IRS penalties can cost taxpayers thousands of dollars annually, but many don’t realize these charges aren’t always permanent. The IRS collected over $7 billion in penalties during fiscal year 2023 alone.

IRS penalty abatement offers a legitimate path to reduce or eliminate these financial burdens. We at Bette Hochberger, CPA, CGMA have helped numerous clients successfully navigate this process and recover substantial amounts.

What Does IRS Penalty Abatement Cover

IRS penalty abatement represents your legal right to request removal or reduction of tax penalties when specific conditions apply. The IRS abated penalties worth $1.2 billion in fiscal year 2023, which shows this program actively helps taxpayers.

Types of Penalties Eligible for Abatement

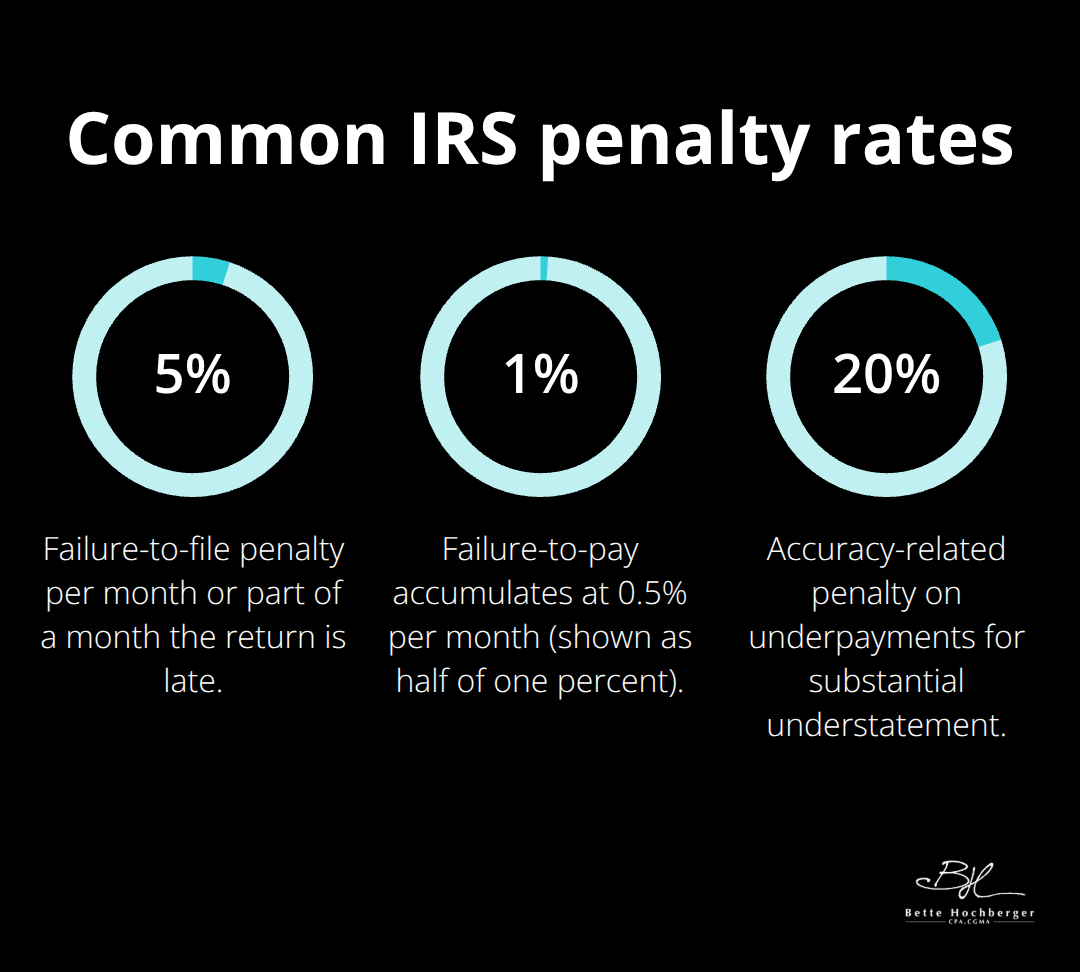

Three main penalty types qualify for abatement. Failure-to-file penalties are 5% of the tax due for each month or partial month the return is late, while failure-to-pay penalties accumulate at 0.5% per month. Accuracy-related penalties can reach 20% of underpayments when the IRS finds substantial understatement of tax liability.

Employment tax penalties for businesses and estimated tax penalties for individuals also qualify for relief. The average penalty abatement saves taxpayers $2,800 per successful request according to IRS data (making this relief program financially significant for most taxpayers).

First-Time Abatement Requirements

The First-Time Penalty Abatement program offers the strongest path to relief for taxpayers with clean compliance records. You qualify if you filed all required returns for the past three years and paid all taxes owed, with no penalties assessed during this period.

This administrative waiver removes failure-to-file, failure-to-pay, and failure-to-deposit penalties automatically once approved. The IRS grants approximately 85% of first-time abatement requests, which makes this your best option when eligible. Business owners can use this program for payroll tax penalties if they meet the three-year clean record requirement.

