Real estate wholesaling generates significant profits, but many investors overlook the tax implications that can eat into their earnings. The IRS treats wholesale deals as ordinary income, subjecting them to both income and self-employment taxes.

We at Bette Hochberger, CPA, CGMA see wholesalers lose thousands annually due to poor tax planning and missed deductions.

How Wholesale Deals Are Taxed as Ordinary Income

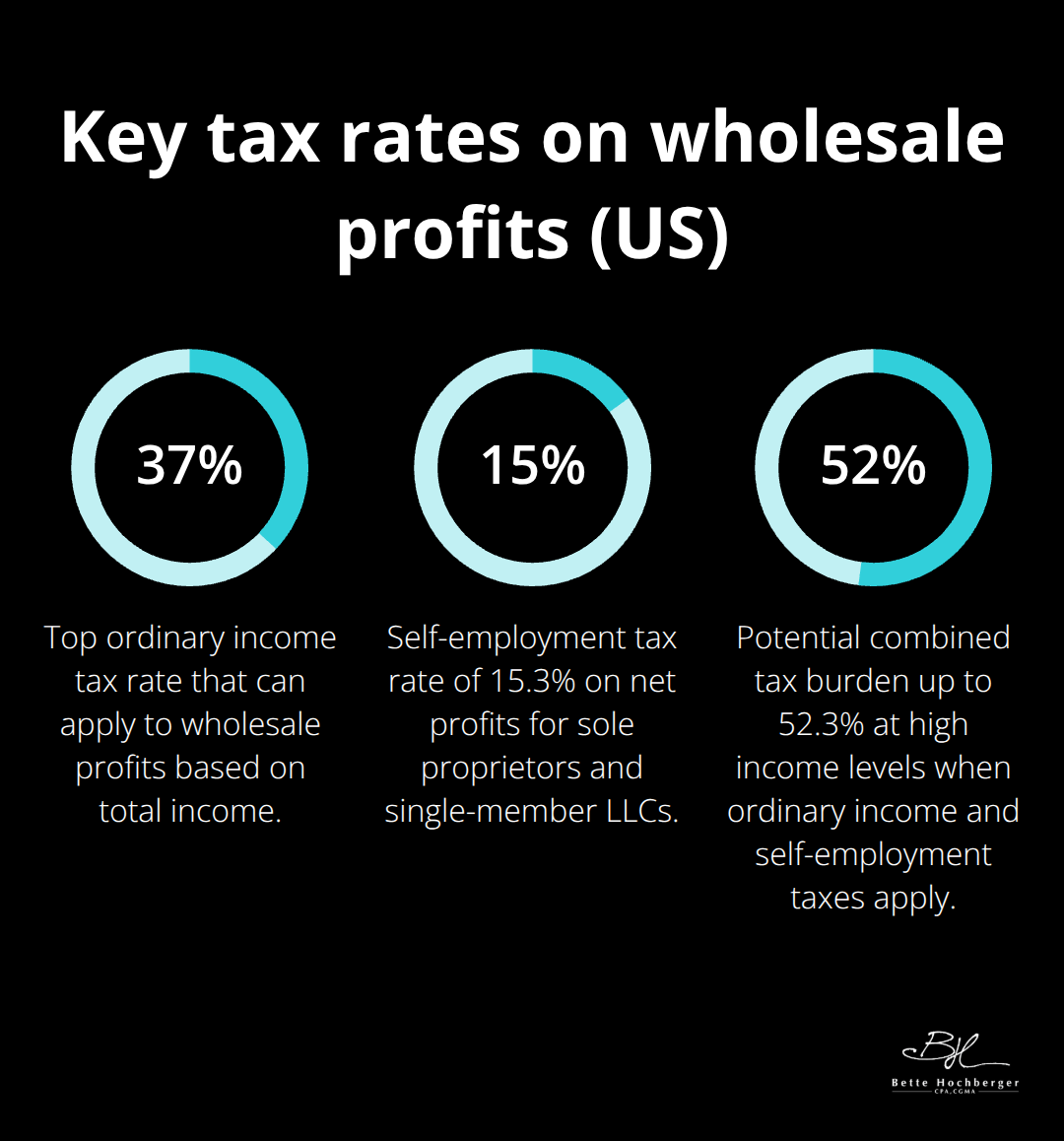

The IRS views real estate wholesaling as an active business, not passive investment activity. This classification means your assignment fees and double closing profits face ordinary income tax rates from 10% to 37% based on your total income, not the favorable 15% to 20% capital gains rates that traditional real estate investors enjoy.

Wholesalers who operate as sole proprietors or single-member LLCs also pay the 15.3% self-employment tax on net profits, which brings your total tax burden to potentially 52.3% on high earnings.

