Startup tax planning can make or break your business’s financial future. The IRS collected $4.7 trillion in 2023, and new businesses often pay more than necessary due to poor planning.

We at Bette Hochberger, CPA, CGMA see entrepreneurs lose thousands annually by choosing wrong structures or missing key deductions. Smart tax strategy from day one protects your profits and accelerates growth.

Which Business Structure Saves the Most Tax?

LLCs Offer Maximum Flexibility for Early-Stage Companies

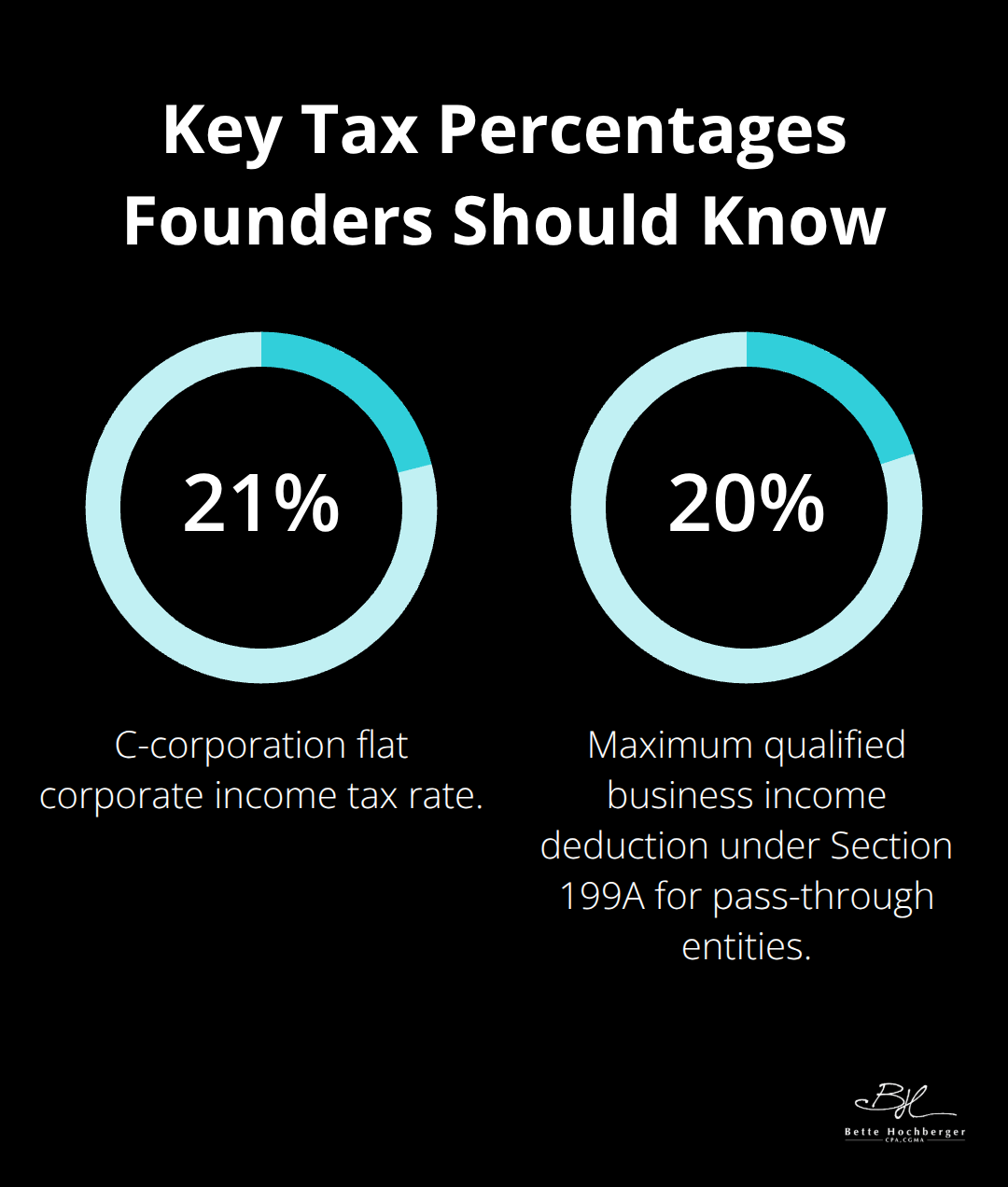

LLCs dominate startup formations because they provide pass-through taxation without corporate formalities. Your business income flows directly to your personal tax return and avoids the double taxation that plagues C-corporations. The Section 199A qualified business income deduction allows you to deduct up to 20% of your LLC profits, which reduces your effective tax rate significantly. LLCs also permit unlimited owners and flexible profit distributions, which makes them perfect for startups with multiple founders or different investment levels.

Most importantly, LLCs can elect S-corporation tax treatment later without a change to their legal structure. This flexibility becomes valuable when your business generates enough profit to justify payroll tax savings through reasonable salary strategies.

