Strategic tax relief requires more than just filing your return on time. The average American overpays taxes by $1,200 annually due to missed opportunities and poor planning.

We at Bette Hochberger, CPA, CGMA see businesses and individuals leave thousands on the table each year. Smart tax planning can reduce your burden by 15-30% through proper timing and structure optimization.

What Are Your Best Tax Relief Options

Tax Credits vs Tax Deductions and Their Impact

Tax credits deliver dollar-for-dollar reductions in what you owe, while deductions only lower your taxable income. The Child Tax Credit provides up to $2,000 per child, directly cutting your tax bill. Compare this to a $2,000 deduction that saves you only $440 if you’re in the 22% tax bracket.

The American Opportunity Tax Credit offers up to $2,500 annually for education expenses, making it one of the most valuable credits available. The Earned Income Tax Credit (EITC) provides additional relief for low-to-moderate-income workers based on income and family size. Focus on credits first since they provide immediate savings.

Income and Expense Timing Strategies

You can shift income and expenses between tax years to reduce your overall burden significantly. Accelerate deductible expenses into high-income years and defer income when possible. Small business owners can delay December invoices until January or prepay January expenses in December.

The IRS allows businesses to deduct up to $1,220,000 in equipment purchases through Section 179 expensing for 2024. This strategy works particularly well when you expect lower tax rates next year or anticipate reduced income. Bonus depreciation stands at 60% for equipment placed in service in 2024.

Business Structure Tax Benefits

Your business structure directly impacts your tax liability. S-Corporations can save self-employment taxes on profits above reasonable salary requirements (typically 15.3% savings). Pass-through entities benefit from the 20% qualified business income deduction, which expires after 2025.

LLCs offer flexibility but may face higher self-employment taxes on all profits. The wrong structure costs the average small business owner $3,000-$8,000 annually in unnecessary taxes. Converting from sole proprietorship to S-Corp typically saves 15.3% on self-employment taxes once profits exceed $60,000.

These foundational strategies set the stage for more sophisticated approaches that can multiply your tax savings through advanced planning techniques.

How Can Advanced Strategies Multiply Your Tax Savings

Retirement Account Optimization Beyond Basic Contributions

Retirement contributions represent just the starting point for advanced tax relief. For 2025, 401k contributions reach $23,500 with an additional $7,500 catch-up for those 50 and older. Traditional IRA limits hit $7,000 annually. The real power lies in strategic account selection and proper timing.

High earners face Traditional IRA deduction phase-outs, which makes backdoor Roth conversions valuable. This strategy involves contributions to a non-deductible Traditional IRA, then conversion to a Roth IRA. This approach bypasses income limits entirely.

Health Savings Accounts offer triple tax advantages unavailable anywhere else. For 2025, HSA limits reach $4,300 for individuals and $8,550 for families. Unlike FSAs, HSA funds roll over indefinitely and become retirement accounts after age 65. Solo 401k plans allow business owners to contribute as both employee and employer (potentially reaching $70,000 annually).

Investment Loss Harvesting and Capital Gains Management

Tax-loss harvesting can offset capital gains dollar-for-dollar, with excess losses reducing ordinary income by up to $3,000 annually. The key lies in proper timing and wash sale rule avoidance. You cannot repurchase the same security within 30 days of selling for a loss.

Smart investors harvest losses in November and December, then reinvest after the 30-day period expires. Long-term capital gains rates of 0%, 15%, or 20% beat ordinary income rates significantly. Single filers pay zero capital gains tax on income up to $47,025 in 2025.

This creates opportunities for strategic Roth conversions and asset rebalancing in low-income years. Municipal bonds generate tax-free interest income, particularly valuable for high earners in states with no income tax.

