Tax planning and strategy is more than just a yearly chore-it’s a powerful tool for financial success. At Bette Hochberger, CPA, CGMA, we’ve seen firsthand how effective tax planning can significantly impact both businesses and individuals.

By implementing smart strategies, you can legally minimize your tax burden and maximize your financial resources. This guide will walk you through the essential steps to create a robust tax plan that aligns with your financial goals.

Why Tax Planning Matters

The Strategic Approach to Financial Management

Tax planning transcends the annual task of filing taxes. It represents a strategic approach to financial management that optimizes your tax position and enhances overall financial health. This process involves analyzing your financial situation to minimize tax liabilities while maximizing your after-tax income.

Unlocking Significant Savings

Effective tax planning can lead to substantial savings. The IRS reports that millions of taxpayers overpay their taxes each year due to inadequate planning. A proactive stance allows both businesses and individuals to retain more of their hard-earned money. For businesses, strategic tax planning often determines whether they struggle to break even or have resources to invest in growth opportunities.

Debunking Common Misconceptions

Many people incorrectly believe that tax planning only benefits the wealthy or that it’s too complex for the average person. In reality, tax planning benefits everyone, regardless of income level. Another prevalent myth equates tax planning with tax evasion. Tax planning uses legal methods to reduce tax burden, while tax evasion (illegal and punishable) should never be confused with legitimate planning strategies.

The Long-Term Financial Impact

Tax planning benefits extend far beyond a single tax year. Strategies such as retirement account contributions or strategic charitable giving not only reduce current tax burdens but also build a stronger financial foundation for the future. Tax incentives for retirement plans such as pensions, 401(k)s, and individual retirement accounts (IRAs) are one of the largest federal tax expenditures.

Real-World Transformations

At Bette Hochberger, CPA, CGMA, we’ve witnessed clients transform their financial outlook through smart tax planning. Small business owners save thousands by restructuring their companies, while individuals uncover previously untapped deductions. These examples underscore the undeniable impact of thoughtful tax strategy.

The Ongoing Nature of Tax Planning

Effective tax planning requires attention throughout the year, not just during tax season. This continuous process adapts to changes in your financial situation, tax laws, and economic conditions. As we move into the next section, we’ll explore the key components that form the foundation of a robust tax planning strategy.

Building Blocks of Smart Tax Planning

Strategic Income and Deduction Timing

Tax planning success hinges on timing. You can lower your tax liability by managing when you receive income and incur expenses. If you expect higher income next year, accelerate deductions into the current year. This might include prepaying property taxes or making charitable donations before December 31st.

If you anticipate a lower tax bracket next year, defer income to the following year. This could involve postponing the sale of appreciated assets or negotiating for bonuses to be paid in January instead of December.

Optimizing Business Structure

Your business entity type impacts your tax obligations significantly. Each structure (sole proprietorship, partnership, LLC, S-corporation, or C-corporation) has unique tax implications. S-corporations, for example, can provide tax advantages by splitting income between salary and distributions, potentially reducing self-employment taxes.

Switching from a sole proprietorship to an S-corporation can result in substantial savings. However, the optimal choice depends on various factors, including business size, growth plans, and personal financial situation.

Tax-Efficient Investment Strategies

Smart investment choices lead to significant tax savings. Consider tax-efficient investment vehicles like municipal bonds, which offer interest income that is typically exempt from federal income tax-and in many cases, state and local taxes as well. For taxable accounts, focus on investments that generate long-term capital gains, taxed at lower rates than short-term gains or ordinary income.

Exchange-Traded Funds (ETFs) often have tax advantages over mutual funds due to their structure. Generally, holding an ETF in a taxable account will generate less tax liabilities compared to traditional mutual funds.