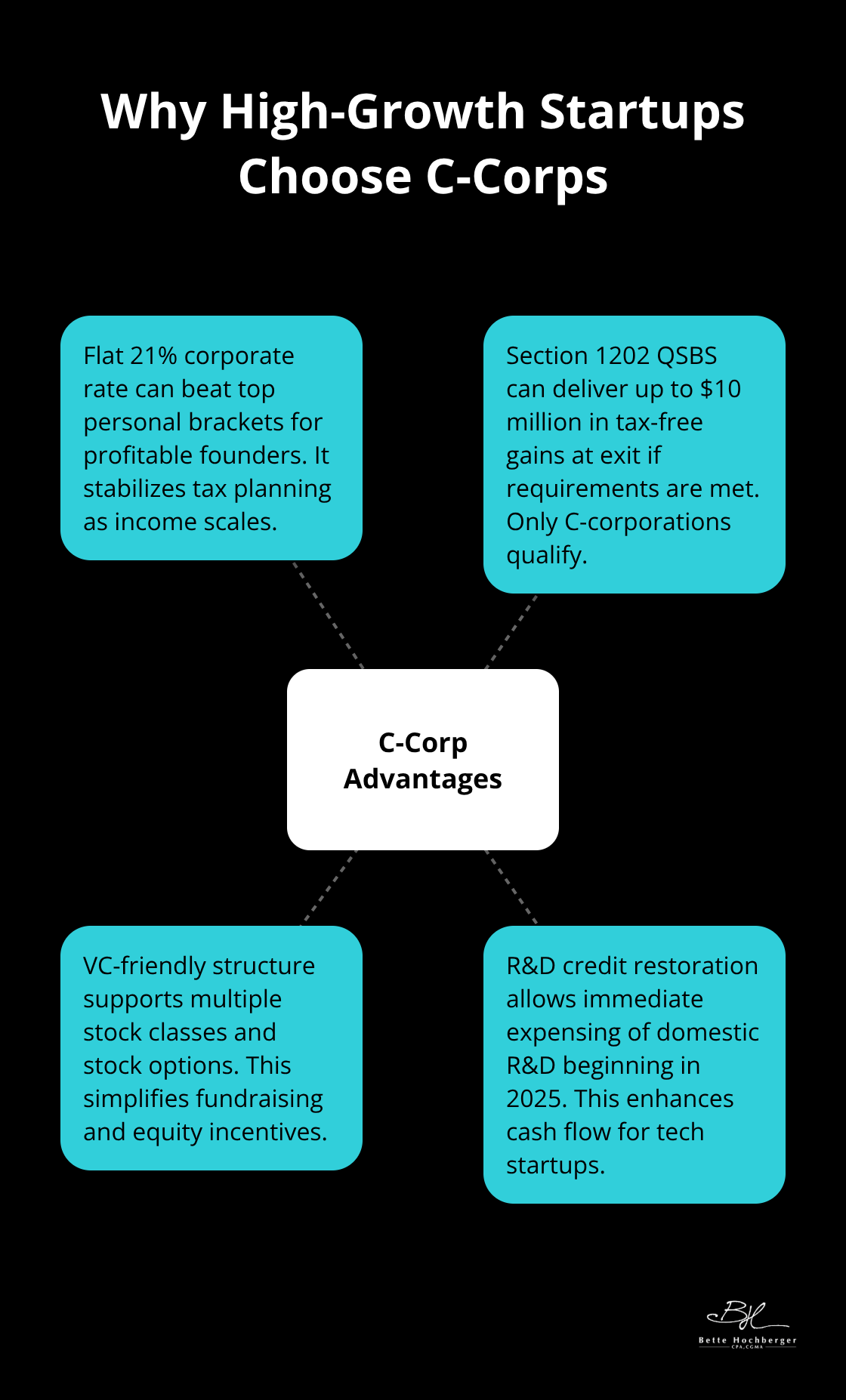

C-Corporations Become Essential for High-Growth Ventures

C-corporations face double taxation but offer unmatched benefits for businesses that scale rapidly. The corporate tax rate sits at a flat 21%, often lower than personal income tax rates for profitable founders. Section 1202 qualified small business stock provides up to $10 million in tax-free capital gains when you sell (but only C-corporations qualify for this massive benefit).

Venture capital firms strongly prefer C-corporations because they can issue multiple stock classes and stock options without immediate tax consequences for recipients. The research and development tax credit restoration under the One Big Beautiful Bill Act makes C-corporations even more attractive for tech startups, which allows immediate expense treatment of domestic R&D costs that start in 2025.

S-Corporations Work Best for Service-Based Profitable Businesses

S-corporations combine pass-through taxation with payroll tax savings but impose strict limitations. You can only have 100 shareholders, all must be U.S. citizens or residents, and only one class of stock is permitted. These restrictions make S-corporations unsuitable for most venture-backed startups.

However, profitable service businesses benefit enormously from S-corporation elections. Owners pay themselves reasonable salaries subject to payroll taxes, while additional profits flow through as distributions exempt from self-employment tax. This structure can save thousands annually in Medicare and Social Security taxes for businesses that generate consistent profits above $60,000.

Each structure creates different opportunities for tax optimization through deductions and credits that can dramatically impact your bottom line.

Which Tax Benefits Can Slash Your Startup Costs

Research and Development Credits Transform Tech Startup Finances

The R&D tax credit stands as the most powerful weapon in your startup tax arsenal and potentially saves up to $500,000 per year. Under the One Big Beautiful Bill Act, startups can now immediately expense domestic R&D costs that start in 2025, while the credit offsets up to $250,000 in payroll taxes annually for unprofitable companies.

The four-point IRS test requires your activities to have a permitted purpose, eliminate uncertainty, rely on experimentation, and involve technological processes. Software development, algorithm improvements, and product tests typically qualify, but you must document everything meticulously.

Employee wages for R&D work, contractor payments, and materials used in development all count as eligible expenses. Form 6765 captures your credit calculation, while Form 8975 claims the payroll tax offset after IRS approval.

