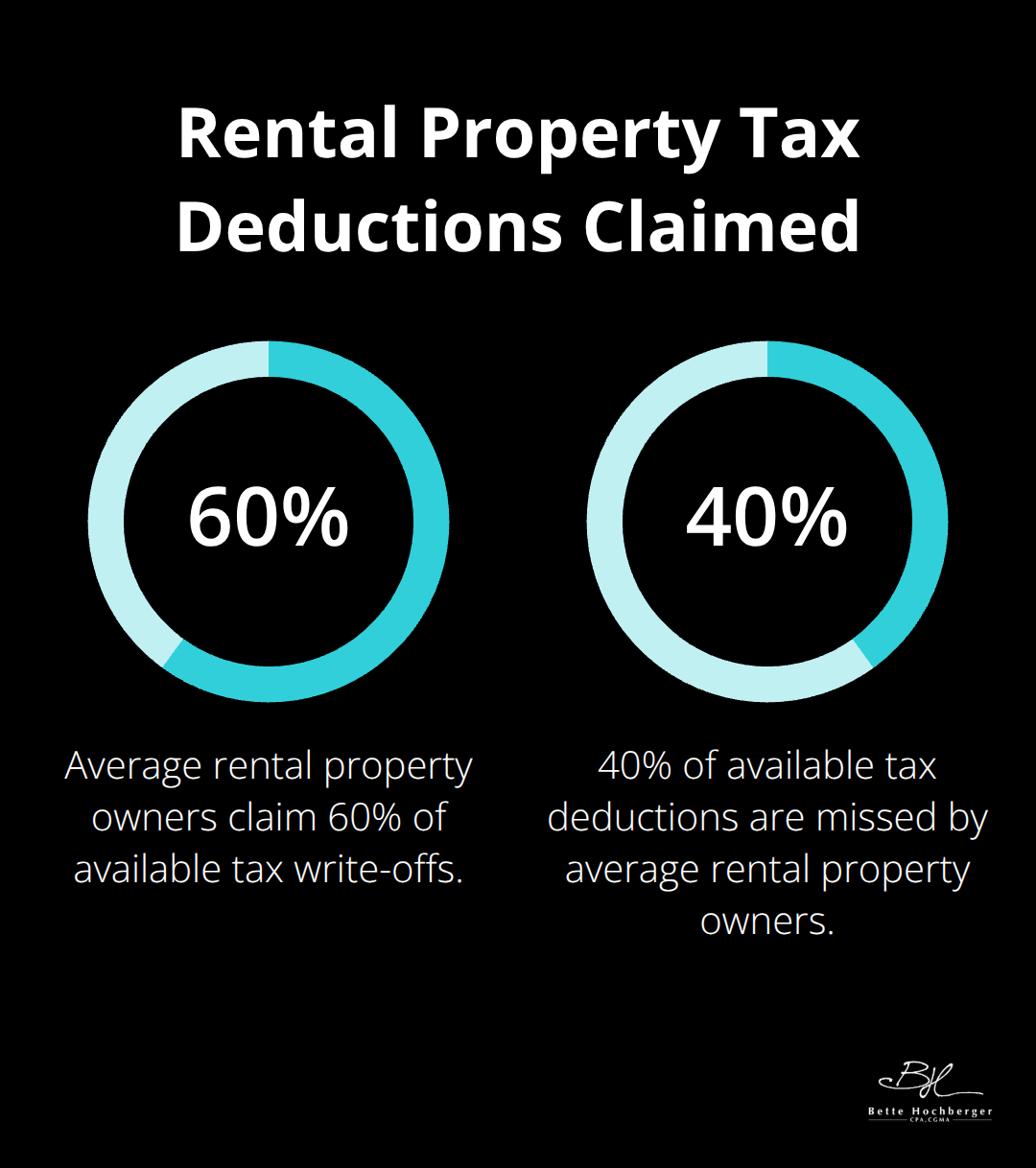

Real estate investors leave thousands of dollars on the table each year by missing key tax deductions. The average rental property owner claims only 60% of available write-offs, according to IRS data.

Real estate depreciation alone can save investors $3,000-$15,000 annually per property. We at Bette Hochberger, CPA, CGMA see clients reduce their tax bills by 25-40% when they implement proper strategies.

Real Estate Tax Deductions That Most Investors Miss

Depreciation Strategies for Rental Properties

Depreciation deductions create the largest tax savings that most investors overlook completely. Residential rental properties depreciate over 27.5 years, which means a $275,000 property creates $10,000 in annual deductions. Commercial properties depreciate over 39 years and provide $7,692 annually for a $300,000 building.

