Growing businesses face a critical decision point when their financial complexity outpaces their current resources. Traditional full-time CFOs cost $200,000+ annually, making them unrealistic for most scaling companies.

Fractional CFO implementation offers the strategic financial leadership you need at a fraction of the cost. We at Bette Hochberger, CPA, CGMA see companies achieve 15-25% revenue growth within 18 months of bringing on fractional CFO services.

What Makes Fractional CFOs Different

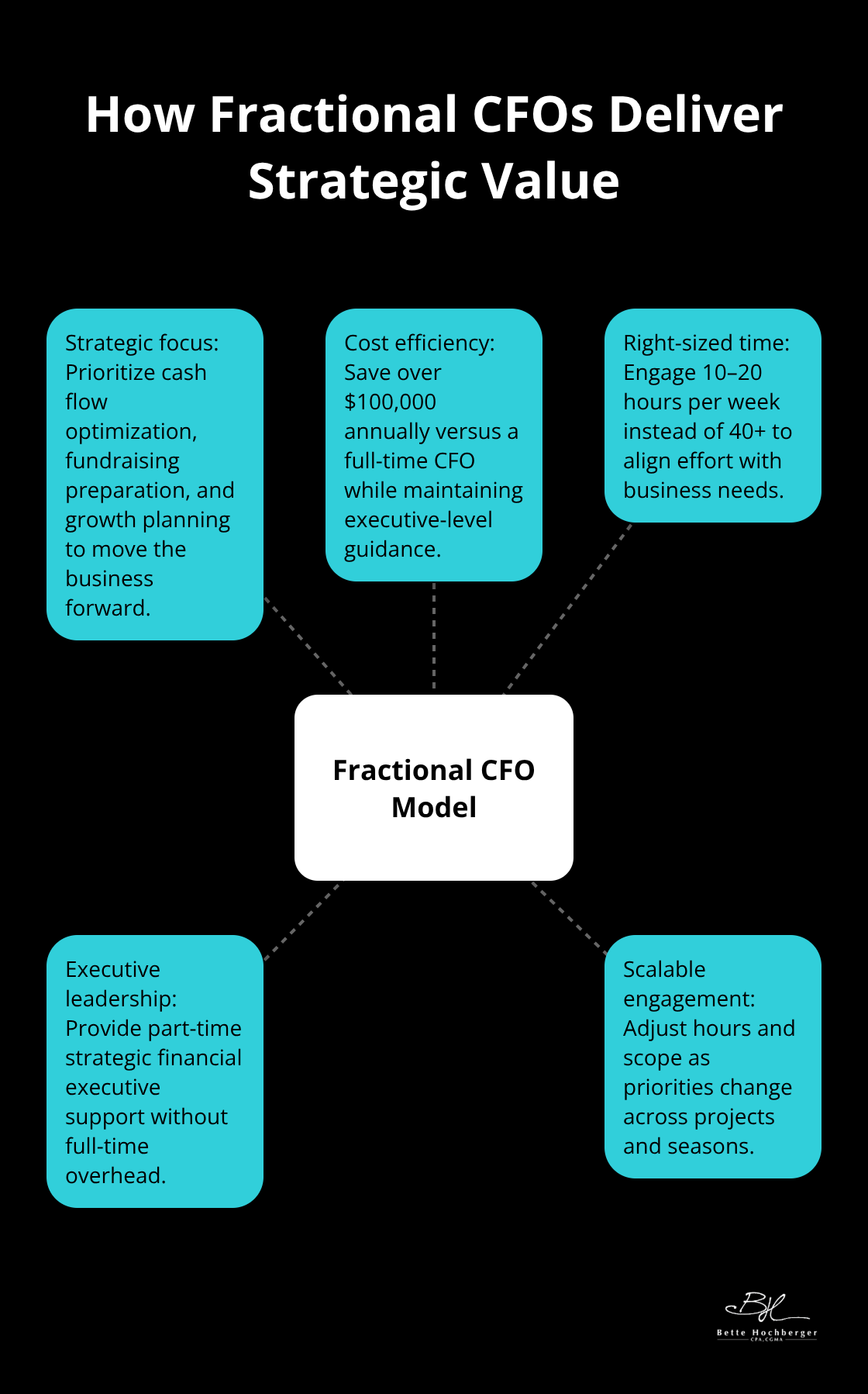

A fractional CFO operates as your part-time strategic financial executive, works 10-20 hours per week compared to a traditional CFO’s 40+ hour commitment. This model delivers the same caliber of financial leadership at significantly lower cost than full-time alternatives, potentially saving over $100,000 annually. Traditional CFOs focus heavily on day-to-day operations and compliance, while fractional CFOs concentrate on high-impact strategic initiatives like cash flow optimization, fundraising preparation, and growth planning.

