Tax planning for medical practices is a complex but essential aspect of running a successful healthcare business. At Bette Hochberger, CPA, CGMA, we understand the unique challenges faced by medical professionals in managing their finances and taxes.

This blog post will guide you through effective tax strategies tailored specifically for medical practices, helping you optimize your financial performance and ensure compliance with ever-changing tax regulations.

How Tax Regulations Impact Medical Practices

Navigating Healthcare-Specific Tax Rules

The tax landscape for medical practices presents unique challenges. The IRS applies specific rules to medical equipment, which differ from other business assets. IRS Publication 946 explains depreciation rates and the methods you can use to calculate the annual depreciation of your medical equipment. Proper management of depreciation schedules for high-tech medical devices can yield substantial tax benefits. Moreover, the tax treatment of patient records and goodwill in practice sales requires specialized knowledge.

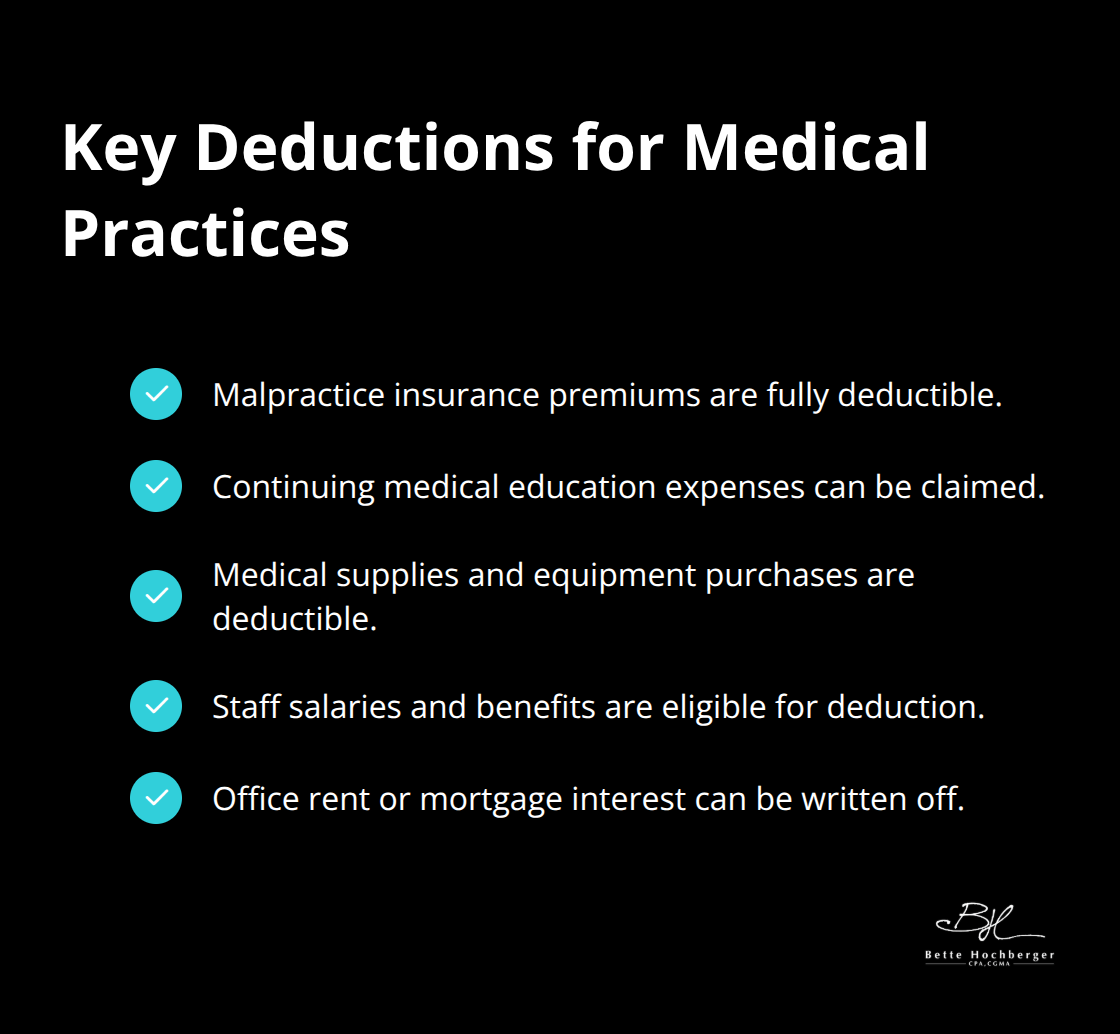

Maximizing Deductions for Medical Practices

Deductions serve as a powerful tool to reduce taxable income. Medical practices should focus on these common deductions:

- Malpractice insurance premiums

- Continuing medical education expenses

- Medical supplies and equipment

- Staff salaries and benefits

- Office rent or mortgage interest

Meticulous record-keeping is essential (the IRS closely scrutinizes medical practices). Proper documentation isn’t optional; it’s a necessity for compliance and optimal tax positioning.

Adapting to Recent Tax Law Changes

Recent years have introduced significant changes to the tax code affecting medical professionals. The Tax Cuts and Jobs Act of 2017 brought the Qualified Business Income (QBI) deduction, allowing eligible taxpayers to deduct up to 20 percent of their QBI, plus 20 percent of qualified real estate investment trust (REIT) dividends. However, this deduction phases out for high-income earners, necessitating strategic planning.