Cost segregation studies identify components like carpets, appliances, and landscaping that depreciate over 5, 7 and 15 years instead of decades. These studies typically increase first-year deductions by 15-30% and turn a standard $10,000 write-off into $13,000-$15,000. The IRS allows bonus depreciation of 80% for property components with useful lives under 20 years, though this percentage phases down in coming years.

Home Office Deductions for Real Estate Professionals

Real estate professionals who qualify for business status can deduct home office expenses through two methods. The simplified method allows $5 per square foot up to 300 square feet and creates a maximum $1,500 deduction. The actual expense method calculates the percentage of home used exclusively for business and applies it to mortgage interest, utilities, insurance, and repairs.

A 200-square-foot office in a 2,000-square-foot home generates 10% deductions on all qualifying expenses. Most investors miss this opportunity because they fail to maintain exclusive business use of the space (the IRS requires strict separation between personal and business areas).

Travel and Vehicle Expense Write-offs

Business mileage for property visits, tenant meetings, and supply purchases deducts at 70 cents per mile for 2025. Investors who drive 5,000 business miles annually save $3,500 in deductions. Travel expenses for out-of-state property management include flights, hotels, and 50% of meal costs as qualifying business expenses.

The IRS requires detailed logs that show business purpose, dates, and mileage. Many investors lose thousands when they fail to track these expenses properly or mix personal and business use without documentation. Professional property managers often maintain separate vehicles or detailed mileage logs to maximize these deductions.

These foundational deductions represent just the beginning of sophisticated tax strategies that can transform your real estate portfolio’s profitability.

Advanced Tax Strategies for Real Estate Portfolios

1031 Like-Kind Exchanges for Capital Gains Deferral

The 1031 like-kind exchange defers capital gains taxes indefinitely when investors swap properties of equal or greater value. A $500,000 property sale with $200,000 in gains saves $59,600 in federal taxes at current capital gains rates. The exchange timeline demands strict adherence to IRS rules: investors have 45 days to identify replacement properties and 180 days to complete the transaction.

Most investors fail because they miss these deadlines or attempt to access sale proceeds before the transaction closes. Qualified Intermediaries handle the funds and documentation to prevent disqualification. Sequential exchanges allow portfolio expansion without tax consequences and turn a single property into multiple investments over decades.

