Foreign businesses expanding into the U.S. market face a complex web of tax obligations. At Bette Hochberger, CPA, CGMA, we understand the challenges these companies encounter when navigating the U.S. tax system.

This guide breaks down the key aspects of U.S. tax requirements for foreign businesses, including filing obligations, reporting forms, and strategic planning considerations. By understanding these obligations, foreign companies can avoid costly penalties and optimize their tax positions in the U.S. market.

What Defines a Foreign Business for U.S. Tax Purposes?

Foreign Business Classification

The Internal Revenue Service (IRS) classifies a foreign business as any entity not created or organized in the United States or under U.S. law. This classification includes corporations, partnerships, and limited liability companies formed under the laws of another country. The IRS uses this designation to determine how it will tax the business on its U.S. source income.

U.S. Source Income

Foreign businesses generate U.S. source income through various activities. These may include:

- Profits from the sale of goods or services within the U.S.

- Royalties from intellectual property used in the U.S.

- Rental income from U.S. property

For Tax Year 2002, there were 12,705 foreign corporations with effectively connected U.S. income, about 0.2 percent of all active corporations filing a U.S. tax return.

Permanent Establishment

The concept of permanent establishment plays a pivotal role for foreign businesses operating in the U.S. Permanent establishment is a minimum threshold of business presence for a source country to tax a foreign corporation’s business income. Examples include:

- Offices

- Branches

- Factories

- Workshops

The presence of a permanent establishment often triggers U.S. tax obligations. For instance, a foreign company with a sales office in New York could constitute a permanent establishment, subjecting the company to U.S. tax on the income attributable to that office.

As of 2020, the U.S. maintained tax treaties with over 60 countries. These treaties often contain specific provisions regarding permanent establishment (which can significantly impact a company’s tax liability).

Tax Treaty Considerations

Tax treaties between the U.S. and other countries can modify the standard rules for determining foreign business status and tax obligations. These agreements aim to prevent double taxation and provide clarity on various tax-related issues.

Key aspects of tax treaties include:

- Definition of permanent establishment

- Reduced withholding tax rates on certain types of income

- Rules for attributing profits to permanent establishments

Foreign businesses must carefully review applicable tax treaties to understand their specific obligations and potential benefits.

The next section will explore the specific filing requirements and forms that foreign businesses must address when operating in the U.S. market. Understanding these requirements proves essential for maintaining compliance and avoiding costly penalties.

Essential Forms for Foreign Businesses in the U.S.

Foreign businesses operating in the United States must navigate a complex web of tax reporting requirements. Compliance with these obligations prevents penalties and maintains good standing with the IRS. This chapter focuses on the key forms that foreign businesses must file and the reporting requirements they must meet.

Form 1120-F: The Primary Tax Return for Foreign Corporations

Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, serves as the primary tax return for foreign corporations with U.S. operations. This form reports income effectively connected with a U.S. trade or business and determines the tax liability.

Filing deadlines for Form 1120-F depend on the corporation’s U.S. presence:

- Corporations with a U.S. office: File by the 15th day of the fourth month after the tax year ends (typically April 15 for calendar year taxpayers).

- Corporations without a U.S. office: File by the 15th day of the sixth month after the tax year ends.

The IRS reported that in 2019, approximately 50,000 foreign corporations filed Form 1120-F (a number that has steadily increased, reflecting the growing presence of foreign businesses in the U.S. market).

Form 5472: Reporting Related Party Transactions

Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, ensures transparency in international business operations. This form reports transactions between a U.S. corporation and its foreign parent or other related parties.

Key points about Form 5472:

- Filing threshold: Any reportable transaction, regardless of amount, triggers the filing requirement.

- Penalties: Failing to file or filing an incomplete Form 5472 incurs steep penalties (starting at $25,000 per form).

In 2018, the IRS processed over 80,000 Forms 5472, highlighting the significant number of foreign-owned U.S. corporations and their complex international transactions.

FBAR and FATCA: Financial Account Reporting

The Foreign Bank and Financial Accounts Report (FBAR) and Foreign Account Tax Compliance Act (FATCA) requirements add another layer of complexity for foreign businesses with U.S. operations.

