Working capital management separates thriving businesses from those that struggle to pay bills. Companies with optimized working capital grow 23% faster than their competitors, according to PwC research.

We at Bette Hochberger, CPA, CGMA see businesses fail not from lack of sales, but from poor cash flow timing. Smart working capital strategies turn your existing assets into growth fuel.

Understanding Working Capital Management Fundamentals

Working capital equals current assets minus current liabilities. This formula represents the cash available for daily operations after you pay immediate bills. Current assets include cash, accounts receivable, and inventory. Current liabilities cover accounts payable, short-term debt, and accrued expenses. Positive working capital means you have funds to operate and grow your business.

The Financial Impact of Strong Working Capital

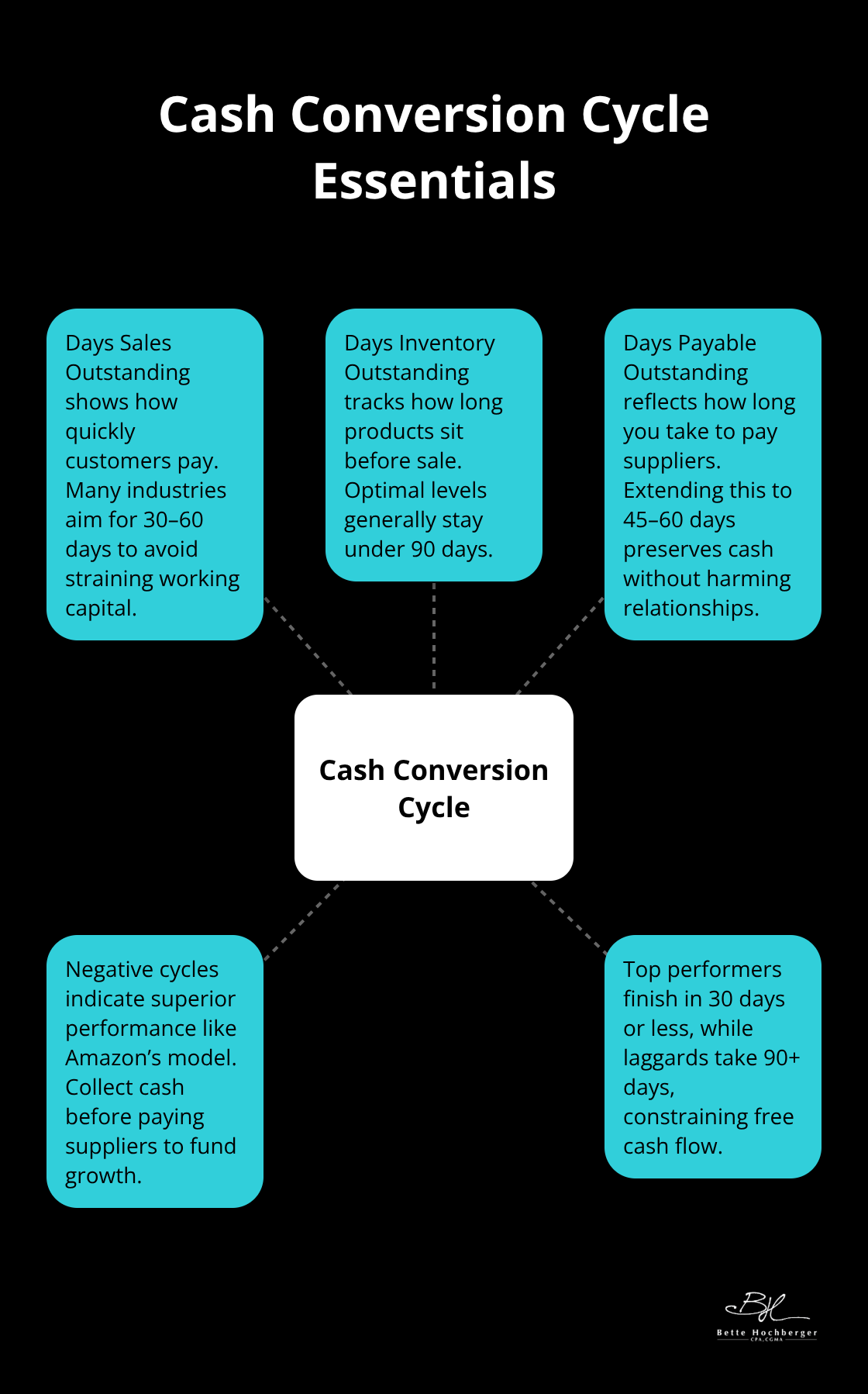

Companies with strong working capital management achieve significant advantages over their peers. The cash conversion cycle measures how quickly you turn investments into cash flow. Top performers complete this cycle in 30 days or less, while struggling businesses take 90+ days to convert investments back to cash.