The expansion of bonus depreciation now allows medical practices to deduct 100% of the cost of qualifying equipment in the year of purchase (rather than depreciating it over time). This change can result in substantial tax savings, especially for practices investing in new technology.

The COVID-19 pandemic also spurred temporary tax measures, such as the Employee Retention Credit, which many medical practices used to offset payroll costs during challenging times.

The Importance of Professional Tax Guidance

Understanding these regulations and staying current with changes is critical for medical practices. While this overview provides a foundation, the intricacies of tax planning demand expert guidance. Professional tax advisors specialize in navigating these complexities, ensuring medical practices optimize their tax positions while maintaining full compliance.

As we move forward, let’s explore strategic tax planning techniques that can further enhance the financial health of medical practices.

Optimizing Your Medical Practice’s Tax Strategy

Choosing the Right Business Structure

Your practice’s legal structure impacts your tax obligations significantly. Many physicians operate as sole proprietors or partnerships, but these structures may not offer the best tax advantages. Many independent contractor physicians choose to form an LLC and elect to be taxed as an S-Corp for federal income tax purposes, which can provide substantial tax savings. They allow you to pay yourself a reasonable salary and take the rest as distributions, potentially reducing self-employment taxes.

For larger practices, a C corporation structure might benefit you, especially with the current corporate tax rate of 21%. However, this structure comes with the risk of double taxation on dividends. You should assess your specific situation and growth plans to determine the most tax-efficient structure.

