Gambling can be a thrilling pastime, but it often comes with financial risks. Many people wonder if they can offset their losses through tax deductions gambling losses.

At Bette Hochberger, CPA, CGMA, we understand the complexities of reporting gambling activities on your tax return. This blog post will guide you through the rules, requirements, and best practices for claiming gambling losses on your taxes.

What Are Gambling Losses for Tax Purposes?

Definition of Gambling Losses

Gambling losses for tax purposes represent the total amount of money you lose while participating in legal gambling activities during a tax year. This includes losses from casino games, lottery tickets, sports betting, and other forms of wagering. The Internal Revenue Service (IRS) allows taxpayers to deduct these losses, but only under specific conditions.

IRS Stance on Gambling Losses

The IRS takes a clear position on gambling losses: they’re deductible, but only up to the amount of your gambling winnings. For example, if you won $5,000 gambling but lost $8,000, you can only deduct $5,000 of your losses. The remaining $3,000 cannot offset other income or carry forward to future tax years.

The Necessity of Meticulous Record-Keeping

Accurate record-keeping is not just important; it’s a requirement when you claim gambling losses on your taxes. The IRS demands that taxpayers provide detailed documentation of both their winnings and losses. This includes maintaining a diary or log of your gambling activities, as well as keeping all relevant receipts, tickets, and statements.

What to Include in Your Gambling Records

Your gambling records should contain the following information:

- The date and type of each gambling activity

- The name and location of the gambling establishment

- The names of other people present with you at the gambling establishment

- The amounts you won or lost

For lottery tickets, you should keep the actual tickets as proof of purchase. (This level of detail helps substantiate your claims if the IRS ever questions your deductions.)

The Impact of Proper Documentation

According to the American Gaming Association, total gross gambling revenue (GGR) reached an all-time high of $60.5 billion in Calendar Year 2023. This statistic highlights the importance of understanding and properly documenting your gambling activities. Proper documentation can make a significant difference in your tax liability and ensure you’re not leaving money on the table when it comes to your gambling activities and tax obligations.

As we move forward, let’s examine the specific rules for deducting gambling losses and how they can affect your tax return.

How to Deduct Gambling Losses on Your Taxes

Itemization: A Requirement for Deduction

The IRS mandates that you itemize your deductions on Schedule A of Form 1040 to claim gambling losses. This requirement precludes you from taking the standard deduction and claiming gambling losses simultaneously. For the 2023 tax year, the standard deduction stands at $13,850 for single filers and $27,700 for married couples filing jointly. You should evaluate whether your itemized deductions (including gambling losses) exceed these amounts to determine if itemization benefits you.

Understanding the Deduction Limit

The IRS imposes a strict limit on gambling loss deductions. You can only deduct losses up to the amount of your gambling winnings. For instance, if you won $10,000 but lost $15,000, your deduction caps at $10,000. The IRS does not allow you to carry forward the remaining $5,000 to future tax years or use it to offset other income.

Qualifying Gambling Activities

The IRS recognizes a broad spectrum of activities as gambling. These include:

- Casino games (slots, poker, blackjack, roulette)

- Lottery tickets

- Sports betting

- Horse and dog racing

- Bingo

- Keno

Fantasy sports leagues and online gambling also fall under this category, provided they’re legal in your jurisdiction.

The Importance of Detailed Record-Keeping

Proper documentation forms the backbone of successful gambling loss deductions. The IRS expects you to maintain meticulous records of all your gambling transactions, regardless of the activity type. This practice not only ensures compliance with IRS regulations but also maximizes your potential deductions.

Seeking Professional Guidance

The tax implications of gambling can become complex, especially for frequent gamblers or those with significant winnings or losses. A tax professional can provide invaluable guidance through this process, helping you navigate the intricacies of tax law while optimizing your deductions.

As we move forward, let’s explore the specific documentation requirements for claiming gambling losses on your taxes. This information will equip you with the knowledge to maintain accurate records and substantiate your claims effectively.

