High income tax planning is a complex but essential task for wealthy individuals. At my firm, we understand the unique challenges and opportunities that come with substantial earnings.

This blog post will explore effective strategies to minimize tax liabilities, maximize deductions, and preserve wealth for high-income earners. From strategic income timing to estate planning, we’ll cover key approaches to help you keep more of what you’ve earned.

How to Maximize Tax Deductions and Credits

High-income earners have numerous opportunities to reduce their tax burden through strategic deductions and credits. A multi-faceted approach will maximize these benefits.

Itemized vs. Standard Deduction

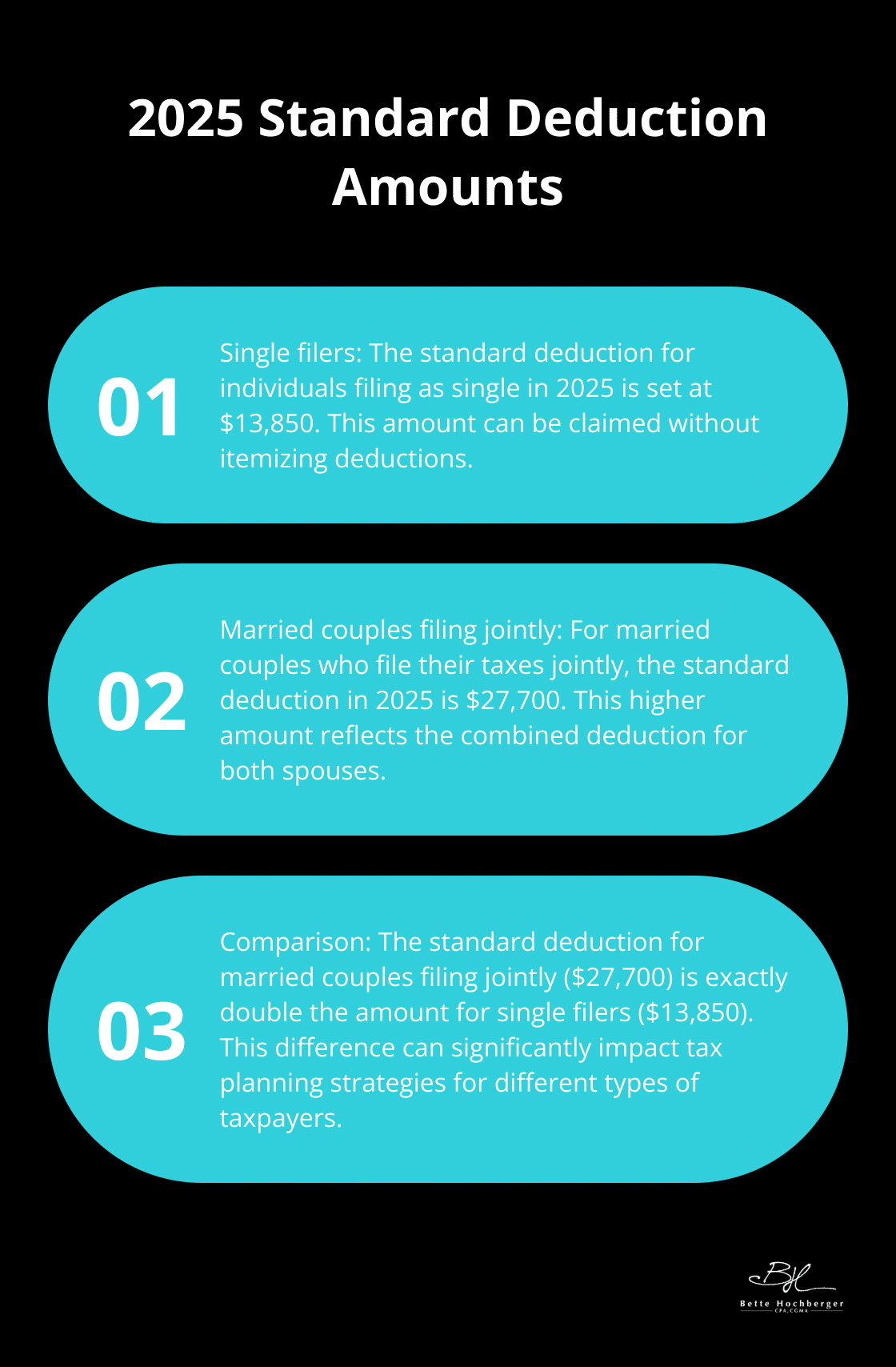

For 2025, the standard deduction stands at $13,850 for single filers and $27,700 for married couples filing jointly. High-income earners often benefit more from itemizing deductions. Common itemized deductions include mortgage interest, state and local taxes (SALT), and charitable contributions. However, the SALT deduction cap of $10,000 can significantly impact taxpayers in high-tax states.

Charitable Giving Strategies

Charitable donations not only support causes you care about but can also provide substantial tax benefits. Consider bunching donations in alternating years to surpass the standard deduction threshold. Donor-advised funds (DAFs) allow you to make a large contribution in one year for an immediate tax deduction while spreading out the actual charitable gifts over time.