Self-Employment Tax Creates Additional Burden

Self-employment tax applies to all net profits from wholesale activities when you operate as a sole proprietor or single-member LLC. This 15.3% tax covers Social Security and Medicare contributions on earnings up to $160,200 for 2023. Wholesalers who earn $100,000 annually face $15,300 in self-employment taxes alone, before regular income taxes. S-Corporation election can reduce this burden by allowing you to pay reasonable salary subject to payroll taxes while taking remaining profits as distributions (exempt from self-employment tax).

Assignment Fees Trigger Immediate Tax Liability

The IRS treats assignment fees as taxable income in the year you receive payment, regardless of whether you receive a 1099 form. Wholesalers must report these fees on Schedule C with Form 1040 for sole proprietorships, Form 1065 for partnerships, or Form 1120-S for S-Corporations. Double closing profits follow the same immediate taxation rules, with no opportunity to defer income recognition through installment sales or 1031 exchanges (which apply only to investment properties held for rental purposes).

Record Maintenance Protects Against IRS Scrutiny

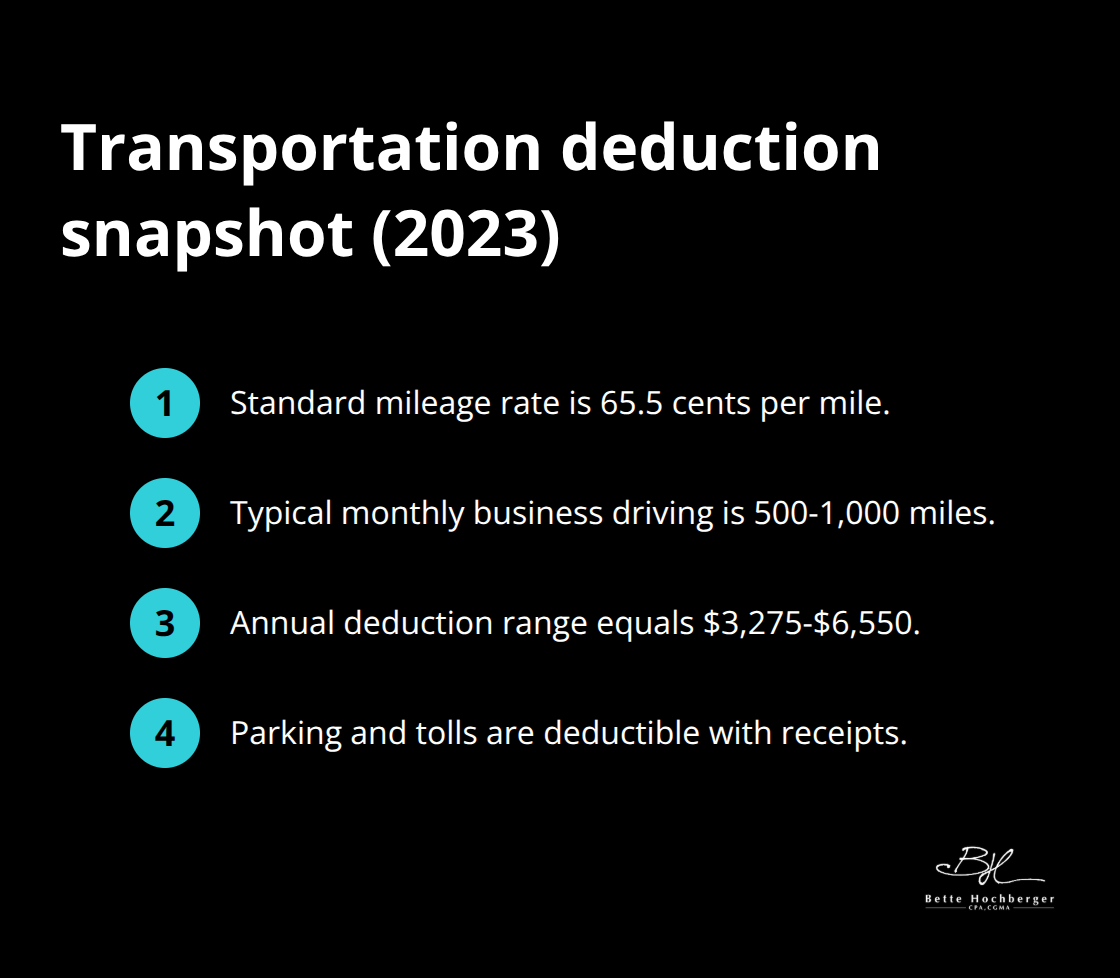

The IRS requires wholesalers to maintain detailed records for at least three years to support income and deduction claims. Transaction files must include purchase contracts, assignment agreements, earnest money receipts, closing statements, and correspondence with buyers and sellers. Marketing expense documentation needs invoices, bank statements, and proof of payment for direct mail campaigns, online advertising, and networking events. Mileage logs require date, destination, business purpose, and odometer readings for property visits and buyer meetings to support the 65.5 cents per mile deduction for 2023.