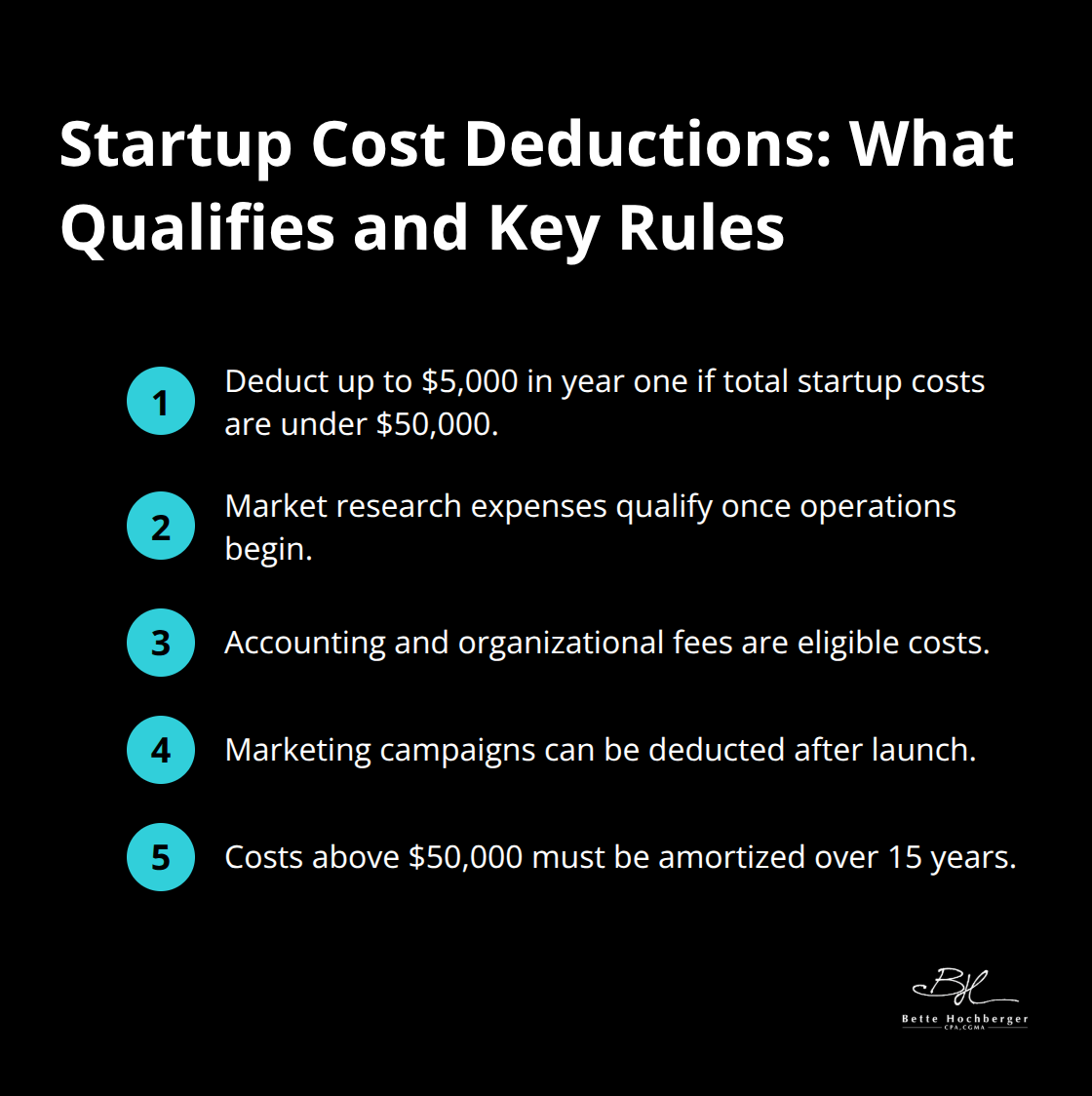

Startup Cost Deductions Provide Immediate Cash Flow Relief

New businesses can deduct up to $5,000 of startup costs in their first year if total expenses stay under $50,000 (according to IRS regulations). Market research, accounting fees, marketing campaigns, and organizational costs all qualify for immediate deduction once operations begin.

Expenses that exceed the $50,000 threshold must be amortized over 15 years with Form 4562. The key timing rule: costs only become deductible after your business officially launches and starts operations. Pre-launch expenses remain personal and non-deductible.

Section 199A Deduction Cuts Pass-Through Entity Taxes

Pass-through entities can claim up to 20% of qualified business income under Section 199A, which creates substantial tax savings for profitable startups. This deduction applies to LLCs, S-corporations, and sole proprietorships but phases out at higher income levels ($182,050 for single filers in 2025).

Service businesses face additional restrictions, while manufacturing and tech companies often qualify for the full deduction. The W-2 wage limitation becomes important for larger businesses (those with taxable income above the threshold).

Strategic Year-End Expense Acceleration Maximizes Deductions

Smart founders stockpile cloud credits and prepaid expenses before year-end to maximize deductions while supporting next year’s operations. The 12-month rule for prepaids creates additional opportunities to accelerate deductions into the current tax year.

Cost segregation studies paired with bonus depreciation can maximize tax benefits for leased improvements and equipment purchases. Tangible assets with a class life of 20 years or less qualify for full deduction when placed in service in 2025, which includes servers and lab equipment.

