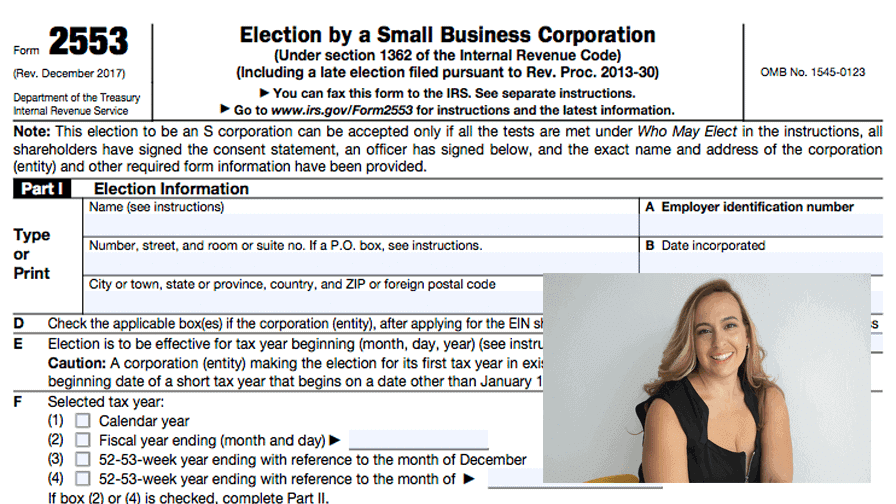

Election by a small business corporation to election S Status. This turns your business into a pass through tax entity, and is critical to avoid doube-taxation. Names for the IRS Code’s Subchapter S, a timely filing of Form 2553 can save you a lot of taxes.

How to Fill in Form 2553 Election by a Small Business Corporation S Election

Bette Hochberger, CPA, CGMA2020-12-01T02:03:48-05:00S Corporations are popular and have many tax advantages. If you wish you make your new (or existing) corporation an S Corporation, you need to fill our Form 2553 for the S Corporation Election.