These tax obligations create substantial financial pressure, but strategic deduction planning can significantly reduce your taxable income and overall tax burden.

Essential Tax Deductions for Real Estate Wholesalers

Smart wholesalers can reduce their tax burden through aggressive but legitimate deduction strategies. The IRS allows wholesalers to deduct all ordinary and necessary business expenses, but most investors miss thousands in savings when they fail to track every deductible cost. Marketing expenses represent your largest deduction opportunity, with successful wholesalers who spend $2,000 to $5,000 monthly on direct mail campaigns that generate 1% to 3% response rates according to the Direct Marketing Association. Yellow letters, postcards, and bandit signs all qualify as fully deductible marketing costs when you maintain proper receipts and documentation.

Marketing Costs Deliver Maximum Tax Savings

Direct mail campaigns, online ads, and networking events create your biggest deduction categories. Facebook and Google Ads typically cost wholesalers $0.50 to $2.00 per click for motivated seller keywords, with monthly budgets that range from $500 to $3,000 for active markets. Real Estate Investor Association memberships (which average $200 to $500 annually) provide networking opportunities while they generate tax deductions. Business cards, flyers, website development, and SEO services all qualify as marketing expenses when you use them for lead generation activities.

Transportation Expenses Add Up Quickly

Vehicle expenses for property inspections, buyer meetings, and networking events generate substantial deductions at 65.5 cents per mile for 2023. Active wholesalers drive 500 to 1,000 miles monthly for business purposes, which creates $3,275 to $6,550 in annual deductions. Parking fees, tolls, and public transportation costs for property visits also qualify as deductible expenses when you document them properly with receipts and business purpose records.

Office Operations Create Ongoing Deductions

Home office expenses allow deductions for dedicated workspace that you use exclusively for wholesale activities, calculated with either the simplified $5 per square foot method (maximum $1,500) or actual expense method. Phone bills, internet service, software subscriptions, and office supplies generate monthly deductions that average $200 to $500 for active wholesalers. Professional services that include attorney fees, title company charges, and contractor estimates for repair assessments all qualify as deductible business expenses when they relate to wholesale transactions.

These deduction strategies work best when you combine them with proper quarterly tax payment schedules and optimal business structure choices.