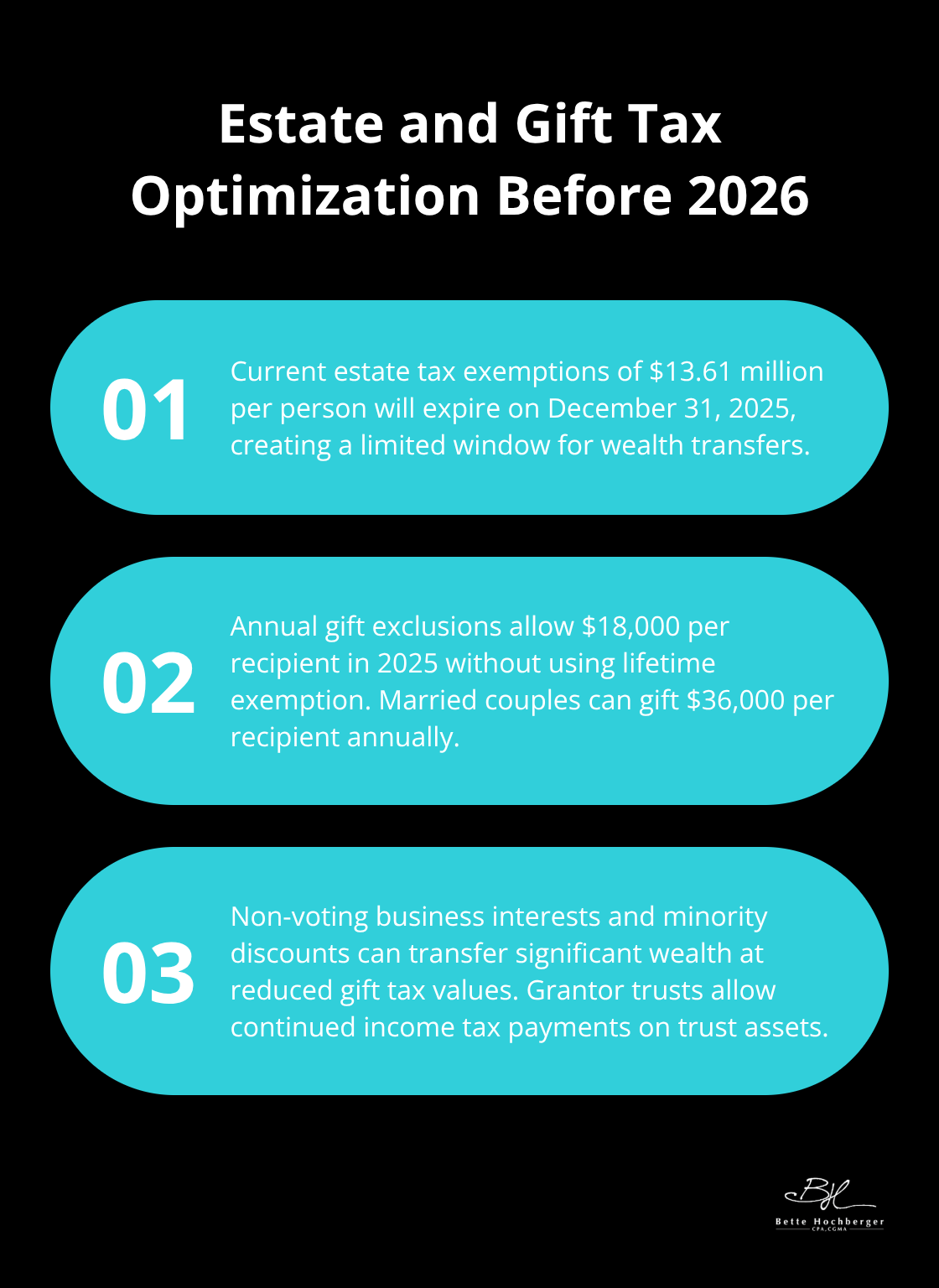

Estate and Gift Tax Optimization Before 2026

Current estate tax exemptions of $13.61 million per person expire December 31, 2025. They will revert to approximately $7 million, which creates a limited window for wealth transfers. Annual gift exclusions allow $18,000 per recipient in 2025 without using lifetime exemption (married couples can gift $36,000 per recipient annually).

Non-voting business interests and minority discounts can transfer significant wealth at reduced gift tax values. Grantor trusts allow continued income tax payments on trust assets, which effectively transfers additional wealth tax-free to beneficiaries.

The five-year look-back rule for Roth IRA withdrawals makes immediate conversions valuable for younger beneficiaries who won’t need funds immediately. However, even the best strategies fail without proper implementation and record keeping, which leads to costly mistakes that can eliminate your tax savings entirely.

Why Do Most Tax Relief Strategies Fail

Poor Documentation Destroys Tax Savings

Poor documentation destroys more tax savings than any other single factor. The IRS audits taxpayers who cannot substantiate deductions at significantly higher rates than those with complete records. Missing receipts for business meals cost deductions worth 50% of the expense, while inadequate mileage logs eliminate vehicle deductions entirely.

Digital receipt apps like Expensify or Receipt Bank prevent 90% of documentation problems, yet most taxpayers still use shoeboxes and hope for the best. The IRS requires contemporaneous records for business expenses, which means you cannot recreate documentation after an audit begins. Without proper documentation, you can’t substantiate your expenses come tax time.