Cost Structure That Actually Works

Fractional CFO services typically range from $5,000 to $15,000 monthly (according to Zanda Recruiting), versus $450,000 annual salaries for traditional CFOs. This model lets you scale financial expertise with your business needs. Manufacturing and technology companies see the highest ROI from fractional CFO arrangements, with professional services firms close behind. These industries benefit most because they require sophisticated financial models and cash flow management during rapid growth phases.

Strategic Focus Over Administrative Tasks

Fractional CFOs focus primarily on strategic initiatives rather than routine financial administration. They implement financial automation tools, create investor-ready reports, and develop scenario plans that traditional teams cannot provide. SaaS companies and real estate investment firms particularly benefit from this strategic approach, as fractional CFOs can navigate complex revenue recognition and investment analysis requirements.

Flexibility That Scales With Growth

The fractional model adapts to your business cycles and seasonal demands. Companies can increase or decrease hours based on specific projects like fundraising rounds or acquisition analysis. This flexibility proves especially valuable during transitional phases when full-time expertise would be excessive but strategic guidance remains essential.

The next consideration involves identifying which specific financial strategies will drive the most significant impact for your business growth trajectory.

Key Financial Strategies for Business Growth

Successful fractional CFO implementation relies on three financial strategies that consistently produce measurable results. Cash flow forecasting stands as the most impactful strategy, providing a high-frequency lens on revenue, expenses, and financial flows that creates new opportunities to understand how small businesses manage cash-flow challenges. Fractional CFOs implement automated cash flow tracking systems that identify potential shortfalls 8-12 weeks in advance, which allows proactive decision-making rather than reactive crisis management.

