Tax loss harvesting can reduce your tax bill by thousands of dollars annually when executed properly. The IRS allows investors to offset capital gains with losses, creating significant savings opportunities.

We at Bette Hochberger, CPA, CGMA see many investors miss these benefits due to common mistakes and timing errors. Smart implementation requires understanding wash sale rules and strategic planning.

How Tax Loss Harvesting Works in Practice

Tax loss harvesting transforms portfolio losses into immediate tax savings through strategic sales of underperforming investments. The IRS permits investors to offset capital gains with realized losses, and any excess losses can reduce ordinary income by up to $3,000 annually. Remaining losses carry forward indefinitely to future tax years, which creates value from temporary market downturns.

The Real Impact on Your Tax Bill

Short-term capital losses offset short-term gains first, which face ordinary income tax rates that reach 37% for high earners. Long-term losses offset long-term gains taxed at preferential rates of 0%, 15%, or 20% (depending on income levels). This sequence matters significantly because short-term losses applied against ordinary income rates deliver maximum tax savings. For investors in the highest tax brackets, harvested losses of $10,000 in short-term positions can save $3,700 in federal taxes alone.

Strategic Loss Recognition Methods

December represents the peak opportunity for tax-loss harvesting as investors finalize their annual tax positions. However, investors who wait until year-end limit their flexibility and may force suboptimal decisions due to market rebounds. Systematic harvesting throughout the year captures losses when they occur and allows reinvestment in similar but not substantially identical securities to maintain market exposure.

Portfolio Maintenance During Loss Harvesting

Investors must maintain their desired asset allocation while they execute tax loss harvesting strategies. This requires careful selection of replacement securities that provide similar market exposure without triggering wash sale violations. The next critical consideration involves understanding how wash sale rules can completely eliminate your tax benefits if not properly navigated.

Advanced Tax Loss Harvesting Strategies

Wash Sale Rule Navigation Without Market Exposure Loss

The wash sale rule eliminates tax benefits when you repurchase the same or substantially identical securities within 30 days before or after you sell at a loss. The IRS considers ETFs that track the same index as substantially identical, which means you trigger a wash sale violation when you sell the SPDR S&P 500 ETF and immediately buy the Vanguard S&P 500 ETF. Smart investors use sector rotation to maintain exposure while they avoid violations. You sell technology stocks that show losses and rotate into healthcare or financial sector positions. This approach preserves equity market participation while it captures legitimate tax losses.

Account Location Strategy for Maximum Tax Efficiency

Tax-advantaged accounts like 401(k)s and IRAs cannot generate tax-deductible losses, which makes them unsuitable for loss harvesting activities. You should focus harvesting efforts exclusively in taxable accounts where realized losses create immediate tax benefits. Hold tax-inefficient assets like REITs and high-dividend stocks in tax-deferred accounts while you keep broad market index funds in taxable accounts for harvesting opportunities.

