Startup equity compensation can create significant tax complications that catch many employees off guard. The IRS treats different equity types distinctly, leading to vastly different tax outcomes.

We at Bette Hochberger, CPA, CGMA see founders and employees make costly mistakes with stock options, restricted stock, and equity grants. Poor timing decisions can result in thousands of dollars in unnecessary taxes.

What Tax Treatment Applies to Your Equity Type

Stock Options Create Different Tax Consequences

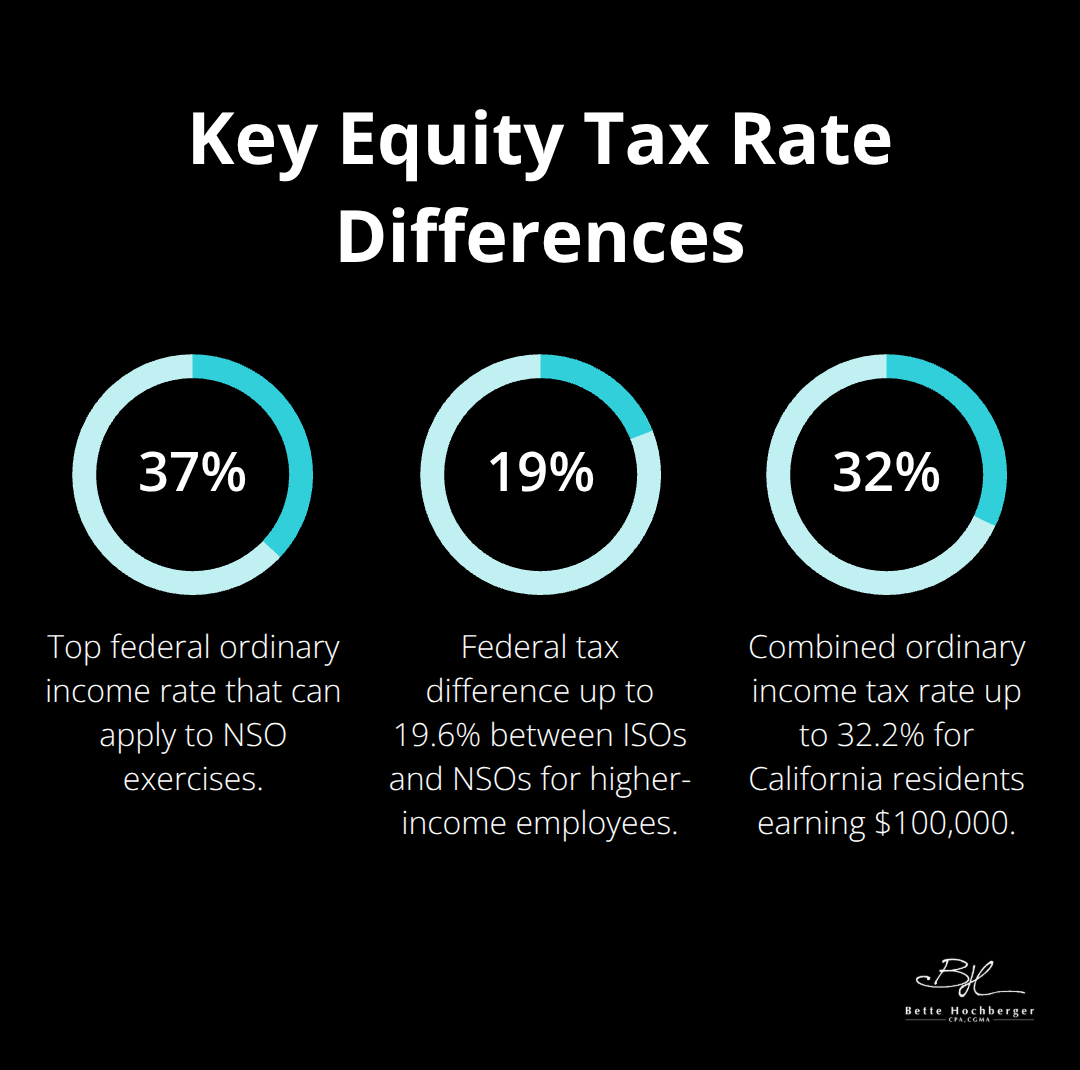

Stock options come in two forms that create dramatically different tax consequences. Incentive Stock Options offer superior tax treatment but include strict requirements. You pay no tax when you receive or exercise ISOs, but the Alternative Minimum Tax can apply based on the spread between exercise price and fair market value. Non-Qualified Stock Options trigger ordinary income tax immediately upon exercise, with rates that reach 37% federally plus state taxes. Higher-income employees face tax differences up to 19.6% between ISOs and NSOs at the federal level.

Restricted Stock Elections That Save Thousands

Restricted stock becomes taxable when it vests, not when you receive the grant. The fair market value at the time of vesting counts as ordinary income, which potentially creates massive tax bills if your company has grown significantly. You can file an 83(b) election within 30 days of receipt to pay taxes at the grant date instead of the vesting date. This election can save thousands when companies appreciate rapidly, but it carries risk if the company fails since you paid taxes upfront on worthless stock.

