Owing money to the IRS creates stress that keeps business owners awake at night. The good news is that IRS debt resolution doesn’t have to be overwhelming when you know your options.

We at Bette Hochberger, CPA, CGMA have helped countless clients navigate these waters successfully. With the right approach, you can resolve your tax debt and regain financial peace of mind.

Understanding Your IRS Debt Situation

What Type of IRS Debt Are You Actually Facing

IRS debt falls into distinct categories that determine your resolution options. Income tax debt from unfiled or underreported returns represents the most common type, affecting millions of Americans with significant collective debt according to IRS data. Payroll tax debt hits businesses hardest because the IRS treats employee withholdings as trust fund money, which makes business owners personally liable even in bankruptcy. Penalty and interest charges create the third category, often doubling original tax bills within three years.

How Your Debt Grows While You Wait

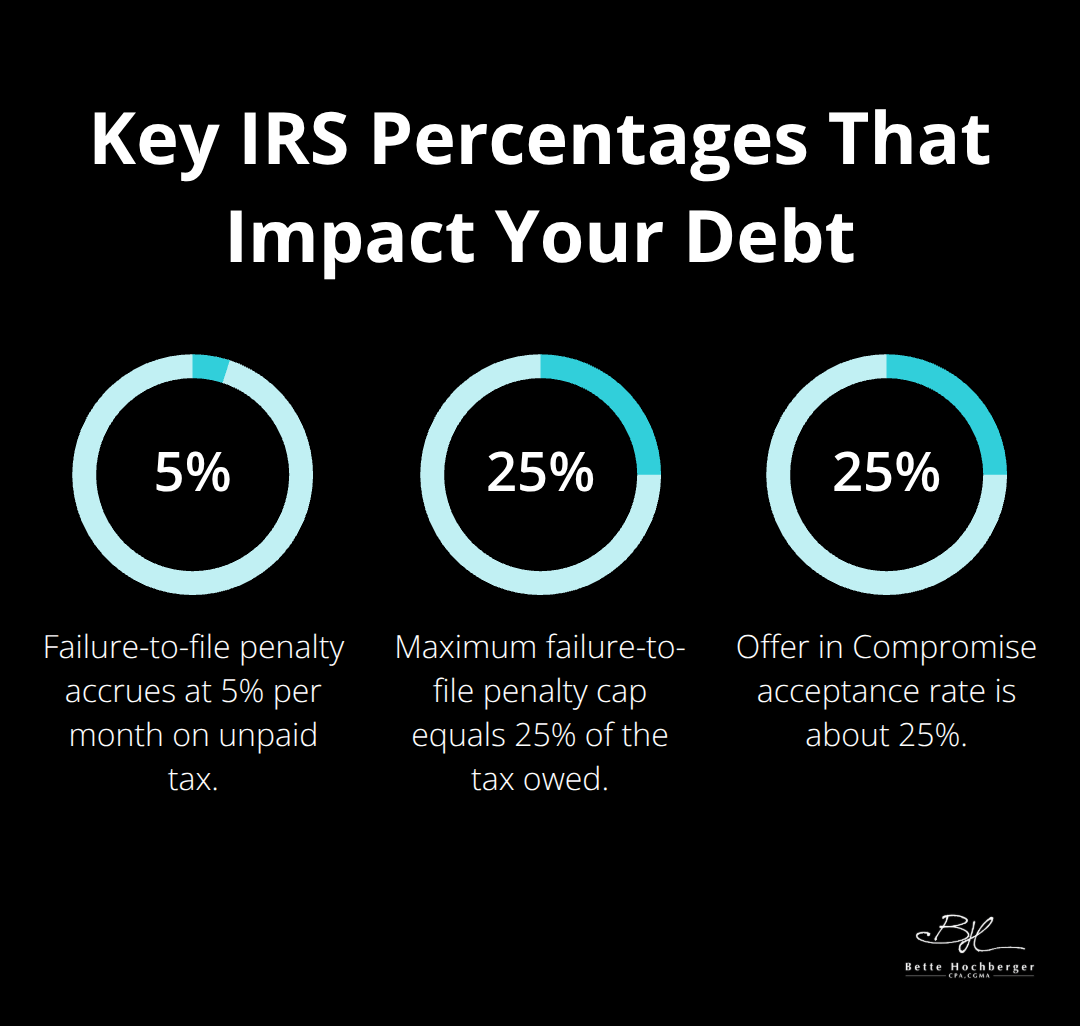

Interest compounds daily on unpaid tax balances, with rates adjusted quarterly between 3-8% annually based on federal short-term rates. The failure-to-file penalty charges 5% monthly up to 25% of your tax owed, while failure-to-pay penalties add 0.5% monthly. These penalties stack, which means a $10,000 tax debt becomes $17,500 after just two years of inaction. The IRS reduces the failure-to-pay penalty to 0.25% monthly once you enter an installment agreement (cutting your penalty accumulation in half). This reduction alone saves thousands for taxpayers who act quickly rather than avoid the problem.