FBAR filing:

- Mandatory for U.S. persons (including corporations) with foreign financial accounts exceeding $10,000 at any time during the calendar year.

- Deadline: April 15, with an automatic extension to October 15.

FATCA requirements:

- Certain U.S. taxpayers holding foreign financial assets with an aggregate value exceeding $50,000 must report information about those assets on Form 8938.

- This form is filed with the annual income tax return.

The Treasury Department reported that in 2020, over 1.2 million FBARs were filed, indicating the widespread use of foreign financial accounts by U.S. taxpayers (including foreign businesses operating in the U.S.).

Understanding and complying with these filing requirements establishes a solid foundation for long-term success in the U.S. market. Foreign businesses that master these reporting obligations gain a competitive edge and build trust with U.S. authorities and partners. The next chapter will explore tax planning strategies that foreign businesses can employ to optimize their tax positions while maintaining compliance with U.S. regulations.

Optimizing Tax Strategies for Foreign Businesses

Foreign businesses operating in the U.S. face unique challenges in tax planning. This chapter explores effective tax planning strategies for foreign businesses, focusing on entity structure, transfer pricing, and tax treaty benefits.

Choosing the Right Entity Structure

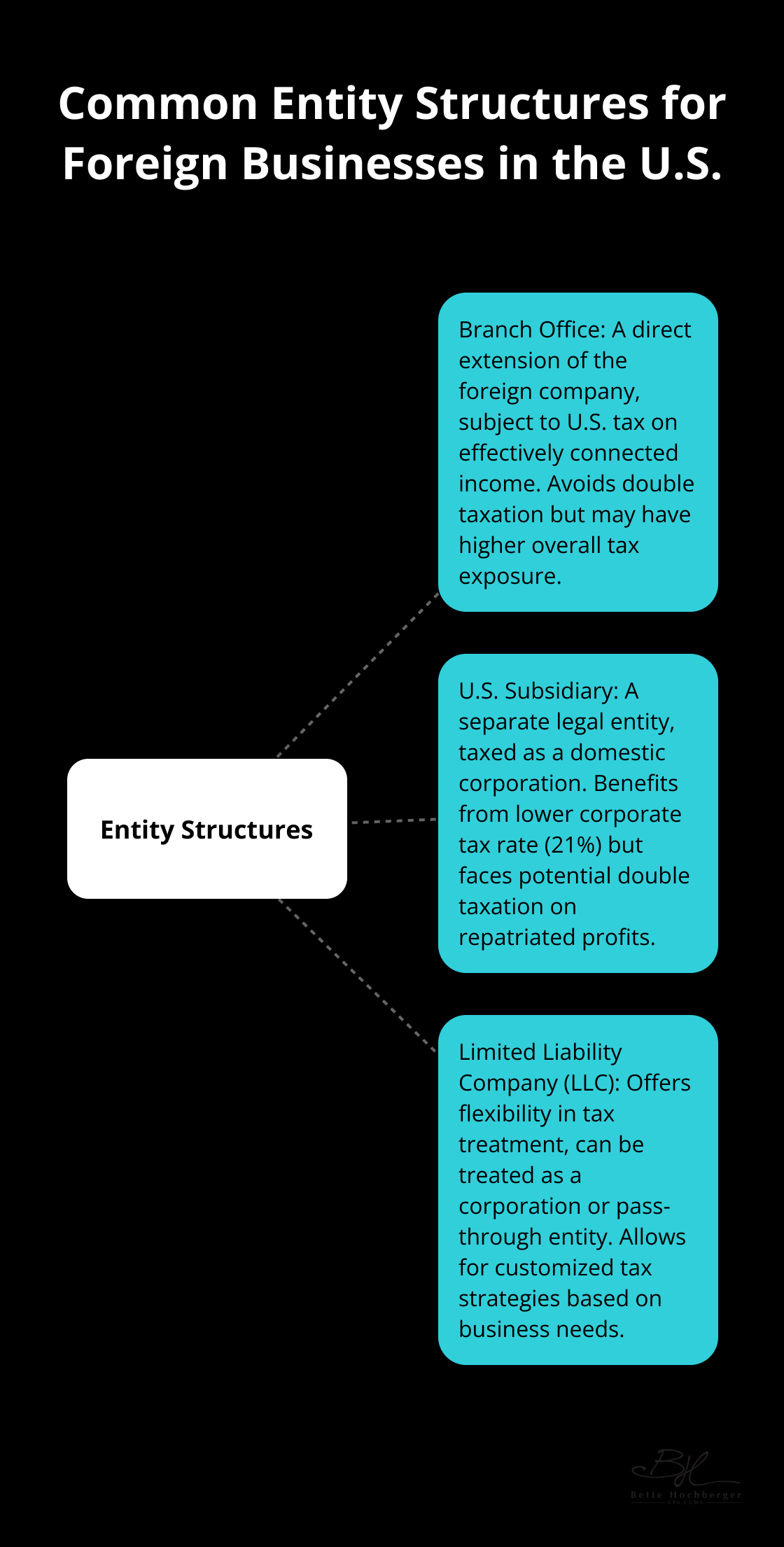

The choice of entity structure significantly impacts a foreign business’s U.S. tax obligations. Common options include:

- Branch Office: A direct extension of the foreign company, subject to U.S. tax on effectively connected income.

- U.S. Subsidiary: A separate legal entity, taxed as a domestic corporation.

- Limited Liability Company (LLC): Offers flexibility in tax treatment, can be treated as a corporation or pass-through entity.

Each structure has distinct tax implications. For example, a U.S. subsidiary might benefit from a lower corporate tax rate (currently 21%) but faces potential double taxation on repatriated profits. Conversely, a branch office avoids this double taxation but may have higher overall tax exposure.

Implementing Effective Transfer Pricing Strategies

Transfer pricing remains a critical area of focus for both foreign businesses and tax authorities. The IRS closely scrutinizes intercompany transactions to ensure they reflect arm’s length pricing. Effective transfer pricing strategies include:

- Regular transfer pricing studies to support pricing methodologies.

- Advance pricing agreements (APAs) with tax authorities to provide certainty on transfer pricing methods.