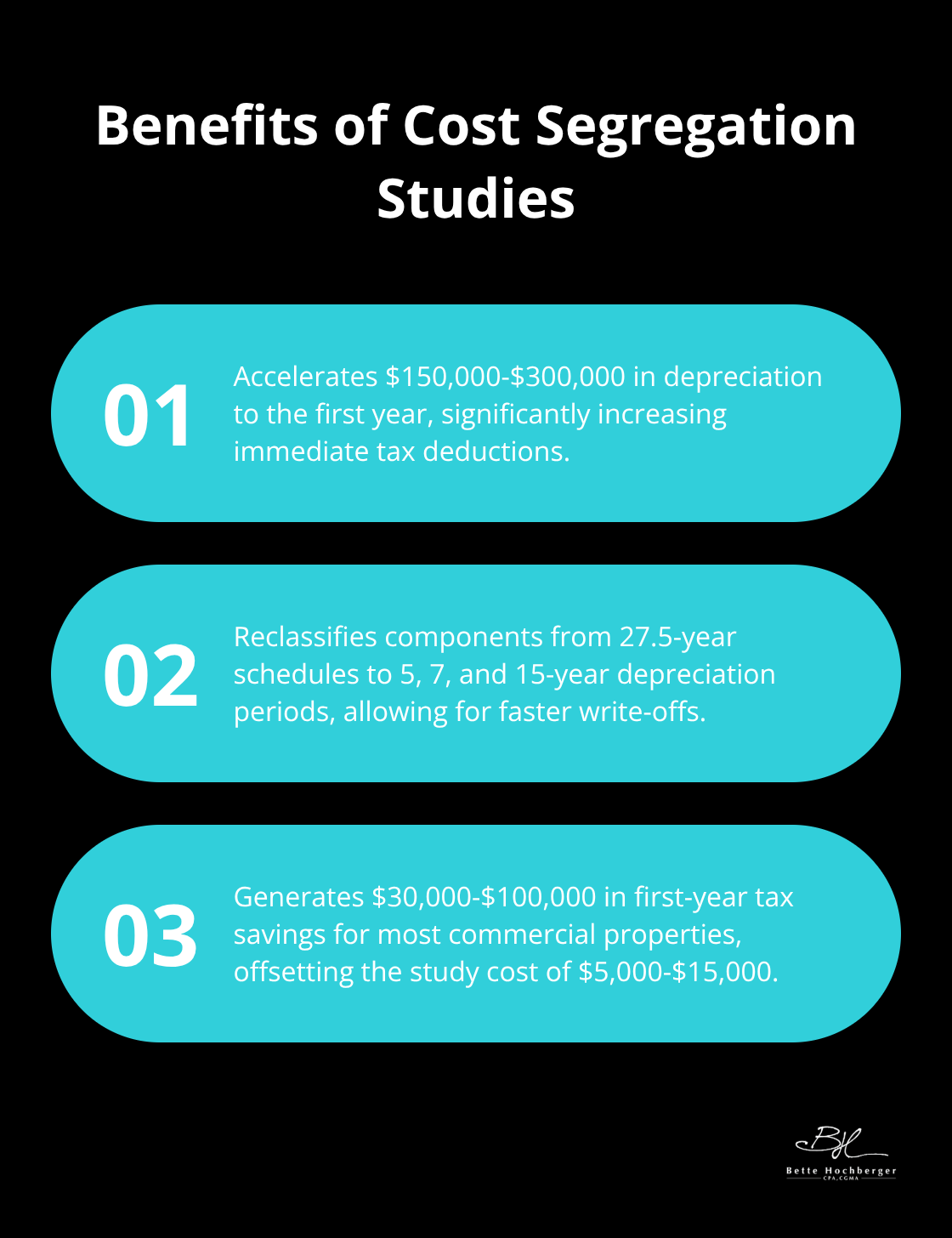

Cost Segregation Studies for Accelerated Depreciation

Cost segregation studies reclassify components from 27.5-year schedules to 5, 7, and 15-year depreciation periods. A typical study on a $1 million rental property accelerates $150,000-$300,000 in depreciation to the first year. Components like carpets, appliances, electrical systems, and landscaping qualify for faster write-offs.

The current 80% bonus depreciation applies to assets with useful lives under 20 years (though this phases down annually). Engineering-based studies cost $5,000-$15,000 but generate $30,000-$100,000 in first-year tax savings for most commercial properties.

Real Estate Professional Tax Status Benefits

Real estate professional status removes the $25,000 passive activity loss limitation and allows unlimited deductions against ordinary income. Qualification requires 750 hours annually in real estate activities and more time in real estate than any other business. This status transforms $50,000 in rental losses into immediate deductions against W-2 income and saves $12,000-$18,500 annually.

Material participation in each property requires regular, continuous involvement in operations. Documentation through detailed time logs proves professional status during IRS examinations. Investors must track their hours meticulously to maintain this valuable classification.

These advanced strategies work best when investors avoid common implementation mistakes that can trigger audits or disqualify valuable deductions.