Leveraging Retirement Plans for Tax Savings

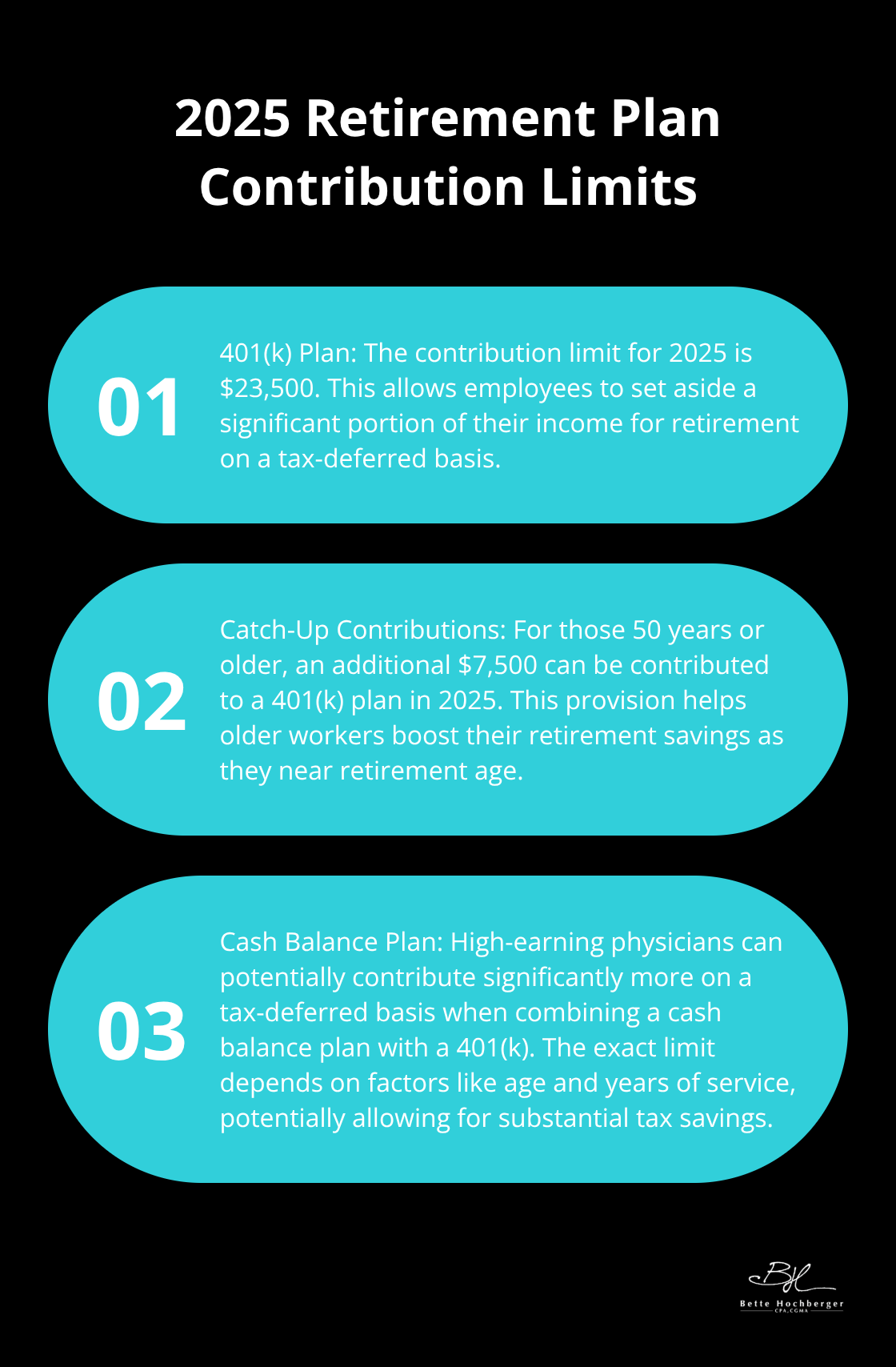

Retirement plans are not just about securing your future; they’re powerful tax-saving tools. For 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). But don’t stop there. Consider establishing a cash balance plan alongside your 401(k). This combination can allow high-earning physicians to contribute significantly on a tax-deferred basis, potentially reducing current tax liabilities. The maximum cash balance amounts assume a 3-year average compensation of at least $280,000 (the maximum annuity limit for 2025), and prior years of service.

Smart Equipment and Technology Investments

The Section 179 deduction and bonus depreciation rules offer excellent opportunities for medical practices to invest in new equipment while reaping immediate tax benefits. In 2025, you can deduct up to $1,160,000 in qualifying equipment purchases under Section 179. This can include medical devices, computer systems, and even certain software.

Strategic timing of these purchases can help manage your tax liability. If you’re having a particularly profitable year, make large equipment purchases before year-end to help offset your taxable income.