- Robust documentation to support transfer pricing positions.

Leveraging Tax Treaty Benefits

Tax treaties between the U.S. and other countries offer significant benefits for foreign businesses. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of income they receive from sources within the United States. Key considerations include:

- Permanent Establishment (PE) Thresholds: Treaties often provide higher thresholds for PE, potentially reducing U.S. tax exposure.

- Withholding Tax Reductions: Many treaties reduce or eliminate withholding taxes on dividends, interest, and royalties.

- Dispute Resolution Mechanisms: Treaties typically include provisions for resolving tax disputes between countries.

However, businesses must navigate complex limitation on benefits (LOB) provisions to ensure treaty eligibility.

Strategic Tax Planning Considerations

Foreign businesses should consider several strategic factors when planning their U.S. tax approach:

- Repatriation strategies: Careful planning can minimize the tax impact of moving profits back to the home country.

- State and local tax obligations: These can vary significantly and require separate consideration from federal tax planning.

- Industry-specific tax incentives: Certain industries (e.g., renewable energy, research and development) may qualify for specific tax benefits.

Effective tax planning requires a deep understanding of U.S. tax laws, treaty provisions, and international tax principles. Foreign businesses that master these elements can optimize their tax positions and thrive in the U.S. market.

Final Thoughts

Foreign businesses face significant challenges when navigating U.S. tax obligations. Professional tax advice proves invaluable for managing these complex requirements and staying current with evolving laws. A well-crafted tax strategy optimizes cash flow, minimizes liabilities, and supports overall business objectives for companies operating in the American market.

Proper tax planning yields long-term advantages for foreign businesses in the U.S. It allows companies to make informed decisions about expansion, profit repatriation, and investment in U.S. operations. A proactive approach to tax planning provides a competitive edge, enabling businesses to allocate resources efficiently and focus on core operations.

Bette Hochberger, CPA, CGMA specializes in helping foreign businesses navigate U.S. tax complexities. Our team offers personalized financial services, including strategic tax planning, Fractional CFO services, and tax preparation. We empower foreign businesses to thrive in the U.S. market while maintaining full compliance with tax laws.