Hi everyone! I’m Bette Hochberger, CPA, CGMA. At our firm, we often see clients struggling with unexpected tax bills. This is where quarterly estimated tax payments come into play.

These payments can help you avoid penalties, manage your cash flow better, and reduce stress during tax season. In this post, we’ll explore why making quarterly estimated tax payments is a smart financial move for many taxpayers.

What Are Quarterly Estimated Tax Payments?

Definition and Purpose

Quarterly estimated tax payments allow individuals and businesses to pay their taxes throughout the year instead of in one lump sum. These payments apply to income that isn’t subject to withholding, such as self-employment earnings, rental income, or investment profits.

Who Must Make These Payments?

The IRS requires estimated tax payments from:

- Individuals who expect to owe $1,000 or more when they file their annual tax return

- Corporations that anticipate owing $500 or more

This often includes:

- Freelancers

- Independent contractors

- Small business owners

- Investors

Even if you have a regular job with tax withholding, you might need to make estimated payments if you have significant additional income from other sources.

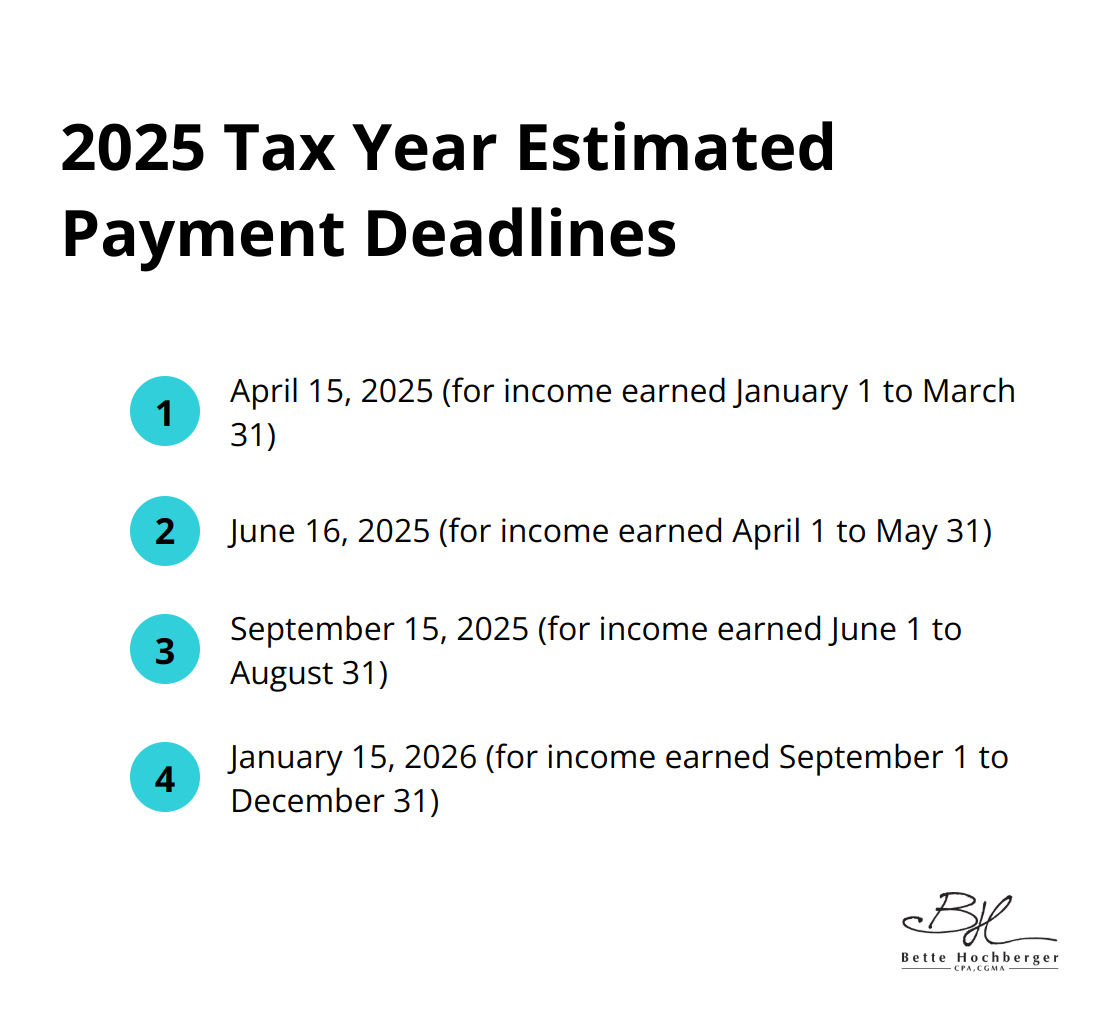

Payment Deadlines

The IRS has established four specific deadlines for estimated tax payments. For the 2025 tax year, these dates are:

- April 15, 2025 (for income earned January 1 to March 31)

- June 16, 2025 (for income earned April 1 to May 31)

- September 15, 2025 (for income earned June 1 to August 31)

- January 15, 2026 (for income earned September 1 to December 31)

These dates can shift if they fall on a weekend or holiday. Missing these deadlines can result in penalties (even if you’re due a refund when you file your annual return).