Maximizing Retirement Contributions

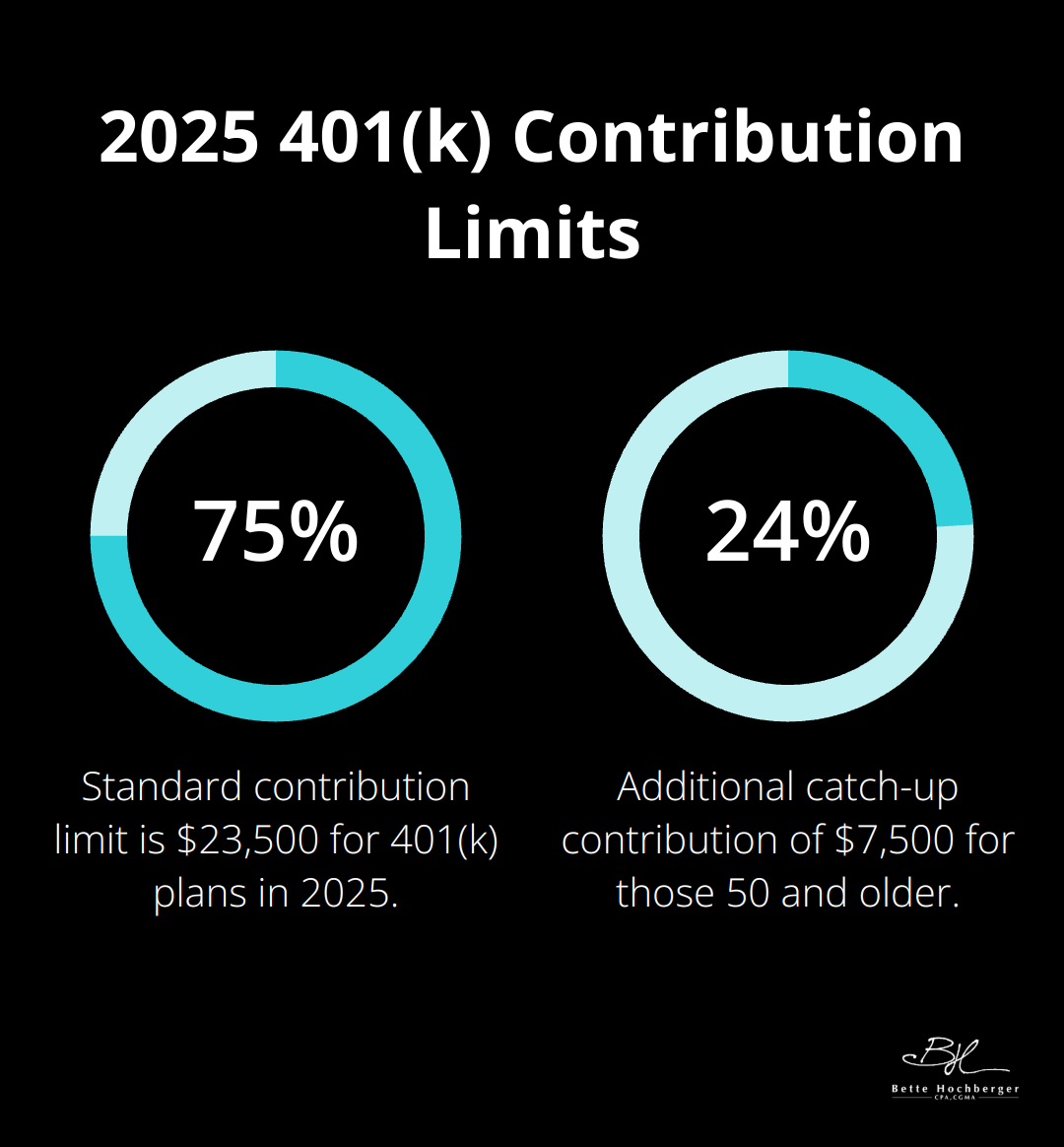

Retirement accounts offer powerful tax benefits. Traditional 401(k)s and IRAs allow for tax-deferred growth and can lower your current taxable income. For 2025, you can contribute up to $23,500 to a 401(k), with an additional $7,500 catch-up contribution if you’re 50 or older.

