Funded startups often focus intensely on growth and product development while tax strategy takes a backseat. This oversight can cost companies thousands of dollars in unnecessary taxes and missed opportunities.

We at Bette Hochberger, CPA, CGMA see this pattern repeatedly with venture-backed companies. Smart tax planning from day one protects your funding and maximizes resources for scaling your business.

How Funding Changes Your Tax Situation

Different Investment Types Create Distinct Tax Burdens

Series A rounds through convertible notes create different tax obligations than straight equity investments. When investors purchase preferred stock, your company faces immediate compliance requirements including quarterly estimated tax payments if you show profit. The IRS requires C-corporations to pay estimated taxes when they owe $500 or more annually. Convertible debt creates a different scenario where interest payments become tax-deductible expenses, which reduces your overall tax burden during the conversion period.

SAFE agreements (popular with Y Combinator startups) defer tax implications until conversion, but founders must track the fair market value of shares at each round. The Inflation Reduction Act of 2022 has increased and modified the qualified small business payroll tax credit for increasing research activities.

Founders Face Immediate Tax Consequences from Equity Changes

Stock option exercises and equity grants trigger taxable events that many founders overlook. When you exercise options below fair market value, the IRS treats the difference as ordinary income taxed at rates up to 37%. Section 1202 permits a taxpayer to claim an exclusion from capital gains in connection with the sale or exchange of qualified small business stock held for the minimum required period.