Calculating Payment Amounts

Determining the correct amount for your estimated tax payments can be complex. The IRS recommends paying either:

- 90% of your expected tax liability for the current year, or

- 100% of your tax liability from the previous year (110% if your adjusted gross income exceeded $150,000)

Form 1040-ES can help you estimate your payments accurately. Many taxpayers find it helpful to consult with a tax professional to ensure they avoid underpayment penalties without overpaying unnecessarily.

As we move forward, let’s explore the benefits of making these quarterly payments and how they can positively impact your financial health.

Why Quarterly Tax Payments Make Financial Sense

Penalty Prevention

The IRS imposes strict penalties for underpayment of taxes. These penalties can accumulate rapidly, with the IRS charging 1/2% of the tax due for each month or part of a month your payment is late (1/4% for months covered by an installment agreement). This penalty applies in addition to interest on the unpaid balance. Quarterly payments help you avoid these costly penalties by keeping you ahead of your tax obligations.

Cash Flow Management

Quarterly tax payments allow for better cash flow management. Instead of facing a large lump sum payment in April, you can spread your tax liability throughout the year. This approach proves particularly beneficial for self-employed individuals and small business owners (who often experience fluctuating income). It facilitates more consistent financial planning and helps prevent cash flow crunches that can occur with annual payments.

Stress Reduction at Tax Time

Tax season often brings anxiety, especially when uncertainty looms about the amount owed. Quarterly payments effectively implement a pay-as-you-go system. This method reduces the likelihood of surprises when April arrives. Regular tracking of tax obligations throughout the year provides a clearer picture of your financial situation, which can lead to improved financial decision-making.

Financial Discipline

Making quarterly tax payments fosters financial discipline. It necessitates regular review of income and expenses, which can lead to more informed business decisions. This habit of frequent financial assessment can uncover areas for potential savings or investment opportunities that might otherwise go unnoticed with an annual tax review.

Improved Budgeting

Quarterly payments allow for more accurate budgeting. When you set aside smaller amounts throughout the year, it becomes easier to allocate funds for other business or personal expenses. This approach provides a more realistic view of your disposable income, helping you make informed decisions about spending and saving.

The benefits of quarterly tax payments extend beyond mere compliance. They represent a proactive approach to financial management that can positively impact your overall financial health. As we move forward, let’s explore the practical aspects of calculating and submitting these payments.

How to Calculate and Pay Estimated Taxes

Estimating Your Tax Liability

The first step in managing your estimated taxes requires an accurate projection of your income and deductions for the year. Review your previous year’s tax return as a baseline. Then, factor in any anticipated changes in income or deductions for the current year.

The IRS provides Form 1040-ES, which includes a worksheet to help you figure and pay your estimated tax. This form is used for estimated tax, which is the method used to pay tax on income that is not subject to withholding.

For a more precise estimate, you might consider using tax preparation software or consulting with a tax professional. Professional assistance can ensure accuracy and potentially identify tax-saving opportunities.

