Cryptocurrency staking has become a popular way to earn passive income, with over $120 billion currently staked across various blockchain networks. However, many investors overlook the complex tax implications of their crypto staking rewards.

At Bette Hochberger, CPA, CGMA, we see clients struggle with proper reporting and planning for staking income. The IRS treats these rewards as taxable income, creating significant compliance challenges for active stakers.

How Does Crypto Staking Generate Taxable Income

Crypto staking operates through Proof of Stake consensus mechanisms where validators lock their cryptocurrency holdings to verify network transactions. Ethereum switched to this system in September 2022, significantly reducing energy consumption compared to traditional mining operations. Stakers receive rewards that range from 4% to 20% annually depending on the network, with Ethereum currently offering approximately 5.2% annual yields according to data from StakingRewards.

Validator Operations and Network Participation

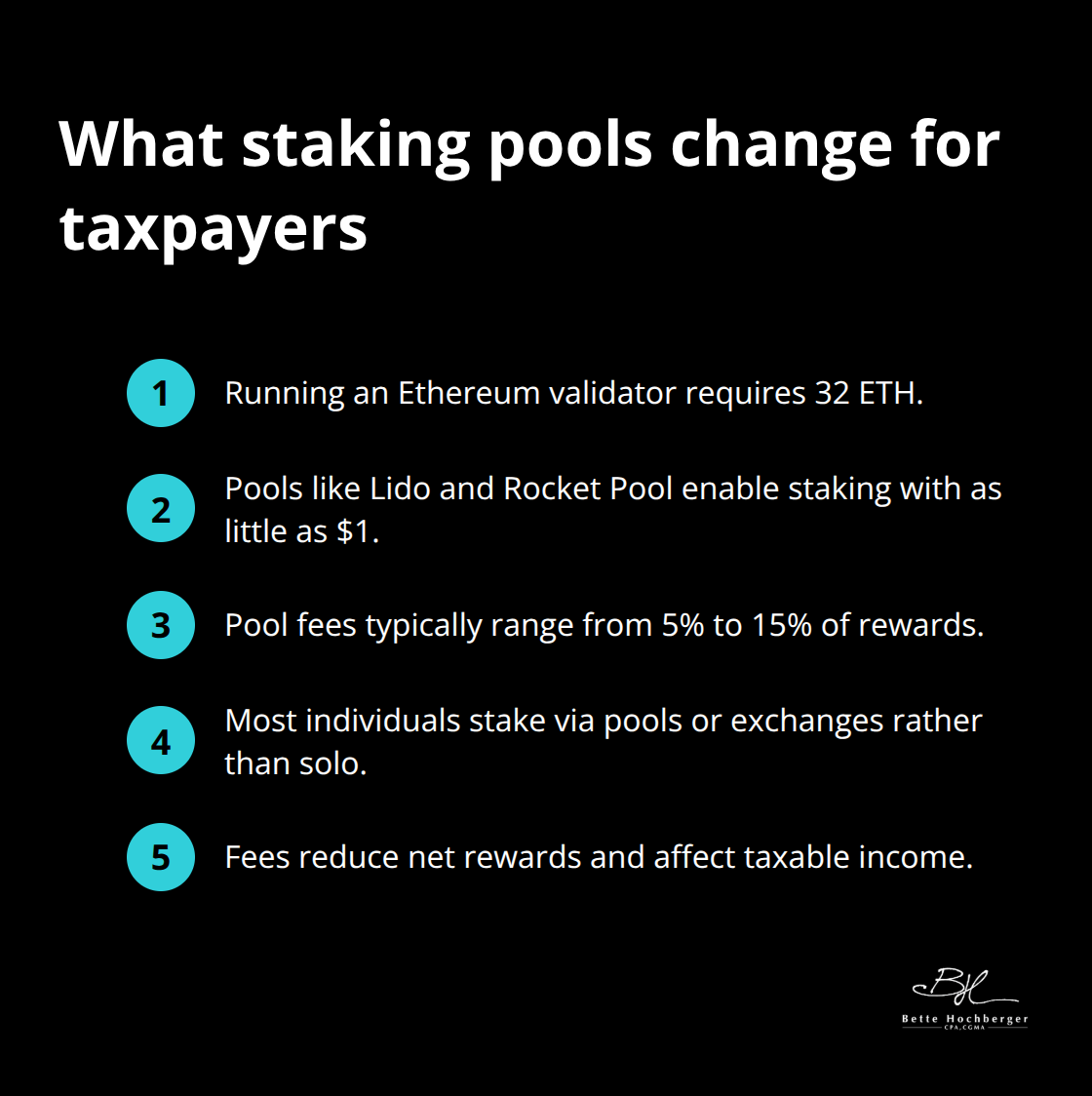

Most individual stakers participate through pools or exchanges rather than operate validator nodes directly. An Ethereum validator requires 32 ETH (worth over $100,000 at current prices). Platforms like Lido and Rocket Pool allow smaller investors to stake with minimum amounts that start at $1. These services charge fees between 5% to 15% of rewards, which directly affects your taxable income calculations.