Amazon operates with negative working capital by collecting customer payments before paying suppliers. This strategy generates billions in free cash flow that fuels expansion and innovation.

Common Working Capital Errors That Destroy Profits

The biggest mistake treats accounts receivable like guaranteed cash. Late payments from customers create cash shortages that force expensive emergency financing decisions. Poor inventory management ties up 30-40% of working capital in dead stock that generates zero returns.

Small businesses lose significant amounts annually through inefficient working capital practices. Companies that pay suppliers too quickly waste discount opportunities and strain cash flow unnecessarily.

Why Working Capital Management Drives Success

Effective working capital management provides the foundation for sustainable growth. Companies optimize their cash conversion cycles to fund expansion without external financing. Smart businesses use working capital as a competitive weapon to seize market opportunities faster than competitors.

The next step involves implementing proven strategies that accelerate cash flow and optimize your working capital position.

How Can You Transform Working Capital Into Growth Capital

Accelerate Customer Payment Collection

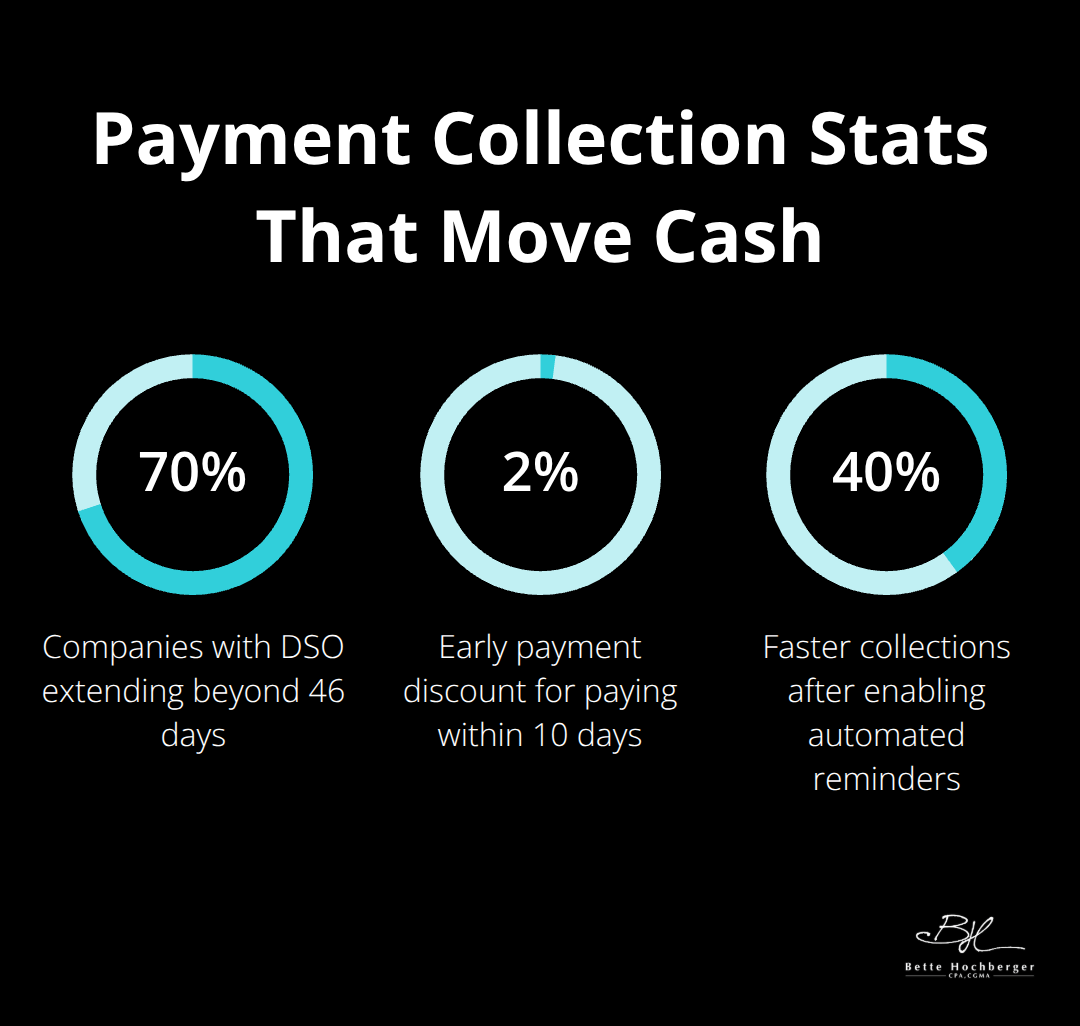

Fast customer payments stand as the most powerful working capital strategy available to businesses today. With about 70% of companies having days sales outstanding that extend beyond 46 days, which severely disrupts cash flow, reducing payment cycles becomes critical. Automated invoice systems send bills within 24 hours of delivery and offer 2% early payment discounts for settlements within 10 days. QuickBooks and Xero users report 40% faster payment collection when they activate automatic payment reminders at 7, 14, and 21-day intervals.

