At Bette Hochberger, CPA, CGMA, we know that strategic tax preparation is more than just filling out forms. It’s about maximizing your financial benefits and minimizing your tax burden.

In this post, we’ll show you how to approach your taxes with a strategic mindset, outlining key components and practical steps for effective tax planning. By the end, you’ll understand why proactive tax management is essential for your financial success.

What Is Strategic Tax Planning?

Strategic tax planning is a proactive approach to manage your finances. It aims to minimize your tax burden while maximizing your wealth. This process goes beyond annual form-filling; it requires careful consideration of your financial decisions throughout the year.

The Power of Proactive Tax Management

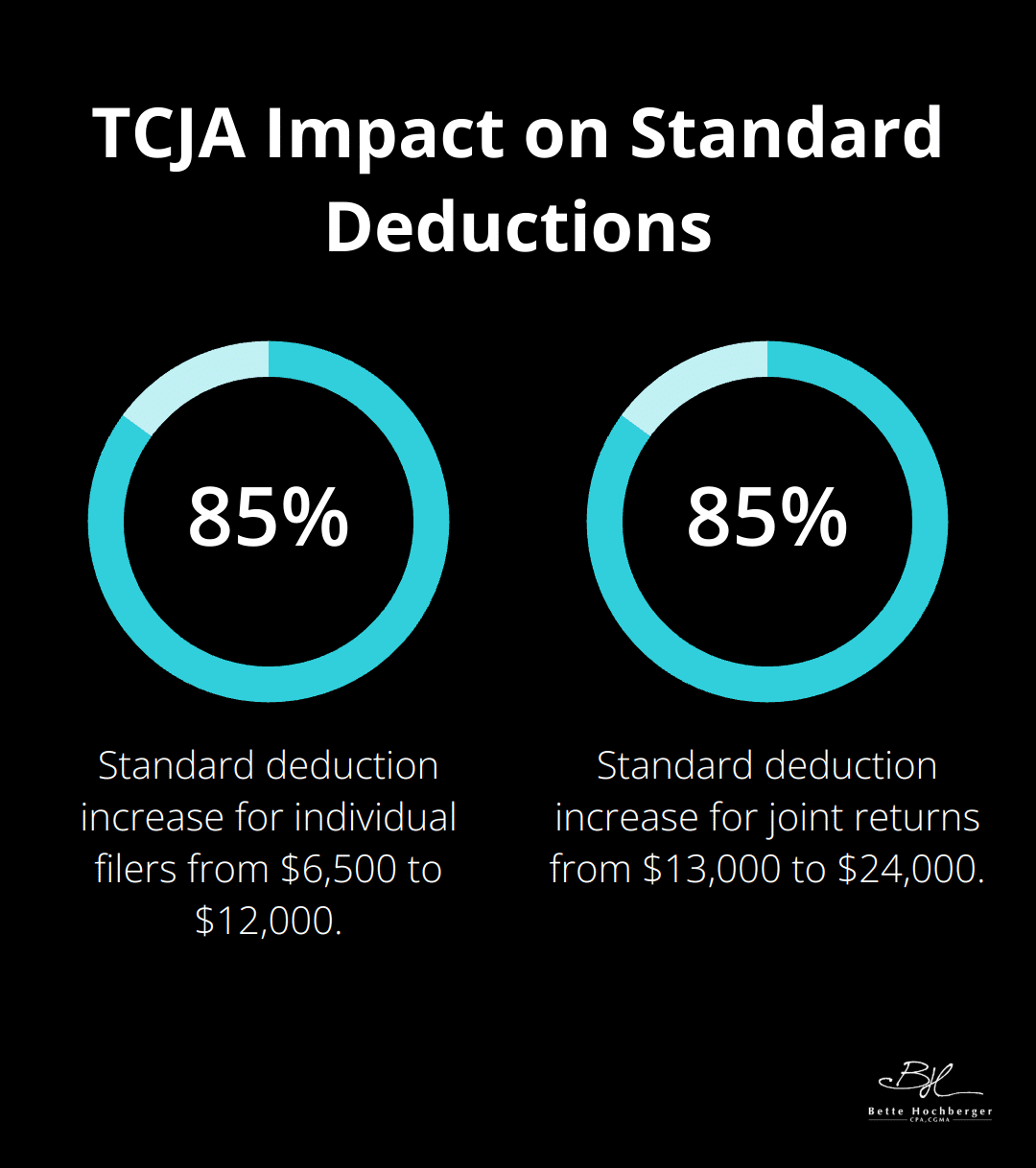

Proactive tax management can lead to significant savings. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for individual filers, and from $13,000 to $24,000 for joint returns. This change highlights the importance of planning ahead and keeping detailed records of potential deductions.