Strategic Tax Planning That Maximizes Profits

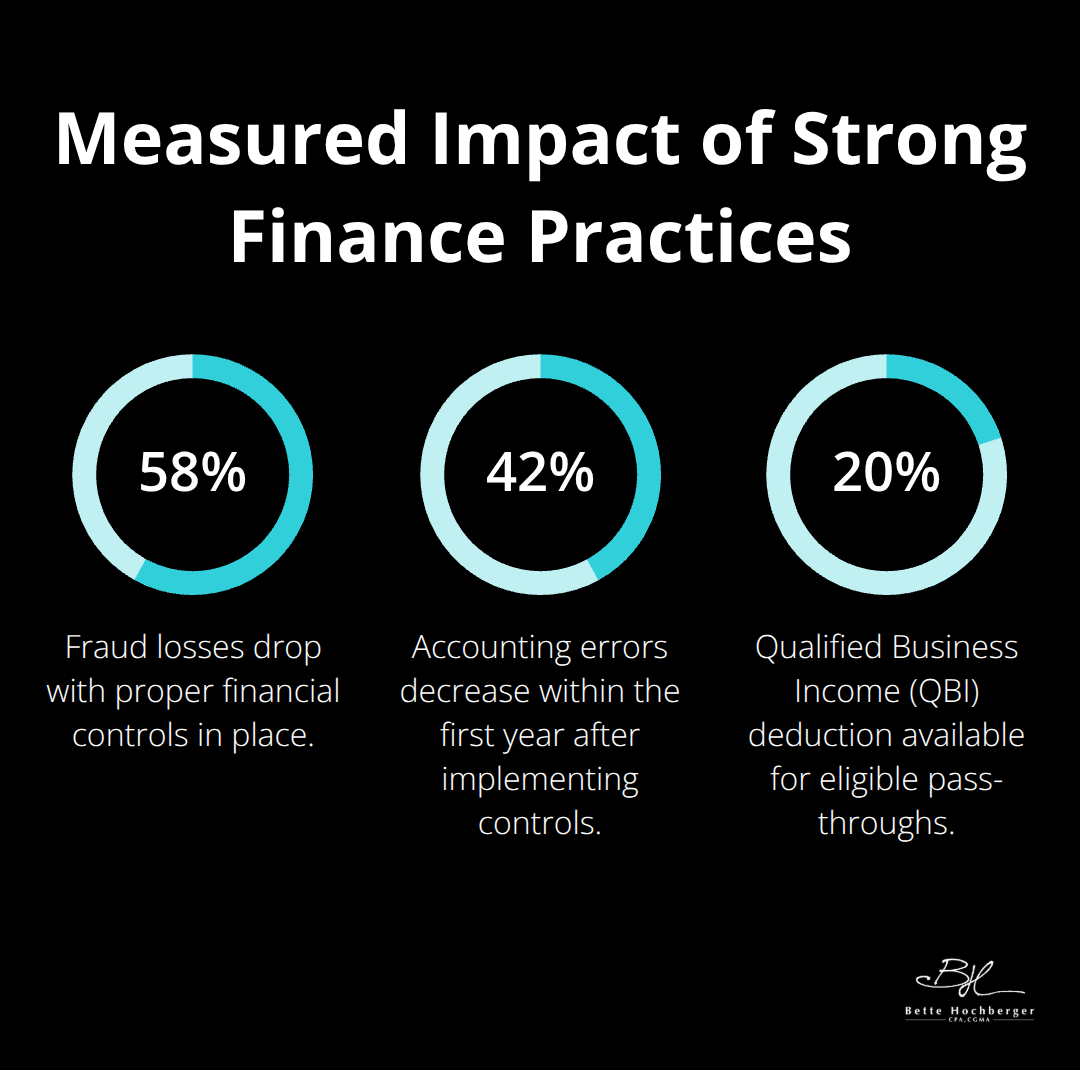

Strategic tax optimization delivers immediate bottom-line impact, with proper planning that reduces effective tax rates by 15-30% for most growing businesses. Advanced tax strategies like Section 199A deductions for pass-through entities allow eligible taxpayers to deduct up to 20 percent of their qualified business income, plus 20 percent of qualified REIT dividends. Strategic timing of equipment purchases creates substantial savings that fuel reinvestment opportunities. Companies that work with experienced tax professionals see their tax burden decrease significantly while maintaining full compliance with regulations.

Cash Flow Management Systems

Fractional CFOs establish sophisticated cash flow management systems that track multiple revenue streams and expense categories. These systems provide real-time visibility into financial performance and help businesses avoid the cash crunches that destroy growth momentum. Companies with proper cash flow management maintain healthier working capital ratios and can take advantage of growth opportunities when they arise.

Financial Controls That Prevent Revenue Loss

Robust financial controls prevent the revenue leakage that destroys growing companies. Fractional CFOs establish segregation of duties protocols and monthly account reconciliation processes that catch errors before they compound. Companies that implement proper financial controls see fraud losses drop by 58% and accounting errors decrease by 42% within the first year.

Risk Management Frameworks

Risk management frameworks developed by experienced fractional CFOs identify operational vulnerabilities early, with scenario planning models that stress-test business performance under various market conditions. These controls create the financial foundation necessary for sustainable scaling without the operational chaos that typically accompanies rapid growth.

The success of these financial strategies depends heavily on selecting the right fractional CFO partner who can implement them effectively within your specific business context.

Choosing the Right Fractional CFO Partner

The wrong fractional CFO selection costs companies 6-12 months of lost momentum and $50,000+ in wasted fees. Industry-specific experience matters more than general financial credentials. Manufacturing companies require supply chain finance expertise while SaaS businesses need recurring revenue models. Look for candidates with previous full-time CFO experience at companies 2-3x your current size, as they understand the financial challenges you will face during growth phases.

Essential Credentials and Experience

CPA certification combined with CGMA credentials indicates advanced management accounting knowledge that separates strategic thinkers from basic bookkeepers. To become a fractional CFO, you’ll need a bachelor’s degree in finance, accounting, or a related field. Avoid candidates who primarily offer accounting services disguised as fractional CFO work. Previous experience with fundraising rounds, financial restructuring, or M&A transactions demonstrates the strategic capabilities your business needs.

Technology Proficiency Requirements

Modern fractional CFOs must demonstrate proficiency with advanced financial software beyond basic QuickBooks functionality. NetSuite, Sage Intacct, and similar ERP systems provide the real-time reporting capabilities that growing businesses require for decision-making. Cash flow forecasting tools like Float or Cashflow Frog should be part of their standard toolkit, along with financial modeling expertise in Excel or Google Sheets.

Reporting and Dashboard Capabilities

Dashboard creation capabilities using Tableau or Power BI separate professional fractional CFOs from amateur practitioners. They should create automated monthly reports that track key performance indicators specific to your industry. Financial transparency through visual dashboards helps leadership teams make faster, more informed decisions about resource allocation and strategic priorities.

