The IRS Offer in Compromise program settles tax debts for less than the full amount owed, but acceptance rates hover around just 25%. Most taxpayers fail because they misunderstand eligibility requirements or submit incomplete applications.

We at Bette Hochberger, CPA, CGMA have guided hundreds of clients through successful IRS offer in compromise submissions. The right strategy and documentation make the difference between acceptance and costly rejection.

Understanding IRS Offer in Compromise Requirements

Basic Compliance Prerequisites

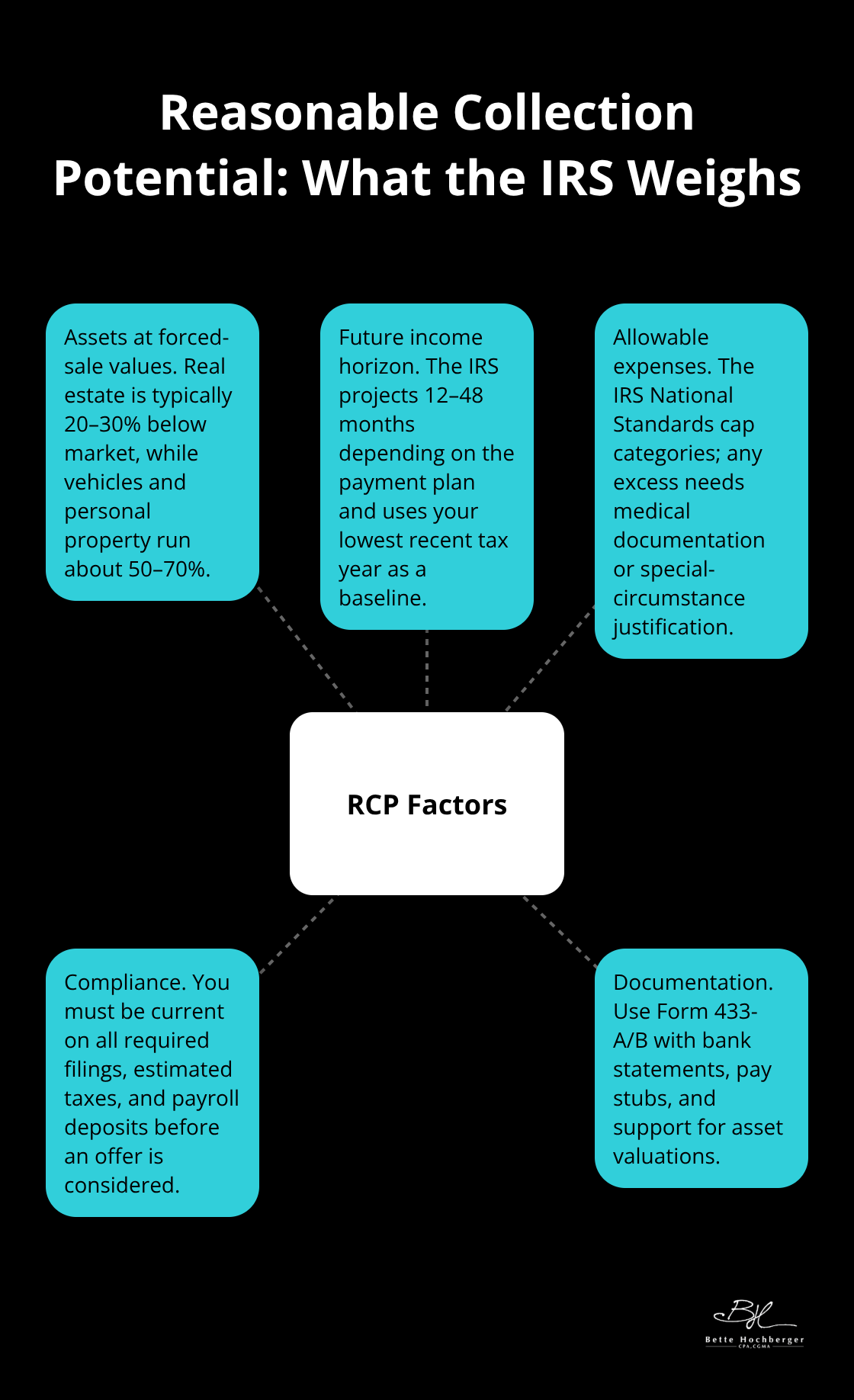

The IRS requires complete tax compliance before it considers any offer. You must file all required federal tax returns and make current estimated tax payments if you work for yourself. Business owners with employees need current payroll tax deposits for the most recent quarter. The IRS rejects approximately 43% of applications immediately due to compliance failures, according to Treasury Inspector General data. One missing return or payment disqualifies your entire application, which wastes months of preparation time.

