High net worth individuals face tax complexities that standard planning simply cannot address. Multiple income streams, international investments, and estate planning requirements demand specialized expertise.

We at Bette Hochberger, CPA, CGMA understand that effective high net worth tax advisory requires both technical knowledge and strategic thinking. The right approach can save wealthy families millions in taxes while protecting their long-term financial goals.

What Tax Challenges Do Wealthy Individuals Face?

Complex Income Structures Create Multiple Tax Obligations

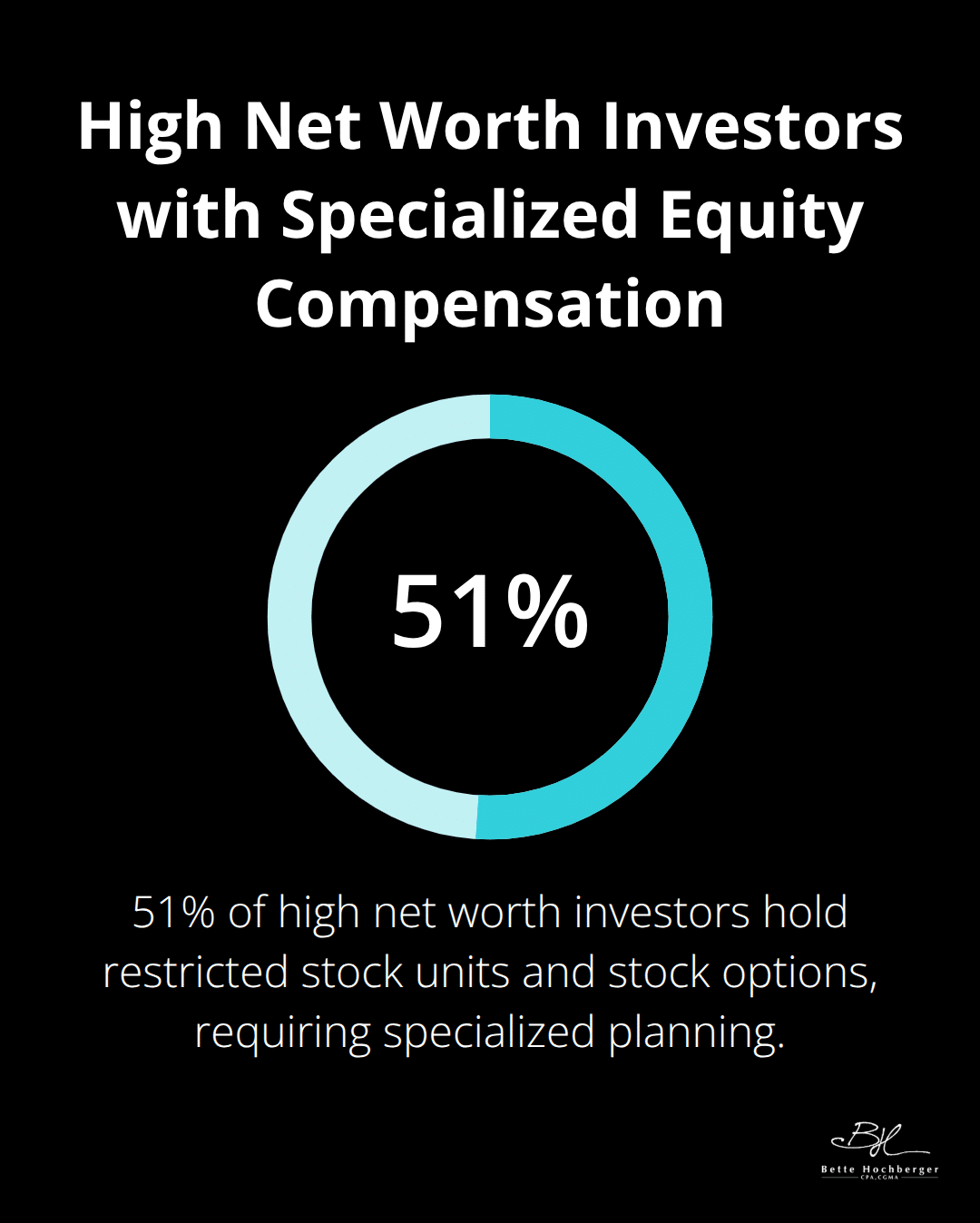

High net worth individuals manage income from salary, business ownership, investment gains, rental properties, and alternative investments like private equity or cryptocurrency. The IRS reports that 51% of high net worth investors hold restricted stock units and stock options, which require specialized equity compensation planning.

