Nurses play a vital role in our healthcare system, often going above and beyond for their patients. At Bette Hochberger, CPA, CGMA, we understand the financial challenges that come with this demanding profession.

Many nurses are unaware of the numerous tax deductions available to them. This guide will explore the various nurse tax deductions you may be eligible to claim, helping you keep more of your hard-earned money.

What Can Nurses Deduct for Uniforms and Equipment?

Nurses invest in specialized clothing and equipment essential for their job. Understanding which expenses you can deduct on your taxes can help you keep more of your hard-earned money.

Scrubs and Nursing Shoes

The IRS allows deductions for work uniforms that are not suitable for everyday wear. Scrubs and nursing shoes typically qualify as tax-deductible items. However, athletic shoes or pants that can be worn outside of work aren’t deductible. You can also write off the costs of cleaning and maintaining your work-specific attire.

Personal Protective Equipment (PPE)

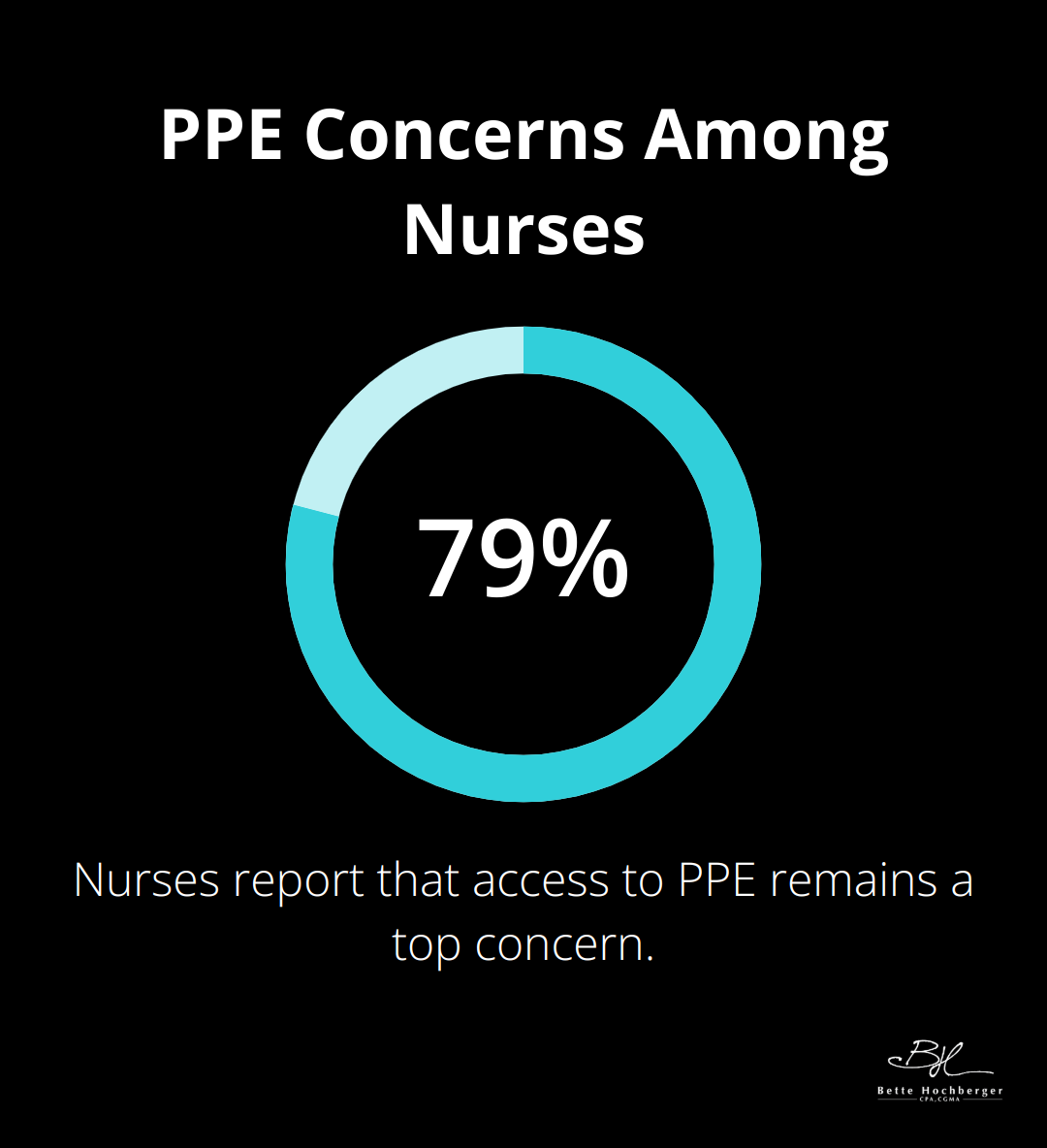

PPE has become more important than ever in recent years. Masks, gloves, face shields, and other protective gear required for your job are deductible if you purchase them out of pocket. According to a survey by the American Nurses Association, almost half of nurses say they have experienced a shortage of PPE, with 79 percent reporting that access to PPE remains a top concern. If you’re part of this group, it’s crucial to keep your receipts for tax purposes.