Financial Documentation Standards

Your financial disclosure must include Form 433-A for individuals or Form 433-B for businesses, plus three months of bank statements, pay stubs, and asset valuations. The IRS calculates your reasonable collection potential using national and local expense standards, not your actual expenses. Living expenses above these standards require detailed justification with supporting documents. Asset values must reflect quick-sale prices (typically 80% of fair market value). Documentation gaps cause 60% of rejections, which makes thorough preparation essential.

Processing Timeline Expectations

The IRS takes 6-24 months to process offers, with complex cases that extend longer. Collection activities pause during this period, but penalties and interest continue to accrue. The agency requests additional information in 70% of cases, which adds 3-6 months to processing time. Applications submitted between January and April face longer delays due to filing season workload. Your offer becomes automatically accepted if the IRS fails to respond within 24 months, though this rarely occurs in practice.

The foundation of compliance and documentation sets the stage for the next critical element: how you calculate and present your offer amount to maximize acceptance chances.

Strategic Approaches to Maximize Acceptance Rates

Mastering the Reasonable Collection Potential Formula

The IRS uses a specific formula to determine your reasonable collection potential: realizable value of assets plus future income capacity minus necessary living expenses. Asset values must reflect forced-sale prices, typically 20-30% below market value for real estate and 50-70% for vehicles and personal property. The IRS National Standards allow taxpayers the total National Standards amount monthly for their family size, but actual grocery bills that exceed this require medical documentation or special circumstances.

Future income calculations span 12-48 months depending on your payment plan choice, with the agency using your lowest recent tax year as the baseline. Tax professionals who understand these calculations achieve 65% higher acceptance rates than self-prepared submissions.

Strategic Financial Hardship Documentation

Financial hardship extends beyond simple inability to pay full amounts. The IRS accepts hardship arguments when full payment creates undue economic burden, prevents basic living standards, or causes significant health risks. Medical expenses that exceed 5% of income qualify for special consideration, while eldercare costs for parents or disabled family members receive favorable treatment. Document everything with receipts, medical records, and third-party statements. Cases that involve job loss, business closure, or divorce require 12 months of financial records that show the impact. Hardship arguments fail when taxpayers maintain luxury expenses like private school tuition, expensive car payments, or vacation properties while they claim inability to pay taxes.

Common Calculation Errors That Destroy Applications

The biggest mistake involves asset undervaluation or expense overstatement without proper justification. The IRS cross-references your financial information with credit reports, property records, and previous tax returns. Inconsistencies trigger automatic rejection and potential fraud investigation. Never submit offers below 10% of your calculated reasonable collection potential unless extraordinary circumstances exist. Applications that miss required forms, signatures, or payment arrangements face immediate return without review. The $205 application fee becomes non-refundable even for procedural rejections (making accuracy essential from the start).

Professional Documentation Standards

Complete financial disclosure requires Form 433-A for individuals or Form 433-B for businesses, plus three months of bank statements, pay stubs, and asset valuations. The IRS rejects applications with documentation gaps in 60% of cases. Asset appraisals must come from licensed professionals for items worth more than $5,000. Bank statements cannot show large unexplained deposits or transfers that suggest hidden assets. Pay stubs must match tax return information, and self-employed individuals need profit and loss statements that align with Schedule C filings.

Professional representation becomes essential when these strategic elements prove too complex to handle alone, particularly for taxpayers with substantial assets or complicated financial situations.

Professional vs DIY Offer in Compromise Submissions

When Professional Representation Becomes Necessary

Complex financial situations demand professional representation to avoid costly mistakes. Business owners with multiple entities, taxpayers with significant assets over $100,000, or cases that involve payroll tax debt need expert guidance. The IRS scrutinizes these applications more intensively and demands precise calculations plus comprehensive documentation. Professional representation becomes mandatory when your reasonable collection potential exceeds $50,000 or when you face criminal tax investigations alongside civil collection. When submitting an offer in compromise, you must provide a written statement explaining why the tax debt or portion of the tax debt is incorrect, along with supporting documentation.