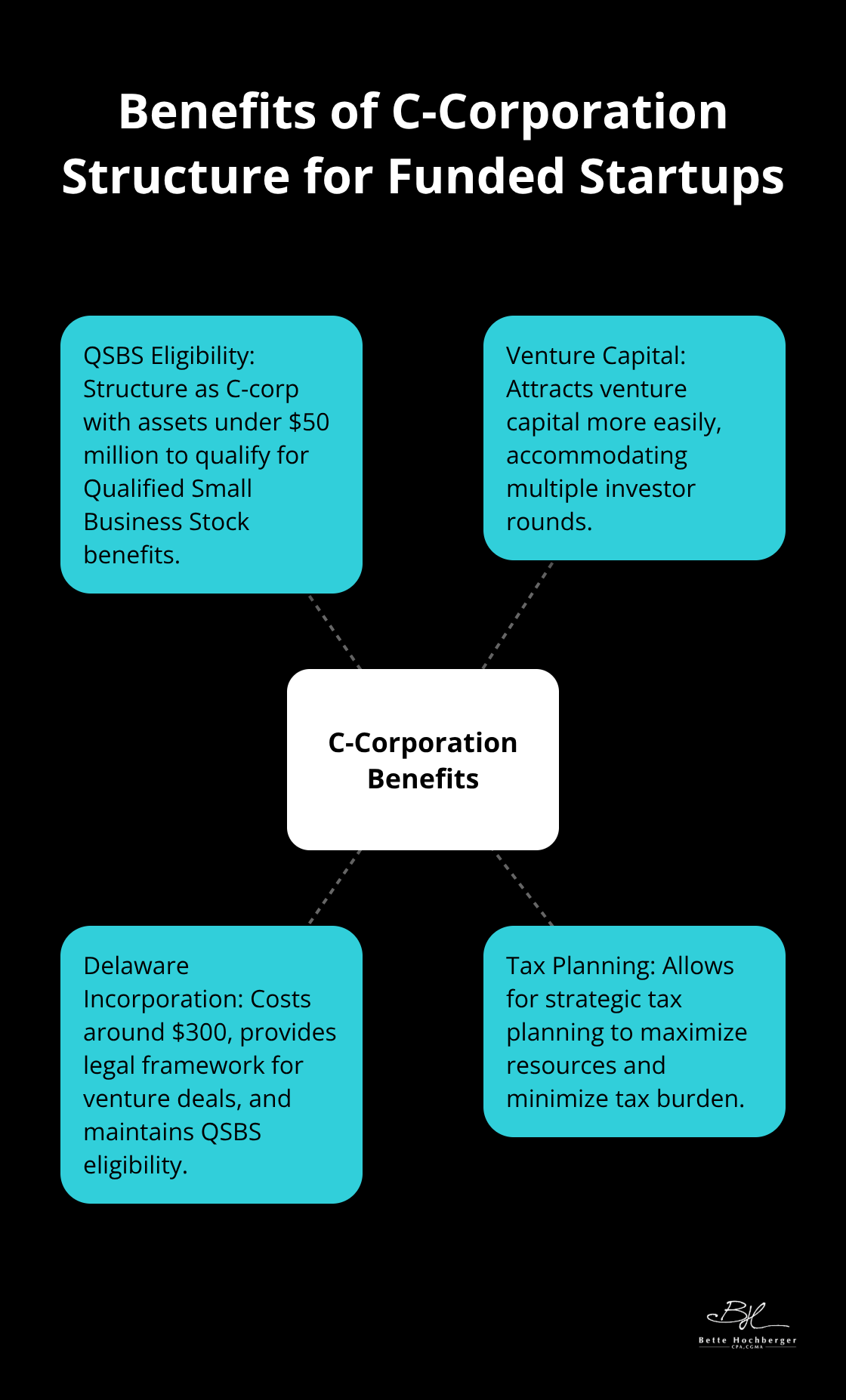

Founders should structure their companies as C-corporations with assets under $50 million to qualify for QSBS benefits. Delaware incorporation costs around $300 but provides the legal framework necessary for most venture deals while maintaining QSBS eligibility.

Multi-State Operations Complicate Tax Requirements

Multi-state operations trigger additional requirements in each state where you conduct business. Costs range from $50 to $800 per state annually, and each jurisdiction has unique rules for nexus determination. Your next consideration involves strategic tax planning that can maximize these new resources while minimizing your overall tax burden.

Strategic Tax Planning for Growing Startups

Accelerate Deductions While You Defer Income

Funded startups can control their tax timeline through strategic expense acceleration and income deferral. Purchase equipment, software licenses, and office furniture before year-end to maximize current-year deductions. The Section 179 deduction allows businesses to write off up to $2.5 million in equipment purchases immediately rather than depreciate over multiple years. Defer client invoices until January to push income into the next tax year when you might face lower rates or have more deductions available.

C-corporations should implement bonus accruals for key employees in December but pay them in January. This creates a current-year deduction while you push the actual cash outflow to the next period. Software companies can prepay annual vendor subscriptions in December, which creates immediate deductions for expenses that benefit the next year.

R&D Credits Offset Payroll Taxes for Cash-Strapped Startups

The PATH Act allows startups with gross receipts under $5 million to apply up to $250,000 in R&D credits against employer payroll taxes annually. This benefit extends for five years and potentially saves $1.25 million total. Software development, product tests, and algorithm improvements all qualify as R&D activities. Startups typically spend 80% of their burn rate on payroll, which makes this credit particularly valuable for cash flow management.

Document all R&D activities with precision because the IRS has tightened substantiation requirements. Track employee time spent on projects, maintain detailed project logs, and save all related invoices. California offers additional R&D credits that stack with federal benefits (tech startups in the state see even greater savings).

Choose the Right Business Structure for Tax Efficiency

Your business structure determines how you pay taxes and what deductions you can claim. C-corporations face double taxation but qualify for QSBS benefits and attract venture capital more easily. S-corporations avoid double taxation but limit the number and type of shareholders you can have. LLCs provide flexibility but complicate equity compensation for employees.

Most venture-backed startups choose C-corporation status to maintain QSBS eligibility and accommodate multiple investor rounds. The structure costs more in compliance fees but provides the framework necessary for most funding deals. Poor record maintenance and missed deadlines create the most common tax problems that funded startups face.

What Tax Mistakes Sink Funded Startups

Missed Tax Deadlines Trigger Expensive Penalties

Quarterly tax payments become mandatory when your startup owes $500 or more annually in federal taxes. The IRS charges penalties of 0.5% per month on late payments, plus interest that compounds daily. Companies that miss the January 15th deadline for Q4 payments face immediate penalties on their entire tax liability.

Delaware C-corporations must file Form 1120 by March 15th, with automatic extensions available until September 15th. State deadlines create additional penalties that range from $50 to $500 per state (depending on your revenue size). Late filers often discover that penalty costs exceed their actual tax liability.

Poor Documentation Destroys R&D Credit Claims

The IRS has tightened documentation requirements for R&D credits after widespread abuse in previous years. Startups must maintain detailed project logs, employee time records, and expense categorization to substantiate their claims. Companies that cannot prove their activities qualify as systematic experimentation lose their entire credit, which averages $75,000 annually for qualifying startups.

Software development logs should specify technical challenges, solution attempts, and time spent on each iteration. Product tests must show scientific methodology rather than routine quality assurance. Many startups lose thousands in credits because they treat documentation as an afterthought.

Multi-State Tax Obligations Multiply Compliance Costs

Revenue activities in multiple states trigger nexus requirements that many startups ignore until audit time. Remote employees create permanent establishment in their home states, which requires tax registration and obligations. California’s Franchise Tax Board actively pursues out-of-state companies with California employees, imposing minimum taxes of $800 annually plus gross receipts fees.

Each state maintains different thresholds for economic nexus, ranging from $100,000 in sales to $500,000 depending on jurisdiction. Companies that operate across state lines need professional guidance to navigate varying compliance requirements and minimize their total tax burden.