How to Document Gambling Losses for Taxes

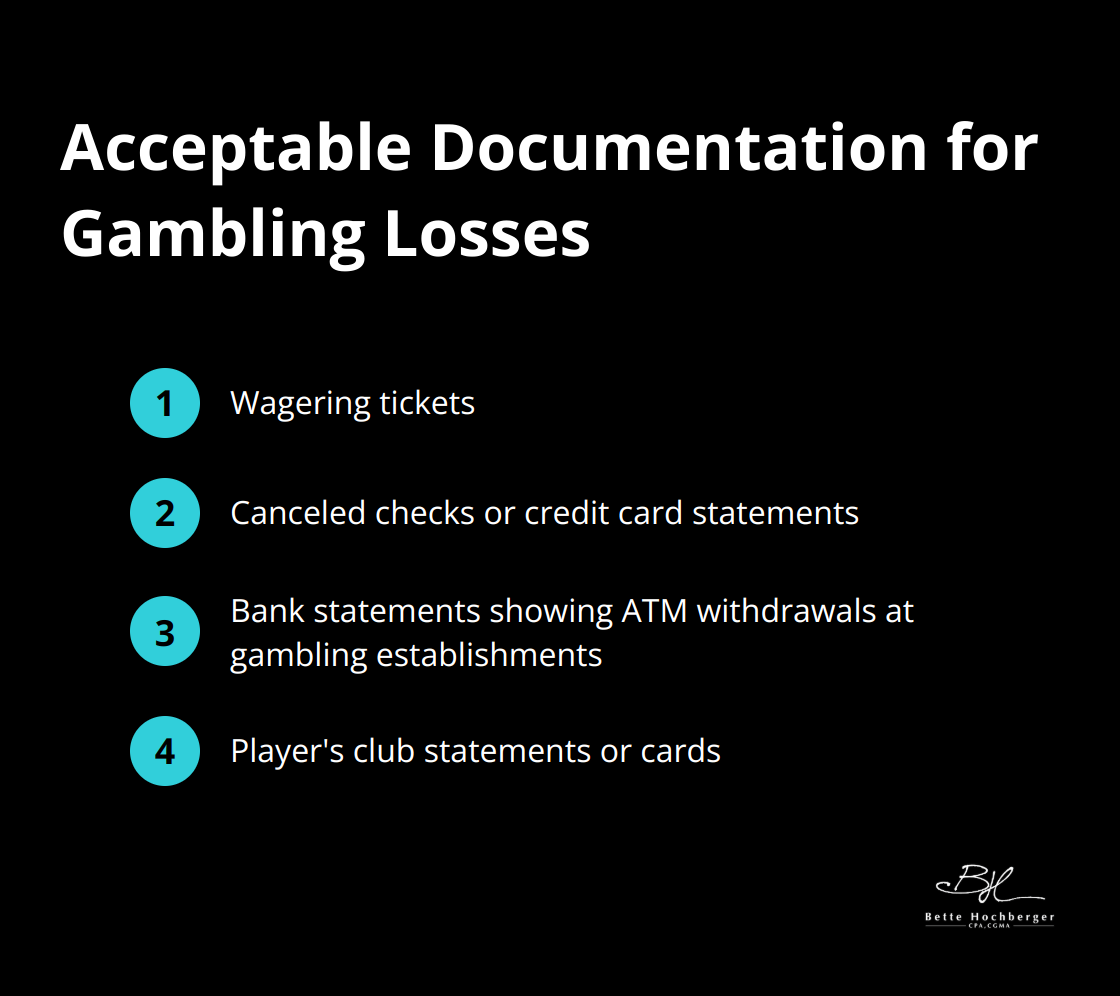

Acceptable Forms of Documentation

The IRS accepts various forms of documentation for gambling losses. These include:

- Wagering tickets

- Canceled checks or credit card statements

- Bank statements showing ATM withdrawals at gambling establishments

- Player’s club statements or cards

For online gambling, screenshots of electronic transactions and account statements are acceptable. The more comprehensive your documentation, the stronger your case for deductions.

Essential Information in Gambling Records

Your gambling records should contain specific details about each gambling session. Include:

- Date and location of the gambling activity

- Type of gambling (e.g., poker, slots, sports betting)

- Amount wagered and lost

- Names of other people present, if applicable

For lottery tickets, keep the actual tickets (whether they’re winners or losers). If you participate in online gambling, maintain a log of your sessions, including the website used and time spent gambling.

Best Practices for Record-Keeping

Accurate gambling records require discipline and organization. Here are some best practices:

- Use a dedicated notebook or smartphone app to log your gambling activities immediately after each session.

- Keep all receipts, tickets, and statements in a single, secure location.

- Regularly reconcile your gambling log with your bank statements and casino records.

- Consider using gambling tracking apps (like Gamblescope or BetBuddy), which can help automate the record-keeping process.

The Importance of Consistency

Consistency in record-keeping is key to supporting your gambling loss claims. Try to:

- Use the same method for recording all gambling activities

- Update your records promptly (ideally within 24 hours of each gambling session)

- Maintain separate logs for different types of gambling activities

This level of detail and consistency will strengthen your position if the IRS questions your deductions.

Seeking Professional Assistance

While meticulous record-keeping is essential, navigating the complexities of gambling loss deductions can be challenging. Professional tax advisors can provide valuable guidance on proper documentation and help you maximize your eligible deductions within IRS guidelines.

Final Thoughts

Tax deductions for gambling losses require careful attention to IRS rules and meticulous record-keeping. You can only deduct losses up to the amount of your winnings, and you must itemize your deductions to claim these losses. Accurate documentation of your gambling activities, including dates, locations, and amounts, will support your claims if the IRS questions your deductions.

Every taxpayer’s situation is unique, and the complexities of tax law make professional advice invaluable. A qualified tax professional can help you navigate these intricacies, ensure compliance with IRS regulations, and maximize your eligible deductions. They can also assist with your overall tax strategy and optimize your financial position.

At Bette Hochberger, CPA, CGMA, we offer personalized financial services for businesses and professionals, including strategic tax planning and preparation. Our team has experience handling gambling-related tax issues and can help you manage your tax liabilities while ensuring compliance. If you need assistance with gambling-related tax issues or your overall tax strategy, contact our skilled team today.