Winning the lottery can be a life-changing event, but it comes with significant tax implications. At my firm, we understand the complexities of managing sudden wealth and the importance of a solid lottery winner tax strategy.

Our expert team is here to guide you through the maze of tax laws and financial planning options available to lottery winners. In this post, we’ll explore effective ways to minimize your tax burden and maximize your windfall for long-term financial success.

How Does Lottery Taxation Work?

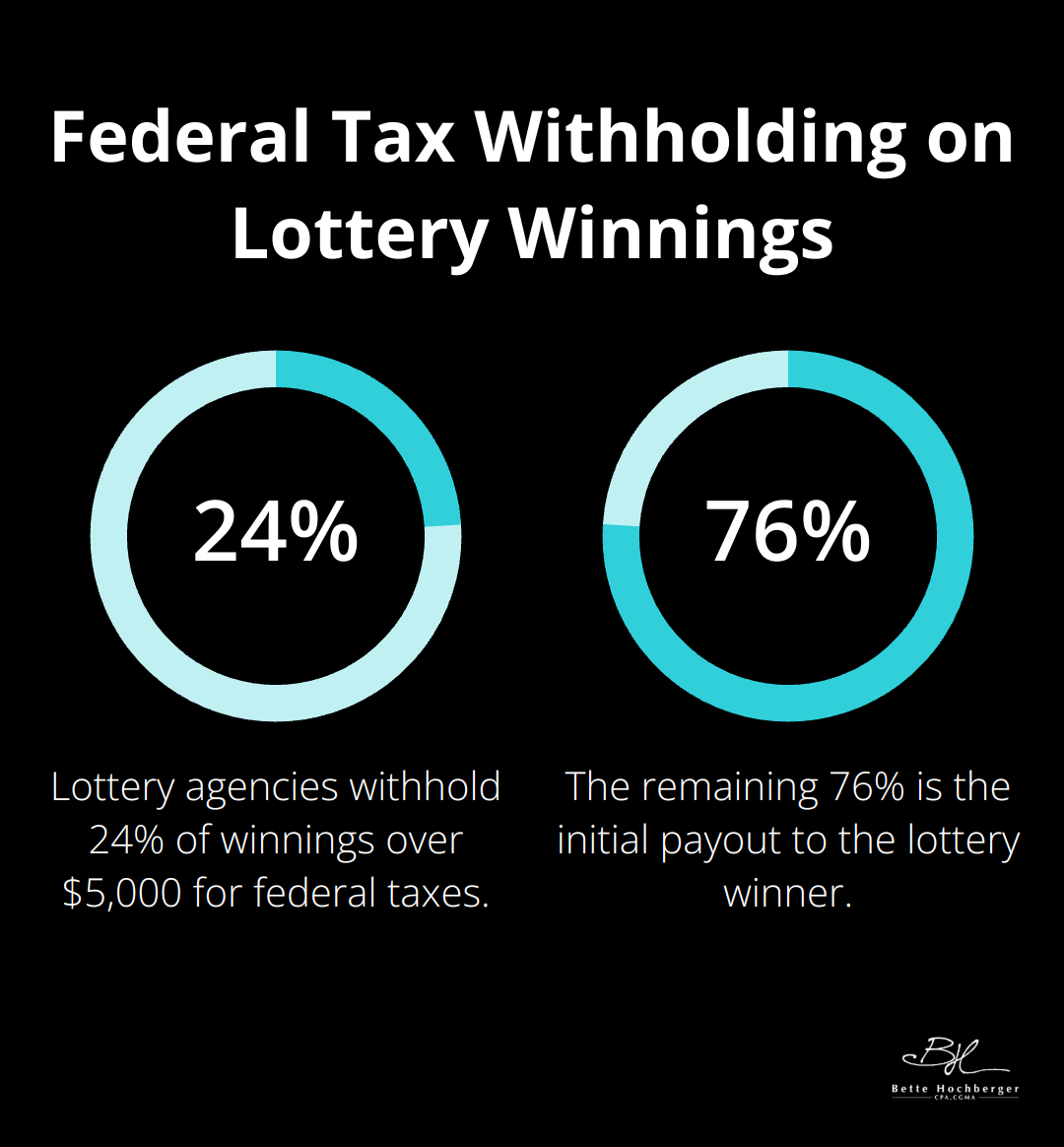

Federal Tax Implications

Winning the lottery transforms your financial landscape, but it also brings significant tax responsibilities. The federal government classifies lottery winnings as ordinary income, subjecting them to income tax rates up to 37% for high earners. Lottery agencies are generally required to withhold 24% of all winnings over $5,000 for taxes, but this might not cover your entire tax liability.

State Tax Considerations

State taxes on lottery winnings vary dramatically across the U.S. Some states (like Florida and Texas) don’t tax lottery winnings at all, while others (such as New York) can take an additional 8.82% of your prize. Understanding your state’s specific tax laws is critical.

Lump Sum vs. Annuity: A Tax Perspective

Lottery winners typically face two payout options: a lump sum or an annuity. These choices can lead to very different tax outcomes.

A lump sum payment provides a smaller amount upfront (often about 60% of the advertised jackpot), but requires you to pay all your taxes at once. This can push you into the highest tax bracket for that year, potentially resulting in a larger overall tax bill.

An annuity spreads your winnings and tax liability over many years. This approach can keep you in lower tax brackets and potentially save you money in the long run.

Tax Brackets and Large Winnings

Large lottery winnings can quickly propel you into the highest tax bracket. In 2025, single filers with taxable income over $609,351 will fall into the 37% bracket. This means that a significant portion of your winnings could be taxed at this highest rate.

It’s important to note that tax brackets are marginal (only the income above each threshold is taxed at the higher rate). However, with lottery winnings, a large portion of your prize will likely fall into the highest bracket.

Professional Guidance for Tax Strategy

The complex tax implications of lottery winnings necessitate expert advice. A tax professional can help you develop a strategy to minimize your tax burden and maximize the amount of your winnings you keep. They can guide you through the intricacies of federal and state tax laws, help you choose between lump sum and annuity options, and create a comprehensive plan for managing your newfound wealth.

As we move forward, let’s explore some strategic tax planning approaches that can help lottery winners make the most of their windfall.