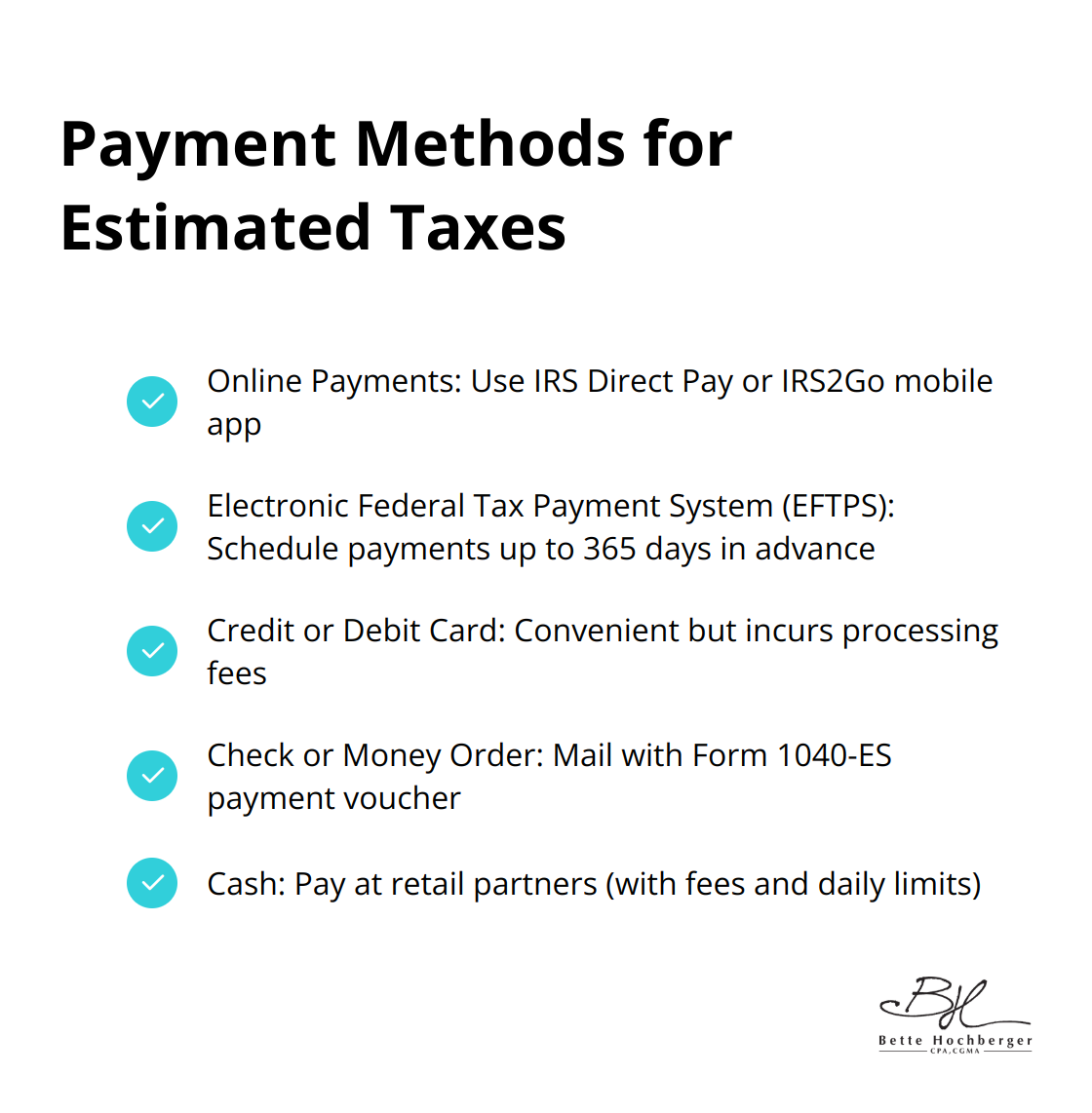

Payment Methods

Once you’ve calculated your estimated tax, you have several options for making payments:

- Online Payments: The IRS’s Direct Pay system allows you to pay directly from your bank account at no cost. The official mobile app of the IRS (IRS2Go) offers convenient payments on the go.

- Electronic Federal Tax Payment System (EFTPS): This free service lets you schedule payments up to 365 days in advance for individuals or 120 days in advance for businesses, which proves particularly useful for quarterly payments.

- Credit or Debit Card: While convenient, this method incurs processing fees.

- Check or Money Order: You can mail your payment with Form 1040-ES payment voucher. However, this method is slower and less secure than electronic options.

- Cash: Some retail partners accept cash payments for taxes (with a fee and a maximum limit of $1,000 per day).

Adjusting Payments Throughout the Year

Your income may fluctuate throughout the year, especially if you’re self-employed or have seasonal income. It’s important to reassess your estimated tax payments periodically.

If you realize you’ve underpaid, you can make an additional payment before the next due date to catch up. Conversely, if you’ve overpaid, you can reduce your next payment accordingly.

The IRS allows you to annualize your income if it’s not earned evenly throughout the year. This method can help you avoid penalties if your income concentrates in later quarters.

Staying proactive with your estimated tax payments not only helps you avoid penalties but also provides a clearer picture of your financial situation throughout the year. If you find the process challenging, don’t hesitate to seek professional help from a qualified tax expert.

Quarterly estimated tax payments provide a powerful tool for effective tax obligation management. These payments spread tax liability throughout the year, which helps avoid penalties and improves cash flow. This proactive approach allows individuals to stay on top of their finances and make informed decisions about expenses.

If you struggle with quarterly estimated tax payments or need assistance with your overall tax strategy, we can help. Our skilled team uses advanced cloud technology to serve diverse industries and provide comprehensive IRS representation. Contact us today for expert guidance on tax planning and preparation.