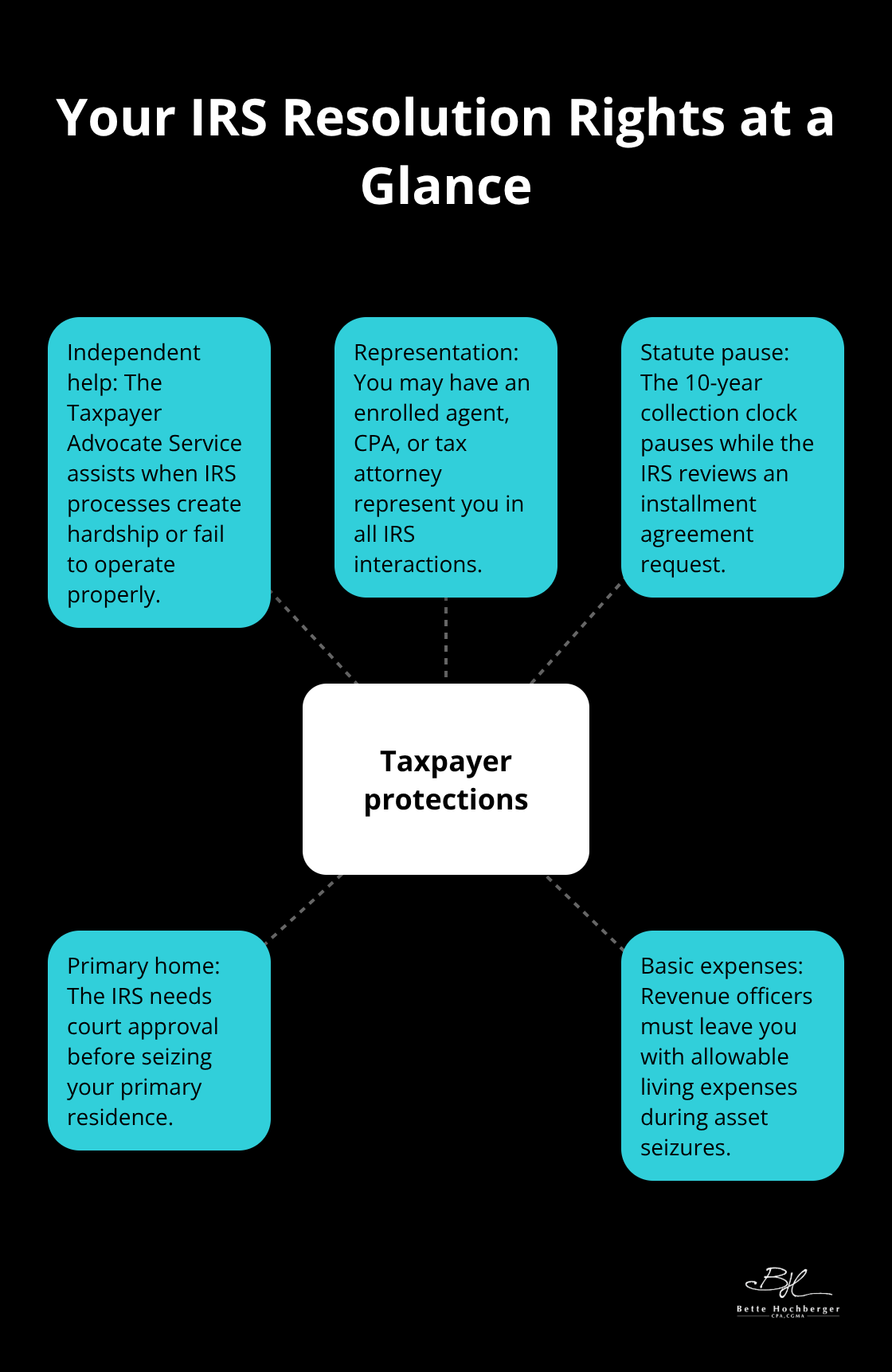

Your Legal Protection During Debt Resolution

The Taxpayer Advocate Service provides independent assistance when IRS processes create financial hardship or fail to operate properly. You have the right to representation during all IRS interactions, whether through an enrolled agent, CPA, or tax attorney. The IRS must pause its 10-year collection statute during installment agreement reviews (giving you breathing room to negotiate). Revenue officers cannot seize your primary residence without court approval, and they must leave you with basic living expenses during asset seizures.

