay compliant throughout the year.

As we move forward, we’ll explore the methods for calculating your estimated tax payments and the factors that can affect these calculations.

How to Calculate Your Estimated Tax Payments

Projecting Your Income

The first step in calculating your estimated tax payments involves a projection of your annual income. This includes all sources such as self-employment earnings, investment returns, and rental income. The IRS provides a worksheet in Form 1040-ES to assist with these calculations. Your previous year’s tax return can serve as a starting point, but it may not reflect accuracy if your income or deductions have changed significantly.

Considering Key Factors

Several elements can impact your estimated tax calculations. Tax law changes, income fluctuations, and life events (marriage, divorce, or having a child) all affect your tax liability. It’s important to reassess your estimates throughout the year and adjust your payments accordingly.

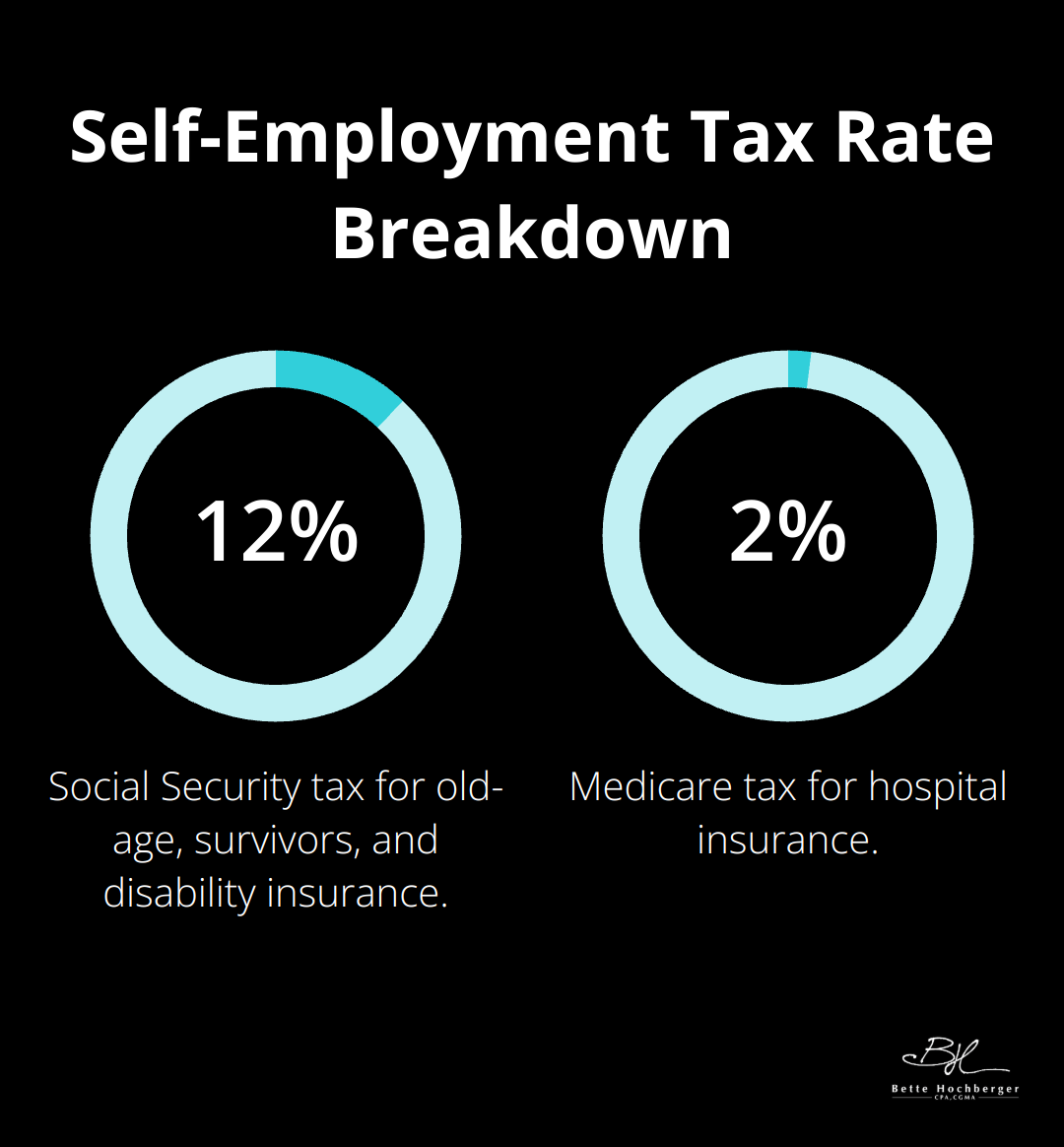

Self-employed individuals must factor in both income tax and self-employment tax. The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