Advanced Tax Planning Strategies for Wholesale Profits

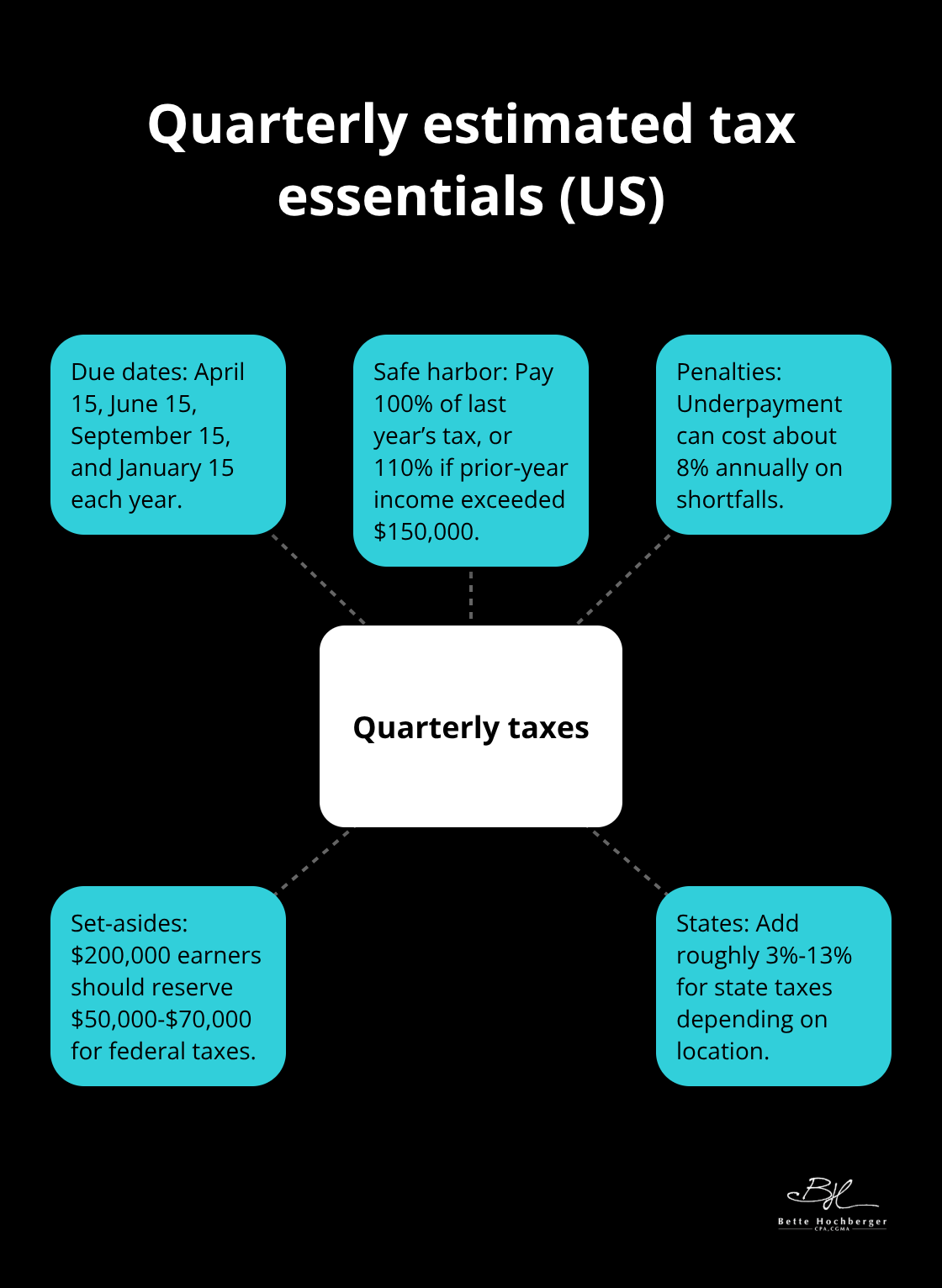

Quarterly estimated tax payments prevent IRS underpayment penalties that cost wholesalers 8% annually on shortfalls. The IRS requires payments on April 15, June 15, September 15, and January 15 when you expect to owe $1,000 or more in taxes. Calculate payments with IRS Publication 505 guidelines, which recommend 25% of expected annual tax liability per quarter. Wholesalers who earn $200,000 annually should set aside $50,000 to $70,000 for federal taxes, with an additional 3% to 13% for state obligations (depending on location).

Safe harbor rules protect you from penalties when you pay 100% of last year’s tax liability or 110% if prior year income exceeded $150,000.

S-Corporation Election Reduces Self-Employment Tax Burden

S-Corporation election eliminates self-employment tax on distributions while it requires reasonable salary payments subject to payroll taxes. Wholesalers who earn $150,000 can pay themselves $60,000 salary and take $90,000 as distributions, which saves $13,770 in self-employment taxes annually. The IRS scrutinizes unreasonably low salaries, with safe benchmarks at 40% to 60% of net profits for active owner-operators. File Form 2553 within 75 days of business formation or March 15 for current year election. Single-member LLCs can elect S-Corporation status without they change business structure, which maintains liability protection while it gains tax benefits.

Income and Expense Timing Controls Tax Impact

December deal closings can defer income to the next tax year when you expect lower rates or need time for quarterly payment preparation. Accelerate deductible expenses like equipment purchases, professional services, and marketing campaigns into high-income years to offset profits. Section 179 expensing allows immediate deduction of up to $1,220,000 in equipment purchases for 2024, while bonus depreciation provides 80% first-year write-offs on assets that qualify. Pay January expenses in December to maximize current year deductions, which include professional memberships, software subscriptions, and office lease payments. Cash basis accounting gives wholesalers flexibility to time income recognition and expense payments for optimal tax outcomes.

Final Thoughts

Real estate wholesaling offers substantial profit potential, but tax obligations can consume 30% to 50% of earnings without proper planning. Marketing expenses, transportation costs, and office deductions provide immediate tax relief when you document them correctly. S-Corporation election saves thousands in self-employment taxes for high-earning wholesalers, while quarterly payments prevent costly IRS penalties.

Professional tax guidance becomes indispensable as wholesale volumes increase. Complex regulations around business structures, deduction limits, and compliance requirements demand specialized expertise. We at Bette Hochberger, CPA, CGMA help real estate professionals minimize tax liabilities through strategic planning and preparation services.

Start to implement these strategies immediately when you organize expense records, calculate quarterly payments, and evaluate your business structure. Set aside 25% to 35% of each deal’s profit for taxes and track all business-related expenses. Consider S-Corporation election if you earn over $60,000 annually (proactive tax planning transforms wholesale profits from tax burdens into wealth-building opportunities).