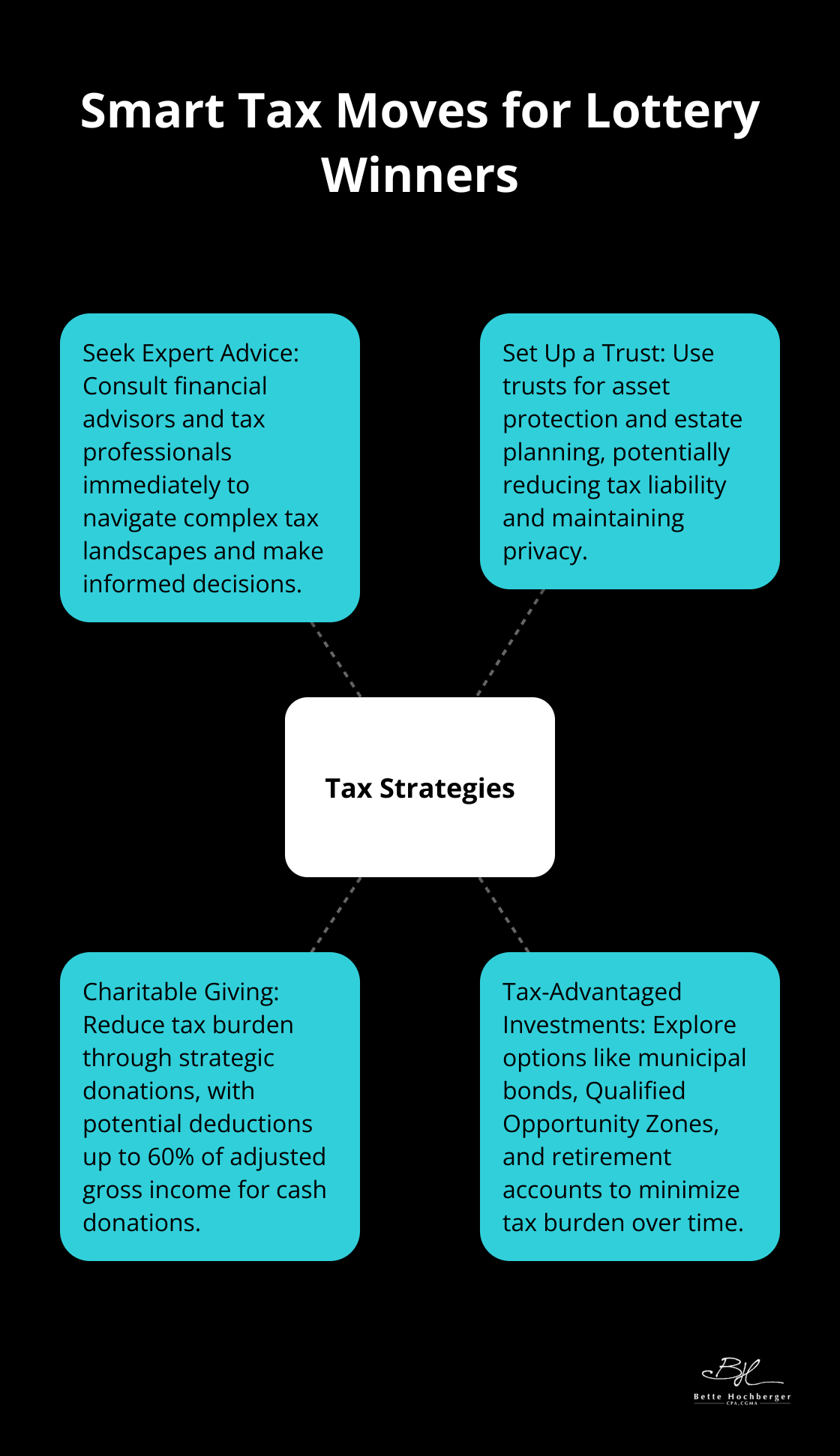

Smart Tax Moves for Lottery Winners

Winning the lottery transforms your financial landscape, but quick and wise action protects your newfound wealth. Let’s explore effective strategies to retain more of your winnings.

Seek Expert Advice Immediately

The moment you realize you’ve won, call a financial advisor or tax professional. Time matters. Without careful planning, winners can lose their entire windfall and possibly be forced to file for bankruptcy just a few years after their win. This highlights the need for expert guidance right away.

A qualified advisor helps you navigate the complex tax landscape and make informed decisions about your payout options. They also assist in creating a comprehensive financial plan that considers your short-term and long-term goals.

Set Up a Trust

An effective strategy for managing lottery winnings involves setting up a trust. Trusts are powerful tools for both asset protection and estate planning. By placing assets in a trust, they are managed by the trustee for the benefit of the beneficiaries.

For instance, a blind trust allows you to claim your winnings anonymously in some states (shielding you from unwanted attention). An irrevocable trust can potentially reduce your estate tax liability by removing assets from your taxable estate.

Use Charitable Giving

Strategic charitable giving reduces your tax burden while making a positive impact. The IRS allows you to deduct up to 60% of your adjusted gross income for cash donations to qualified charities.

For example, if you win a $10 million jackpot and take the lump sum option, you might receive about $5 million after taxes. A $1 million donation to charity could potentially reduce your taxable income by that amount, saving hundreds of thousands in taxes.

Consider establishing a donor-advised fund or a private foundation. These vehicles allow you to make a large charitable contribution in one year for an immediate tax deduction, while spreading out the actual grants to charities over time.

Explore Tax-Advantaged Investments

Investing your lottery winnings wisely can help minimize your tax burden over time. Consider tax-advantaged investment options such as:

- Municipal bonds: These offer tax-free interest income at the federal level (and sometimes at the state level).