Strategic Inventory Optimization Techniques

Inventory represents the largest working capital drain for most businesses, often consuming 60-70% of available funds. AI forecasting engines can automate up to 50% of workforce-management tasks, leading to cost reductions of 10 to 15 percent while gradually improving accuracy. Just-in-time ordering works best for fast-moving products while consignment agreements with suppliers handle slow-moving items effectively. ABC analysis categorizes inventory by profitability (focus 80% of attention on A-category items that generate the highest margins and fastest turnover rates).

Smart Accounts Payable Management

Payment term extensions without damaged supplier relationships require strategic negotiation rather than delayed payments. Request 45-60 day payment terms from new suppliers and renegotiate existing contracts during renewal periods. Take advantage of early payment discounts only when they exceed your cost of capital – a 2/10 net 30 discount equals 36% annual interest. Electronic payment platforms like Bill.com schedule payments on the exact due date, which maintains strong vendor relationships while maximizing cash retention periods.

Technology Integration for Working Capital Efficiency

Modern businesses leverage technology to streamline working capital processes and gain real-time visibility into cash flow patterns. Cloud-based accounting systems provide instant access to receivables aging reports and payment tracking dashboards. Automated workflows reduce manual errors and speed up collection cycles by 25-30% compared to traditional paper-based systems. Proper bookkeeping becomes essential for maintaining accurate financial records that support these optimization efforts.

The next step involves measuring these improvements through specific metrics and performance indicators that track your working capital optimization progress.