Final Thoughts

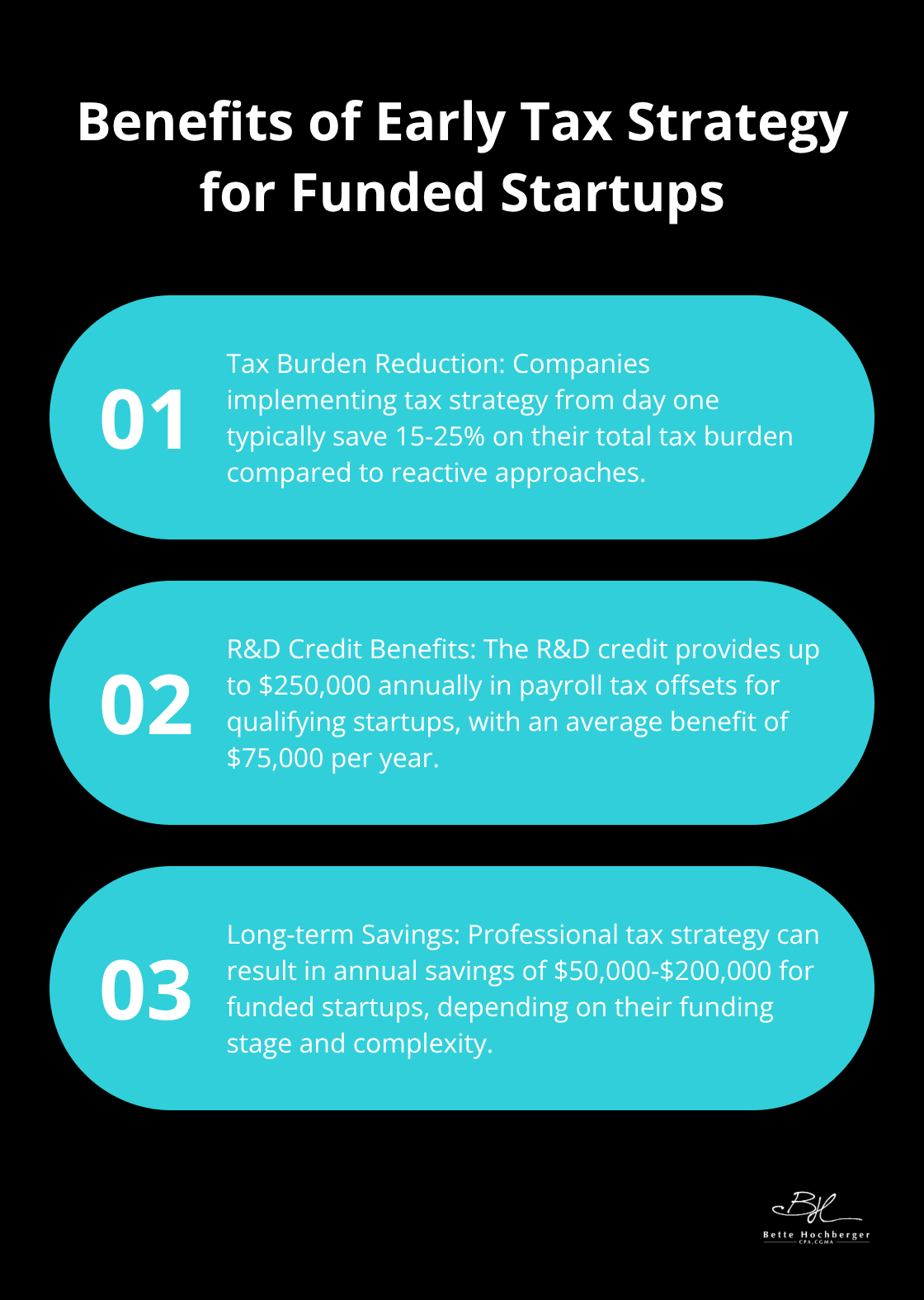

Early tax strategy transforms funded startups from reactive taxpayers into strategic operators who maximize every dollar raised. Companies that implement tax strategy from day one typically save 15-25% on their total tax burden compared to those who address taxes reactively. The R&D credit alone provides $250,000 annually in payroll tax offsets, while QSBS structure can save founders up to $10 million in capital gains taxes during exit events.

Professional tax strategy pays for itself through avoided penalties, maximized credits, and optimized cash flow management. Funded startups that work with specialized CPAs report average annual savings of $50,000-$200,000 (depending on their funding stage and complexity). These savings compound over time as proper structure and documentation create benefits that last throughout the company’s growth.

We at Bette Hochberger, CPA, CGMA help funded startups implement comprehensive tax strategies that grow with their business. Our team provides strategic tax guidance that minimizes liabilities while maximizes available credits and deductions. Start your tax strategy conversation today to protect your funding and accelerate your path to profitability.