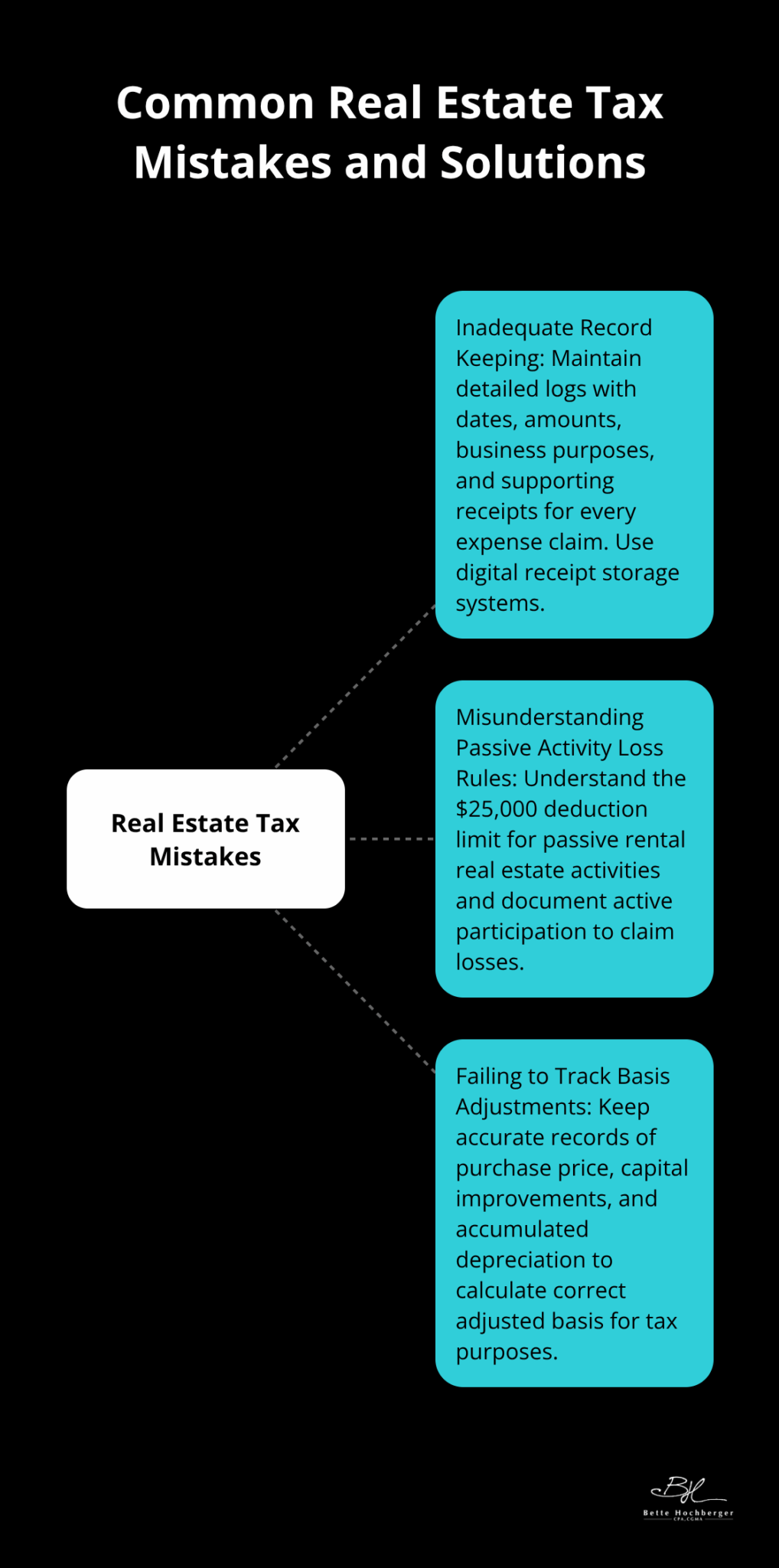

Common Real Estate Tax Mistakes and How to Avoid Them

Poor documentation destroys more real estate tax deductions than any other factor. The IRS requires contemporaneous records for all business expenses, yet many real estate investors fail to maintain adequate documentation. Missing receipts for a $50,000 renovation project can eliminate the entire deduction during an audit.

Inadequate Record Keeping and Documentation

Investors must keep detailed logs that show dates, amounts, business purposes, and supporting receipts for every expense claim. The IRS demands proof of business purpose for each deduction, not just payment records. A simple spreadsheet won’t suffice when auditors request documentation for travel expenses, property visits, or contractor payments.

Digital receipt storage systems prevent loss of paper documents and create searchable databases for tax preparation. Investors who photograph receipts immediately after purchase avoid the common problem of faded thermal paper receipts that become unreadable over time.

Misunderstanding Passive Activity Loss Rules

Most investors misunderstand passive activity loss rules and forfeit thousands in potential deductions. If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity against ordinary income only if modified adjusted gross income stays below $100,000.

Active participation means approving tenants, setting rental terms, and authorizing repairs (not just collecting rent checks). Investors earning $150,000 annually lose this entire benefit through income phase-outs, while those who fail to document active participation cannot claim losses even with lower incomes.

Failing to Track Basis Adjustments Properly

Property basis tracking prevents massive tax problems when selling properties. Original purchase price plus capital improvements minus accumulated depreciation equals adjusted basis for calculating gains. A property bought for $300,000 with $50,000 in improvements and $75,000 in claimed depreciation has an adjusted basis of $275,000.

Selling for $400,000 creates $125,000 in taxable gains, not the $100,000 many investors expect. Investors who lose improvement receipts or depreciation records face higher tax bills and potential penalties. The IRS requires Form 4562 filings for depreciation claims and Schedule E reporting for all rental income and expenses.

Final Thoughts

Real estate investors who implement these tax strategies save $10,000-$50,000 annually per property through proper depreciation, documentation, and advanced planning techniques. Real estate depreciation alone creates the foundation for substantial tax savings that compound over decades of ownership. The difference between successful investors and those who struggle often comes down to tax strategy execution.

Investors who claim only basic deductions miss 40% of available write-offs, while those who implement cost segregation studies, maintain real estate professional status, and execute 1031 exchanges build wealth faster through tax optimization. Professional tax planning becomes essential as portfolios grow beyond three properties. Complex strategies like passive activity loss rules, basis tracking, and depreciation recapture require expertise that prevents costly mistakes (and potential IRS penalties).

Start by organizing your records, tracking all business expenses, and documenting time spent on real estate activities. Review your current depreciation schedules and consider cost segregation studies for properties over $500,000. We at Bette Hochberger, CPA, CGMA help real estate investors minimize tax liabilities while maximizing cash flow through personalized financial services.