Leveraging Deductions and Credits

To minimize your tax liability, consider all applicable deductions and credits. Common deductions for self-employed individuals include home office expenses, health insurance premiums, and retirement plan contributions. The Qualified Business Income (QBI) deduction allows eligible taxpayers to deduct up to 20 percent of their QBI, plus 20 percent of qualified real estate investment trust (REIT) dividends.

Credits such as the Child Tax Credit, Education Credits, and Energy-Efficient Home Improvement Credit can directly reduce your tax bill. However, these credits and deductions are subject to specific rules and limitations (often complex and subject to change), so professional guidance proves beneficial in many cases.

Utilizing Available Tools

The IRS Tax Withholding Estimator tool can provide more precise calculations for your estimated taxes. This tool takes into account various factors and can help you determine the right amount to pay each quarter.

Seeking Professional Assistance

Tax professionals (like those at Bette Hochberger, CPA, CGMA) specialize in identifying all potential deductions and credits for their clients. They ensure you pay only what you owe and stay up-to-date with the latest tax laws to maximize your tax savings.

As we move forward, we’ll explore the critical filing and payment deadlines for your estimated taxes, ensuring you stay compliant and avoid potential penalties.

When Are Estimated Tax Payments Due?

Quarterly Payment Schedule

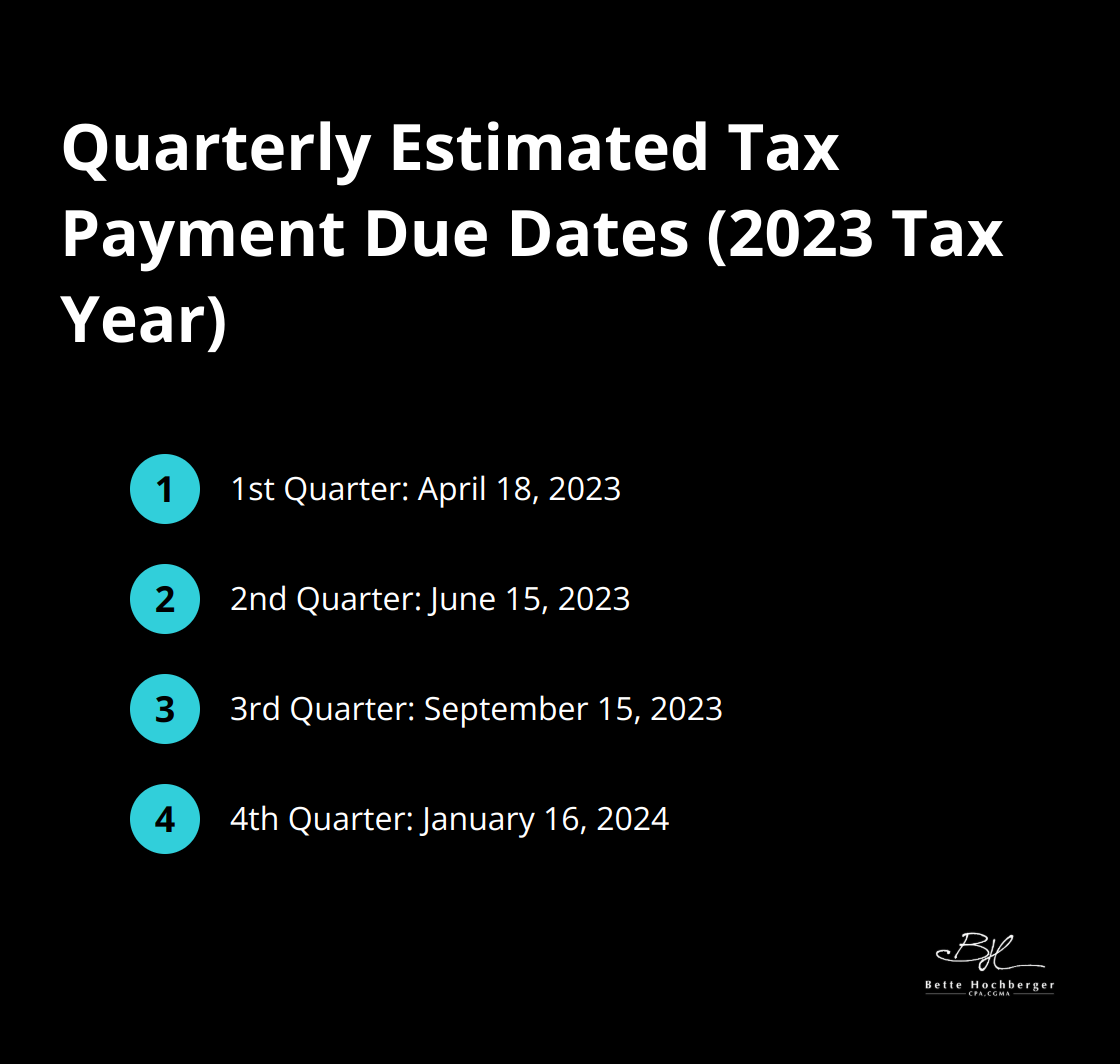

The Internal Revenue Service (IRS) has established specific due dates for quarterly estimated tax payments. These dates fall on the 15th day of April, June, September, and January of the following year. For the 2023 tax year, the estimated tax payment due dates are:

The IRS may adjust these dates if they fall on a weekend or holiday. For example, the first quarter deadline in 2023 moved to April 18 due to the Emancipation Day holiday in Washington, D.C.

Consequences of Late Payments

Missing these deadlines can result in penalties and interest charges. The IRS calculates penalties based on the amount of underpayment and the number of days the payment is late.

To avoid these charges, you should set reminders or automate your payments. Many tax professionals offer services to help clients meet these important deadlines.

Payment Methods

The IRS provides several convenient methods for making estimated tax payments:

- Electronic Funds Withdrawal (EFW): This option allows you to pay directly from your bank account when you e-file your tax return.