Reasonable Cause Documentation Standards

Reasonable cause abatement requires proof that circumstances beyond your control prevented tax compliance. Natural disasters, serious illness, death of immediate family members, and IRS processing delays qualify as valid reasons.

Reasonable cause abatement requests must be documented via an adjustment with a source document. Medical records, death certificates, disaster declarations, and detailed timelines strengthen your case significantly. Fire, flood, or other casualty losses that destroyed tax records also qualify, but you must provide insurance claims or official damage reports as proof.

Administrative and Statutory Relief Options

Administrative waivers apply when widespread IRS issues affect large groups of taxpayers (such as delayed form releases or system failures). Statutory exceptions provide relief under specific tax law provisions for situations like newly retired individuals or those affected by federally declared disasters.

These relief options require less documentation than reasonable cause claims but apply to narrower circumstances. Understanding which type of relief fits your situation becomes essential before you submit your abatement request.

Who Qualifies for IRS Penalty Relief

Meeting First-Time Abatement Standards

First-time penalty abatement approval depends on three specific requirements that the IRS verifies through their automated systems. Your tax compliance history must show zero penalties for failure-to-file, failure-to-pay, or failure-to-deposit during the three years before your penalty assessment. You must file all required returns for this three-year period, and you must pay any outstanding tax balances from previous years in full or establish an approved payment arrangement.

According to Treasury Inspector General data, approximately 250,000 taxpayers with failure-to-file penalties and 1.2 million taxpayers with failure-to-pay penalties did not receive penalty relief despite being eligible. This administrative waiver works for individual taxpayers and businesses equally, which makes it the most reliable penalty relief option when you meet the qualifications.

Reasonable Cause Documentation Requirements

Reasonable cause abatement requires comprehensive documentation that proves circumstances beyond your control prevented tax compliance. Medical emergencies must include hospital records, physician statements, and treatment timelines that directly correlate with your filing or payment deadline. Death of immediate family members requires death certificates plus documentation that shows your role in estate matters or funeral arrangements.

Natural disasters need FEMA declarations, insurance claims, or official damage assessments that demonstrate how the event prevented tax compliance. IRS processing delays qualify when you can provide certified mail receipts that show timely filing attempts or payment submissions. The key lies in creating a clear timeline that connects your documented circumstances to the specific tax deadline you missed.

Administrative Waivers and System Failures

Administrative waivers apply when IRS operational failures affect large taxpayer groups (such as delayed form releases or system outages during filing season). These relief options require minimal documentation since the IRS acknowledges their responsibility for the compliance issues. The IRS automatically grants these waivers when they identify widespread problems that prevented taxpayers from meeting their obligations.

Statutory Exceptions and Special Circumstances

Statutory exceptions provide automatic relief for federally declared disaster areas, military combat zones, and specific situations defined in tax code provisions. These exceptions operate independently of your compliance history and require different documentation standards than reasonable cause claims. Disaster area residents receive automatic extensions, while military personnel in combat zones get special filing deadline extensions (typically 180 days after leaving the combat zone).

The application process varies significantly depending on which type of relief best fits your specific situation and available documentation. Professional IRS representation can help navigate complex cases and maximize your chances of successful penalty relief.

How Do You Actually Request Penalty Abatement

Choose Form 843 vs Phone Requests

Form 843 creates the strongest documentation trail for penalty relief requests. This written approach works best for reasonable cause claims that require extensive documentation like medical records or disaster declarations. The IRS processes Form 843 requests within 90 days on average, though complex cases take longer.

Phone requests work effectively for first-time penalty abatement since the IRS can verify your compliance history immediately through their automated systems. The IRS penalty hotline at 1-866-897-0051 handles most straightforward abatement requests during business hours. Phone calls resolve simple cases faster but provide no paper trail for your records.

Gather Documentation That Actually Works

Reasonable cause requests demand specific evidence that directly connects your circumstances to the missed deadline. Hospital admission records must show treatment dates that overlap with your filing deadline, while death certificates need documentation that proves your involvement in estate matters.

Natural disaster claims require FEMA declarations or official damage assessments dated within your penalty period. IRS processing delay claims need certified mail receipts that show timely submission attempts. The Treasury Inspector General found that abatement requests face long delays in processing times and inconsistent treatment, which makes thorough evidence collection your top priority.

Consider Professional Representation for Complex Cases

Tax professionals become necessary when multiple penalty types apply simultaneously or when your case involves business employment taxes that exceed $50,000. Enrolled agents and CPAs can communicate directly with IRS penalty determination officers, which speeds resolution for complicated cases.