Roth accounts, while not providing immediate tax benefits, offer tax-free withdrawals in retirement. This can be particularly advantageous if you expect to be in a higher tax bracket in the future.

Strategic Charitable Giving

Charitable donations not only support causes you care about but can also provide tax benefits. Try bunching donations in alternating years to exceed the standard deduction threshold. This strategy can maximize your itemized deductions in certain years while taking the standard deduction in others.

Donating appreciated securities directly to charities can be particularly tax-efficient. You avoid capital gains tax on the appreciation and can deduct the full fair market value of the donation (subject to certain limitations).

As we move forward, we’ll explore how to implement these strategies effectively in your personal or business tax plan. The next section will guide you through the practical steps of putting these building blocks into action, ensuring you maximize your tax savings potential.

Putting Your Tax Plan into Action

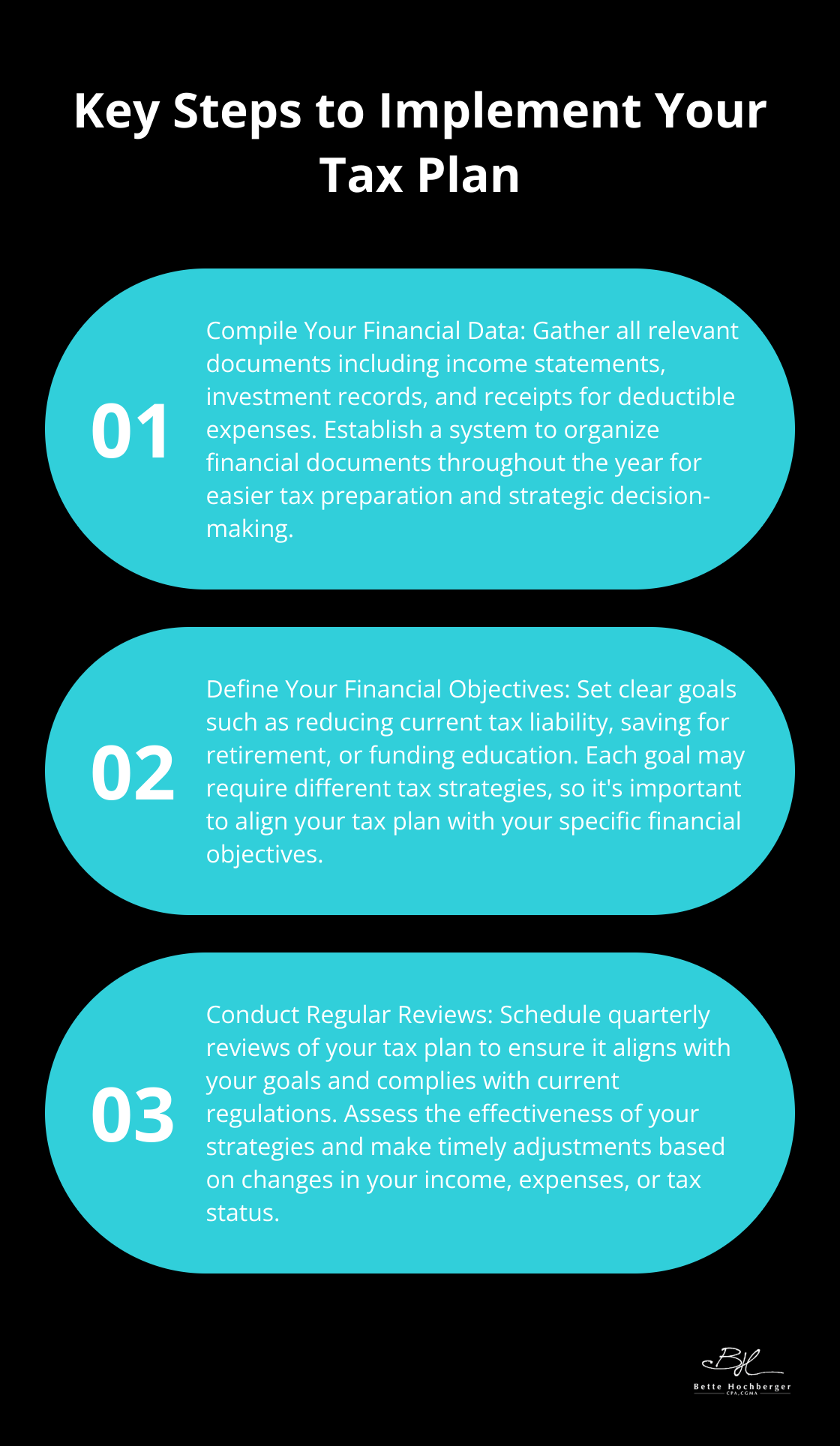

Compile Your Financial Data

The foundation of any solid tax plan requires comprehensive financial information. Start by gathering all relevant documents: income statements, balance sheets, investment records, and receipts for deductible expenses. Individuals should collect W-2s, 1099s, and records of charitable donations. Business owners need profit and loss statements, payroll records, and asset depreciation schedules.

The IRS points out that poor record-keeping often undermines tax planning efforts. Establish a system to organize financial documents throughout the year. This simplifies tax preparation and provides a clear picture of your financial situation for strategic decision-making.

Define Your Financial Objectives

Clear financial goals play a key role in effective tax planning. Determine if you want to reduce your current tax liability, save for retirement, or fund your children’s education. Each goal may require different tax strategies. For example, if retirement savings is a priority, maximize contributions to tax-advantaged accounts like 401(k)s or IRAs as part of your plan.

A study by the Employee Benefit Research Institute revealed that only 48% of workers have attempted to calculate their retirement needs. This highlights the importance of setting specific, measurable financial objectives in your tax planning process.

Collaborate with Tax Professionals

