Relocating for work can be an exciting yet complex process, especially when it comes to understanding the tax implications. At Bette Hochberger, CPA, CGMA, we often guide clients through the maze of relocation tax benefits.

From moving expense deductions to employer-provided relocation packages, there are numerous financial aspects to consider. This post will break down the key tax benefits and considerations you should be aware of when planning a job-related move.

Can You Deduct Moving Expenses?

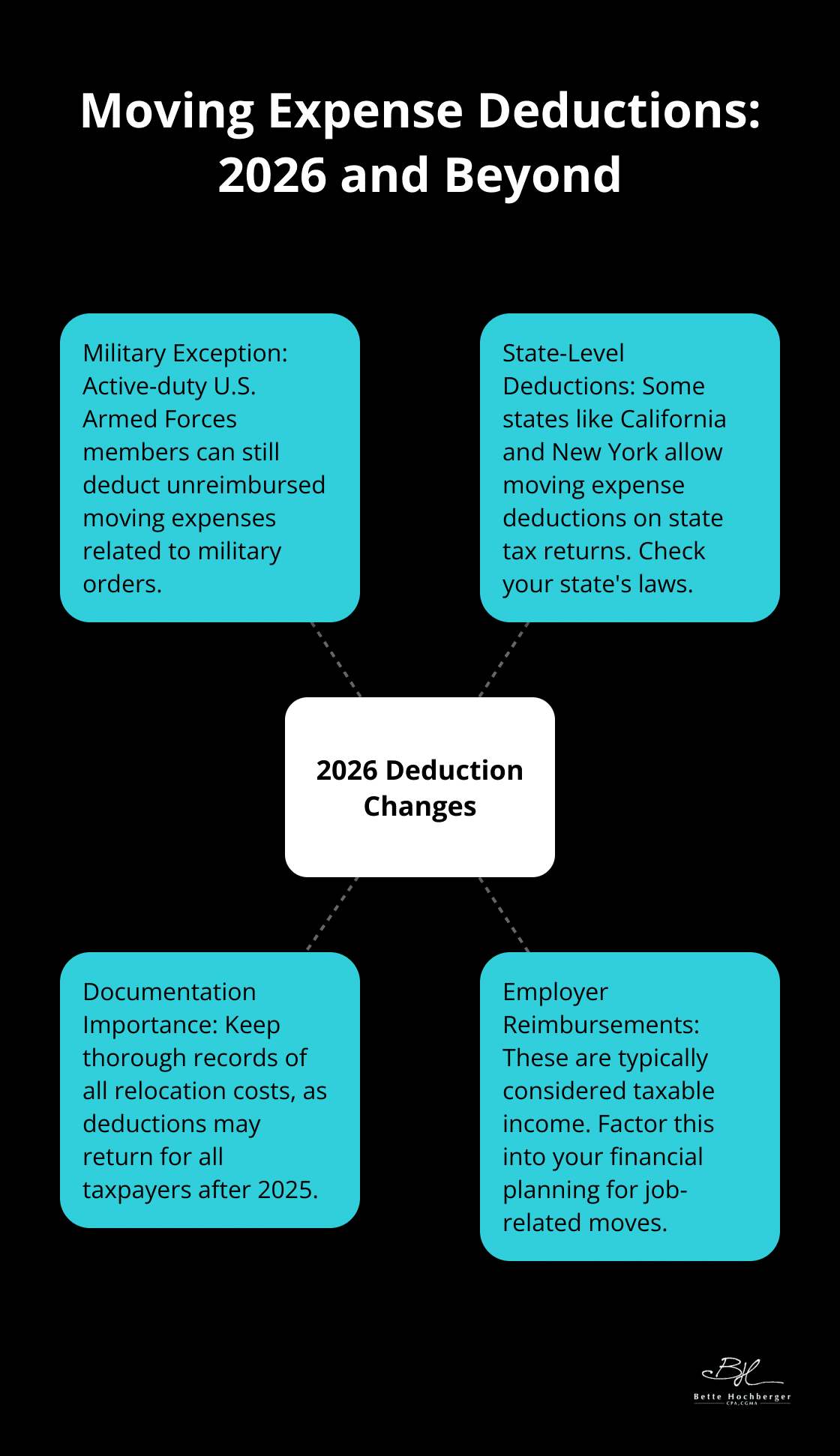

The Tax Cuts and Jobs Act of 2017 transformed the landscape for moving expense deductions. As of 2023, most taxpayers cannot claim these deductions on their federal tax returns. However, important exceptions and considerations remain.