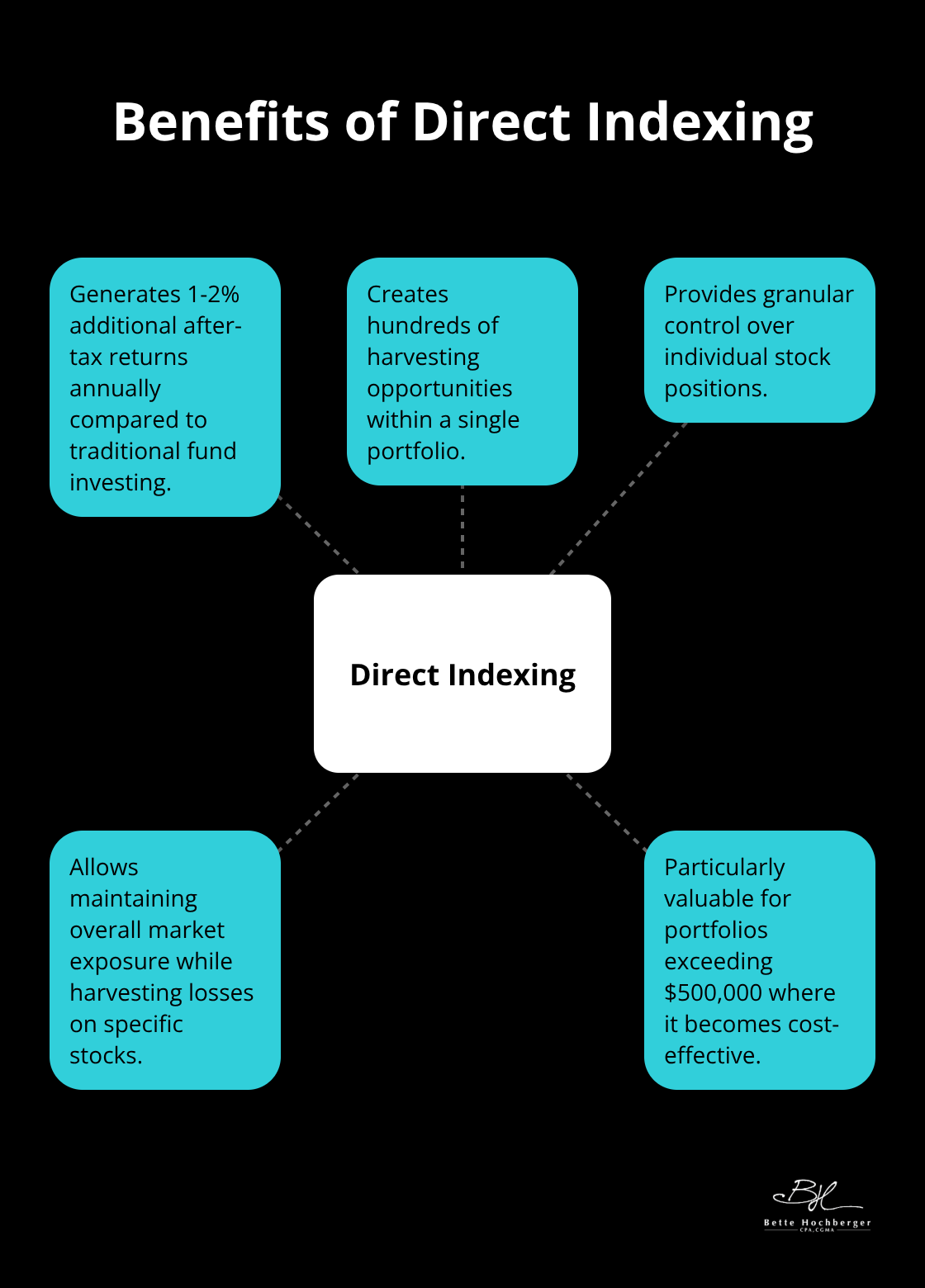

Direct Indexing for Enhanced Loss Opportunities

Direct indexing amplifies these benefits when you own individual stocks instead of funds, which creates hundreds of harvesting opportunities within a single portfolio. This approach can generate 1-2% additional after-tax returns annually compared to traditional fund investing (particularly valuable for portfolios that exceed $500,000 where direct indexing becomes cost-effective). You gain granular control over individual positions and can harvest losses on specific stocks while you maintain overall market exposure through the remaining holdings.

Multi-Account Coordination Strategies

Sophisticated investors coordinate loss harvesting across multiple taxable accounts to maximize benefits while they avoid wash sale violations. You can sell a position at a loss in one account and purchase a similar but not identical security in another account (maintaining market exposure while capturing the tax benefit). This strategy requires careful record keeping and coordination but allows for more aggressive harvesting without portfolio disruption. However, these advanced techniques often require professional guidance to avoid costly mistakes that could trigger unwanted tax consequences.

Common Mistakes That Cost Investors Money

Timing Violations That Trigger Wash Sale Rules

Investors lose thousands in potential tax savings through preventable errors that transform profitable strategies into costly violations. The most expensive mistake involves timing violations that trigger wash sale rules and eliminate tax benefits entirely. Purchase dates create the biggest trap because investors focus only on the sale date while they ignore the 30-day window before the loss sale.

When you buy identical securities 25 days before you sell at a loss, the IRS disallows the entire deduction regardless of your sale date. This forward-looking rule catches even experienced investors who add to positions before they harvest losses. The wash sale period extends 61 days total (30 days before and after the sale), which means you must track all transactions within this window to preserve your tax benefits.