Vesting Schedules Impact Tax Events

Standard four-year vesting schedules with one-year cliffs create predictable tax events annually. Each vesting date triggers taxable income for restricted stock unless you filed an 83(b) election. Stock options remain non-taxable until exercise regardless of their vesting status. Companies increasingly offer extended post-termination exercise windows beyond the standard 90 days (which provides departing employees more flexibility). Early exercise provisions allow you to exercise unvested options immediately, which potentially qualifies for 83(b) elections and starts your capital gains period sooner.

These tax implications become even more complex when you consider the timing of your exercise and sale decisions, which we’ll explore next. For comprehensive guidance on startup tax planning, consider consulting with professionals who specialize in equity compensation strategies.

How Should You Time Your Equity Decisions

Exercise Timing Affects Your Tax Bill Dramatically

The timing of stock option exercises directly impacts your tax liability and cash flow requirements. California residents who earn $100,000 face combined tax rates up to 32.2% on ordinary income from exercised options, which makes timing decisions worth thousands of dollars. You minimize ordinary income tax exposure when you exercise ISOs as they vest while you spread the potential Alternative Minimum Tax burden across multiple years. For NSOs, you reduce your marginal tax rate on the spread between exercise price and fair market value when you exercise during lower income years.

Companies that allow early exercise of unvested options provide additional flexibility (you can start your capital gains period immediately and potentially qualify for Section 83(b) elections).

AMT Planning Prevents Costly Surprises

The Alternative Minimum Tax creates additional tax obligations when you exercise ISOs, with rates of 26% on income up to $175,000 and 28% above that threshold. AMT exemptions for individuals start at $73,600 and phase out after $523,600 in income, which creates planning opportunities for high earners. You eliminate AMT on unrealized gains when you sell ISO shares within the same tax year as exercise, though this sacrifices potential capital gains treatment. You help manage AMT exposure while you maintain favorable tax treatment when you space ISO exercises across multiple years. The minimum tax credit allows you to recover excess AMT payments in future years when regular tax exceeds AMT (proper bookkeeping becomes essential for tax planning).

Capital Gains Treatment Maximizes After-Tax Returns

You qualify gains for long-term capital gains treatment when you hold ISO shares for more than two years from grant and one year from exercise, which reduces federal rates from up to 37% to maximum 20%. The Qualified Small Business Stock exemption allows complete elimination of capital gains taxes on eligible shares you hold for five years, with exclusions up to $10 million or 10 times your cost basis. Short-term capital gains face ordinary income tax rates, which makes the one-year period critical for tax optimization. Post-termination exercise windows typically last 90 days and force departing employees into immediate exercise decisions that may not align with optimal tax timing.

These timing strategies become even more important when you consider the common mistakes that can derail your tax planning efforts entirely.