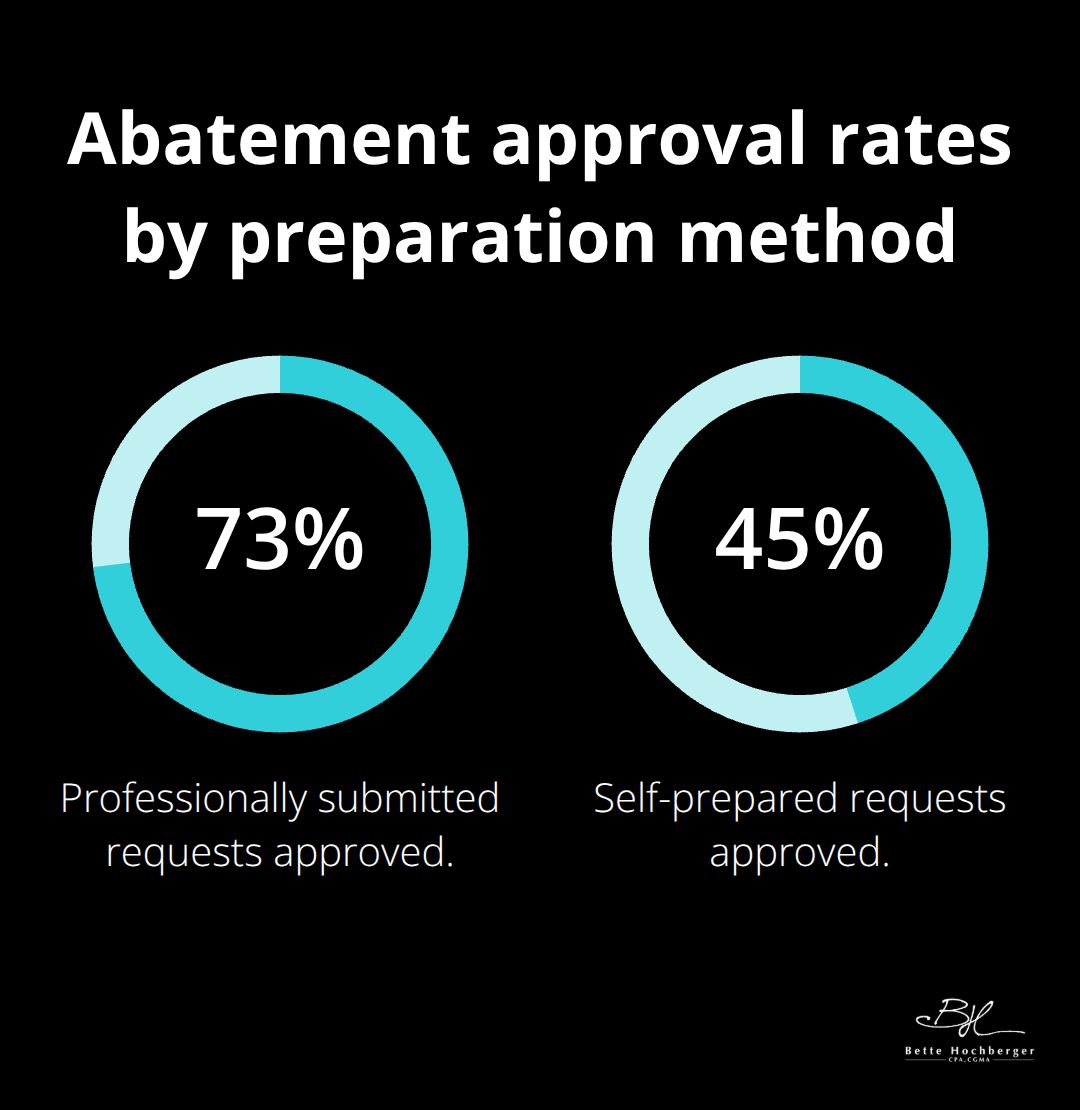

Professional representation costs typically range from $500 to $2,500 (depending on case complexity), but successful abatement often saves $5,000 to $25,000 in penalties. The IRS grants 73% of professionally submitted abatement requests compared to 45% for self-prepared submissions according to Taxpayer Advocate Service data.

Submit Your Request Promptly

The IRS requires abatement requests within specific timeframes that vary by penalty type. Most penalty relief requests must be submitted within three years of the penalty assessment date or two years from the date you paid the penalty (whichever is later). First-time penalty abatement has no specific deadline but works best when requested promptly after penalty assessment.

Final Thoughts

IRS penalty abatement provides substantial financial relief when you handle it correctly. The average successful request saves taxpayers $2,800, while complex business cases often recover $15,000 to $50,000 in penalties. These savings far exceed the costs of professional assistance in most situations.

Time works against you with penalty notices. Interest continues to accumulate on unpaid penalties at rates that reach 8% annually, which means delays cost real money. The IRS requires most abatement requests within three years of penalty assessment (making prompt action essential for your relief options).

Professional representation significantly improves your success rate. The IRS approves 73% of professionally submitted requests compared to just 45% for self-prepared applications. We at Bette Hochberger, CPA, CGMA help clients navigate complex penalty situations while minimizing tax liabilities.

Don’t let IRS penalties drain your finances when legitimate relief options exist.