- IRS Direct Pay: This free service enables you to pay directly from your checking or savings account.

- Credit or Debit Card: While convenient, this method incurs processing fees.

- Electronic Federal Tax Payment System (EFTPS): This free service is particularly useful for businesses and individuals who make frequent payments.

- Check or Money Order: For those who prefer traditional methods, you can mail your payment with the appropriate payment voucher from Form 1040-ES.

Each method has its advantages and disadvantages, and the best choice depends on your individual circumstances. For instance, EFTPS excels at scheduling payments in advance, while Direct Pay is user-friendly for one-time payments.

Importance of Compliance

Staying compliant with estimated tax payments helps you avoid penalties and smooths out your tax liability throughout the year. This approach prevents a large, unexpected bill when you file your annual return. (It’s worth noting that proper tax planning can significantly reduce stress during tax season.)

Professional Assistance

Tax professionals (such as those at Bette Hochberger, CPA, CGMA) can provide valuable assistance in managing estimated tax payments. They can help you calculate the correct amount, choose the best payment method, and ensure timely submissions. (Their expertise can prove invaluable in navigating the complexities of the tax system.)

Final Thoughts

Form 1040-ES plays a vital role in the U.S. tax system, helping individuals manage their tax obligations throughout the year. This form proves particularly important for self-employed individuals, freelancers, and those with significant non-wage income. Taxpayers who use Form 1040-ES to calculate and pay estimated taxes can avoid large tax bills and potential penalties at the end of the year.

Staying compliant with estimated tax payments offers several benefits. It helps manage cash flow by spreading tax payments over the year, reduces the risk of underpayment penalties, and provides peace of mind. Regular estimated tax payments also make it easier to budget and plan for tax expenses, leading to better financial management overall.

Navigating the complexities of estimated taxes can challenge those with fluctuating income or multiple income sources. Professional assistance can make a significant difference in this area. Bette Hochberger, CPA, CGMA specializes in personalized financial services for businesses and professionals (including strategic tax planning and preparation). Our team can help you streamline your tax planning process and maximize your tax savings.