While DIY tax software has its place, complex tax situations often benefit from professional expertise. A qualified tax professional can identify opportunities for tax savings you might overlook. They stay current with ever-changing tax laws and provide personalized advice tailored to your unique financial situation.

Professional tax preparers closely monitor national audit rates to better advise their clients. If audit rates are high, tax preparers may be more cautious in their approach. Professional guidance proves invaluable in navigating complex tax situations.

Conduct Regular Reviews

Tax planning requires ongoing attention. Your financial situation and tax laws evolve constantly. Schedule regular reviews of your tax plan (ideally quarterly) to ensure it aligns with your goals and complies with current regulations.

During these reviews, assess the effectiveness of your current strategies. Ask yourself: Are you on track to meet your tax savings targets? Have any significant changes in your income or expenses impacted your tax status? These regular check-ins allow for timely adjustments to your plan.

Stay Informed About Tax Law Changes

Tax laws are notoriously complex and subject to frequent changes. The Tax Foundation reports that the U.S. tax code has grown from 409,000 words in 1955 to over 2.4 million words today. Staying informed about these changes is essential for effective tax planning.

Subscribe to reputable tax news sources, attend workshops or webinars, and maintain open communication with your tax professional. This proactive approach ensures that your tax strategy remains current and takes advantage of any new opportunities for tax savings.

Final Thoughts

Effective tax planning and strategy empowers individuals and businesses to achieve financial success. This proactive approach minimizes tax burdens, maximizes resources, and builds a strong foundation for the future. Tax planning requires a personalized strategy tailored to unique financial situations and goals.

We at Bette Hochberger, CPA, CGMA specialize in personalized financial services, including strategic tax planning and preparation. Our team uses advanced cloud technology to help businesses and professionals reduce tax liabilities, manage cash flow, and ensure profitability. We guide clients through every step of their tax planning journey, whether they aim to grow wealth or optimize business structures.

Tax planning and strategy transforms tax obligations from a yearly burden into a powerful tool for financial growth and stability. You can take control of your financial future today by embracing proactive tax planning. With the right strategies and expert guidance, you will position yourself for significant tax savings and improved financial health in the long run.