Startup M&A transactions present complex tax challenges that can make or break deal value. Poor tax planning during mergers and acquisitions often costs companies millions in unexpected liabilities and missed opportunities.

We at Bette Hochberger, CPA, CGMA see founders and buyers struggle with tax structures that seemed simple on paper but created costly complications later.

Smart tax strategy transforms M&A from a financial burden into a growth catalyst.

Which M&A Structure Saves You More Tax?

Asset Purchase Creates Different Tax Outcomes

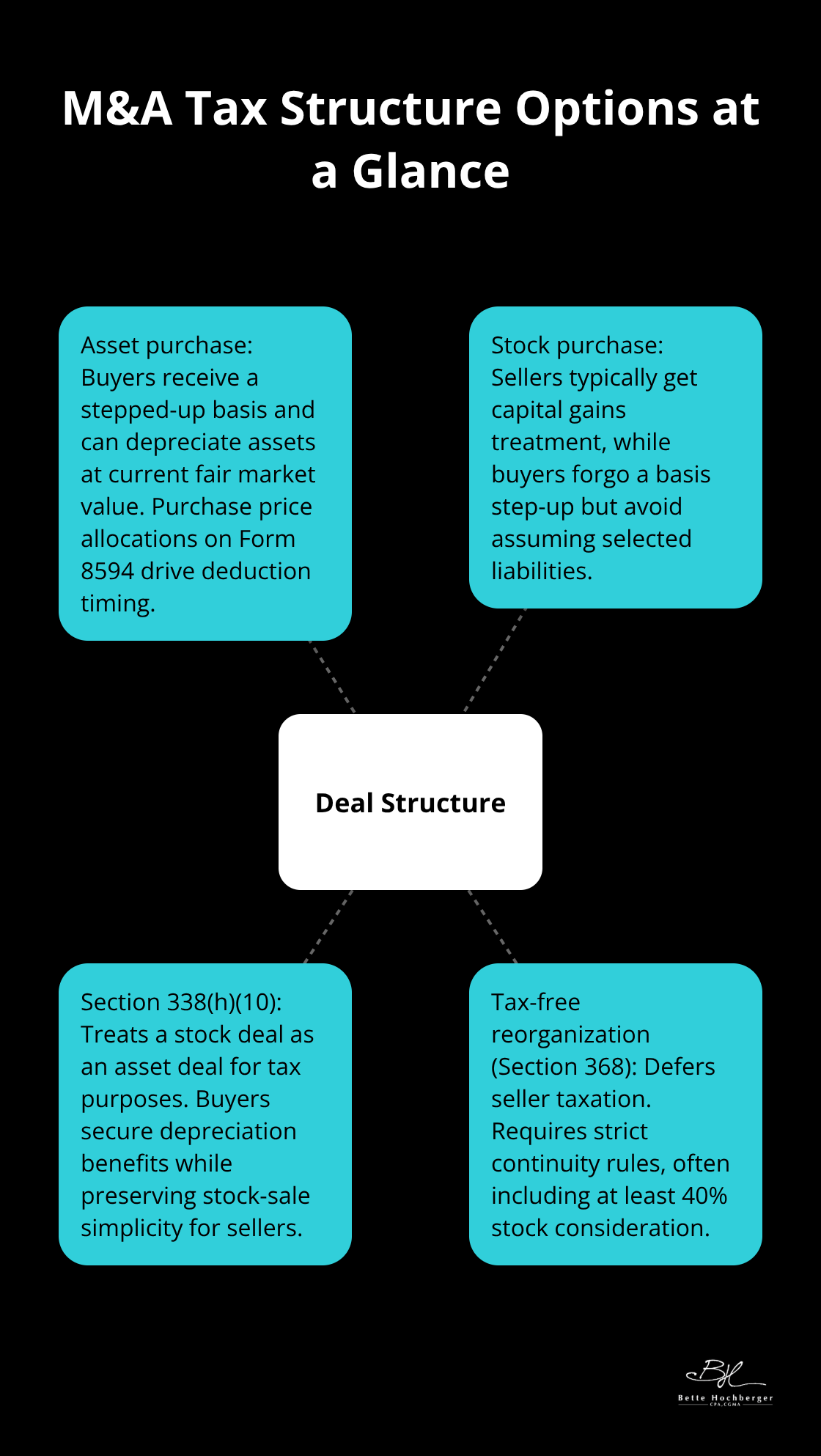

Asset purchases give buyers significant tax advantages through stepped-up basis benefits. When you purchase assets at fair market value, you can depreciate them at current values rather than the seller’s original cost basis. This translates to higher depreciation deductions and lower taxable income for years after the transaction. The IRS requires buyers to allocate purchase price across acquired assets with Form 8594, which determines future deduction amounts and timing.

Sellers face harsher tax treatment in asset deals. C-corporations experience double taxation: the corporation pays tax on asset sale gains, then shareholders pay tax again on distributions. The corporate tax rate of 21 percent combined with individual capital gains rates can push total tax burden above 35 percent. S-corporations and LLCs avoid double taxation but may trigger ordinary income treatment on certain assets like inventory and accounts receivable.

Stock Purchases Favor Sellers Tax-Wise