These protections become meaningless if you ignore IRS notices, which makes immediate action far more valuable than procrastination.

Now that you understand the nature of your debt and your rights, let’s explore the specific resolution options the IRS offers to help you tackle this challenge head-on.

Which Debt Resolution Path Fits Your Situation

Payment Plans That Actually Work

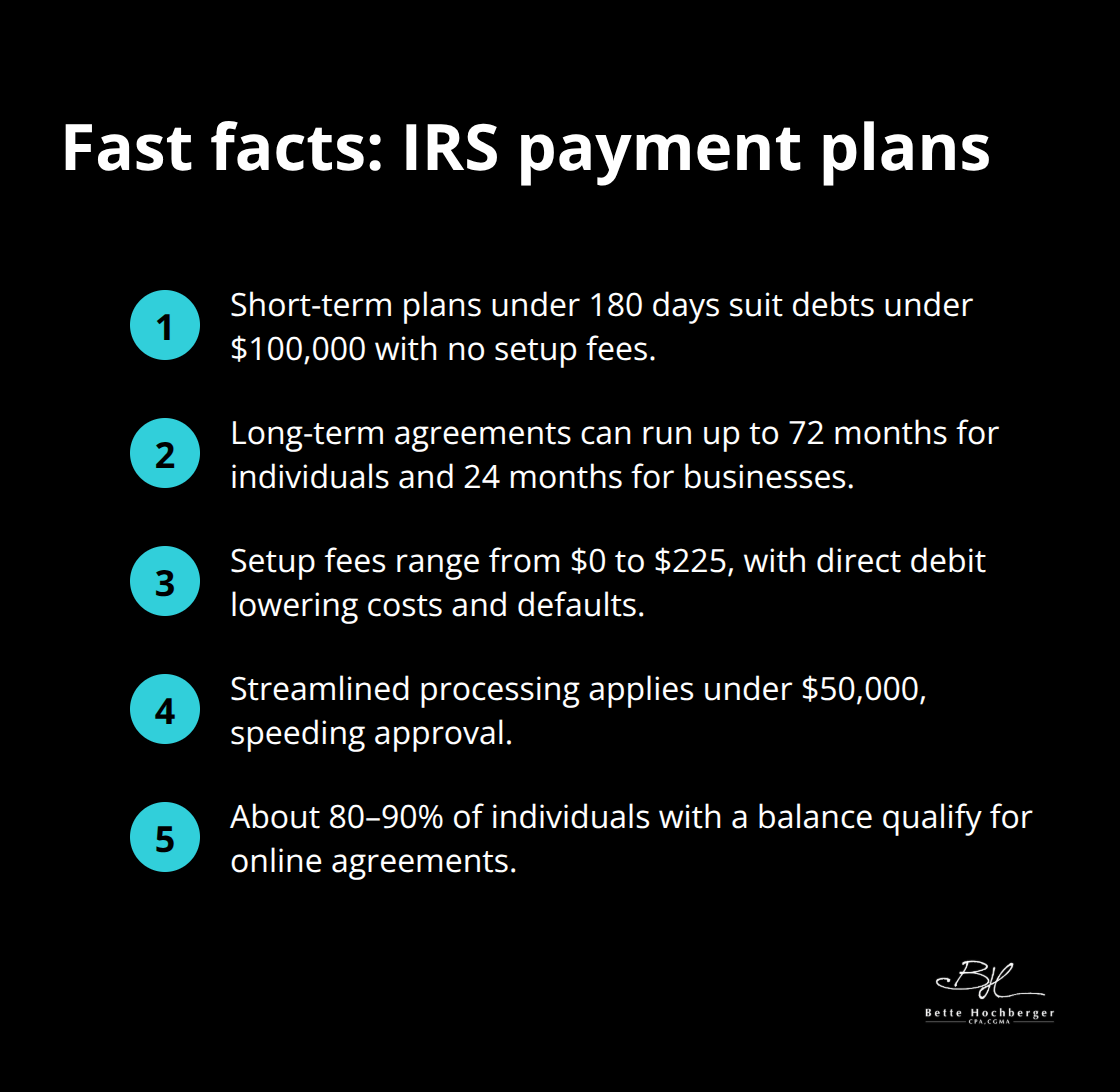

Installment agreements allow you to spread tax payments over time, with individual taxpayers who qualify for amounts up to $50,000 and businesses up to $25,000. Short-term plans under 180 days work best for debts under $100,000 with no setup fees, while long-term agreements can extend up to 72 months for individuals and 24 months for businesses. Setup fees range from $0 to $225 based on your payment method, but direct debit reduces costs and default rates according to IRS data. The streamlined process requires minimal financial documentation for debts under $50,000, which makes approval faster than traditional applications.