Beyond Basic Tax Preparation

Tax preparation focuses on accurately reporting your income and deductions for the past year. Tax strategy, however, looks to the future. It involves making informed decisions about investments, business structures, and financial transactions to optimize your tax position.

The choice of business entity can have a major impact on your tax liability. For owners reporting higher profits, 42% credited sales volumes, 32% cited usual seasonal change, and 7% cited higher selling prices, according to a recent survey.

Tailoring Your Tax Strategy

Every individual and business has unique financial circumstances. A tailored tax strategy takes into account your specific goals, income sources, and potential deductions. This personalized approach can lead to substantial savings.

Components of Effective Tax Planning

Effective tax planning includes several key components:

- Income Timing: Strategically timing when you receive income can impact your tax bracket.

- Deduction Optimization: Maximizing available deductions to reduce taxable income.

- Investment Strategy: Choosing tax-efficient investments (such as municipal bonds).

- Retirement Planning: Utilizing tax-advantaged retirement accounts to defer taxes.

The Ongoing Nature of Tax Strategy

Tax laws change, and your financial situation evolves. Your strategy should be regularly reviewed and adjusted. This ongoing process can potentially save you thousands of dollars each year and set you up for long-term financial success.

As we move forward, let’s explore the essential components of strategic tax planning in more detail. These elements form the foundation of a comprehensive tax strategy that can significantly impact your financial well-being.

Building Blocks of Effective Tax Planning

Income Timing Strategies

Strategic tax planning requires careful consideration of when you receive income. The timing of income recognition can significantly impact your tax liability. You can lower your taxable income by deferring income to a future tax year or accelerating deductions into the current year. This strategy proves particularly effective if you expect to be in a lower tax bracket in the following year. The IRS reports that nearly 75% of taxpayers take the standard deduction rather than itemizing. However, for those who itemize, precise income and deduction timing can lead to substantial tax savings.

Optimizing Deductions and Credits

Reducing your taxable income through deductions and credits forms a cornerstone of effective tax planning. For heads of households, the standard deduction will be $22,500 for tax year 2025. However, itemizing deductions might benefit you more if your total deductions exceed this amount. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Tax credits such as the Child Tax Credit or the American Opportunity Tax Credit can directly reduce your tax bill, providing even more significant savings.