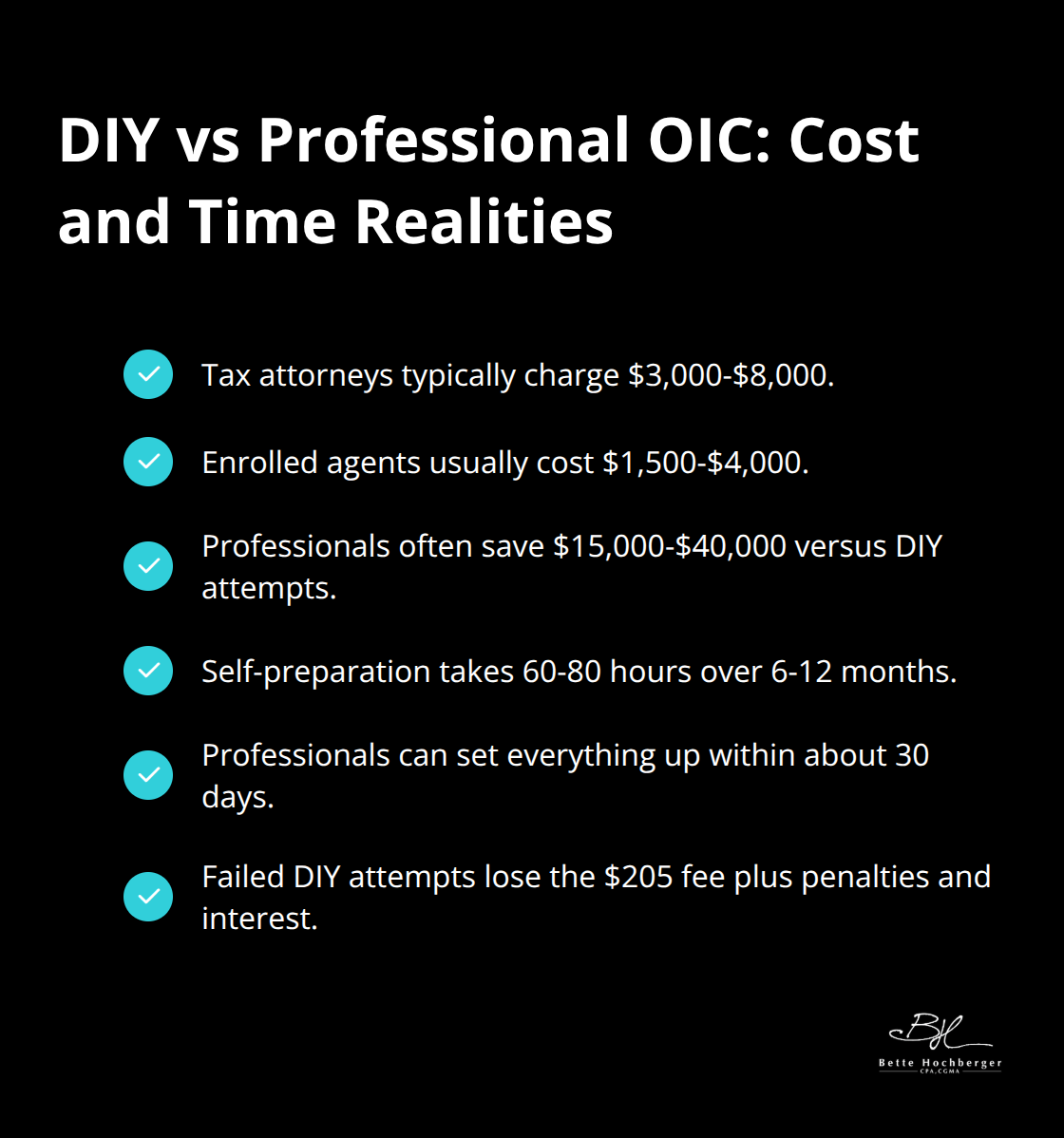

Cost Analysis That Justifies Professional Fees

Tax attorneys charge $3,000-$8,000 for offer in compromise representation, while enrolled agents typically cost $1,500-$4,000. These fees pale compared to potential savings on tax debt that often exceeds $25,000. Professional representation saves an average of $15,000-$40,000 on accepted offers compared to DIY attempts (based on National Association of Enrolled Agents statistics). The time investment for self-preparation averages 60-80 hours over 6-12 months, while professionals handle everything within 30 days. Failed DIY attempts cost taxpayers the $205 application fee plus accumulated penalties and interest during processing delays.

Success Rate Disparities Reveal Clear Advantages

Enrolled agents and tax attorneys understand IRS collection procedures and negotiation tactics that typical taxpayers cannot master quickly. They know which IRS officers handle specific case types and how to present arguments that resonate with agency priorities. Professional submissions include strategic cover letters that highlight favorable circumstances while they address potential red flags proactively. DIY applicants often submit offers too low or too high (which triggers automatic rejections). Professionals also handle IRS correspondence during the review process and prevent miscommunication that derails applications. The expertise gap explains why professional representation provides significant advantages over self-prepared submissions.

Final Thoughts

Successful IRS Offer in Compromise applications demand meticulous preparation, accurate financial calculations, and complete compliance with all tax requirements. The 25% acceptance rate reflects the program’s strict standards, but taxpayers who understand reasonable collection potential formulas and provide comprehensive documentation achieve significantly better outcomes. Acceptance creates a five-year compliance period where any failures void the entire agreement.

The IRS monitors your tax obligations closely after acceptance and applies future tax refunds to other outstanding liabilities until full compliance occurs. Complex cases with business ownership, significant assets, or payroll tax debt benefit from professional representation. The investment in expert guidance often pays for itself through higher acceptance rates and better terms (making professional help worthwhile for complicated situations).

We at Bette Hochberger, CPA, CGMA provide strategic tax services that help clients minimize liabilities and maintain compliance. Our personalized approach addresses each client’s unique financial situation while we use advanced technology to streamline the process. Professional guidance makes the difference between successful IRS offer compromise resolution and costly rejection.