Around 80-90% of individual taxpayers with balance due qualify for online payment agreement applications, which means most people can set up plans without extensive paperwork or revenue officer meetings.

Compromise Programs That Reduce Your Debt

Offer in Compromise programs allow eligible taxpayers to settle debts for less than the full amount owed, but acceptance rates hover around 25%. The program works best when you pay the full amount creates genuine financial hardship or when asset liquidation would leave you unable to meet basic living expenses. Applications require detailed financial disclosure through Form 433-A for individuals or Form 433-B for businesses, plus a non-refundable application fee. The IRS Pre-Qualifier Tool helps you determine eligibility before you submit your proposal (which saves time and application fees).

Temporary Relief Through Hardship Status

Currently Not Collectible status provides temporary relief when financial hardship prevents any payment ability, effectively pausing collection actions while your situation improves. This status requires annual financial reviews and gets reversed when income increases, but it stops penalties and interest accumulation during the hardship period. Revenue officers focus on your ability to pay rather than the debt amount, which makes honest financial disclosure more valuable than attempts to hide assets. The IRS evaluates your monthly income against allowable living expenses to determine if you qualify for this protection.

With these resolution options in mind, you need to take specific steps to move from debt stress to financial freedom through proper documentation and strategic planning.

How Do You Build Your IRS Resolution Game Plan

Document Everything Before You Make Any Moves

Form 433-F serves as a collection information statement to help the IRS decide if you are eligible for payment plans. This form requires detailed household income documentation including pay stubs, bank statements, and proof of monthly expenses like rent, utilities, and necessary costs. Revenue officers scrutinize every financial detail, which means incomplete or inaccurate submissions create delays and deeper IRS scrutiny into your finances.

Around 14 million Americans owe back taxes totaling $131 billion according to IRS data. Those who submit thorough documentation resolve cases faster than taxpayers who provide incomplete information. Keep three years of tax returns, current financial statements, and asset valuations ready because the IRS uses this information to determine your ability to pay and which resolution options fit your situation.

Pick Your Strategy Based on Hard Numbers Not Emotions

Your monthly disposable income determines which path works best after the IRS subtracts allowable expenses from your total income. Taxpayers with disposable income above $25 monthly typically get pushed toward installment agreements, while those with little or no disposable income qualify for Currently Not Collectible status or Offer in Compromise consideration. To qualify for CNC status, a taxpayer must demonstrate to the IRS that paying their tax debt would cause significant financial hardship.

Professional representation becomes essential for debts above $25,000 because tax attorneys understand IRS collection standards and protect business assets during negotiations (which prevents costly mistakes). DIY approaches work for straightforward installment agreements under $50,000, but complex cases require professional expertise that maximizes your position with the IRS.

Time Your Application Submission Strategically

The IRS pauses its 10-year collection statute during installment agreement reviews, which gives you breathing room to negotiate. Submit applications early in the tax year when revenue officers handle lighter caseloads and process requests faster. Avoid peak collection periods between April and July when the IRS focuses on current year compliance rather than debt resolution cases.

Financial hardship documentation carries more weight when you can demonstrate recent income loss or unexpected expenses (rather than chronic financial mismanagement). The IRS evaluates your situation based on current ability to pay, not past financial decisions or future earning potential.

Final Thoughts

IRS debt resolution becomes manageable when you understand your options and act promptly rather than avoid the problem. The key lies in accurate financial documentation, the right strategy based on your actual ability to pay, and strategic application timing. Most taxpayers qualify for payment plans, with 80-90% of individuals eligible for online installment agreements that reduce penalties by half.

Professional help becomes necessary for complex cases with debts above $25,000, business tax issues, or when asset protection matters. Tax attorneys and CPAs understand IRS collection standards and prevent costly mistakes during negotiations (while DIY approaches often work effectively for straightforward cases under $50,000). The sooner you address tax debt, the more options remain available and the less you pay in accumulated penalties and interest.

We at Bette Hochberger, CPA, CGMA help clients navigate tax challenges and develop strategic solutions for their specific situations. Your IRS debt situation has solutions that fit your circumstances. Take action now by gathering your financial documents, evaluating your options, and choosing the path that works best for your financial reality.