For example, if you typically donate $10,000 annually, you could contribute $30,000 to a DAF in one year, claim the itemized deduction, and then distribute the funds to charities over the next three years. This strategy can prove particularly effective for high-income years.

Optimizing Business Expenses

Business owners have additional opportunities for deductions. Keep meticulous records of all business-related expenses, including home office costs, vehicle expenses, and professional development. The Section 179 deduction allows business taxpayers to deduct the cost of certain property as an expense when the property is first placed in service.

Investment-Related Deductions

While the Tax Cuts and Jobs Act eliminated many investment expense deductions, some still remain. Interest on money borrowed to purchase taxable investments is deductible (subject to certain limitations). Additionally, if you’re an active trader, you may deduct home office expenses and the cost of investment-related software and subscriptions.

Tax laws are complex and constantly changing. What works best for one taxpayer may not be optimal for another. Personalized advice from a qualified tax professional proves invaluable in maximizing your deductions and credits while staying compliant with tax regulations.

As we explore these strategies to maximize deductions and credits, it’s important to also consider how to strategically time your income and defer taxes. Let’s examine some effective methods in the next section.

How to Time Income and Defer Taxes

Strategic income timing and tax deferral serve as powerful tools for high-income earners to manage their tax liabilities effectively. Careful planning of income receipt can potentially reduce overall tax burden and preserve more hard-earned money.

Roth IRA Conversion Strategies

Converting traditional IRA funds to a Roth IRA can prove a smart move, especially in lower-income years. However, you’ll owe ordinary income tax on the converted amount, including not just your pretax contributions but also any income or gains. This strategy works well for those who anticipate a higher tax bracket in retirement.