Investment and Asset Management

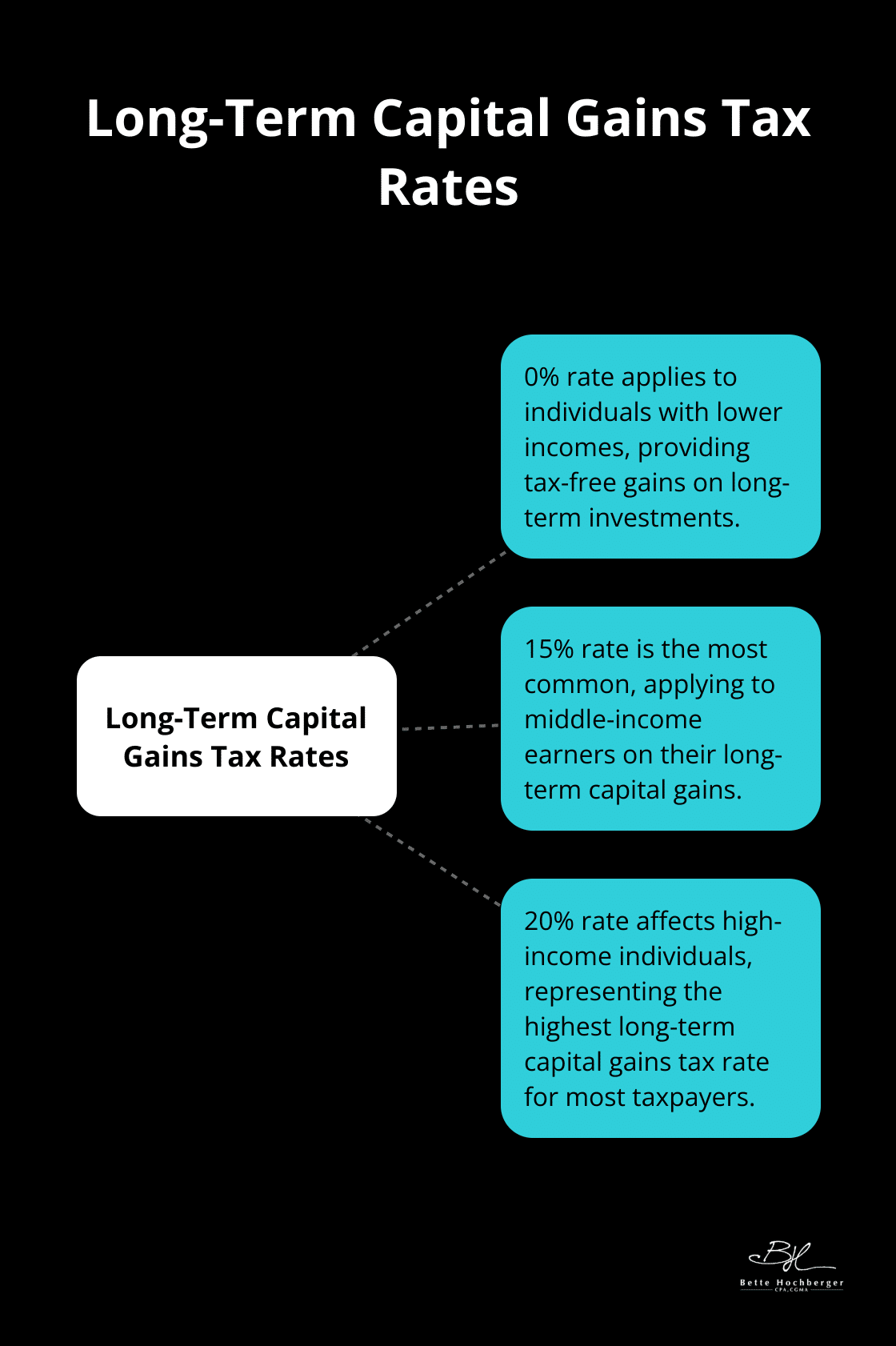

Your investment strategy plays a vital role in your overall tax picture. Capital gains taxes can significantly impact your investment returns. The tax system favors long-term capital gains with preferential rates compared to short-term gains. Long-term capital gains tax rates are 0%, 15% or 20%, depending on income and filing status. This fact underscores the potential benefits of holding investments for longer periods when possible.

Selecting the Right Business Structure

For business owners, the choice of business structure can have profound tax implications. Each structure (sole proprietorship, partnership, LLC, or corporation) comes with different tax consequences. For example, S corporations can provide tax advantages by allowing business income to pass through to the owner’s personal tax return, potentially reducing self-employment taxes. The U.S. Small Business Administration reports that about 73% of small businesses operate as sole proprietorships, but this may not always represent the most tax-efficient choice.

Retirement Planning for Tax Efficiency

Retirement planning forms an integral part of a comprehensive tax strategy. Contributions to traditional 401(k) plans and IRAs can reduce your current taxable income. For 2023, the contribution limit for 401(k) plans stands at $22,500, with an additional $7,500 catch-up contribution for those 50 and older. While Roth IRAs don’t provide immediate tax benefits, they offer tax-free growth and withdrawals in retirement. This option can prove particularly advantageous if you expect to be in a higher tax bracket during retirement.

As we move forward, let’s explore practical steps you can take to implement these strategic tax planning components effectively.

How to Implement Effective Tax Strategies

Effective tax strategies require a proactive approach and attention to detail. This chapter outlines several practical steps to optimize your tax position and maximize financial benefits.

Conduct Regular Financial Reviews

Regular financial reviews are essential for effective tax planning. Quarterly assessments of your income, expenses, and potential tax liabilities allow you to adjust your strategy as needed and avoid surprises come tax season. Self-employed individuals should adjust their estimated tax payments based on income fluctuations.