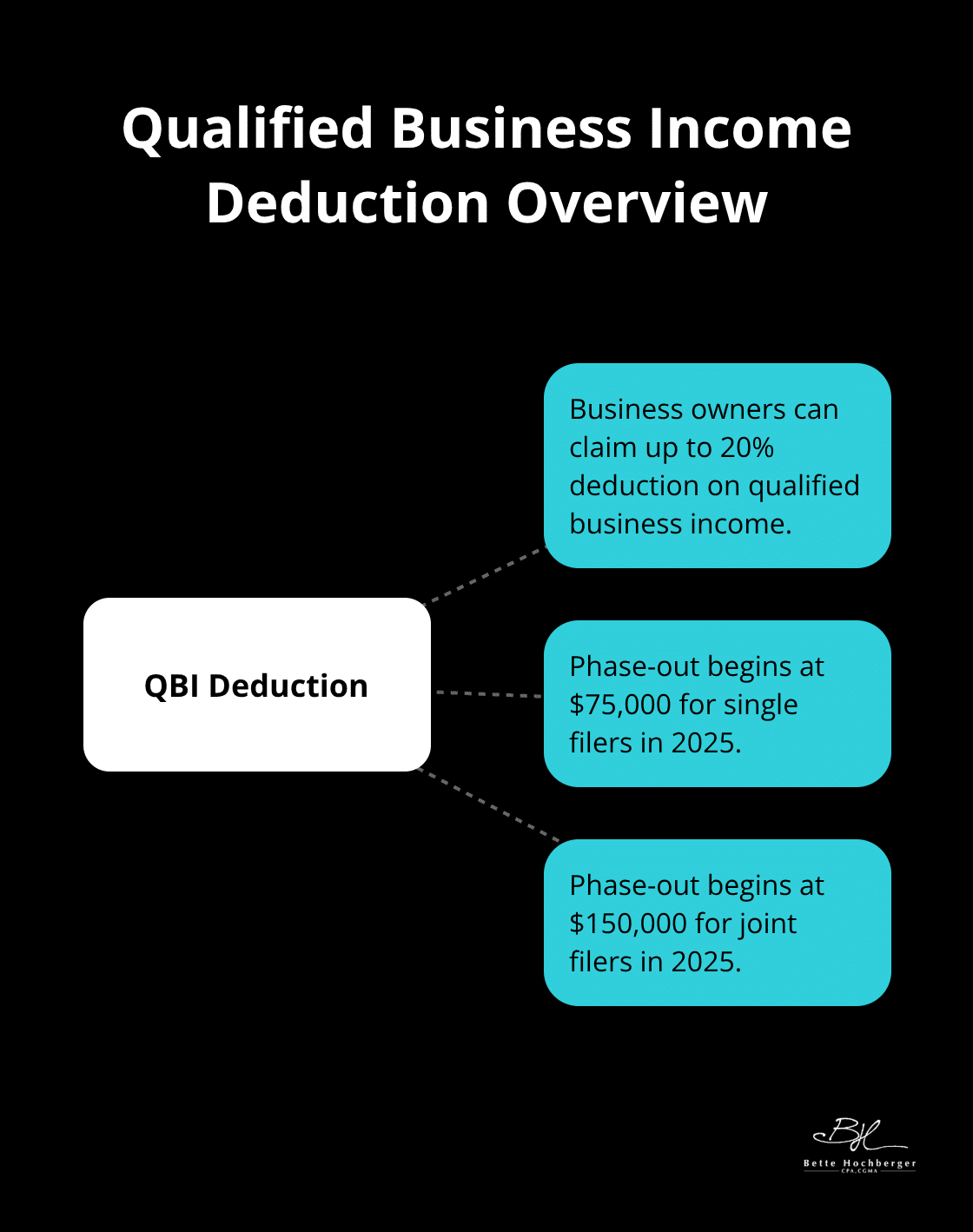

Each income source follows different tax rules and timing requirements. Business owners with qualified business income can claim a 20% deduction, but the phase-out begins at $75,000 for single filers and $150,000 for joint filers in 2025. Investment income faces different rates based on asset types and holding periods, while rental income requires depreciation calculations and passive activity loss limitations.

Multi-State Tax Compliance Demands Strategic Planning

Wealthy individuals often own properties or conduct business across multiple states, which creates complex filing obligations. Some states impose no income tax, while others like California tax residents at rates that exceed 13%. The new OBBBA legislation raises the state and local tax deduction cap to $40,000 for 2025, but phases out for modified adjusted gross income over $500,000. International investments add another layer of complexity through foreign tax credit calculations and reporting requirements like FBAR and Form 8938. Estate tax obligations vary dramatically by state, with some states imposing taxes on estates as small as $1 million while others follow the federal exemption of $13.99 million in 2025.