Stock transactions typically generate capital gains treatment for sellers, with rates from 0 percent to 23.8 percent based on income levels and asset ownership periods. Qualified Small Business Stock provides even better outcomes, with up to 100 percent exclusion on gains for eligible shareholders. The $50 million gross asset test and active business requirements make QSBS planning essential for startup founders.

Buyers lose the stepped-up basis advantage in stock deals but avoid selective assumption of unwanted liabilities. The Section 338(h)(10) election allows treatment of stock purchases as asset purchases for tax purposes, which gives buyers depreciation benefits while it maintains stock sale simplicity for sellers.

Tax-Free Reorganizations Require Strict Compliance

Tax-free mergers under IRC Section 368 defer seller taxation but demand continuity of interest requirements. Target shareholders must receive at least 40 percent of consideration in buyer stock to qualify. Cash portions trigger immediate taxable recognition, which makes deal structure planning vital for tax optimization.

These structural choices create the foundation for your transaction’s tax efficiency, but hidden liabilities in historical tax compliance can derail even the best-planned deals. Working with experienced fractional CFOs helps navigate complex pricing structures and financial planning throughout the M&A process.

What Tax Traps Hide in M&A Due Diligence?

State Tax Nexus Violations Cost Companies Millions

Most buyers focus on obvious financial metrics but miss critical tax exposures that surface after deal closure. State tax nexus violations represent the biggest hidden liability risk, with non-compliance exposing businesses to fines, penalties, and interest charges across multiple jurisdictions. Remote employees create tax obligations in states where companies never filed returns, which triggers corporate income tax liabilities that can reach six figures annually.