What Metrics Actually Matter for Working Capital Success

Track the Numbers That Drive Cash Flow

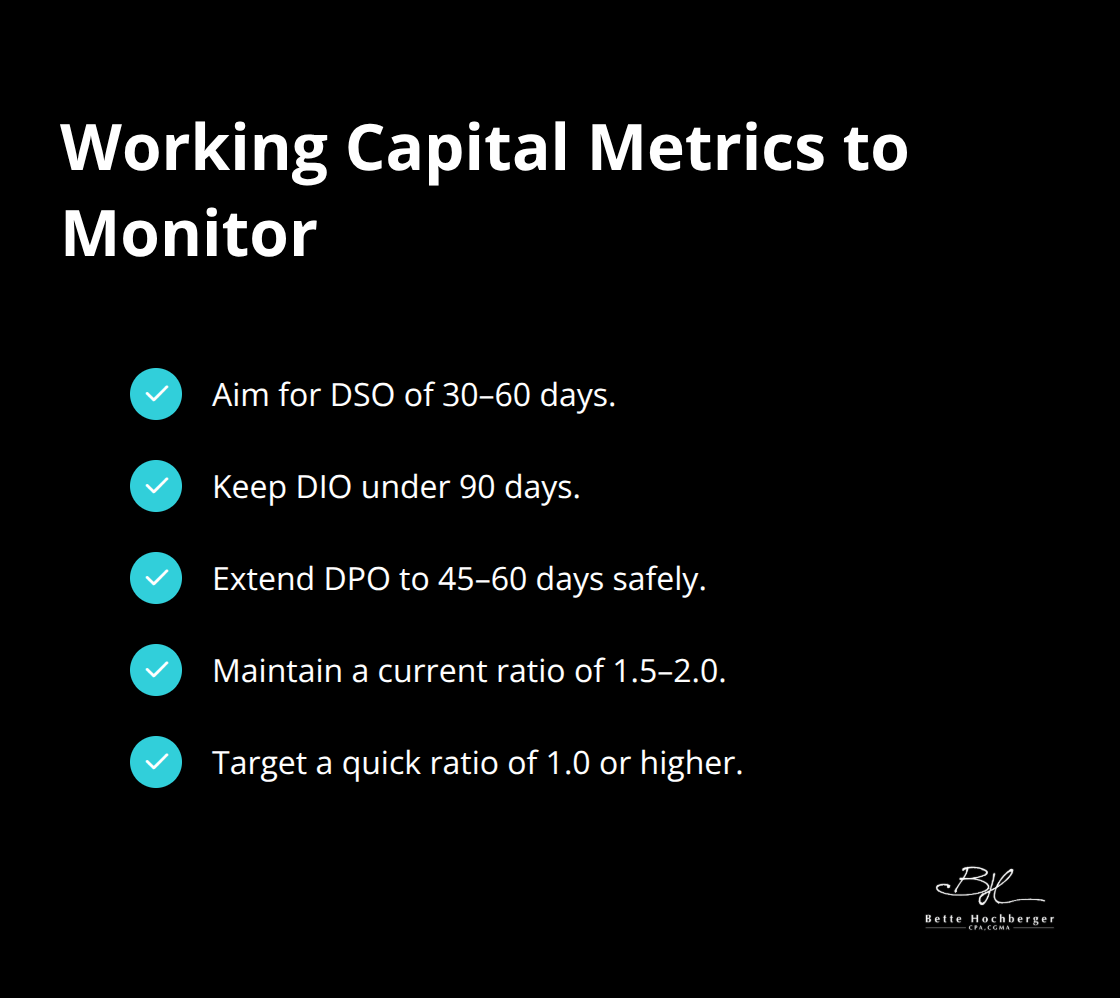

Days Sales Outstanding (DSO) reveals how quickly you collect customer payments, with benchmarks varying by industry as many companies aim for 30 to 60 days. Calculate DSO by dividing accounts receivable by daily sales – a DSO of 60 days means customers take two months to pay, which strains working capital severely. Days Inventory Outstanding (DIO) measures how long products sit in stock before sale, with optimal levels that vary by industry but generally stay under 90 days. Days Payable Outstanding (DPO) shows payment schedules to suppliers – extend this to 45-60 days without damaged relationships.

The current ratio (current assets divided by current liabilities) should maintain 1.5 to 2.0 for adequate liquidity. The quick ratio excludes inventory and targets 1.0 or higher for immediate payment capability.

Cash Conversion Cycle Optimization Methods

The cash conversion cycle combines DSO, DIO, and DPO into one powerful metric that measures working capital efficiency. Calculate it as DSO plus DIO minus DPO – negative numbers indicate superior performance like Amazon’s model. Companies with cycles under 30 days generate significantly more free cash flow than competitors stuck at 90+ days.

Reduce your cycle through automated invoices that cut DSO by 15-20 days, inventory management software that lowers DIO by 25%, and strategic payment schedules that extend DPO safely. SAP and Oracle users report 40% cycle improvements when they integrate real-time data feeds across all working capital components.

Technology Tools for Real-Time Monitoring

Modern dashboard software provides instant visibility into working capital performance through automated data collection and analysis. Tableau and Power BI connect directly to accounting systems and display key metrics through customizable dashboards that update hourly. Cash flow forecasts predict working capital needs 13 weeks ahead with 95% accuracy based on historical patterns and seasonal trends.

NetSuite and Sage Intacct offer built-in working capital modules that track performance against industry benchmarks and send alerts when ratios fall outside target ranges. These platforms eliminate manual calculations and provide actionable insights for immediate decision-making.

Final Thoughts

Working capital forms the backbone of sustainable business growth. Companies that master these fundamentals generate 23% more growth than competitors while maintaining financial stability during market fluctuations. Smart businesses transform working capital from operational necessity into competitive advantage through strategic implementation.

Start these strategies immediately to accelerate cash flow optimization. Set up automated invoices to reduce payment cycles by 15-20 days and negotiate extended payment terms with suppliers. Install inventory management software that prevents overstocking and reduces costs by 25% (monitor your cash conversion cycle monthly through dashboard software that tracks key metrics).

Professional guidance accelerates working capital optimization when internal resources lack expertise. Complex businesses with multiple revenue streams, seasonal fluctuations, or rapid growth phases benefit from specialized financial advisory services. Bette Hochberger, CPA, CGMA provides strategic tax planning and Fractional CFO services that optimize cash flow management while minimizing tax liabilities.