Mastering the Timing of Income and Expenses

Timing plays a vital role in tax planning. For cash-basis taxpayers (which most medical practices are), you have some control over when you recognize income and expenses. If you anticipate a lower tax bracket next year, consider deferring income by delaying billing or accelerating expenses by prepaying some costs in December.

Conversely, if you expect to be in a higher tax bracket next year, you might want to accelerate income and defer expenses. This strategy requires careful planning and projection of your income and expenses.

While these strategies can be powerful, tax laws are complex and ever-changing. What works for one practice may not be ideal for another. Working with a tax professional who understands the unique challenges and opportunities in the medical field will ensure you’re always positioned for maximum tax efficiency.

Now that we’ve explored strategies to optimize your tax position, let’s turn our attention to another critical aspect of financial management for medical practices: cash flow and tax efficiency.

How Medical Practices Can Boost Cash Flow and Tax Efficiency

Effective cash flow management and tax efficiency are essential for the financial health of medical practices. Let’s explore practical strategies to enhance your cash flow and tax efficiency.

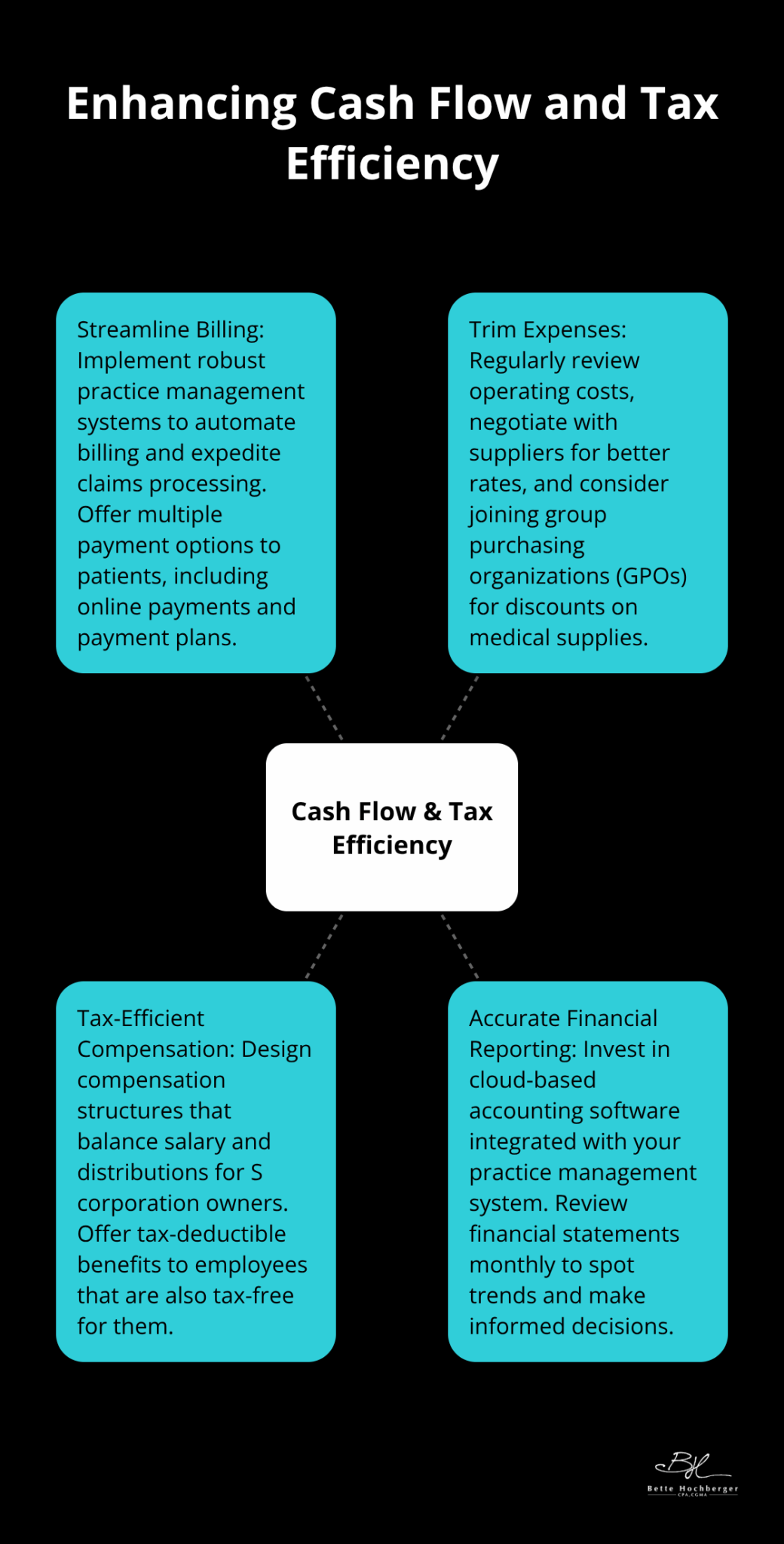

Streamline Your Billing and Collections

Improve your billing and collection processes to boost your cash flow. Implement a robust practice management system that automates billing and sends out claims quickly. Optimizing collections and billing processes is crucial for ensuring the stability and growth of your medical practice.

Offer multiple payment options to patients, including online payments and payment plans for larger bills. Negotiating payment terms with vendors can also contribute to optimized cash flow management.

Trim Operating Expenses Without Sacrificing Quality

Review your operating expenses regularly to identify areas for cost reduction. Negotiate with suppliers for better rates on medical supplies and equipment. Many practices overlook this simple step, but it can lead to significant savings. Group purchasing organizations (GPOs) can help smaller practices leverage collective buying power to secure discounts on supplies.

Energy costs can also be a substantial expense. Healthcare facilities can reduce energy consumption through energy-efficient practices and technologies. Simple changes like switching to LED lighting or upgrading to energy-efficient HVAC systems can lead to long-term savings.

Design Tax-Efficient Compensation Structures