State Tax Rules Multiply Federal Benefits

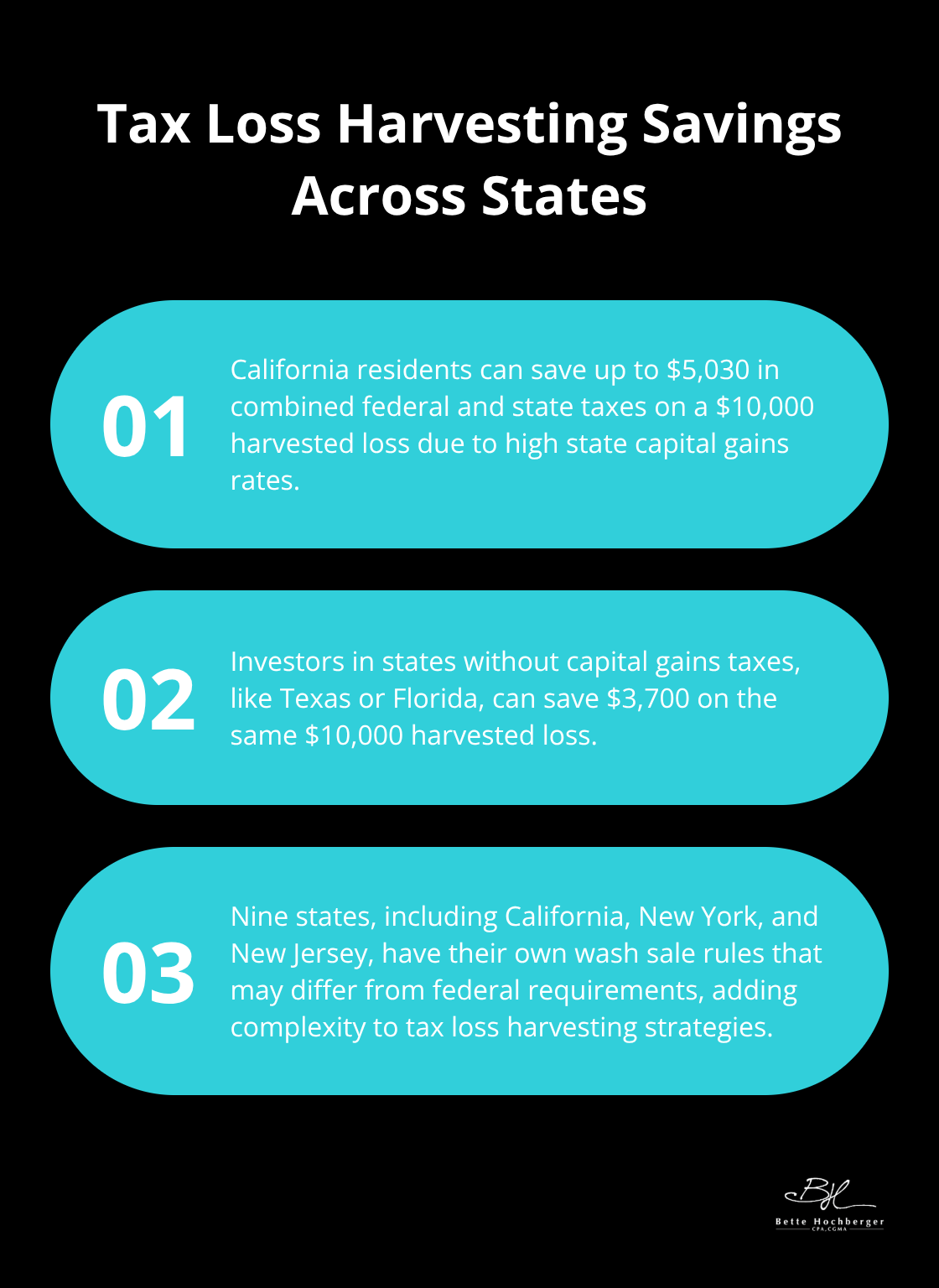

State tax implications multiply your benefits but require different approaches across jurisdictions. California residents face 13.3% state capital gains rates on top of federal taxes, which makes loss harvesting worth significantly more than in states without capital gains taxes like Texas or Florida.

Nine states including California, New York, and New Jersey impose their own wash sale rules that may differ from federal requirements. Nevada and Washington residents capture full federal benefits without state-level complications, while Connecticut applies different periods for state tax purposes. Your strategy must account for both federal and state implications because a $10,000 harvested loss saves California residents up to $5,030 in combined taxes versus $3,700 for investors in no-tax states.

Tax Bracket Optimization Determines Value

Your marginal tax rate determines whether loss harvesting provides meaningful benefits or wastes transaction costs and effort. Investors in the 12% federal bracket save only $1,200 on $10,000 in harvested losses, while those in the 37% bracket save $3,700 from identical transactions.

High earners subject to the 3.8% Net Investment Income Tax gain additional benefits worth $380 per $10,000 harvested. The strategy becomes counterproductive for investors who expect significant income increases because they carry losses forward to higher tax rate years (which maximizes value). Retirees who drop from high income years to lower tax brackets should harvest aggressively before retirement when their rates peak, avoiding common tax mistakes that reduce overall returns.

Final Thoughts

Tax loss harvesting delivers measurable benefits when you execute these strategies with precision and strategic timing. Investors who implement systematic approaches can reduce their annual tax bills by thousands while they maintain desired portfolio allocations. The key lies in your understanding of wash sale rules, coordination across multiple accounts, and transaction timing that maximizes both federal and state tax advantages.

Professional guidance becomes essential when your portfolio exceeds $500,000 or when you face complex situations with multiple account types, state tax considerations, or significant income fluctuations. The cost of mistakes often exceeds the fees for expert advice (particularly when wash sale violations eliminate intended benefits entirely). Smart investors recognize that tax complexity requires specialized knowledge to avoid costly errors.

We at Bette Hochberger, CPA, CGMA specialize in strategic tax planning that integrates loss harvesting with comprehensive wealth management strategies. Our approach combines advanced technology with personalized service to minimize tax liabilities while we manage cash flow effectively. We help clients navigate complex tax regulations, coordinate multi-account strategies, and optimize timing decisions that maximize after-tax returns across diverse investment portfolios.