Reward Distribution and Payment Timing

Networks distribute rewards differently, which creates distinct tax recognition events. Ethereum distributes rewards every 6.4 minutes through consensus layer rewards, while execution layer tips vary based on network activity. Cosmos networks typically distribute rewards every block (approximately every 6 seconds). The frequency matters for tax purposes because each reward distribution represents a separate taxable event at fair market value when you gain control over the tokens.

Income Recognition and Control Standards

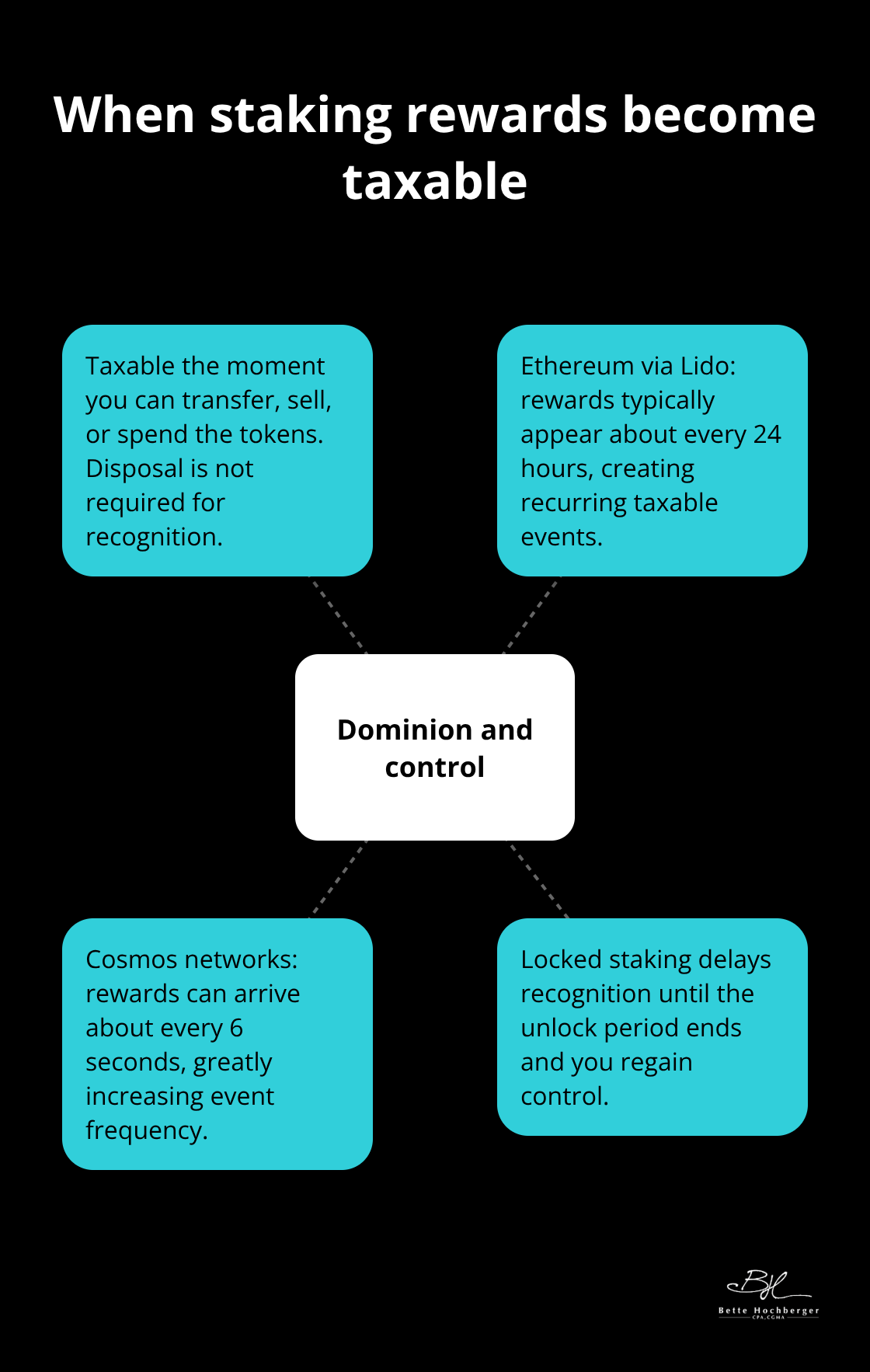

The IRS applies the “dominion and control” standard to determine when staking rewards become taxable. Revenue Ruling 2023-14 clarifies that you must report income when you can sell, transfer, or otherwise dispose of the tokens. Staking rewards generate taxable income at fair market value when received, not when sold. Locked staking rewards remain non-taxable until the lock period expires and you gain access to move the tokens.