Estate Planning Requires Immediate Action

The federal estate tax exemption will increase to $15 million per individual in 2026 under current law, but wealthy families cannot wait. Annual gift tax exclusions allow $18,000 per recipient in 2024 (doubling to $36,000 for married couples). Generation-skipping transfer tax planning becomes essential for families who want to benefit grandchildren while minimizing tax impact. Trust structures like dynasty trusts and charitable remainder trusts require careful timing and valuation work. Business owners should obtain current valuations to maximize gifting strategies before asset appreciation occurs.

These complex challenges require sophisticated strategies that go beyond basic tax preparation and demand specialized expertise to navigate effectively.

How Can Wealthy Individuals Maximize Tax Efficiency Through Strategic Planning?

Municipal Bonds and Tax-Free Investment Vehicles

Municipal bonds generate interest exempt from federal income taxes and potentially state taxes, which makes them powerful tools for high net worth portfolios. Rising interest rates have made municipal bond yields more attractive while they maintain tax advantages. Health Savings Accounts offer triple tax benefits with 2025 contribution limits at $4,300 for individuals and $8,550 for families (plus catch-up contributions for those 55 and older). The 529 plan conversion rule now allows up to $35,000 in funds to transfer to a ROTH IRA for beneficiaries, which creates new education strategies. Donor-advised funds provide immediate tax deductions while they allow control over future charitable distributions.

Business Structure Decisions Drive Long-Term Tax Savings

S-Corporation elections can reduce self-employment taxes for business owners while they preserve qualified business income deduction benefits. Eligible taxpayers can claim the deduction for tax years beginning after December 31, 2017, and ending on or before December 31, 2025. Family limited partnerships and limited liability companies protect assets while they facilitate wealth transfers at discounted valuations. Qualified small business stock now offers 100% gain exclusion for stock held five years or longer, which makes C-Corporation structures attractive for certain businesses. Business owners should obtain current valuations before they implement strategies, as asset appreciation reduces future transfer opportunities.

Income and Deduction Strategies Create Immediate Tax Benefits

ROTH conversions reduce future estate values while they allow tax-free growth, though the right approach matters with potential tax rate changes ahead. A Roth IRA conversion has the advantage of helping to immediately lower the value of your estate by the amount of conversion income taxes paid. The SALT deduction cap increases to $40,000 for 2025 but phases out for modified adjusted gross income over $500,000, which requires careful income management. Tax-loss harvesting offsets capital gains while it maintains portfolio balance through strategic security sales. Charitable contribution bunching every other year maximizes itemization benefits, especially with the new 0.5% AGI floor for individual donations that starts in 2026. Energy-efficient home improvements now qualify for annual tax credits without lifetime caps, which makes ongoing efficiency investments worthwhile.

These strategic approaches require careful coordination with professional advisors who understand the complexities of high net worth tax situations and can implement these strategies effectively.

How Do You Choose the Right High Net Worth Tax Advisor?

Credentials and Experience Requirements

You need an advisor with specific qualifications for complex tax situations. Look for CPAs with the CGMA designation, which requires a minimum of 3 years of relevant work experience and demonstrates advanced management accounting expertise beyond basic tax preparation. The advisor must have at least 10 years of experience with clients who possess investable assets exceeding $1 million. Demand evidence of their experience with multi-state tax compliance, international reporting requirements, and estate coordination. Ask for references from clients in similar financial situations and verify their track record with complex structures like family limited partnerships and charitable remainder trusts.

Questions That Reveal True Expertise

Direct questions separate qualified advisors from generalists who claim high net worth experience. Ask how they handled clients during the 2017 Tax Cuts and Jobs Act transition and what specific strategies they implemented for qualified business income deductions, which allow up to 20% deductions for eligible business owners. Request examples of how they structured ROTH conversions for clients with estates exceeding $10 million. Inquire about their approach to SALT deduction optimization and how they coordinate with estate attorneys for gift tax strategies. The advisor should provide specific methodologies for tax loss harvesting and demonstrate knowledge of current municipal bond market conditions. Their responses should include actual dollar amounts and specific tax code references rather than vague generalizations.

Year-Round Advisory Relationships

The most effective advisory relationships involve continuous planning rather than annual tax preparation. Your advisor should proactively contact you about legislative changes that affect your tax situation and recommend strategy adjustments before year-end. Establish quarterly review meetings to assess income timing opportunities and investment rebalancing for tax efficiency. The advisor should coordinate directly with your investment managers, estate attorneys, and insurance professionals to implement comprehensive strategies. Expect detailed written tax projections that model different scenarios and their financial impact (including various income timing strategies). Successful relationships produce measurable results through reduced effective tax rates and improved after-tax investment returns that compound over time.