- Qualified Opportunity Zones: Investing in these designated areas can provide significant tax benefits, including deferral and potential exclusion of capital gains.

- Retirement accounts: Maxing out contributions to tax-advantaged retirement accounts like 401(k)s and IRAs can reduce your current taxable income.

Tax laws change frequently, and what works for one lottery winner may not suit another. Work with experienced professionals who tailor a plan to your specific situation and goals. As we move forward, let’s examine some investment strategies that can further reduce your tax burden and grow your wealth.

Remember, lottery winners often forget that their sudden influx of wealth won’t last forever. It’s crucial to plan for the long term and make smart financial decisions from the start.

Smart Investments for Tax-Efficient Wealth Growth

After winning the lottery, strategic investing becomes essential for preserving and growing your newfound wealth while minimizing tax burdens. Let’s explore various investment options that offer tax advantages and long-term financial stability.

Municipal Bonds: A Tax-Free Option

Municipal bonds stand out as a prime choice for tax-conscious investors. These securities, issued by state and local governments, typically offer interest that’s exempt from federal income tax. In many cases, if you buy bonds issued in your state of residence, the interest is also free from state and local taxes.

A high-income lottery winner in the 37% federal tax bracket who invests $1 million in municipal bonds yielding 3% would earn $30,000 in tax-free income annually. This is equivalent to a taxable bond yielding 4.76% before taxes (showcasing the power of tax-free investments).

Real Estate: Depreciation and Tax Benefits

Real Estate investments offer multiple tax advantages for lottery winners. One of the most significant benefits is depreciation, which allows you to deduct a portion of the property’s value each year as a non-cash expense.

If you purchase a $1 million rental property (excluding land value), you could potentially deduct $36,364 annually over 27.5 years using the straight-line depreciation method. This deduction can offset rental income and potentially lower your overall tax bill.

Moreover, real estate investments open doors to strategies like 1031 exchanges, which allow you to defer capital gains taxes when selling one property and reinvesting in another. This can be a powerful tool for building a diverse real estate portfolio while deferring tax liabilities.

Qualified Opportunity Zones: Tax Breaks for Impact Investing

Qualified Opportunity Zones (QOZs) offer a unique blend of tax benefits and community impact. When you invest unrealized capital gains into QOZ funds, you can defer and potentially reduce your tax liability while supporting economically distressed communities.

It’s important to note that lottery winnings are subject to both federal and state taxes, which can significantly reduce your payout. This makes tax-efficient investment strategies even more crucial for lottery winners.

Tax-Advantaged Retirement Accounts

Maxing out contributions to tax-advantaged retirement accounts like 401(k)s and IRAs can reduce your current taxable income. These accounts allow your investments to grow tax-deferred or tax-free, depending on the type of account.

For 2025, the contribution limit for 401(k) plans is $23,500. For those 50 and older, there’s an additional catch-up contribution limit of $11,250 instead of $7,500. IRA contribution limits remain at $7,000 for 2025.

Navigating these investment strategies requires expert guidance. A qualified financial advisor can help create personalized investment plans that align with your financial goals and tax situation. They can stay abreast of the latest tax laws and investment trends to ensure you make informed decisions that maximize your wealth while minimizing tax liabilities.

Final Thoughts

Winning the lottery changes lives, but it also brings complex financial responsibilities. A well-crafted lottery winner tax strategy protects and grows your newfound wealth. We explored various approaches to minimize your tax burden, from understanding federal and state taxation to leveraging smart investment options.

Professional guidance proves essential for lottery winners. Experienced financial advisors and tax professionals provide personalized strategies tailored to your unique situation. They help you avoid common pitfalls and create a sustainable financial future through careful budgeting, diversified investments, and ongoing financial education.

At Bette Hochberger, CPA, CGMA, we offer specialized financial services for unique situations like lottery winnings. Our team of experts develops comprehensive tax strategies, manages cash flow, and ensures long-term profitability (using advanced cloud technology). We support diverse industries and help our clients effectively grow their wealth.