These deductions work best when combined with strategic tax planning that spans multiple business growth phases.

How Tax Strategy Must Evolve With Business Growth

Pre-Revenue Startups Need Foundation Plans Not Profit Optimization

Pre-revenue startups face unique tax challenges that require careful attention to structure and documentation rather than income reduction strategies. The IRS allows new businesses to deduct up to $5,000 of startup costs in their first year if total expenses stay under $50,000, but these deductions only activate once operations officially begin. Document every expense from market research to accounting fees because the IRS scrutinizes the exact moment operations commence.

Most pre-revenue companies should elect LLC status initially for maximum flexibility while they build R&D credit documentation systems immediately. Track employee time spent on activities that qualify, maintain detailed project descriptions, and document uncertainty elimination processes. The R&D tax credit can offset up to $250,000 in payroll taxes annually for unprofitable startups under the PATH Act provisions (which makes this credit worth more than traditional deductions when companies operate at a loss).

Profitable Companies Must Balance Growth Investment With Tax Efficiency

Profitable startups face the opposite challenge: they must manage tax liability while they fund rapid growth. Section 199A qualified business income deduction becomes powerful at this stage and potentially reduces effective tax rates by 20% for pass-through entities. However, service businesses face phase-out limitations that start at $182,050 for single filers in 2025.

S-corporation elections generate substantial payroll tax savings for service-based businesses that generate consistent profits above $60,000. Owners pay reasonable salaries subject to payroll taxes while additional profits flow through as distributions exempt from self-employment tax. This strategy saves approximately 15.3% on profits distributed above salary levels.

High-Growth Companies Should Consider C-Corporation Conversion

High-growth tech companies should consider C-corporation conversion when they scale to access Section 1202 qualified small business stock benefits, which provide capital gains exclusion upon exit. The corporate tax rate sits at a flat 21%, often lower than personal income tax rates for profitable founders who face higher brackets.

Venture capital firms strongly prefer C-corporations because they can issue multiple stock classes and stock options without immediate tax consequences for recipients. The research and development tax credit restoration under the One Big Beautiful Bill Act makes C-corporations even more attractive for tech startups (which allows immediate expense treatment of domestic R&D costs that start in 2025).

Exit Plans Require Years of Strategic Tax Preparation

Exit strategies demand multi-year tax plans that begin well before sale negotiations. Section 1202 requires five-year stock periods and active business operations to qualify for capital gains exclusion. C-corporations must maintain qualified small business status throughout the period, which means they must keep gross assets under $50 million and conduct active business operations rather than passive investments.

Asset sales versus stock sales create dramatically different tax consequences for both buyers and sellers. Stock sales typically favor sellers through capital gains treatment while asset sales provide buyers with stepped-up basis and faster depreciation schedules. The choice affects purchase price negotiations and final after-tax proceeds significantly.

Final Thoughts

Startup tax planning demands strategic decisions from day one rather than reactive choices at year-end. The most successful entrepreneurs we work with understand that tax structure choices made early create compound benefits over years of growth. Smart founders choose business structures based on long-term tax implications rather than formation costs alone.

The biggest mistake founders make involves missing R&D credit documentation requirements, which can cost startups hundreds of thousands in lost payroll tax offsets. Many entrepreneurs also fail to track startup costs properly or wait too long to implement strategic tax plans. The IRS collected $4.7 trillion in 2023, and businesses that plan proactively keep more of their profits while those that react pay unnecessary taxes.

Professional guidance becomes essential when your business generates consistent profits, raises capital, or approaches exit opportunities (especially for complex transactions like Section 1202 stock sales). Tax laws change frequently, and specialized knowledge prevents expensive mistakes while maximizing available benefits for your specific situation. We at Bette Hochberger, CPA, CGMA help startups navigate these complexities and optimize their tax strategies for long-term success.

![The Ultimate Startup Tax Planning Roadmap [2025 Edition]](https://bettehochberger.com/wp-content/uploads/emplibot/The-Ultimate-Startup-Tax-Planning-Roadmap-_2025-Edition__1761048569.jpeg)