Military Personnel Exception

Active-duty members of the U.S. Armed Forces can still deduct unreimbursed moving expenses. This applies to moves due to military orders and permanent changes of station. Eligible expenses include:

- Transportation costs

- Storage fees

- Travel expenses related to the move

State-Level Deductions

While federal deductions are limited, some states allow moving expense deductions on state tax returns. California and New York (among others) permit certain moving expense deductions for state income tax purposes. Check your specific state’s tax laws or consult a tax professional to understand your options.

Future Changes

The current restrictions on moving expense deductions will expire after 2025. Unless new legislation passes, the deduction may return for all taxpayers in 2026. This potential change highlights the need to stay informed about tax law updates and plan accordingly.

Employer Reimbursements

Although most taxpayers can’t deduct moving expenses, some employers offer reimbursement for relocation costs. These reimbursements are typically considered taxable income (with some exceptions for military personnel). Employees should factor this into their financial planning when considering a job-related move.

Documentation and Record-Keeping

Even if you can’t deduct moving expenses now, maintain thorough records of all relocation-related costs. This practice will prove valuable if deductions return in the future or if your state allows for such deductions. Keep receipts, mileage logs, and any correspondence related to your move.

The landscape of moving expense deductions has shifted, but opportunities to optimize your tax situation during relocation still exist. A qualified tax professional can help you navigate these complex waters and identify potential tax benefits specific to your situation. As you plan your move, consider how these tax implications might affect your overall financial picture.

Maximizing Job Relocation Benefits

Understanding Relocation Packages

Relocation packages vary widely between companies. Some offer lump sum payments, while others provide itemized reimbursements. Common components include:

- Moving expense coverage

- Temporary housing allowances

- Home sale assistance

- Travel costs for house hunting trips

- Spousal job search support

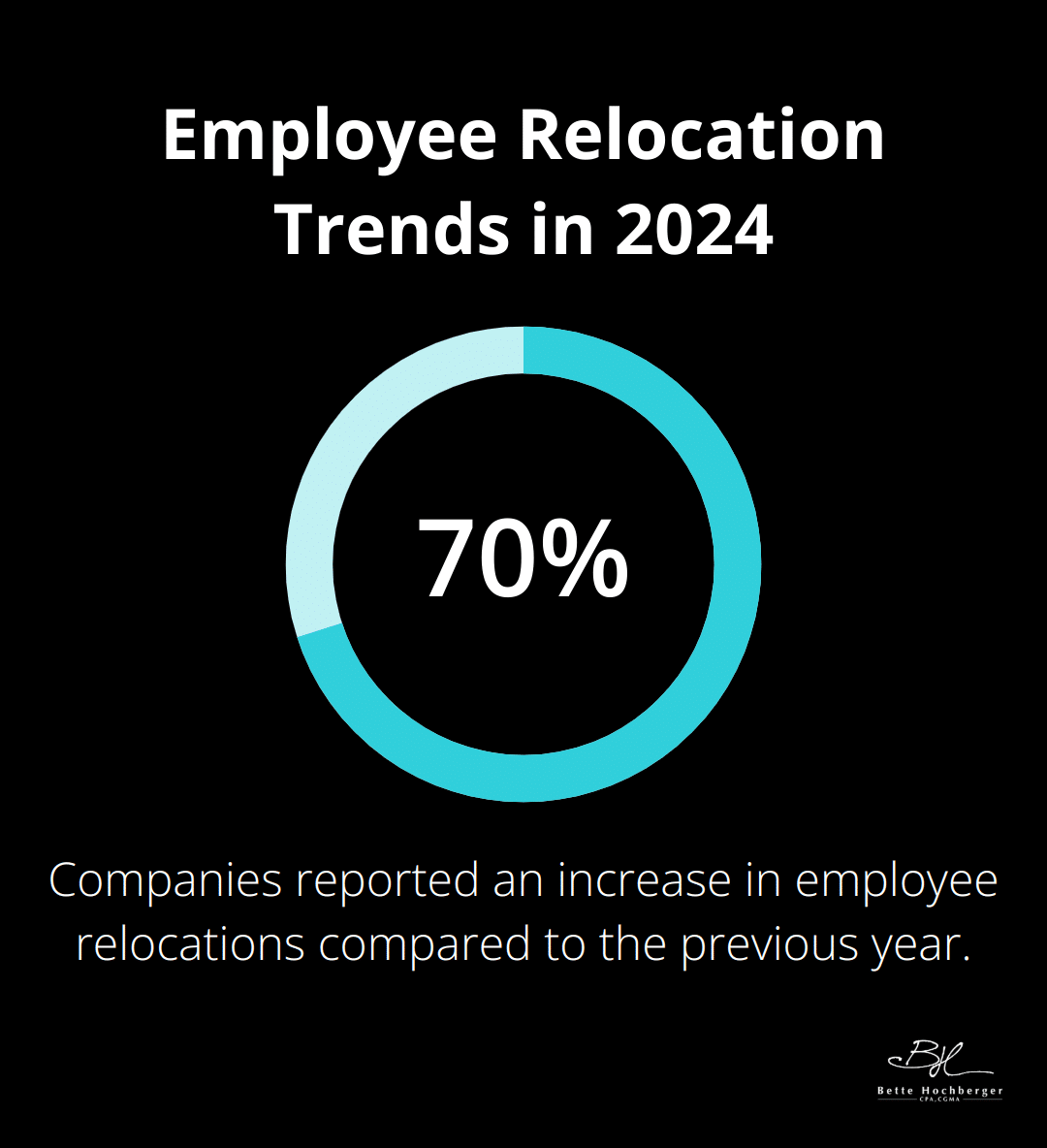

A 2024 survey by Atlas Van Lines revealed that 70% of companies reported an increase in employee relocations compared to the previous year. This trend highlights the importance of understanding relocation benefits in today’s job market.

Tax Implications of Relocation Benefits

Most relocation benefits count as taxable income by the IRS. The IRS includes these benefits in your gross income, subjecting them to federal, state, and local taxes. Some employers offer tax gross-ups to offset this additional tax burden.

A tax gross-up is an additional payment made by the employer to cover the taxes owed on relocation benefits. Without gross-ups, employees can lose a significant portion of their relocation benefits to taxes. For example, if you receive $10,000 in relocation benefits and fall into the 22% tax bracket, you could owe $2,200 in taxes without a gross-up.

Negotiating Your Relocation Package

When discussing relocation benefits with a potential employer, take a proactive and informed approach. Consider these strategies:

- Research typical relocation packages in your industry and location

- Prioritize the benefits that matter most to you (e.g., home sale assistance or temporary housing)

- Discuss tax implications and the possibility of gross-ups

- Consider negotiating for a lump sum payment, which can offer more flexibility in how you use the funds

Relocation packages often have room for negotiation. Don’t hesitate to ask for what you need to make your move successful.

Maximizing Your Benefits

To get the most out of your relocation package:

- Understand all components of the package (some benefits might not be obvious at first glance)

- Ask about any time limits or restrictions on using the benefits

- Inquire about additional support services (such as cultural training for international moves)

- Consider the long-term implications of the package (e.g., how it might affect your overall compensation)

Seeking Professional Advice

Navigating the complexities of relocation benefits and their tax implications can prove challenging. A qualified tax professional can provide personalized advice to ensure you maximize your relocation package while minimizing potential tax liabilities. Their expertise can help you make informed decisions about your move and its financial implications.

As you consider the various aspects of your relocation package, it’s important to also understand how your move might affect your state and local tax obligations. Let’s explore these considerations in the next section.