Tax Deadlines Create Expensive Traps

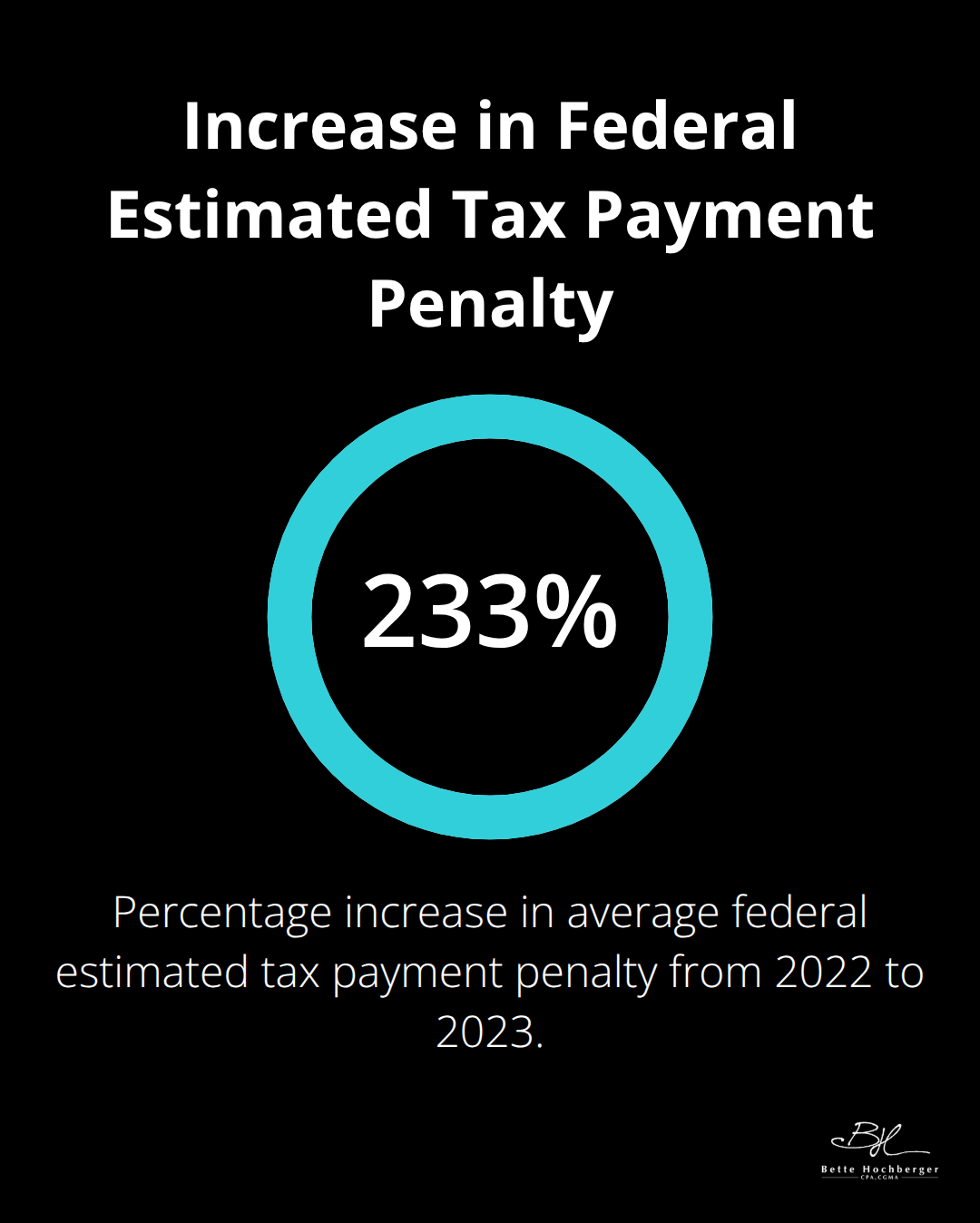

April 15th represents just one of dozens of tax deadlines that impact your liability. Quarterly estimated payments due January 15, April 15, June 15, and September 15 carry penalties of 8% annually for late payments. The average federal estimated tax payment penalty during 2023 increased to about $500 from about $150 during 2022.

Extensions provide extra time for paperwork but never extend payment deadlines, which creates a costly trap for unprepared taxpayers. Retirement account contributions have different deadlines – 401k contributions must complete by December 31, while IRA contributions extend until April 15 of the following year. You cannot make prior-year 401k contributions later, which eliminates up to $23,500 in tax-deferred savings permanently.

Hidden Deductions Cost Thousands Annually

State and local tax deduction limits of $10,000 cause many taxpayers to overlook other itemized deductions entirely. Home office deductions average $3,000 annually for eligible taxpayers, yet only 25% of remote workers claim this benefit according to National Association of Tax Professionals data.

Medical expenses that exceed 7.5% of adjusted gross income qualify for deductions, but most people ignore smaller medical costs that add up significantly over the year. The student loan interest deduction allows up to $2,500 annually regardless of whether you itemize (yet 40% of eligible borrowers never claim it). Professional development courses, work uniforms, and unreimbursed employee expenses often qualify as miscellaneous deductions that taxpayers consistently miss.

Final Thoughts

Strategic tax relief demands consistent action throughout the year, not last-minute scrambles before deadlines. The most successful taxpayers implement systematic approaches that combine proper timing, documentation, and advanced planning techniques. Your business structure, retirement contributions, and investment decisions should align with your overall tax strategy.

Professional guidance becomes essential when your tax situation involves multiple income streams, business ownership, or significant assets. Complex scenarios like estate planning, international income, or major life changes require specialized expertise that prevents costly mistakes. We at Bette Hochberger, CPA, CGMA help clients navigate these complexities through personalized strategic tax planning.

Start your tax strategy implementation immediately rather than wait for year-end. Review your withholdings, maximize retirement contributions, and establish proper record-keeping systems now. The difference between reactive and proactive tax planning often exceeds $5,000 annually for typical households (and significantly more for business owners).