What Expensive Equity Tax Mistakes Can You Avoid

Missing the 30-Day Section 83(b) Window Costs Thousands

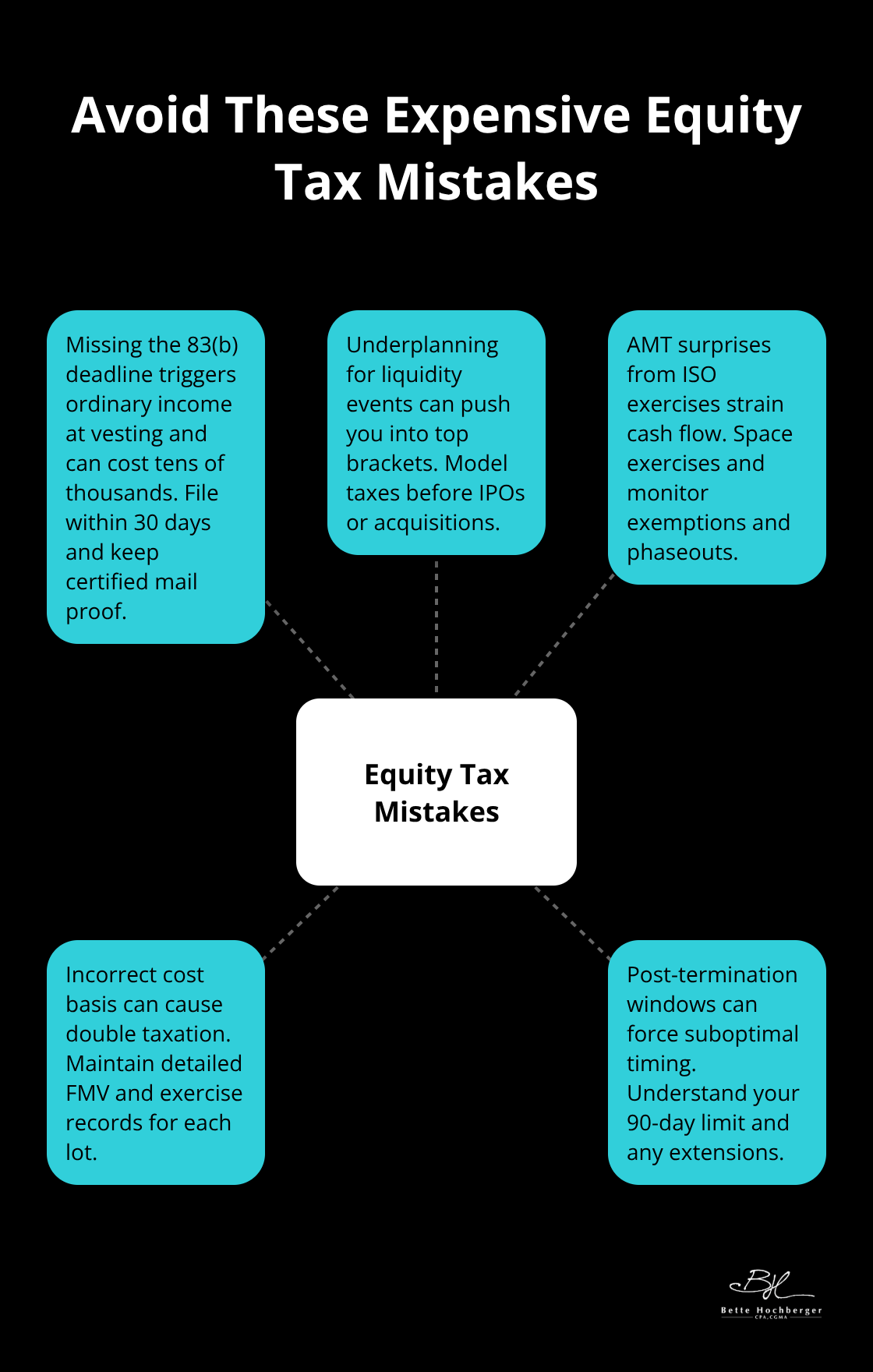

The Section 83(b) election deadline remains absolute with no extensions or exceptions available from the IRS. You must file within 30 days of receipt of restricted stock, not business days, which catches many recipients during holiday periods or vacation times. Missing this deadline forces you to pay ordinary income tax on the full fair market value when shares vest, potentially creating tax bills tens of thousands higher than necessary.

Companies that grow from $1 per share to $50 per share during vesting periods turn manageable tax obligations into crushing liabilities for employees who missed their election window. The election requires mailing a physical copy to the IRS and your employer, plus keeping certified mail receipts as proof of timely filing. Email submissions do not satisfy IRS requirements, despite common misconceptions about digital filing options.

Liquidity Events Create Massive Tax Surprises Without Planning

IPOs and acquisitions trigger immediate tax consequences that many equity holders fail to anticipate or prepare for financially. NSO holders face ordinary income tax on the entire spread between exercise price and sale price, which can push recipients into the highest marginal tax brackets suddenly. AMT calculations become complex during large liquidity events, potentially requiring payments on gains that exceed regular tax obligations by significant amounts.

California residents who sell equity during IPOs face combined tax rates approaching 50% on ordinary income (making geographic planning considerations important before major liquidity events). Cashless exercise options help manage immediate cash flow requirements but reduce the total shares retained after covering tax obligations and exercise costs.

Cost Basis Tracking Errors Lead to Double Taxation

Accurate cost basis records prevent overpayment of taxes when you sell shares, yet many equity holders fail to maintain proper documentation from exercise dates through final sales. The IRS requires you to report the correct cost basis when selling shares, and discrepancies between your reported amounts and actual tax basis create audit risks and additional tax liabilities.

Brokers often report incorrect cost basis information for employee stock transactions, particularly for shares acquired through different exercise dates or equity compensation programs. You establish stepped-up tax basis equal to the fair market value on exercise dates for stock options, but proving this requires detailed records of FMV determinations and exercise transactions. Multiple tranches of stock acquired at different prices and dates require careful tracking to optimize tax outcomes through strategic sale timing of specific share lots.

Final Thoughts

Startup equity compensation requires proactive tax planning to avoid costly mistakes that can eliminate years of potential gains. The 30-day Section 83(b) election window, AMT implications from ISO exercises, and proper cost basis tracking represent the foundation of effective equity tax management. Professional guidance becomes essential when your equity value exceeds $100,000, during liquidity events, or when AMT calculations become complex.

We at Bette Hochberger, CPA, CGMA help clients navigate the complexities of equity compensation through strategic tax planning and proper documentation strategies. Our team works with founders and employees to minimize tax liabilities through optimal timing decisions and comprehensive record maintenance. We focus on preventing the expensive mistakes that can cost equity holders tens of thousands of dollars.

Start your tax planning early and maintain detailed records of all equity transactions, fair market values, and exercise dates. Consider geographic implications before major liquidity events and space ISO exercises across multiple years to manage AMT exposure (never miss critical election deadlines). The difference between reactive and proactive tax planning often measures in tens of thousands of dollars for equity recipients.