Understanding these mechanics becomes essential as you prepare for the complex tax planning strategies that follow each reward distribution.

How Does the IRS Tax Your Staking Rewards

The IRS classifies staking rewards as ordinary income under Revenue Ruling 2023-14, which means you pay your regular income tax rate rather than capital gains rates. This classification applies whether you receive 0.001 ETH or 100 ETH in rewards. The ruling specifically states that staking rewards constitute gross income when you gain dominion and control over the tokens, regardless of whether you immediately sell them or hold for future gains.

Income Recognition Occurs at Control Transfer

Tax recognition occurs the moment you can transfer, sell, or spend your staking rewards, not when you actually dispose of them. Ethereum staking through Lido generates taxable events every time rewards appear in your wallet (typically every 24 hours). Cosmos staking creates even more frequent taxable events with rewards distributed every 6 seconds during active network periods. Locked staking programs like Ethereum 2.0 validators delay tax recognition until the unlock period expires and you regain control.

Fair Market Value Calculations Require Precision

You must record the exact fair market value at the timestamp when rewards become accessible, not at day-end prices or arbitrary times. CoinGecko and CoinMarketCap provide historical price data down to the minute, which becomes essential for audit defense. The IRS expects consistency in your valuation method across all staking activities. If you use Binance prices for January rewards, you cannot switch to Coinbase prices for February without documentation that explains the change.

Record Maintenance Demands Detailed Documentation

Most crypto tax software like Koinly or TaxBit automatically pulls timestamped price data, but manual stakers need spreadsheets that track date, time, token amount, USD value, and the specific exchange rate source for every reward distribution. The IRS requires all staking income reports regardless of amount-no minimum threshold exists for reporting requirements. This timing difference can shift thousands of dollars in tax liability between tax years depending on your staking method, making proper documentation essential for crypto tax planning strategies that can optimize your overall staking tax burden.

Smart Tax Strategies That Cut Your Staking Tax Bill

Tax-Loss Harvesting Maximizes Deduction Opportunities

Tax-loss harvesting transforms staking rewards into powerful tax reduction tools through strategic disposal timing. You can offset up to $3,000 in ordinary income annually when you sell staking rewards at a loss, with unlimited carryforward for future years. The IRS considers virtual currencies to be property rather than securities, which means wash sale rules do not currently apply to cryptocurrency and allows you to repurchase the same tokens immediately after you sell for a loss.

This creates opportunities to harvest losses from volatile staking rewards while you maintain your position. Ethereum staking rewards dropped 40% between April and October 2024, which created substantial harvesting opportunities for active stakers who documented their cost basis properly.

Strategic Year-End Timing Shifts Tax Liability

You can move staking activities between tax years to shift thousands of dollars in tax liability, especially when you face 37% marginal rates as a high-income earner. You accelerate income recognition into the current year when you unstake validators before December 31st. You delay recognition until the following year when you start new staking positions in January.

The timing difference becomes particularly valuable when you expect lower income in future years or when tax rates change. You control the exact timing of validator exits and new staking commitments, which gives you flexibility that traditional investments cannot match.

Business Classification Unlocks Additional Deductions

Business classification of staking activities allows deductions for hardware, electricity, and professional fees that hobbyists cannot claim. The IRS requires consistent business treatment with profit motives, detailed records, and regular activity patterns. You must demonstrate business intent through validator operations, client services, or systematic profit-seeking activities.

Professional stakers who operate multiple validators can deduct up to 20% of net income under Section 199A (reducing effective tax rates from 37% to 29.6% for qualified business income). You can also deduct ordinary and necessary expenses including computer equipment, internet costs, and professional development related to staking operations.

Final Thoughts

Crypto staking rewards create complex tax obligations that demand careful attention to timing, valuation, and documentation requirements. The IRS treats these rewards as ordinary income when you gain control, regardless of whether you sell immediately or hold long-term. Revenue Ruling 2023-14 eliminates previous uncertainty about recognition timing but creates new compliance challenges for active stakers who receive frequent reward distributions.

Professional tax guidance becomes essential as staking activities grow more sophisticated. We at Bette Hochberger, CPA, CGMA help clients navigate these complexities through strategic tax planning and preparation services. Our expertise in cryptocurrency taxation allows stakers to optimize their tax positions through proper classification, timing strategies, and deduction maximization.

Regulatory developments continue to evolve rapidly. The Infrastructure Investment and Jobs Act expands broker reporting requirements starting in 2025, while the OECD develops international frameworks for crypto tax compliance (which will likely increase audit scrutiny for stakers). These changes will affect how you report and manage your crypto staking rewards in future tax years.