How State Taxes Impact Your Relocation

State Income Tax Variations

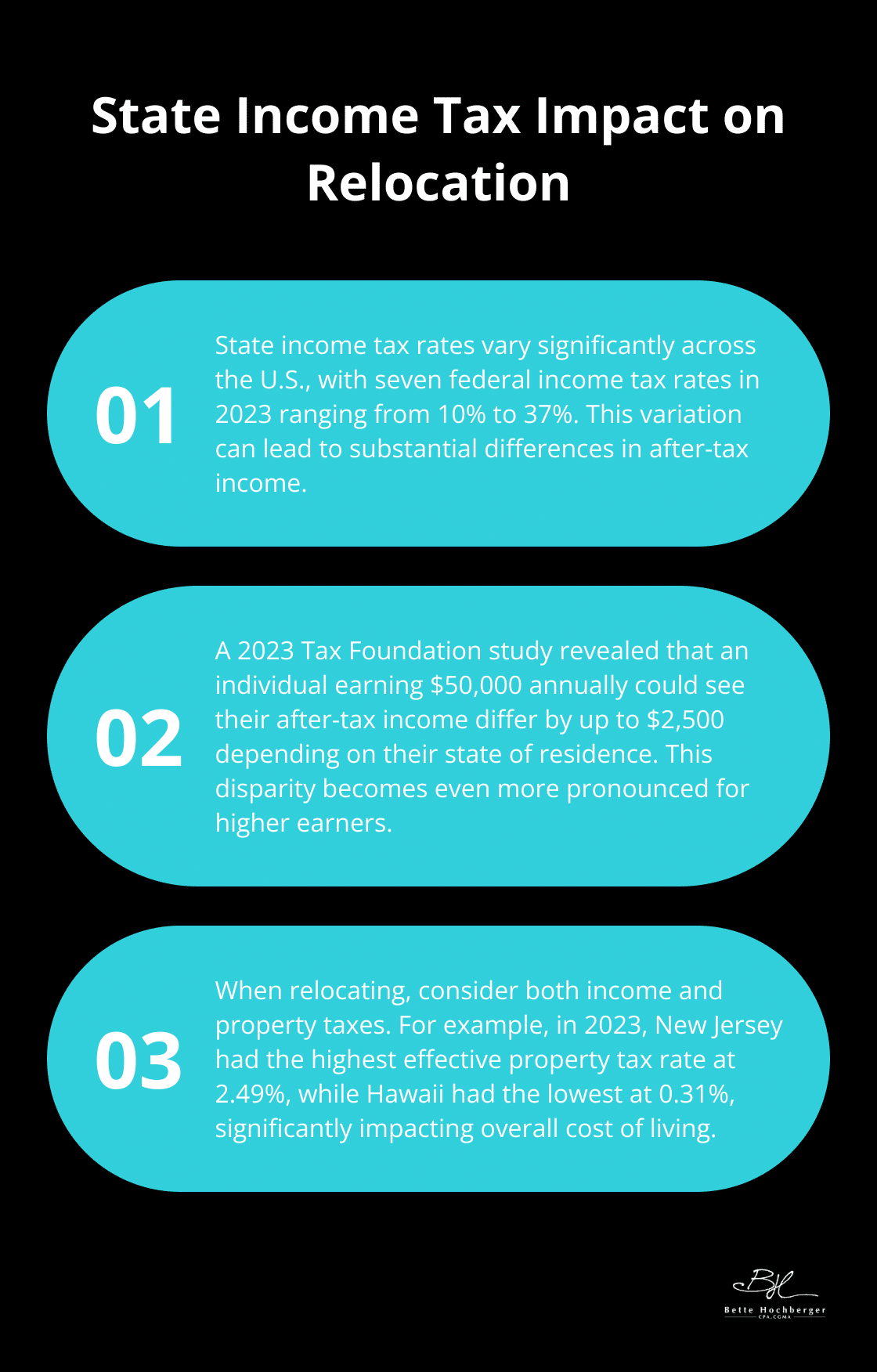

State income tax rates vary significantly across the United States. There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

A 2023 Tax Foundation study revealed that an individual earning $50,000 annually could see their after-tax income differ by up to $2,500 depending on their state of residence. This disparity becomes even more pronounced for higher earners.

Domicile and Residency Rules

Establishing your tax domicile is essential when moving between states. You will generally be considered a resident for state income tax purposes when your “domicile” is within that state and you spend more than half of the year there.

New York, for example, uses a day-counting method. If you spend more than 183 days in New York and maintain a permanent place of abode, the state might consider you a resident for tax purposes (even if you’ve moved your primary residence elsewhere).

Property Tax Implications

Property taxes fluctuate dramatically between states and even within counties. The Tax Foundation reported that in 2023, New Jersey had the highest effective property tax rate at 2.49%, while Hawaii had the lowest at 0.31%.

When relocating, you should factor in these differences. A lower-priced home in a high property tax area might cost more annually than a higher-priced home in a low property tax jurisdiction.

Impact on Take-Home Pay

The variation in state tax structures can significantly affect your take-home pay and overall cost of living. A comprehensive analysis of your potential new location’s tax landscape will help you make informed decisions about your move.

Professional Guidance

Navigating the complex tax landscapes across state lines can prove challenging. Professional guidance from a qualified tax expert (such as Bette Hochberger, CPA, CGMA) can help you optimize your tax situation and potentially save thousands of dollars annually.

Final Thoughts

Relocation tax benefits play a crucial role in the financial aspects of job-related moves. The landscape has changed, but opportunities for tax optimization still exist. Proper documentation of all relocation-related costs remains essential, even if certain expenses aren’t currently deductible.

The complexities of relocation taxes highlight the importance of professional guidance. Bette Hochberger, CPA, CGMA specializes in helping clients navigate the intricate world of relocation tax planning. Our team’s expertise can help you minimize tax liabilities and manage cash flow during your transition.

Informed decision-making is key when you relocate for work. Understanding tax implications, negotiating comprehensive relocation packages, and seeking expert advice can transform a stressful situation into an opportunity for financial optimization. With the right approach, your job-related move can set the stage for long-term financial success in your new location.