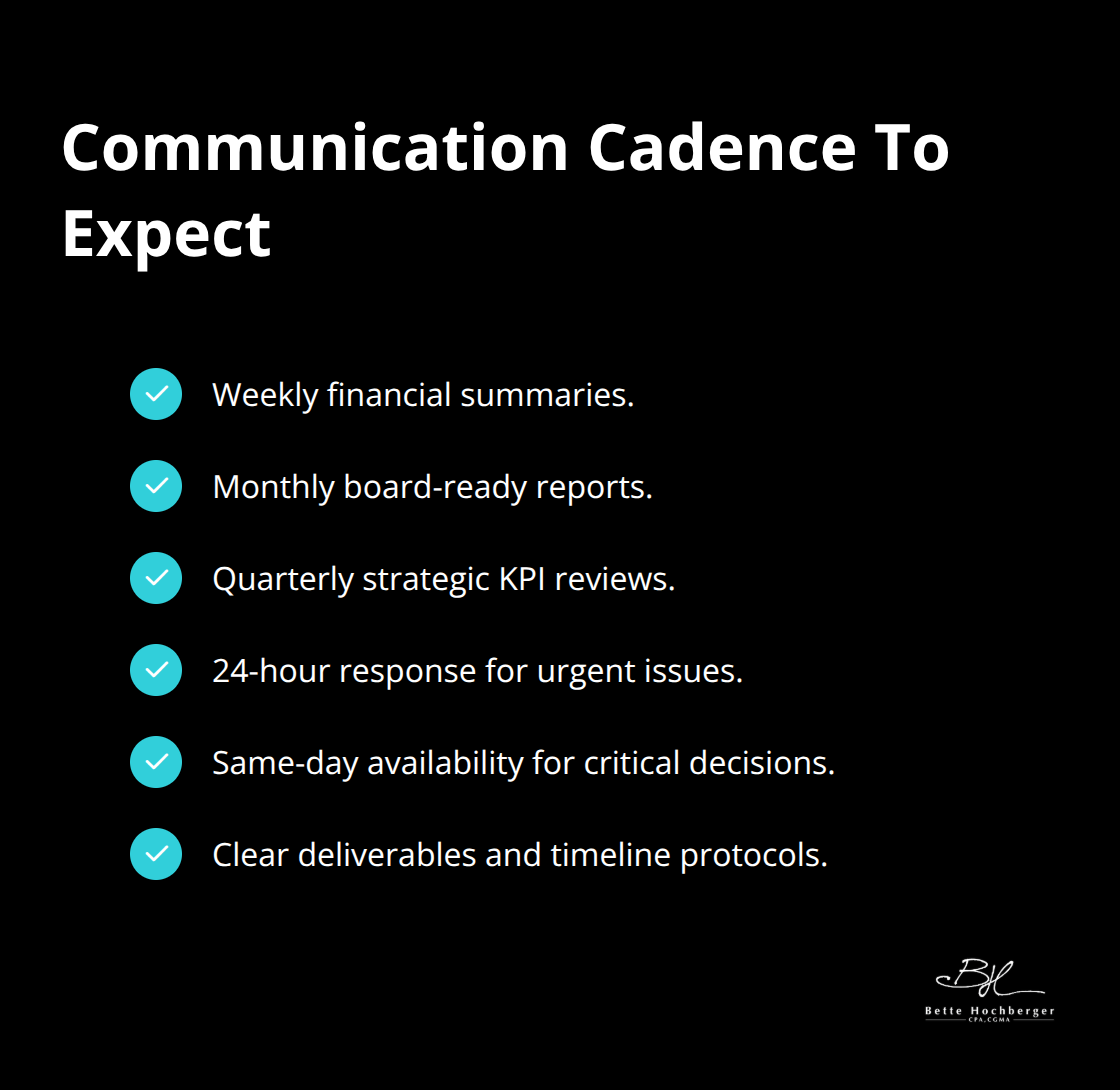

Communication Standards and Response Times

Communication expectations must include weekly financial summaries, monthly board-ready reports, and quarterly strategic reviews with specific KPI tracking. Response time commitments of 24 hours for urgent matters and same-day availability for critical decisions prevent operational delays that damage growth momentum. Clear communication protocols eliminate confusion about deliverables and timeline expectations (which protects both parties from misaligned expectations).

Final Thoughts

Your business needs fractional CFO implementation when monthly revenue exceeds $500,000 or when cash flow forecasts extend only 30 days ahead. Companies with 20%+ annual growth require strategic financial leadership that traditional bookkeeping cannot deliver. The investment typically generates 3:1 ROI within 12 months through improved cash management and tax optimization strategies.

Expected outcomes include 15-25% revenue growth within 18 months, reduced tax burden of 15-30%, and elimination of cash flow surprises through advanced forecasting systems. Companies that work with fractional CFOs report 58% fewer fraud losses and 42% reduction in accounting errors during the first year. Implementation begins with a comprehensive financial assessment to identify immediate opportunities and strategic priorities (with onboarding taking 30-45 days to establish reporting systems and performance dashboards).

We at Bette Hochberger, CPA, CGMA specialize in fractional CFO services that minimize tax liabilities while managing cash flow for sustainable profitability. Our strategic approach combines advanced cloud technology with personalized financial services designed specifically for growing businesses. We provide executive-level financial leadership without full-time overhead costs that burden scaling companies.