Laundry and Maintenance

The costs associated with maintaining your work attire are also deductible. The IRS allows you to deduct the expenses for laundering your uniforms. You have two options:

- Deduct the actual costs of detergent, water, and electricity used for washing your uniforms

- Use the standard rate of $1.50 per uniform

To maximize these deductions, maintain detailed records of all your purchases and maintenance costs. Take photos of receipts and store them digitally to ensure you have proper documentation when tax season arrives.

Record Keeping Tips

Proper record-keeping is essential for claiming these deductions. Try to:

- Keep all receipts for uniform and equipment purchases

- Track laundry expenses (if not using the standard rate)

- Document any reimbursements or allowances from your employer

These deductions apply primarily to itemized returns. If you’re unsure whether to itemize or take the standard deduction, consulting with a tax professional can help you determine the best approach for your unique situation.

As we move on to discuss education and licensing expenses, it’s important to note that these costs can also significantly impact your tax return. Let’s explore how you can maximize your deductions in this area as well.

How Can Nurses Maximize Education and Licensing Deductions?

Continuing Education Courses

The IRS permits nurses to deduct expenses for continuing education that maintains or improves skills needed in your present work. These costs are deductible if they meet IRS criteria.

To claim these deductions:

- Keep detailed records of course fees, textbooks, and supplies.

- Document travel expenses if the course requires overnight stays.

- Save receipts for online course subscriptions or webinar fees.

Courses that qualify you for a new career are not deductible. Focus on claiming expenses for education that enhances your current nursing role.

Professional Licenses and Certifications

Maintaining your nursing license and certifications is essential in healthcare. Professional licenses and certifications are tax-deductible. However, these are considered job-related expenses, which are a miscellaneous itemized deduction subject to the 2% of AGI limitation.

Deductible licensing expenses include:

- Initial licensing fees

- License renewal costs

- Exam fees for specialty certifications

- Required background checks

Set up a dedicated savings account for these expenses. This makes tracking and budgeting easier come tax time.

Professional Subscriptions and Resources

Staying current with medical advancements is part of a nurse’s job. Subscriptions to professional journals and medical databases are tax-deductible.

Other deductible resources include:

- Medical reference books

- Professional association memberships

- Nursing-specific software or apps

Consider bundling subscriptions in one tax year if it pushes you over the standard deduction threshold.

Keep a detailed log of all educational expenses throughout the year. This practice ensures you don’t miss out on deductions and simplifies the tax preparation process. Next, we’ll explore how travel and transportation costs can further reduce your tax burden as a nurse.

How Can Nurses Maximize Travel Tax Deductions?