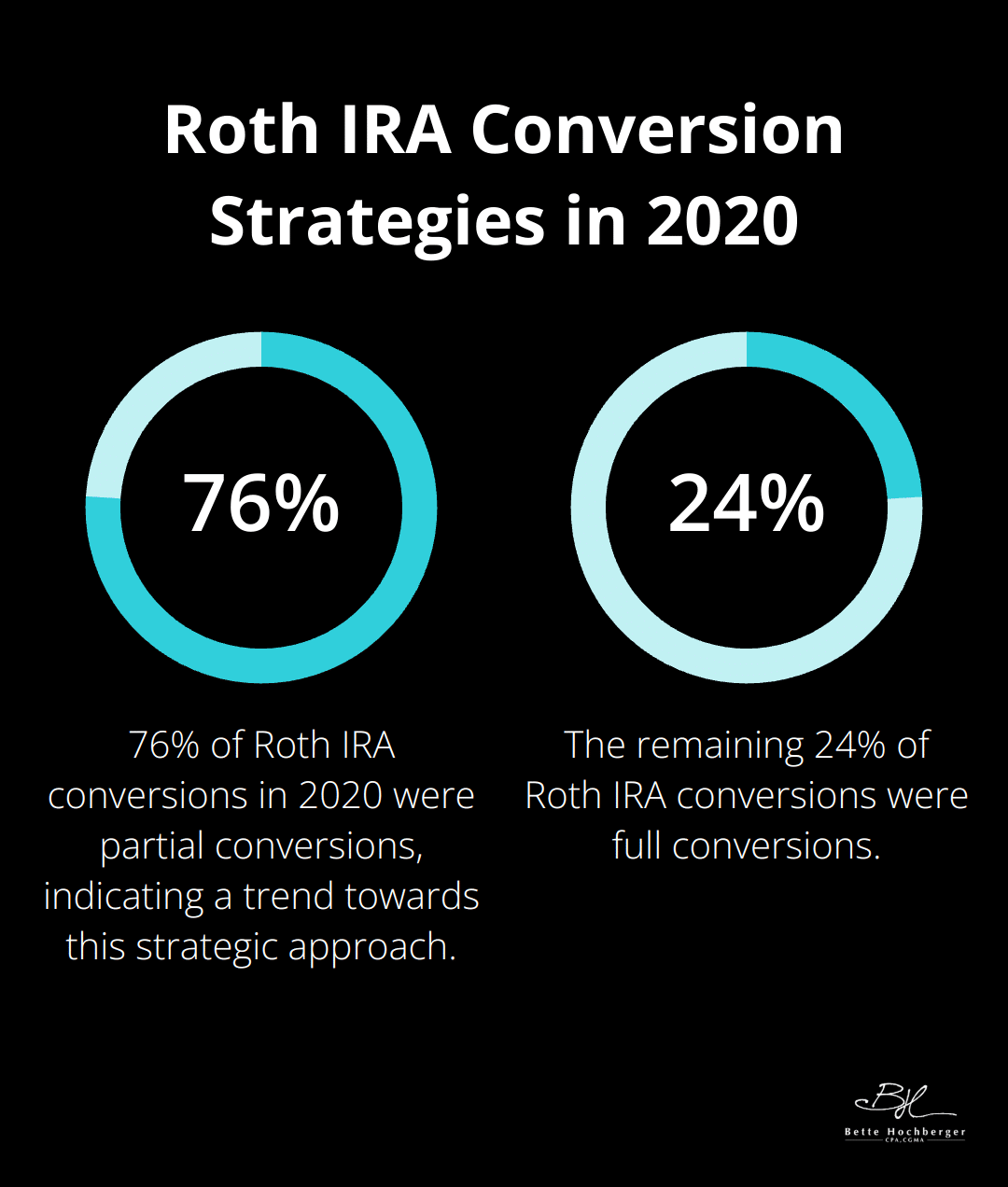

The ideal time to convert might be between jobs or during a sabbatical. The key is to convert just enough to stay within the current tax bracket. A Fidelity study revealed that 76% of Roth IRA conversions in 2020 were partial conversions, indicating a trend towards this strategic approach.

Leveraging Installment Sales

Selling a large asset, such as a business or real estate, through an installment sale allows the gain to spread over several years, potentially maintaining a lower tax bracket. The IRS reports that installment sales can reduce immediate tax impact by up to 20% compared to a lump-sum sale.

Interest rates and potential changes in tax laws can impact this strategy’s effectiveness. Modeling different scenarios helps determine if an installment sale fits a particular situation.

Exploring Deferred Compensation Plans

Executives and high-income employees can use deferred compensation plans to postpone receiving a portion of income until a later date, typically retirement. This approach can lower current taxable income while potentially allowing the deferred amount to grow tax-free.

A survey by the National Association of Plan Advisors found that 94% of Fortune 500 companies offer some form of deferred compensation plan. However, these plans come with risks (including the possibility of losing the deferred income if the company faces financial difficulties).

Mastering Tax-Loss Harvesting

Tax-loss harvesting converts investment losses into tax savings by selling securities below cost basis, offsetting gains and up to $3,000 of income.

Effective implementation of this strategy requires awareness of wash-sale rules and proper documentation. It’s also crucial to consider the long-term implications of investment decisions beyond just the tax benefits.

These strategies require careful planning and consideration of the overall financial picture. Tax laws are complex and ever-changing, making it essential to work with experienced professionals. As we move forward, let’s explore how estate planning and wealth transfer strategies can further optimize the financial situation for high-income earners.

How Estate Planning Can Reduce Your Tax Burden

Estate planning and wealth transfer strategies form essential components of comprehensive tax planning for high-income earners. Effective estate planning can significantly reduce tax burdens while ensuring wealth preservation for future generations.

Strategic Gifting to Minimize Estate Taxes

One of the most straightforward ways to reduce estate taxes involves strategic gifting. In 2025, individuals can gift up to $18,000 per recipient annually without incurring gift tax. For married couples, this amount doubles to $36,000 per recipient. Over time, this strategy can substantially reduce the size of a taxable estate.

A couple with three children and six grandchildren could potentially transfer $324,000 out of their estate each year tax-free. Over a decade, this amounts to over $3 million removed from their taxable estate (potentially saving hundreds of thousands in estate taxes).

Tax-Efficient Trust Structures

Trusts serve as powerful tools for estate planning and tax reduction. Irrevocable Life Insurance Trusts (ILITs) remove life insurance proceeds from your taxable estate. Data from Forbes are particularly useful in understanding the impact of ILITs on very wealthy individuals.

Grantor Retained Annuity Trusts (GRATs) allow you to transfer appreciation on assets to beneficiaries with minimal gift tax consequences. The IRS reports that properly structured GRATs can transfer appreciating assets to heirs with minimal gift tax liability.

Asset Protection with Family Limited Partnerships

Family Limited Partnerships (FLPs) offer both asset protection and potential tax benefits. When applied, valuation discounts reduce the value of the FLP’s underlying assets for gift tax purposes when its shares are given to family members.

Charitable Remainder Trusts for Dual Benefits

Charitable Remainder Trusts (CRTs) provide income to you or your beneficiaries for a set period, with the remainder going to charity. This strategy supports philanthropic goals and offers significant tax benefits.

Data from the National Philanthropic Trust shows that CRTs can provide an immediate income tax deduction of up to 30% of adjusted gross income for cash donations, and up to 20% for appreciated assets. Moreover, CRTs help avoid capital gains taxes on appreciated assets, making them particularly valuable for high-income earners with substantial investment portfolios.

Final Thoughts

High income tax planning combines strategic deductions, income timing, and estate planning. These approaches reduce tax burdens, defer liabilities, and preserve wealth for future generations. Professional guidance proves invaluable due to the complexity of tax laws and the potential for substantial savings.

Bette Hochberger, CPA, CGMA offers personalized financial services for businesses and professionals. We provide strategic tax planning and preparation to minimize tax liabilities and ensure profitability. Our skilled team uses advanced cloud technology to help clients navigate the intricacies of high income tax planning across diverse industries.

Proactive tax planning yields long-term benefits beyond immediate tax savings. It allows for more efficient cash flow management, supports business growth, and helps build lasting wealth. Consistent implementation of these strategies and adaptation to changing tax laws (including regular reviews and adjustments) will optimize your financial position and help you achieve your long-term financial goals.