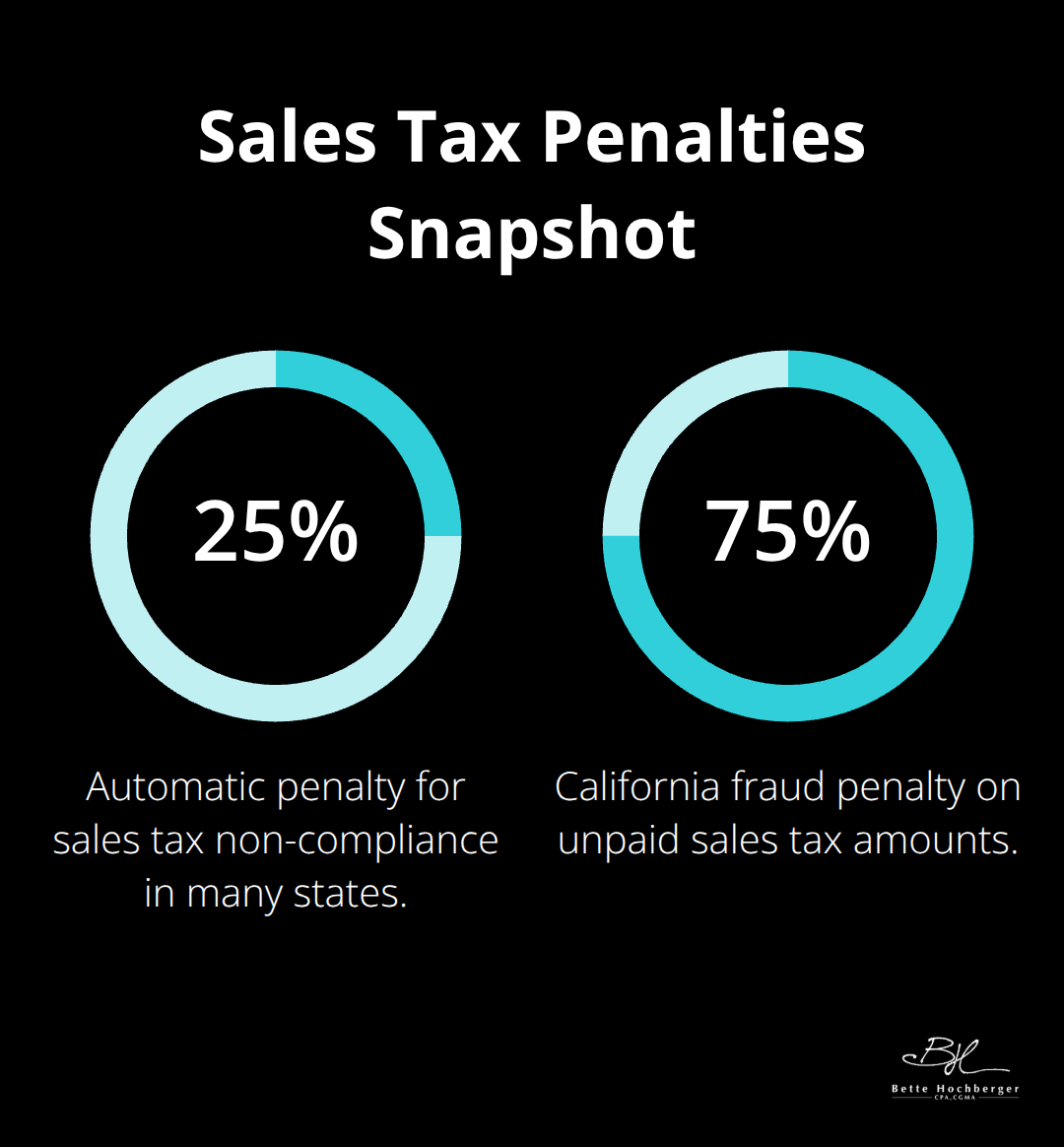

Sales tax compliance failures generate automatic penalties of 25 percent plus interest. Some states like California impose additional fraud penalties that reach 75 percent of unpaid amounts. These violations compound quickly when companies operate across state lines without proper registration and compliance protocols.

Employment Classification Errors Trigger Immediate Liabilities

Employment classification errors create immediate payroll tax liabilities when contractors should have been employees. The IRS assesses 1.45 percent Medicare tax, 6.2 percent Social Security tax, plus federal and state unemployment taxes on reclassified payments. Worker misclassification penalties start at $50 per Form 1099 and escalate to $280 per form for intentional disregard.

Companies face additional exposure from unpaid benefits, overtime compensation, and state labor law violations that compound the financial impact. The Department of Labor reports that 10-30 percent of employers misclassify workers, which makes this a high-probability risk area that buyers must investigate thoroughly.