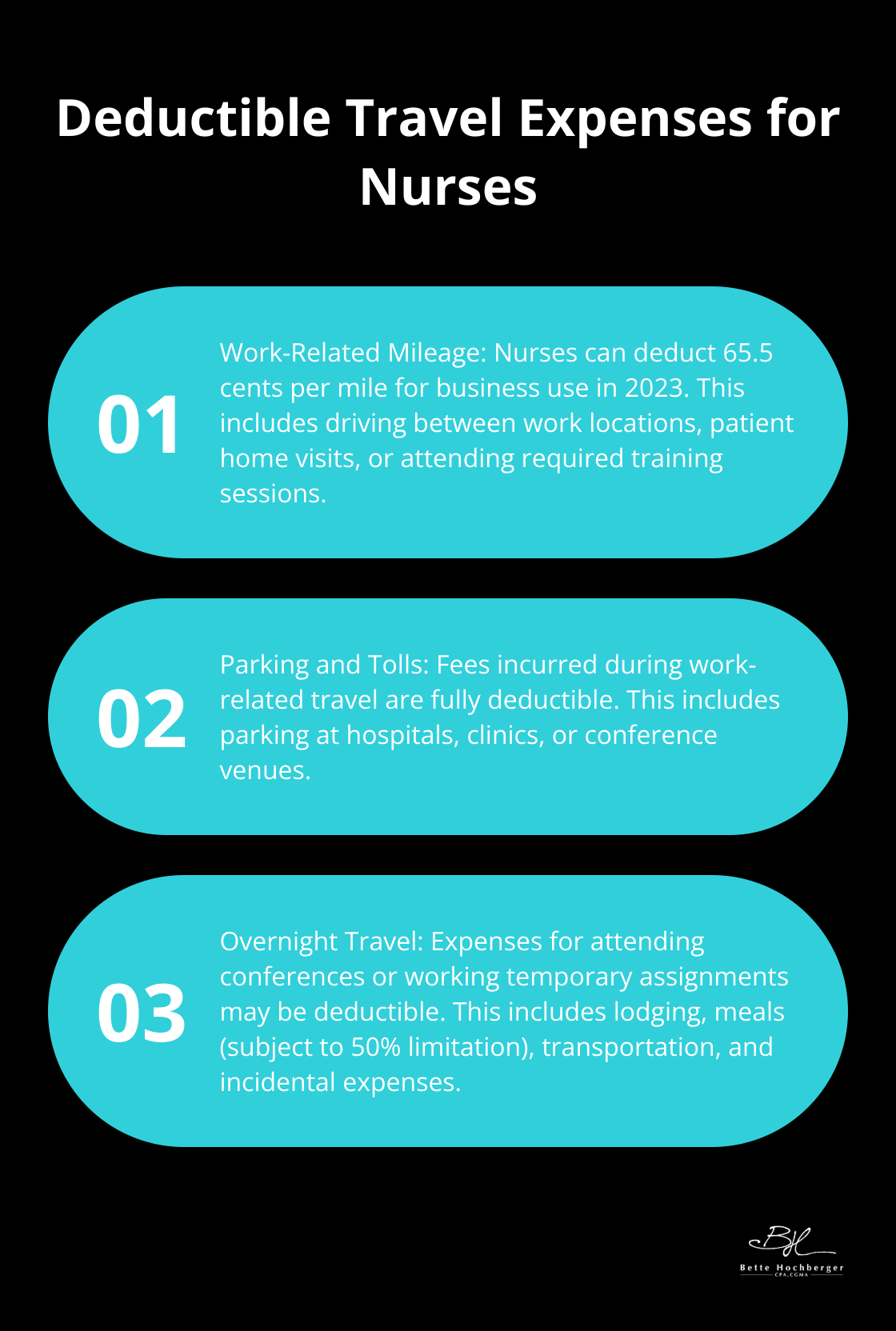

Work-Related Mileage

Nurses often travel for work-related purposes. The IRS allows deductions for mileage accrued during these trips (excluding regular commutes). This includes driving between work locations, patient home visits, or attending required training sessions. For 2023, the standard mileage rate is 65.5 cents per mile for business use.

To claim this deduction:

- Maintain a detailed log of your trips (include dates, destinations, and mileage).

- Use a mileage tracking app to simplify the process.

- Calculate your deduction by multiplying your total business miles by the standard rate.

Parking and Tolls

Parking fees and tolls incurred during work-related travel are fully deductible. This includes parking at hospitals, clinics, or conference venues. Save all receipts and consider using a dedicated credit card for these expenses to simplify tracking.

Overnight Travel Expenses

Nurses who attend conferences, training sessions, or work temporary assignments may incur overnight travel expenses. Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to these expenses.

Deductible expenses include:

- Lodging costs

- Meals (subject to 50% limitation)

- Transportation to and from your destination

- Incidental expenses (tips and laundry)

To maximize these deductions, keep all receipts and document the business purpose of each trip. Try using per diem rates for meals and incidentals to simplify record-keeping.

Record-Keeping Tips

Meticulous record-keeping is essential for maximizing travel deductions. Use digital tools to track expenses and mileage throughout the year. This not only ensures you don’t miss out on deductions but also provides solid documentation in case of an audit.

Consider these strategies:

- Use a dedicated credit card for work-related expenses

- Take photos of receipts and store them digitally

- Utilize expense tracking apps (many offer free versions)

- Create a spreadsheet to log all travel-related costs

By implementing these strategies, nurses can maximize savings on their tax returns while ensuring compliance with IRS regulations.

Final Thoughts

Nurse tax deductions offer numerous opportunities to reduce taxable income. Accurate record-keeping forms the foundation of successful tax planning for nurses. Digital tools simplify expense tracking and organization, making it easier to access financial records during tax season.

Tax professionals provide invaluable benefits when navigating complex tax laws. Bette Hochberger, CPA, CGMA specializes in personalized financial services for professionals like nurses. Our team can help identify additional deductions and develop a comprehensive tax strategy tailored to your unique situation.

Every dollar saved in taxes can improve your quality of life or be invested in your future. Staying informed about nurse tax deductions and seeking professional guidance will help you make the most of your earnings. Let us help you build a strong financial foundation while you continue your vital work in healthcare.