Final Thoughts

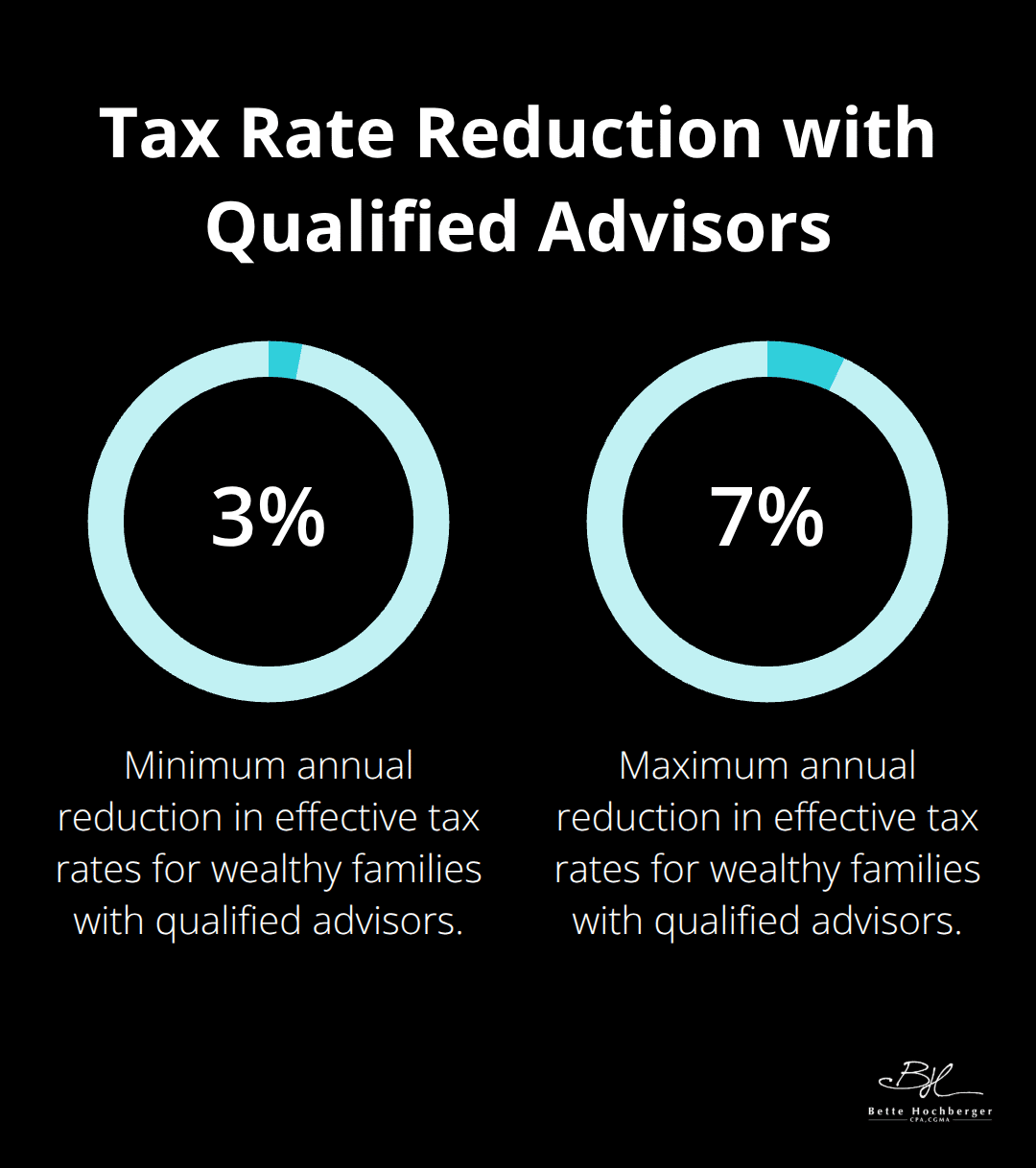

Professional high net worth tax advisory delivers measurable financial benefits that compound over decades. Wealthy families who work with qualified advisors typically reduce their effective tax rates by 3-7 percentage points annually through strategic planning. The PwC High Net Worth Investor Survey found that 46% of wealthy investors plan to change advisors within 24 months, often because they seek more specialized expertise.

Quality tax planning generates returns that far exceed advisory fees. A family with $10 million in assets can save $200,000-$500,000 annually through proper estate planning, ROTH conversions, and business structure optimization (these savings compound over time while they protect wealth for future generations). The tax landscape continues to evolve with new legislation like the OBBBA that creates opportunities for qualified business income deductions and increased estate tax exemptions.

We at Bette Hochberger, CPA, CGMA specialize in strategic tax planning for high net worth individuals and businesses. Our approach combines advanced technology with personalized service to minimize tax liabilities and maximize wealth preservation. The right advisory relationship transforms tax obligations from annual burdens into strategic advantages that build lasting financial security.