Net Operating Losses Face Strict Usage Limitations

Target companies with substantial NOLs appear attractive but face strict limitations under Section 382 ownership change rules. Annual NOL usage caps at the federal long-term tax-exempt rate multiplied by the company’s equity value before ownership change. Built-in gains recognition periods for S-corporations trigger corporate-level taxes on appreciated assets sold within five years of conversion.

Tax attribute preservation demands precise transaction structure to maintain valuable deductions and credits. R&D tax credits face similar ownership change restrictions, with unused credits potentially lost entirely if annual limitation amounts fall below minimum thresholds.

Historical Tax Returns Reveal Compliance Patterns

Professional tax advisors must quantify these limitations before deal price to avoid overpayment for tax benefits that cannot be realized. A thorough review of three to five years of tax returns exposes patterns of aggressive positions, late filings, or audit adjustments that indicate future compliance risks. These historical patterns become the foundation for effective post-merger tax integration strategies.

How Do You Optimize Tax Structure After M&A?

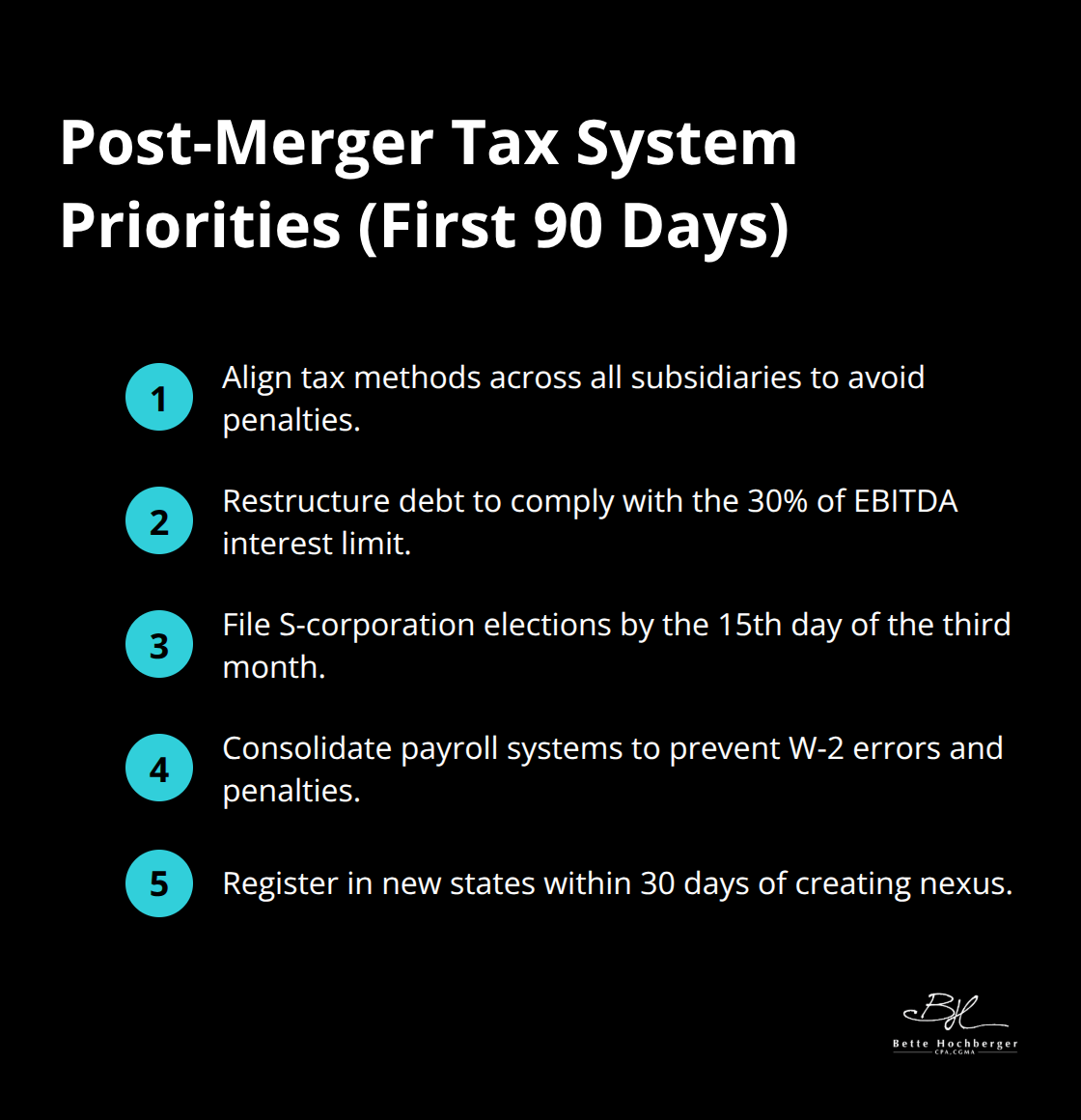

Post-merger tax optimization requires immediate action within the first 90 days of deal closure. The Tax Cuts and Jobs Act limits interest deductions to 30 percent of EBITDA, which makes debt restructure essential for highly leveraged transactions. Combined entities must elect consistent tax methods across all subsidiaries to avoid IRS penalties that reach $25,000 per inconsistent treatment.

S-corporation elections require unanimous shareholder consent and must be filed by the 15th day of the third month after the tax year begins. These tight deadlines cannot be missed without significant consequences.

Consolidate Tax Systems Before Year-End

Tax system integration requires careful planning to avoid compliance issues and missed deductions. Merged entities face dual requirements until systems align, which doubles preparation costs and audit exposure.

Payroll tax consolidation presents the highest risk. Mismatched employee classification triggers automatic penalties of $280 per Form W-2 filed incorrectly. State tax registration must occur within 30 days of nexus creation in most jurisdictions (with late penalties reaching $5,000 plus 25 percent of unpaid taxes in states like New York and California).

Maximize Combined Tax Attributes