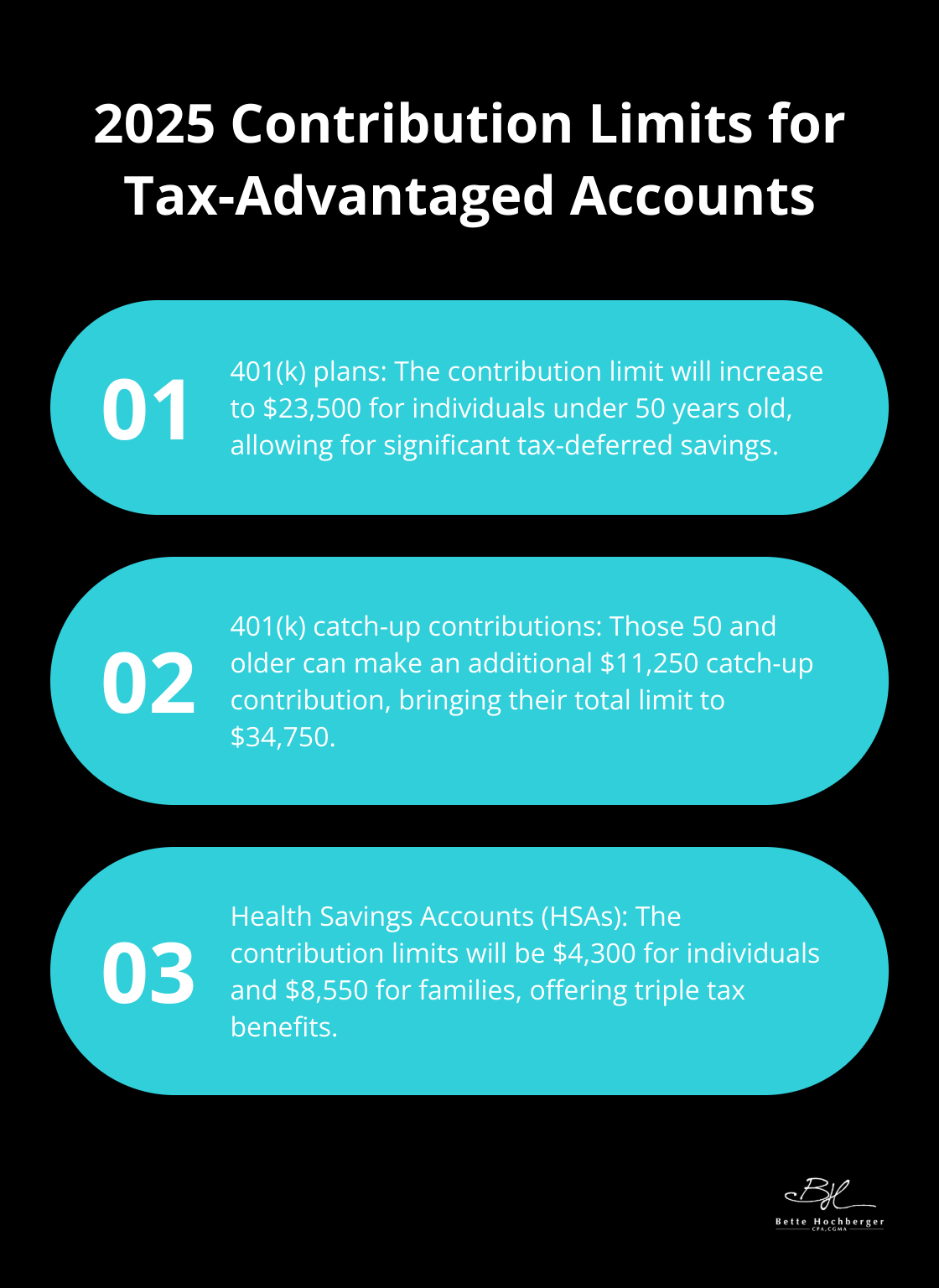

Maximize Tax-Advantaged Accounts

Tax-advantaged accounts are powerful tools for reducing your tax burden. For 2025, the contribution limit for 401(k) plans will increase to $23,500 (with an additional $11,250 catch-up contribution for those 50 and older). Health Savings Accounts (HSAs) offer another opportunity for tax savings, with 2025 contribution limits set at $4,300 for individuals and $8,550 for families. These accounts provide triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Use Strategic Charitable Giving

Charitable giving benefits both you and your chosen causes. The IRS allows you to deduct charitable contributions up to 60% of your adjusted gross income for cash donations to public charities. Consider bunching your donations in a single year to exceed the standard deduction threshold. Donor-advised funds offer another strategic option, allowing you to make a large contribution in one year for an immediate tax deduction while spreading out the actual charitable gifts over time.

Apply Tax Loss Harvesting

Tax loss harvesting involves selling investments at a loss to offset capital gains. This strategy can help reduce your overall tax liability. The IRS allows you to deduct up to $3,000 of net capital losses against your ordinary income each year (with any excess carried forward to future years). Be aware of the wash-sale rule, which prohibits claiming a loss on a security if you buy the same or a substantially identical security within 30 days before or after the sale.

Seek Professional Guidance

Implementing these strategies requires careful planning and expertise. Every financial situation is unique, and tax laws change frequently. A qualified tax professional can create personalized tax strategies tailored to your specific needs and goals. They stay up-to-date with the latest tax laws and regulations to ensure you take advantage of every available opportunity to minimize your tax burden and maximize your wealth.

Final Thoughts

Strategic tax preparation empowers individuals and businesses to optimize their financial positions. We implement tailored strategies to reduce tax burdens, maximize deductions, and make informed financial decisions throughout the year. Our team at Bette Hochberger, CPA, CGMA specializes in personalized financial services, including strategic tax planning.

Tax laws and regulations change constantly, which necessitates ongoing adjustments to your strategy. Regular reassessment of your financial situation helps maintain an effective tax strategy year after year. Our experts navigate the complexities of tax law, develop customized strategies, and ensure you take advantage of every opportunity to minimize your tax liability.

Strategic tax preparation transforms a dreaded chore into a powerful tool for wealth building and financial stability. We use advanced cloud technology to serve diverse industries, offering services such as Fractional CFO, tax preparation, and outsourced accounting (to name a few). Don’t leave your financial future to chance; let us help you take control of your finances and pave the way for long-term financial success.