Your compensation structure can have a significant impact on your tax liability. For S corporation owners, it’s important to strike a balance between salary and distributions. The IRS requires that you pay yourself a reasonable salary, but excess salary payments increase your payroll tax burden. Work with a tax professional to determine the optimal mix.

For employees, consider offering benefits that are tax-deductible for the practice and tax-free for the employee. Health insurance, retirement plans, and certain fringe benefits can be powerful tools in this regard. Benefits can account for a substantial portion of total compensation costs, offering tax savings opportunities.

Leverage Accurate Financial Reporting

Accurate and timely financial reporting is the foundation of effective tax planning and cash flow management. Invest in cloud-based accounting software that integrates with your practice management system. This integration ensures real-time financial data, allowing you to make informed decisions quickly.

Review your financial statements monthly (at a minimum). This practice allows you to spot trends, identify potential issues early, and make necessary adjustments to your tax strategy throughout the year.

Effective cash flow management and tax efficiency require ongoing attention and expertise. While these strategies provide a solid starting point, every medical practice has unique needs and challenges. Work with a financial professional who understands the healthcare industry to tailor these strategies to your specific situation and maximize your financial potential.

Final Thoughts

Tax planning for medical practices requires strategic implementation and careful consideration. Medical practices can reduce their tax burden and improve financial health through optimized business structures, maximized retirement contributions, and smart investment strategies. Effective cash flow management and accurate financial reporting form the foundation for informed decision-making and proactive tax planning.

The complex world of tax regulations and strategies demands professional guidance. Bette Hochberger, CPA, CGMA offers specialized financial services for medical practices, including strategic tax planning and Fractional CFO services. These services aim to minimize tax liabilities and ensure profitability for healthcare providers.

Proactive tax planning sets medical practices up for long-term success. It supports growth and sustainability, allowing healthcare professionals to focus on providing excellent patient care. Tax planning for medical practices is an ongoing process that adapts to evolving business goals and changing tax regulations (which can yield significant future benefits).