R&D tax credits from both entities can offset up to $250,000 of payroll taxes annually for qualified small businesses. This provides immediate cash flow benefits that justify transaction costs. NOL utilization must occur before the first combined return to preserve maximum annual limitations under Section 382 rules.

Foreign tax credits face strict limitations that require separate basket calculations for passive income, general category income, and Section 951A inclusions. Strategic asset dispositions and expense recognition in the first combined tax year can shift income between entities to optimize overall tax rates and credit utilization.

Address Multi-State Compliance Requirements

Multi-state operations create complex compliance webs that demand immediate attention. Each state maintains different rules for combined reporting, apportionment factors, and nexus thresholds. Companies must file separate returns in non-unitary states while maintaining combined reporting in unitary jurisdictions.

Franchise tax obligations vary significantly across states, with Delaware charging $400,000 annually for companies with substantial assets or gross receipts. Texas margins tax applies to combined receipts above $1.18 million (creating unexpected liabilities for previously exempt entities). A fractional CFO can provide specialized expertise to navigate these complex requirements and ensure compliance across all jurisdictions.

Final Thoughts

Startup M&A transactions demand strategic tax planning from day one to maximize deal value and minimize unexpected liabilities. The choice between asset purchases and stock sales creates vastly different tax outcomes that can shift millions in after-tax proceeds between buyers and sellers. Due diligence must uncover hidden exposures like state tax nexus violations and employment classification errors that surface after deal closure.

Post-merger integration requires immediate action within 90 days to preserve tax attributes and optimize combined entity structures. Professional tax advisory becomes non-negotiable when transaction complexity meets tight compliance deadlines. Companies that fail to address these requirements face penalties that can exceed 25 percent of unpaid taxes plus interest charges.

We at Bette Hochberger, CPA, CGMA help companies navigate complex startup M&A transactions while minimizing tax liabilities and managing cash flow throughout the process. Our team provides strategic tax planning that transforms potential compliance burdens into growth opportunities. Future success depends on building tax-efficient structures that support expansion rather than drain resources from core business operations.